insta_photos/iStock via Getty Images

Hims & Hers Health, Inc. (NYSE:HIMS)

This is a company that I’ve had the absolute “pleasure” of investing into way too early — back when “growth at any cost” was still a viable investing strategy (incredibly low risk-free rate).

However, this company is very special.

They went public via SPAC — but unlike other SPACs whose fundamentals have completely flopped since 2020, the Hims & Hers Health, Inc. SPAC shined. Let’s begin by talking about the company’s operational and financial standings upon making their public debut in 2020.

The Public Debut

Launched in 2017, HIMS is a healthcare tech company that was built to connect those seeking medical care with licensed providers who are able to help.

You simply download their app, share your location and your birthday, and you’re immediately offered the option to be treated for a wide range of ailments.

This includes:

-

Sexual health

-

Hair & skin

-

Mental health

-

Everyday healthcare – think primary care, allergies, cold & flu.

But that was only the first step. HIMS doesn’t exactly make their money by offering one-off video consultations — but instead subscriptions.

Let’s pretend you’re like me — determined not to lose your hair as you get older. Everyday I take 10mg of Finasteride to help prevent male-pattern baldness as I age. How do I receive this medication? Through a HIMS subscription.

After users meet with a doctor (likely looking for a specific treatment), the doctor would then prescribe some sort of HIMS-branded generic medication — delivered monthly to the user’s doorstep.

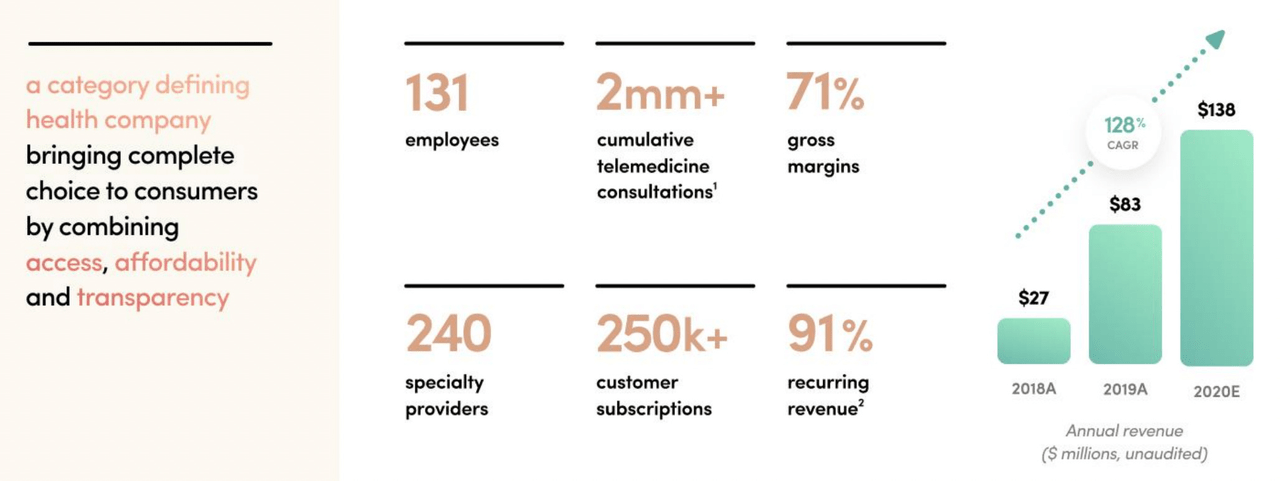

In 2020, the company shared this investor presentation detailing their business, their total addressable market, and the growth levers they planned to use in order to take their business to the next level.

Hims & Hers at a glance (2020 Investor Presentation)

I wanted to call out two main statistics:

-

2M cumulative telemedicine consultations

-

Having resulted in 250K active customer subscriptions.

Between 2017 and 2020, they conducted 2M telemedicine consultations — these 2M consultations resulted in 250,000 customers subscribing to have medication delivered to them monthly.

Mind you, these subscriptions were only across the hair loss, erectile dysfunction, anxiety & depression, dermatology, and primary care markets.

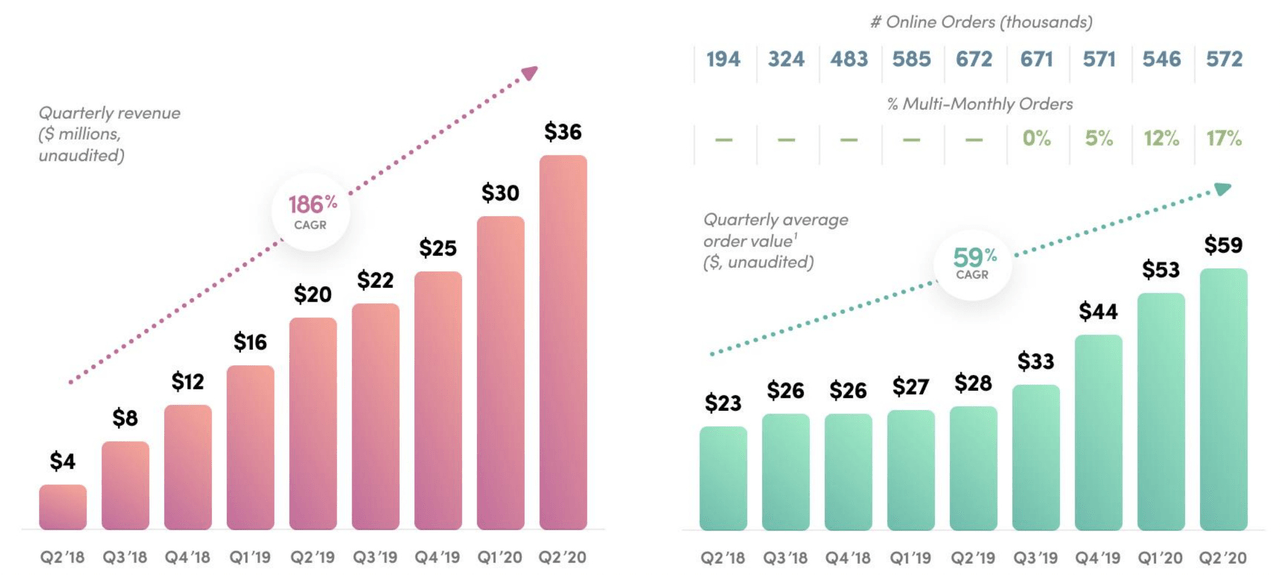

It’s also important to call out that these subscriptions were becoming more and more valuable for the company — as their quarterly revenue per active subscription continued to climb quarter-over-quarter.

Revenue growth (Hims and Hers 2020 Investor Presentation)

Continued Execution

Since making their public debut in 2020, the company has continued to execute against their growth levers — in a very big way.

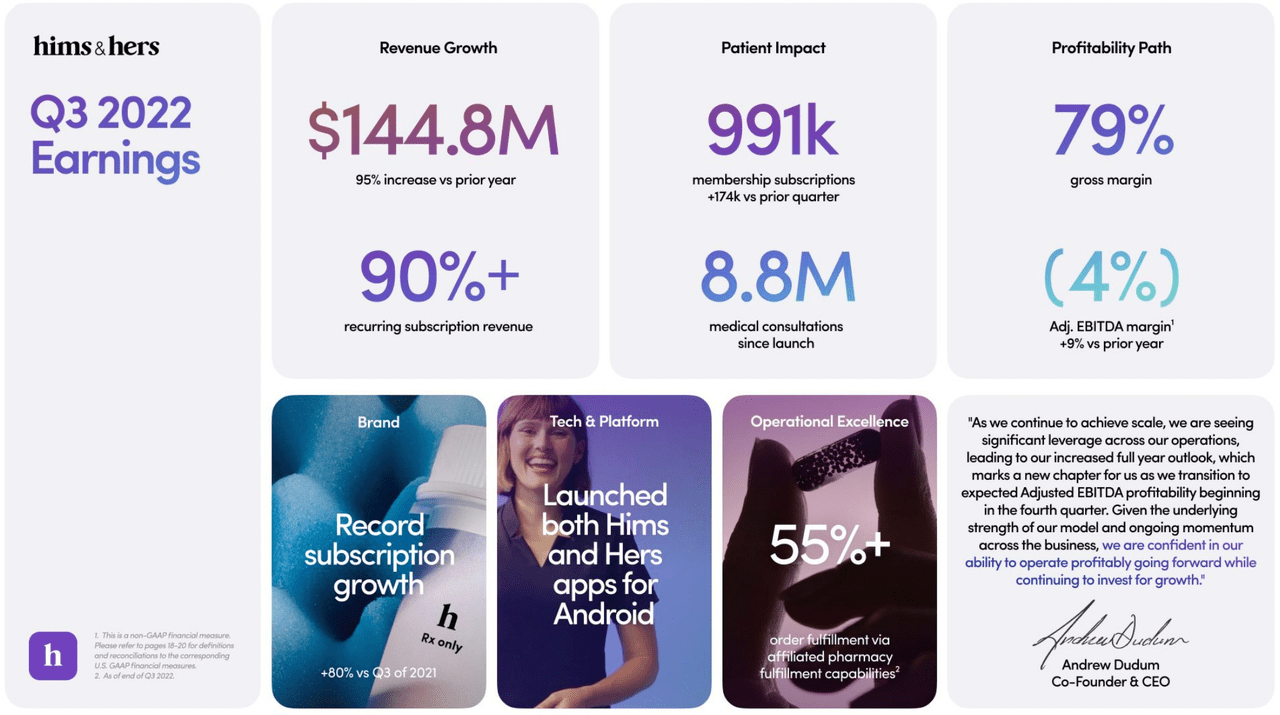

During their most recent quarterly earnings report (Q3), we learned the company generated $145M in revenue, expanded their gross profit margins to 79% (compared to 71% in 2020), and added +174,000 new subscribers quarter-over-quarter — bringing their total subscriber count to 991,000.

Hims and Hers at a glance (Hims and Hers 3Q22 Investor Presentation)

They also shared with us that they’ve conducted 8.8M cumulative medical consultations — compared to that 2M figure in 2020.

In 2022, the company launched an incredibly intuitive mobile app — offering 24/7 care, original content, and 1-click shopping.

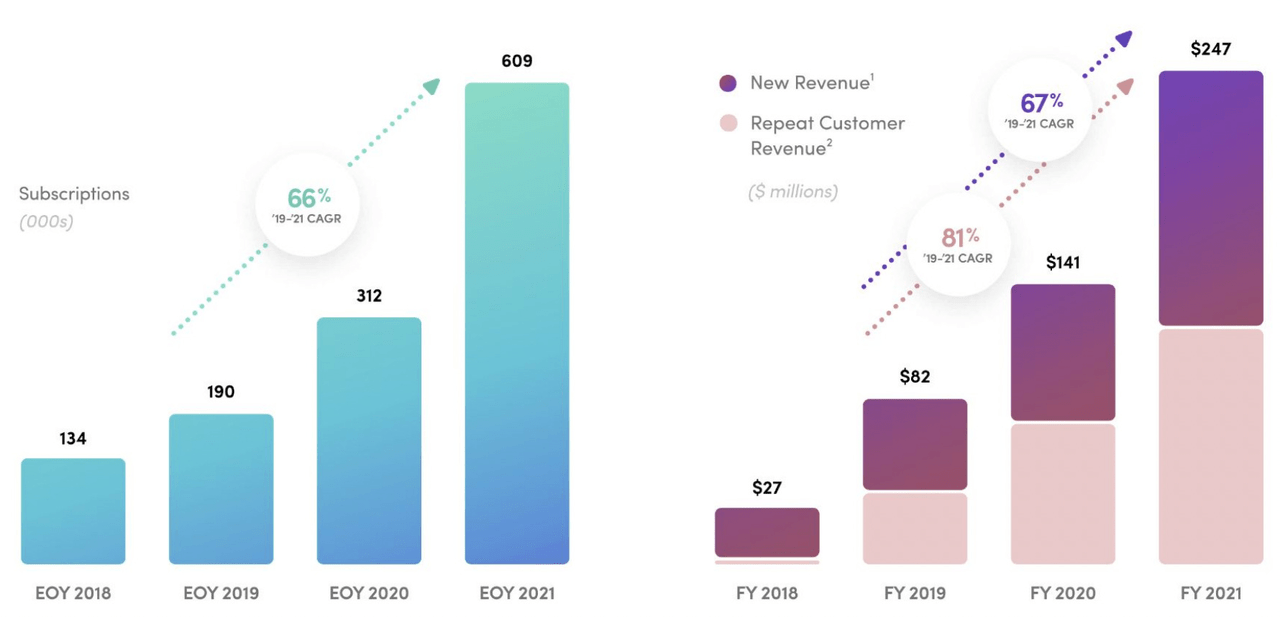

Something that caught my attention, specifically, was how sticky their subscription revenue has become over the last few years. In the image below you can see how nearly all of the “new revenue” generated every year translated into “repeat customer revenue” the following year.

Hims and Hers Health 3Q22 Investor Presentation

As of Q3, the company has:

-

Long-term retention: 85% online revenue retention from subscriptions with a tenure of at least two years

-

Strong unit economics: a less than one year payback period on marketing investments

-

Margin improvement: expected to become adj. EBITDA positive in Q4 and remain in such position for the foreseeable future.

Valuation

Think about it like this — here is a company that between 2017 and 2020 conducted 2M telemedicine consultations, then during 2021 and half of 2022 conducted another +6.8M on top of that.

A company whose monthly subscriber base nearly quadrupled in size from 250K to 991K — with a demonstrated history of retaining these subscribers over the years. A company with 79% gross profit margins, similar to that of SaaS companies.

At $6 / share, HIMS is a $1.2B company. This means the company is trading at ~1.7X their 2023 revenue expectations, despite being adj. EBITDA profitable, projected to grow +40% — all while maintaining margins of 79%.

In the company’s 2020 investor presentation, they shared their 2022 financial projections — revenue of $233M, gross profit of $175M, and an adj. EBITDA loss of -$9M.

According to the company’s Q3 2022 investor presentation, HIMS will do $520M in revenue, $400M in gross profit, and will flip adj. EBITDA positive this year. These figures are more than double of what the company was hoping to deliver!

Conclusion

If you’re an aggressive investor looking to invest into a company disrupting a massive market (healthcare) — Hims & Hers Health, Inc. might be right for you.

Here are a few more reasons why I like the company:

-

Predictable subscription revenue — 90% of quarterly revenue

-

Exceeded expectations — strong management team

-

Expected to flip free cash flow positive in 2023

-

Gross profit margins similar to those of a tech company — 79%

-

Clear runway for growth — deca-billion total addressable market.

I’m happy to continue dollar-cost averaging into my HIMS position at $6/share — but of course, the lower the better, given this company’s solid future.

I plan to continue growing my relatively small position in Hims & Hers Health, Inc. I hope to have $7-10K worth of HIMS stock in my possession by the end of 2023.

Be the first to comment