Sundry Photography

The home improvement industry has undergone tremendous growth over the past two years. In 2020, many invested in home upgrades as more people were at home and had more significant personal savings. This trend led to a boom in many home improvement and construction retailers such as The Home Depot (NYSE:HD). While demand growth has slowed, the overall trend has continued as higher home prices increase professional demand. I covered the stock last November with a bearish outlook in “Home Depot: Rising Costs And Peaking Demand May Reverse Gains” – HD has declined by around 25% since then.

In my view, Home Depot is currently at a critical turning point. The spike in mortgage rates has created growing negative pressure on the housing and construction markets. Additionally, declining real incomes have caused savings levels to fall dramatically, meaning people cannot afford the same home upgrades they could two years ago. Strong economic signals such as the yield curve, business trends, and consumer sentiment all point toward a long-lasting contraction that began around Q2.

Home Depot’s earnings and sales have generally remained stable despite these headwinds. However, I believe Home Depot’s sales lag economic data because most professional and do-it-yourself upgrades, and construction in general, are planned months in advance. As such, Home Depot’s Q2 data reflects the economic reality of Q4 2021 to Q1 of 2022 when home improvement projects were planned or contracted for the Q2 timeframe. Accordingly, Home Depot’s Q3 data may better reflect shifting economic trends, creating the potential for a considerable negative earnings revision.

Economic Slowdown Hits Home Improvement

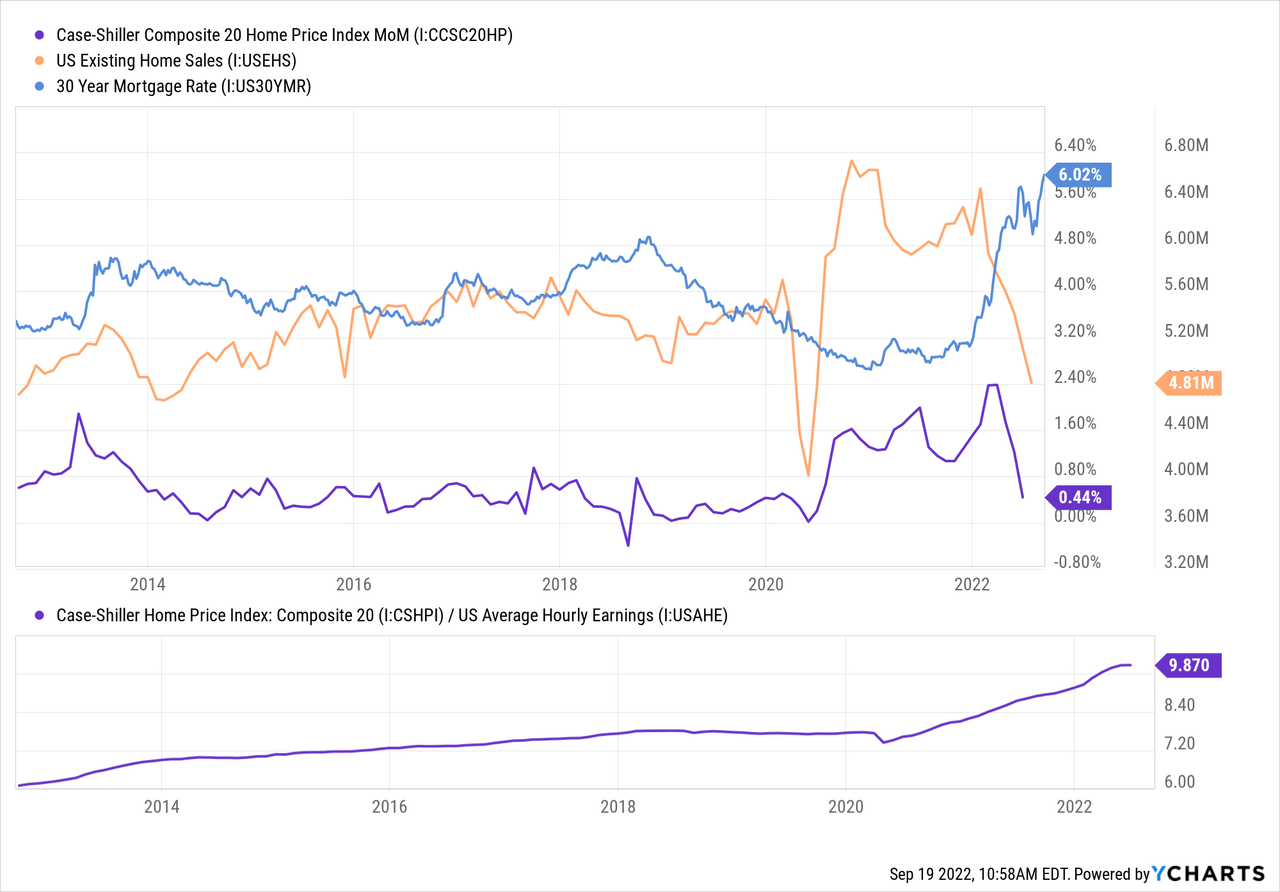

Over recent years, Home Depot has been supported by many economic trends. Home Flipping and home improvement have, in part, become a national hobby following the rise of house-flipping TV shows and brands. The number of home sellers marketing flipped homes was at multi-decade highs last quarter, though profit margins were down for the sixth consecutive quarter. It should be noted that home flipper profit margins slipped despite rising national real estate prices. I expect home-flipping profit margins to decline rapidly as higher mortgage rates negatively impact home price growth. See below:

Trends in 2020, such as Q.E., fueled low mortgage rates and fueled a boom in home prices. The home-price to income ratio rose by around 33% as payment levels were re-adjusted to lower interest costs. This year, the mortgage rate has risen to the highest since the 2000s, triggering a rapid decline in existing home sales. Month-over-month home price growth is still positive but appears very likely to turn negative, given its current trend. The home price-to-income ratio level is similar to just before the 2008 crash, implying that home prices could decline by 20-30% nationally unless inflation triggers a more significant wage boom.

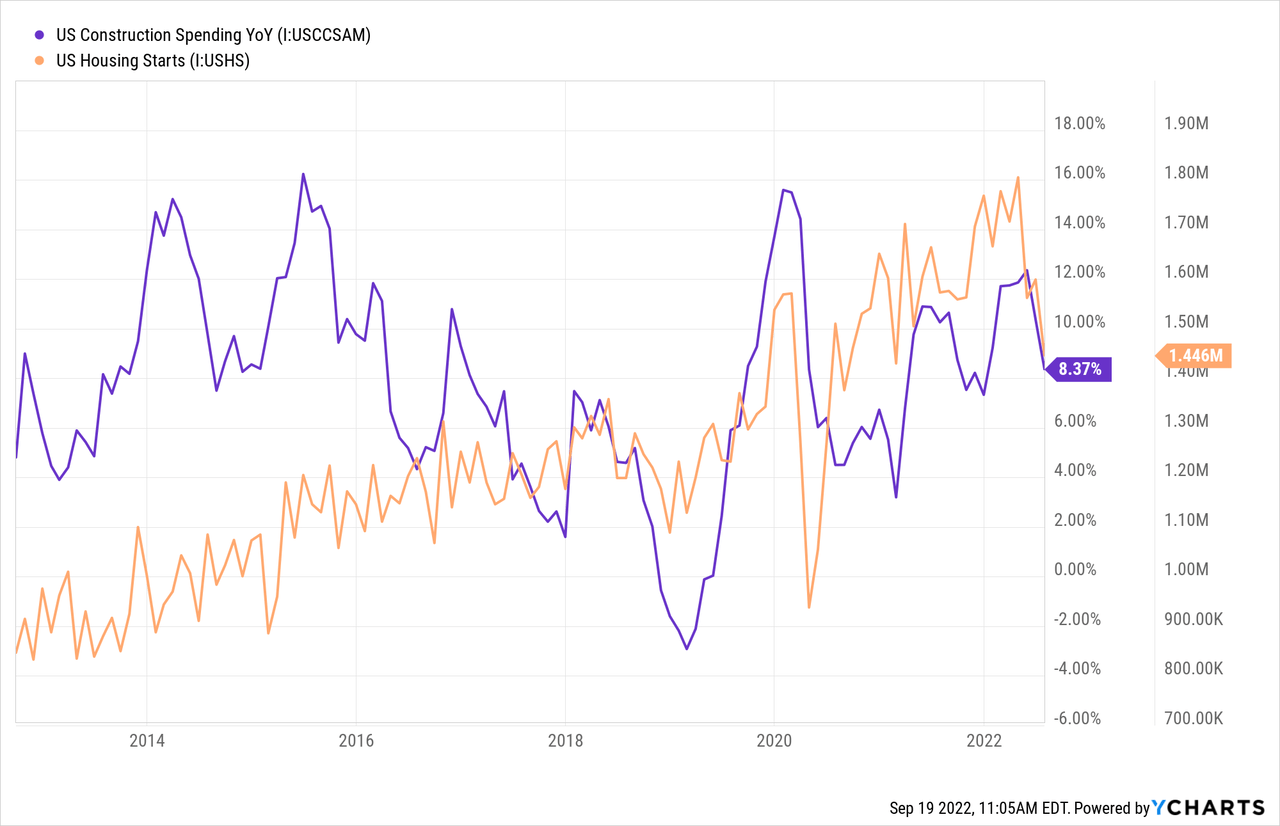

Construction spending growth and housing starts are still generally high despite the negative pressure on the property market. See below:

Home Depot’s sales are likelier to be tied to construction spending growth connected to housing starts. Of course, many large construction contractors are not using Home Depot as a retailer. Still, I believe it is fair to assume that overall construction trends should relate to small projects Home Depot caters to. Construction levels remain high today but will likely lag economic real estate trends by three to eighteen months (depending on project size) since projects are planned well in advance. In other words, much of the construction spending activity today was planned during better economic periods before mortgage rates skyrocketed.

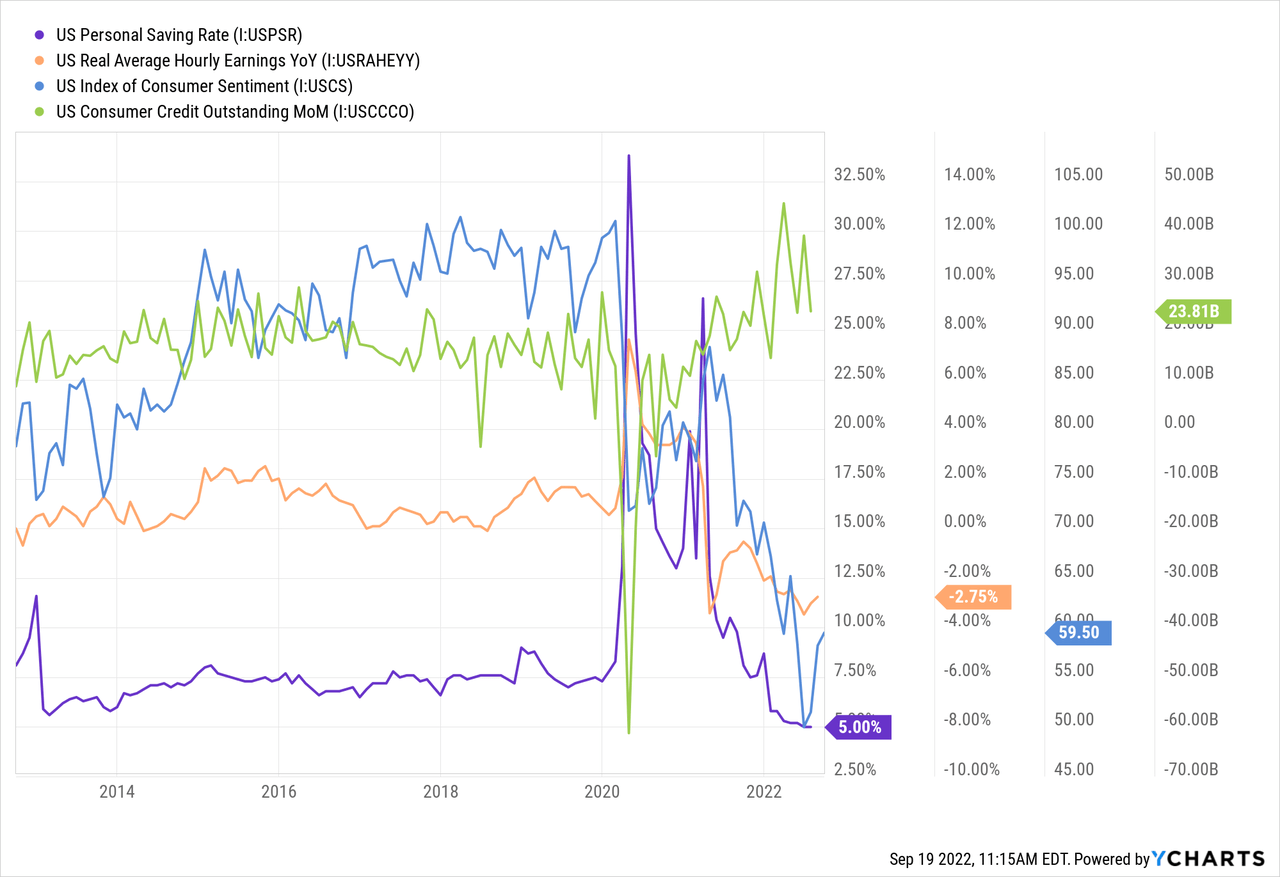

Shifting to the DIY market, we’re seeing solid signals of declines in people’s ability to finance home improvement projects. Sentiment, savings, and wage growth are all shallow. There has been some artificial market support from rising consumer lending, but that is unlikely to continue to benefit the market as credit cards, and other personal debt can only be used so much. See below:

The substantial rise in personal saving levels and real hourly earnings during 2020 was likely a significant factor promoting home improvement sales growth. Many people had excess savings due to reduced spending (vacations, etc.) and stimulus checks. However, this trend has reversed as savings is now well-below pre-2020 levels as inflation causes real incomes to decline. Higher consumer credit has supported consumer spending but cannot continue without spurring a rise in defaults. Eventually, high household debt growth will likely create negative pressure on spending as bankruptcies and defaults should rise given such rapid debt growth.

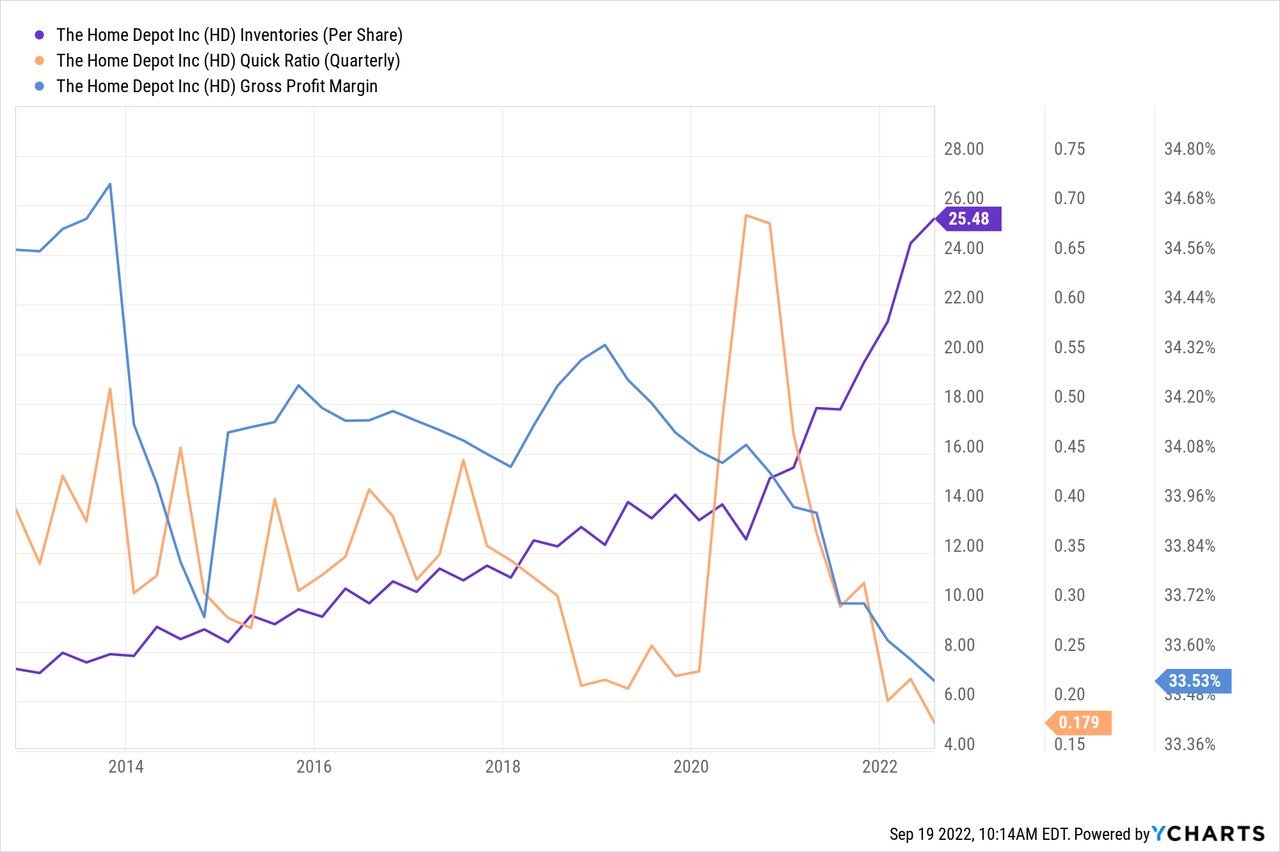

Growing Inventories Signal Liquidity Risks

Home Depot has seen tremendous inventory growth over the past two years. This is partially due to rising prices, which have thus far been passed onto customers, but indicates some risk if sales decline. Additionally, Home Depot’s cash levels are a bit low, exacerbating its downside risk in the case of a slowdown. The company’s stock has declined slightly as these trends have grown, but at a “P/E” valuation of around 17X, I do not believe these risks are fully priced into the stock. See Home Depot’s inventory, quick ratio, and gross margins below:

During 2020, there was an initial surge in Home Depot’s quick ratio as the company increased cash dramatically to reduce lockdown-related risks. Since then, Home Depot’s inventory has surged while its quick ratio has declined toward extreme lows. In my view, this is a red flag because it means the company has few current liquid assets and must sell inventory to meet current obligations. Assuming the demand for home improvement and construction products remains strong, this factor may not be an issue, but economic data signals demand may likely weaken.

Thus far, Home Depot’s gross margins have been stable at 33.5% but have trended lower steadily over the past three years. The pace of declines is not currently large enough to negatively impact the firm’s bottom line materially. That said, it is a sign the firm is having some slight difficulties passing rising input costs onto customers. Assuming a reversal in home improvement demand, the company may sell fewer products at a lower-than-anticipated price. Given its low quick ratio and high inventories, that potential could create material liquidity risks for the company if prolonged.

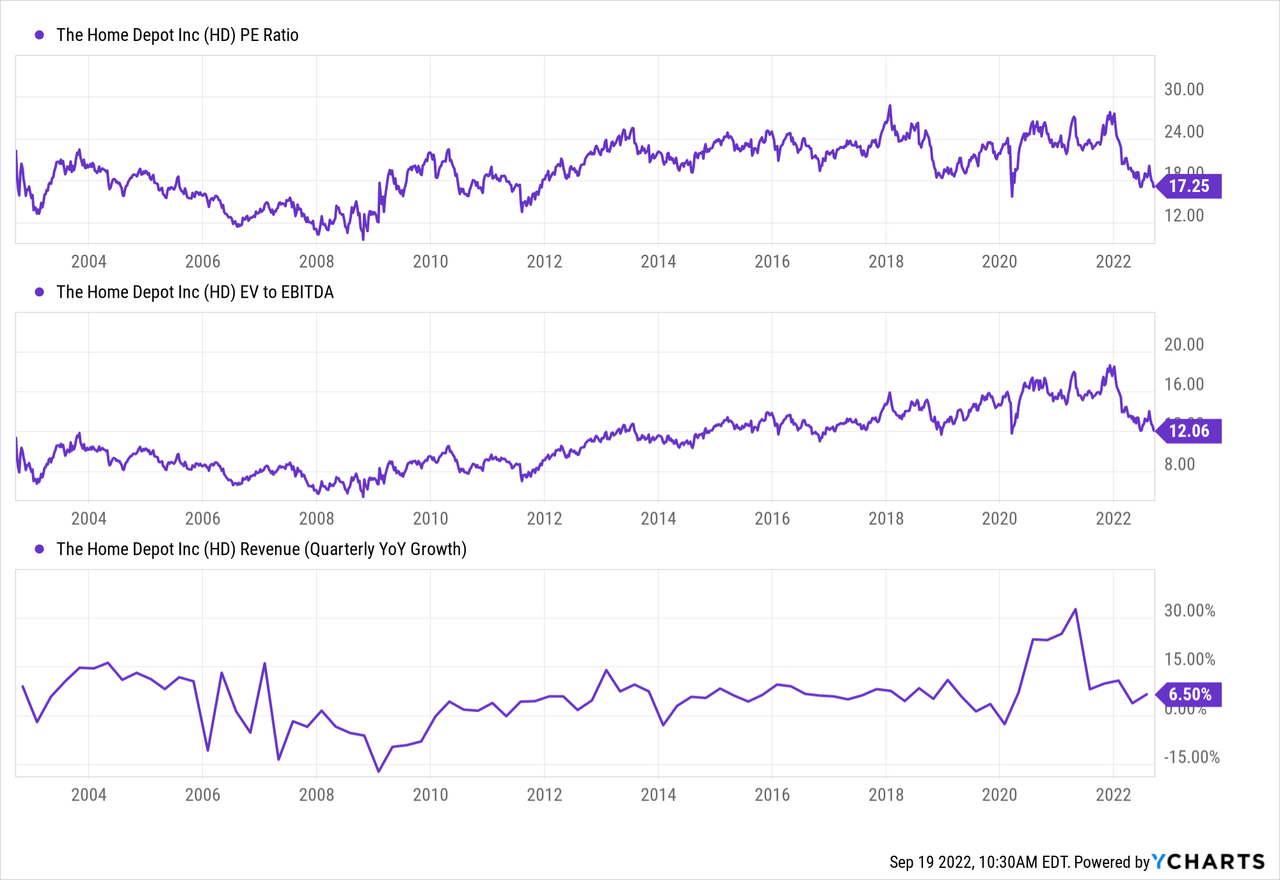

Home Depot’s “P/E” and “EV/EBITDA” valuations are toward the low-end of their ten-year range. On the surface, that data may indicate the company’s risks are priced into the stock. However, the firm has also had steady high sales growth over most of the past decade. During the 2000s, when its sales growth was lower and partially negative, Home Depot’s valuation was roughly 20-40% lower than it is today. See below:

If we assume Home Depot may face a temporary hiccup and quickly return toward a growth position, the stock may be undervalued today. However, HD would still be overvalued, assuming its secular growth phase is ending while its balance sheet and economic risks grow. In my view, the latter is far more likely.

Home Depot has grown tremendously since 2010 as it’s absorbed market share from smaller local competitors. Today, there are virtually no more remaining locally-owned home improvement retailers for Home Depot (or Lowe’s (LOW)) to outcompete. Over time, this should mean Home Depot and Lowe’s will need to become more aggressive in price competition since they are no longer competing with “low economies of scale” firms. Contractors and DIYers will likely become more aware of prices as economic strain grows, particularly if inflation impacts construction and home improvement goods asymmetrically.

The Bottom Line

Overall, I am bearish on HD and believe the stock will likely decline over the coming months. On the surface, its Q2 earnings may have appeared more robust than expected, but this may be because analysts underappreciate the “lag factor” in the construction and home improvement industry. I believe Home Depot’s “strength” is primarily tied to projects initially planned at the beginning of the year when the real estate and consumer markets were much stronger. As such, I expect Home Depot’s Q3 and Q4 earnings to better reflect today’s economic reality.

Given Home Depot’s high inventory levels and low quick ratio, I do not believe it is well positioned for a substantial decline in demand. The company’s debt is not so high that I think it will face insolvency, but its balance sheet risks could spur some lasting financial issues, particularly if it becomes more challenging to pass inflation on to customers. Further, I do not think Home Depot’s long-term prospects are strong, given it will be harder to grow market share (without sacrificing margins) as competitive pressures mount.

Home Depot is a well-run company with a strong track record, but even the best firms cannot overcome strong economic headwinds and competitive pressures. I would not bet against the stock since its valuation is at a 10-year support level and could find new buyers at this price. It is also possible that demand is restored if inflation pressures decline, but for now, that seems unlikely. That said, I believe its price may decrease by an additional 20-40% to a range of $170 to $225 as its valuation reflects a contracting market dynamic and a decline in its long-term earnings growth outlook.

Be the first to comment