Luis Alvarez

Author’s note: This article was released to CEF/ETF Income Laboratory members on January 28th.

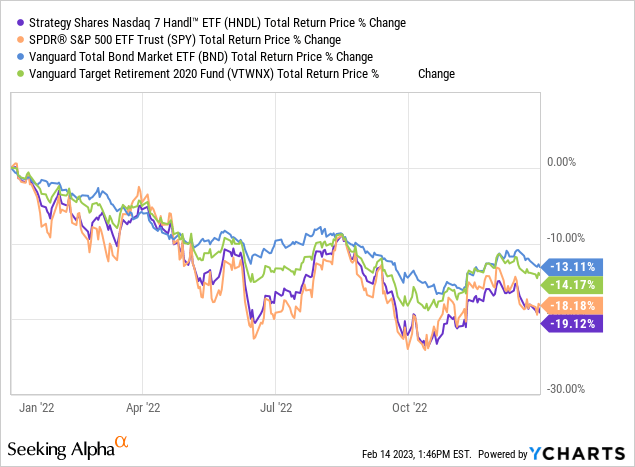

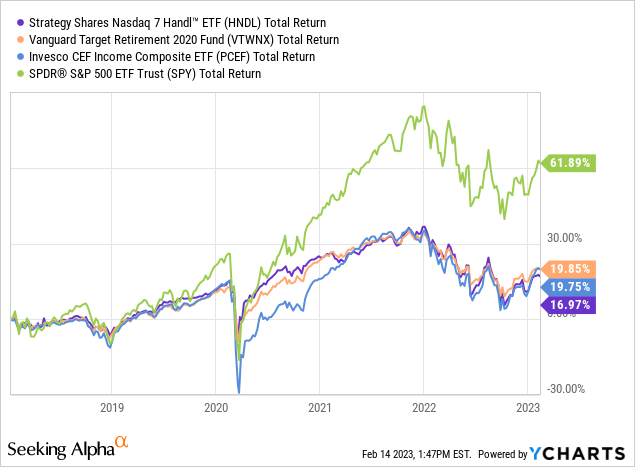

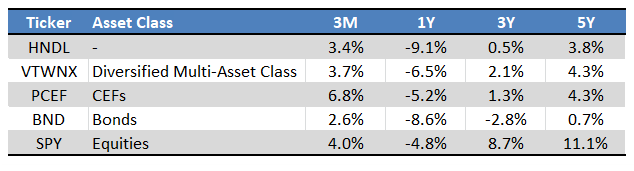

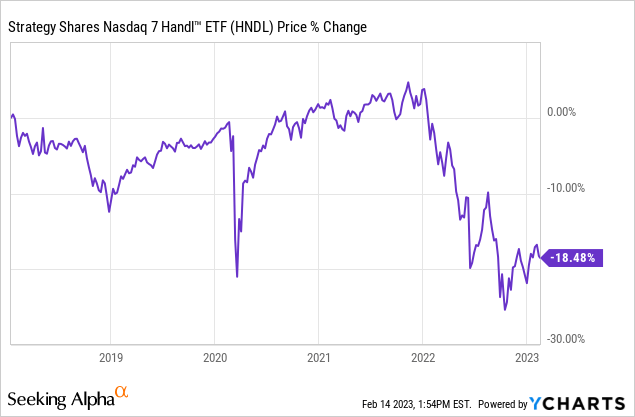

I last covered the Strategy Shares NASDAQ 7 HANDL Index ETF (NASDAQ:HNDL), a diversified, leveraged, multi-asset class fund of funds, in May 2022. In that article, I argued that HNDL’s diversified holdings, comparatively low level of risk, and good performance track-record, make the fund a buy. HNDL is flat since, outperforming bonds, but underperforming equities. Fund performance was in-line with those of its underlying holdings and asset class mix, but slightly below my expectations.

HNDL Previous Article

HNDL still provides investors with exposure to a diversified set of asset classes, and is a reasonably safe fund, with a below-average level of risk. As such the fund remains a buy, recent results notwithstanding.

HNDL Overview and Investment Thesis

Diversified Multi-Asset Class Holdings

HNDL is a diversified, leveraged, multi-asset class fund of funds ETF. It tracks the Nasdaq 7HANDL Index, a very niche, bespoke index.

Said index includes a 50% allocation to a set of fixed income and equity ETFs, with fixed weights. These are as follows.

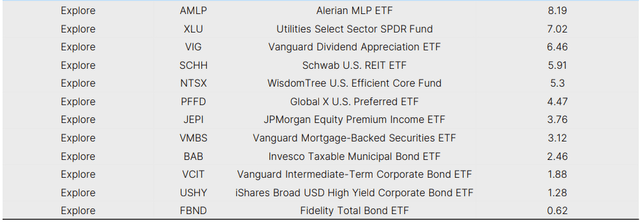

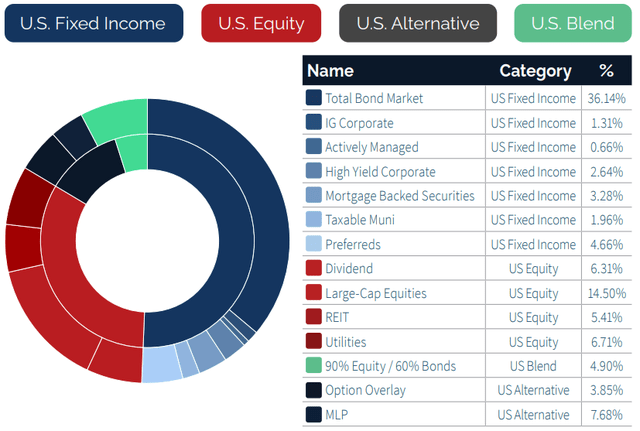

Said index includes another 50% allocation to another set of fixed income, equity, MLP, REIT, etc., funds. Weights are variable and dependent on (relative) price: cheaper funds have greater weights, and vice versa. Funds and (current) weights are as follows.

HNDL is a leveraged fund, with a target leverage ratio of 1.23x.

Although HNDL’s underlying index is a bit complex, and with many moving parts, the end result seems simple enough. HNDL functions as a diversified multi-asset class index ETF, with a strong tilt towards investment-grade bonds, a slight tilt towards value and income, and with some leverage.

Combine the two sets of funds above, and we get HNDL’s actual portfolio:

As can be seen above, HNDL invests in a wide assortment of asset classes, including bonds, preferreds, equities, REITs, and MLPs. There is quite a bit of diversification within asset classes too, with HNDL investing in most relevant bond sub-asset classes, including investment-grade bonds and high yield bonds, as well as most relevant equity industry segments. There is significant diversification at the security level as well, with HNDL providing investors with indirect exposure to over 20,000 securities, an incredibly large number.

HNDL’s asset class and security diversification reduces portfolio risk and volatility, and is a significant benefit for the fund and its shareholders. HNDL is diversified enough that it could function as a core, even only, portfolio holding, as it provides sufficient, diversified exposure to most relevant asset classes. Investors don’t really need anything else, in my opinion at least.

Asset class diversification all but precludes the possibility of significant over or underperformance. With investments in most relevant asset classes and tens of thousands of securities, the fund is, in a sense, tracking the market, and so is likely to achieve market returns. Some aspects and decisions of the fund might lead slight differences in performance relative to the market, but I don’t expect these to ever be significant, or even likely.

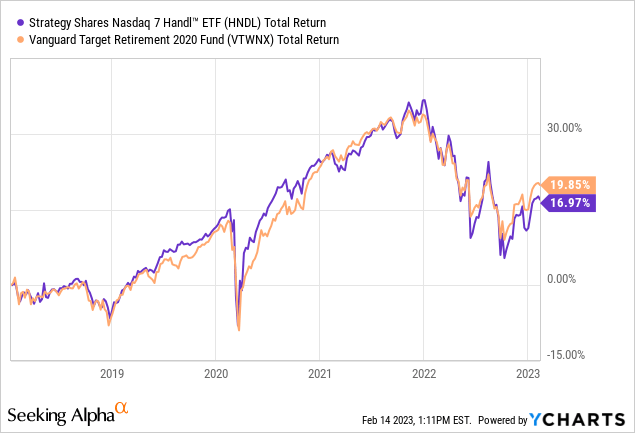

HNDL itself has performed in-line with other diversified multi-asset class index funds, including the Vanguard Target Retirement 2020 Fund (VTWNX), since inception, as expected. VTWNX has a broadly similar asset mix to HNDL, but with no value or income tilt, and with no exposure to some more niche asset classes, including MLPs.

Below-Average Level of Risk

HNDL is a comparatively safe, low-risk investment, for two key reasons.

First, is the fund’s aforementioned diversified multi-asset class holdings. Asset class diversification reduces the probability and magnitude of losses at the fund level from losses in any one specific asset class. If the stock market crashes HNDL’s equity investments would plummet too, but the fund’s bond investments might fare a bit better. If interest rates rise the fund’s bonds might go down in price, but its equities might fare a bit better. Other asset classes provide some extra diversification too. Diversification at the security level also all but precludes the possibility of significant losses from the bankruptcy or default of any specific issuer or security.

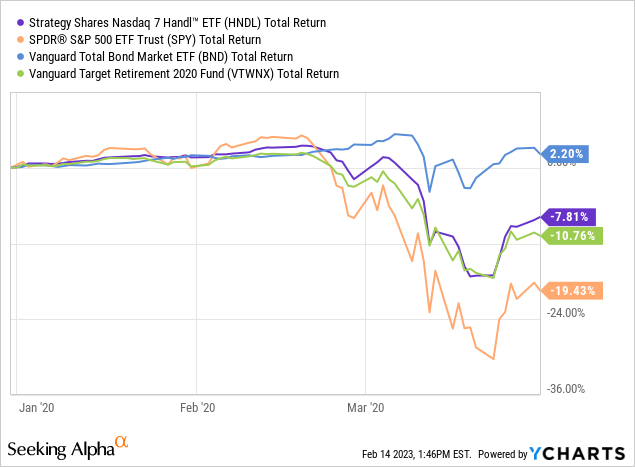

HNDL’s diversification serves to reduce losses during most downturns and recessions, as was the case in 1Q2020, the onset of the coronavirus pandemic. HNDL significantly outperformed equities, slightly outperformed VTWNX, during said time period. Outperformance was effectively entirely driven by strong bond, especially treasury, returns. HNDL invests quite heavily in these, which served to weather equity losses.

HNDL’s diversified multi-asset class holdings reduce risk, volatility, and the probability and magnitude of losses during most major downturns and recessions. Although these were of no benefit in the last bear market, they are generally beneficial, and a positive for the fund and its shareholders.

Second factor behind HNDL’s comparatively low level of risk is the fund’s focus on relatively safe asset classes. HNDL focuses on bonds, and is almost always overweight investment-grade bonds and preferreds relative to equities and high-yield bonds. It is also generally overweight utilities and other similar low-risk equity industry segments. MLPs are the fund’s riskiest asset, but these are generally only 5% – 8% of the fund’s portfolio, a sensible amount.

HNDL’s comparatively safe holdings reduce portfolio risk, volatility, and losses during downturns, and are a significant benefit for the fund and its shareholder.

On a more negative note, and as previously mentioned, HNDL is modestly leveraged, with a target leverage ratio of 1.23x. Leverage is gained through total return swaps. Leverage means more assets which means more income, capital gains, and losses during downturns. In my opinion, HNDL’s diversified, comparatively safe holdings more than make up for the fund’s modest use of leverage. Leverage did increase losses in 2022, but not significantly so.

HNDL – Performance Analysis

HNDL’s performance track-record is reasonably fine, if very slightly below average. The fund has very slightly underperformed relative to VTWNX, its closest benchmark, since inception, as well as relative to the Invesco CEF Income Composite Portfolio ETF (PCEF), a CEF index fund. Underperformance was at least partly due to the fund’s investments in MLPs, which have performed quite badly these past few years. On a more negative note, HNDL and its peers have all significantly underperformed equities since inception.

HNLD’s performance for other time periods seems about average, with the fund sometimes underperforming, sometimes outperforming.

Seeking Alpha – Chart By Author

In general terms, as HNDL has only very slightly underperformed relative to its since inception, I believe the fund’s performance track-record to be fair, or reasonable. Underperformance would have to be greater, or more consistent, for me to see it as a negative.

HNDL – Distribution Analysis

HNDL, unlike the vast majority of ETFs, has a managed distribution policy. The fund targets a 7.0% annualized distribution rate on NAV, paid monthly, irrespective of underlying generation of income or capital gains. HNDL’s distribution policy is meant to provide income investors and retirees with a portion of their returns / assets every month without having to sell shares, incurring fees or spending time to do so.

HNDL’s distributions are not indicative of the income, capital gains, or returns investors should expect moving forward. Some CEFs manage their distributions so as to be long-term sustainable, in theory at least, but this is not the case for HNDL.

As per the fund’s latest annual report, HNDL has a distribution coverage ratio of 31%, with capital gains and ROC distributions making up the remaining 69%. Rising interest rates should increase distribution coverage ratios moving forward, but these should remain relatively low regardless. Bonds simply don’t yield enough to sustain a 7.0% distribution yield, nor do equities.

Although HNDL’s distribution is not covered by underlying generation of income, the fund might be able to generate sufficient capital gains to ensure stable share prices long-term. This had been the case until the 2022 bear market, which led to significant losses across asset classes and investment markets.

In my opinion, HNDL’s managed distribution policy and 7.0% distribution rate are neither positives nor negatives, but important facts for investors to consider.

As a final point, I’m aware that the analysis of HNDL’s performance track-record and distribution make the fund seem like a rather lackluster investment, but this is mostly a reflection of the fund’s holdings and current market conditions. A fund focusing on very vanilla bond funds can’t have outstanding total returns or dividends. A diversified index fund will never outperform the market, as it tracks the market.

Conclusion

HNDL’s diversified multi-asset class holdings and below-average level of risk make the fund a buy.

Be the first to comment