curraheeshutter

(Note: This article appeared in the newsletter on July 27, 2022, and has been updated as needed.)

Hess Corporation (NYSE:HES) announced quarterly cash flow from operating activities in excess of $1 billion. That is roughly half the current market value of the stock. While the stock market appears concentrated on an eventual oil price decline, Hess represents that rare company that is growing production in both the United States and through the partnership in Guyana. Moreover, that growth should top 20% in the current fiscal year.

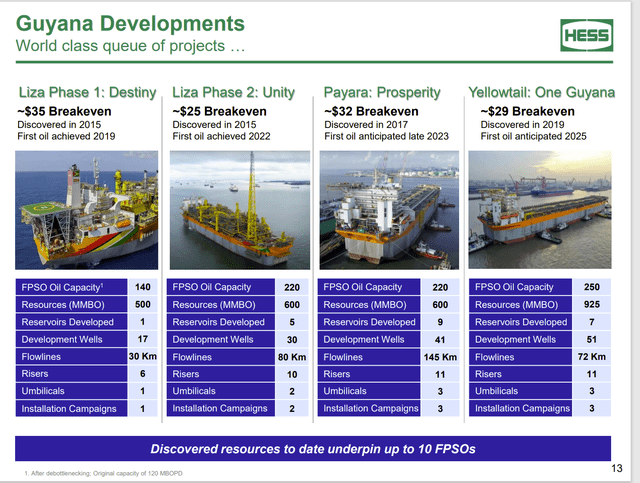

Further reading indicates that the growth rate is not going to be slowing anytime soon (though it may be a little lumpy in the beginning). The Guyana partnership is working to add an FPSO a year probably beginning in 2025. Guyana appears profitable enough that the partnership could easily move to two FPSOs per year sometime in the future.

For the time being, Hess management, at a recent conference stated that as long as the Brent price remained at or above $55, the company can grow cash flow at a 25% rate through 2026. A 25% growth rate compounded means that cash flow triples roughly every 5 years. That is a fantastic return for this industry.

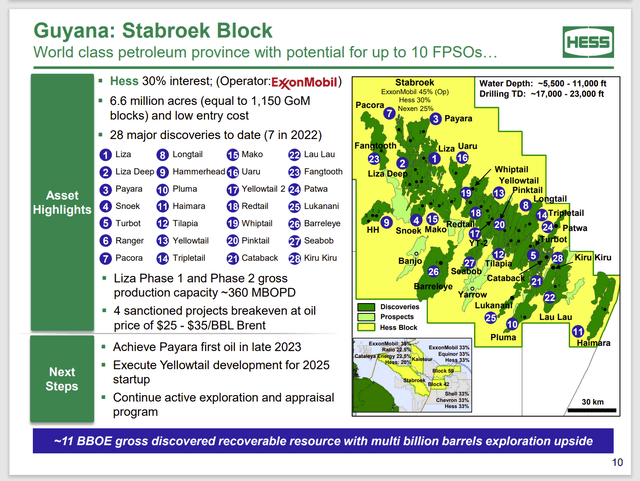

The best part is that all the discoveries announced have been only on one leased block. Hess, through different partnerships, has interests in more blocks that could provide further growth. Guyana is probably the most prolific block of oil production found in recent memory. That is a game changer for a company the size of Hess.

Unlike many competitors who often have a decline in cash flow, the projected rapid production growth in Guyana would likely soften any cyclical decline while sending production and profits higher in the next cycle. Such projected steady growth is exceptionally rare in the oil and gas industry. But it makes a possible buy and hold strategy a very good way for small shareholders to go.

The Asset Story

A traditional measurement of oil in the ground for as long as I can remember is $5 per barrel. By that measure Hess is exceptionally cheap.

Hess Corporation Presentation Of Lease Holdings, Discoveries, And Estimated Reserves (Hess Presentation At September 2022, Conference)

Hess has a roughly 3 BBOE share of the gross discoveries made so far of oil in the ground. Production just began. So continuing discoveries probably more than offset any production. But that means the market value is less than $3 per barrel of oil “in the ground”. That is a huge discount from what many would quickly figure this asset is worth. That is before you consider the superior profitability of this asset.

John Hess himself asked at the June conference why this is and then explained that the market changed. When I was growing up, the company that discovered the North Slope (in Alaska) saw its stock “go through the roof” on news of the discovery. From what I can tell, those days are gone. Now the market wants to see cash flow because these discoveries are often years away from production.

Cash Flow On The Way

In the case of Hess, the cash flow has begun. Management noted that six one-millions barrels of oil loads were sold in the quarterly release. That was up considerably from the first quarter when only one FPSO was operating. The Hess share of production rose to 67 KBOD in the second quarter.

Hess Presentation Of Guyana Cash Flow Growth In The Near Future (Hess Corporation September 2022, Conference Presentation)

Obviously, since the delivery of FPSOs is what powers the majority of long-term profit growth at Hess, the increase in cash flow is not going to be a straight line as shown above. It would actually be closer to a modified step function instead as there is the ramp-up growth followed by a period of lesser (if any) growth until the next FPSO arrives.

The latest quarterly comparison was influenced by some weather issues as well as a Gulf asset sale. That will influence the future cash flow increases as well. But these kinds of issues are not considered repeating. The more cash flow from Guyana, the sooner it is likely to be considered self-funding by the partners. The currently strong commodity price issue probably means it is self-funding far earlier than predicted. Should selling prices decline, then there is a third FPSO arriving next year that should offset lower prices in a material fashion. This project is profitable enough that cash flow is likely to increase in the future just from production growth overriding the effect of lower selling prices.

Now, as this project grows, there will likely be enough partnership cash flow to begin to have two FPSOs start up in a year. That does not include potential discoveries on the other leases that Hess has an interest in.

The Future

Since the second FPSO was ramping up production in the second quarter, the average production from the Guyana partnership that accrues to Hess will be higher in the third quarter. This production is now approaching about one-third of the total corporate production reported.

It can be easily seen that the company’s future will largely be determined by the Guyana progress or lack thereof. Already there are more discoveries this fiscal year than have ever been reported and the fiscal year is not close to the end. The higher commodity selling prices have allowed for a considerable increase in partnership activity while lessening the partnership need for cash.

Hess is likely to become a cash flow monster in the future compared to the current size of the company. The difference between this company and many in the industry is the world-class offshore project in Guyana. That project is profitable enough to continue to grow through industry downturns. That is a huge advantage that this company has over many competitors.

Management is guiding to cash flow growth of 25% a year on average. The currently strong commodity prices may have borrowed some of that future growth as these selling prices are not expected to last long term. But the growth prospects should overcome any commodity price decline to allow that average growth rate to be accomplished.

Hess has some other decent cash flow projects in both the Gulf of Mexico and the Bakken. But the Guyana prospects are likely to outweigh the other projects for the foreseeable future. This company has superior growth prospects compared to just about any competitor in the industry of comparable size. The low breakeven points should allow for very fast cash flow growth as well. This company is probably suitable to a wide variety of investors.

Since Hess is the smallest partner in any of the Guyana partnerships, it may become a takeover candidate at some point. There is an awful lot to offer one of the partners in any of the partnerships of Guyana. Obviously the most likely candidate would be Exxon Mobil (XOM) because the synergies are likely to be greatest for an operator of the leases.

Be the first to comment