400tmax

Both UPS (NYSE:UPS) and FedEx (NYSE:FDX) are delivery powerhouses with a scale and reach that few competitors can match. As such, both companies have benefited from their competitive advantages. These advantages are mostly the result of efficient scale and network effects competitive moats. This in turn has allowed both companies to earn relatively high returns on capital, and outperform the market.

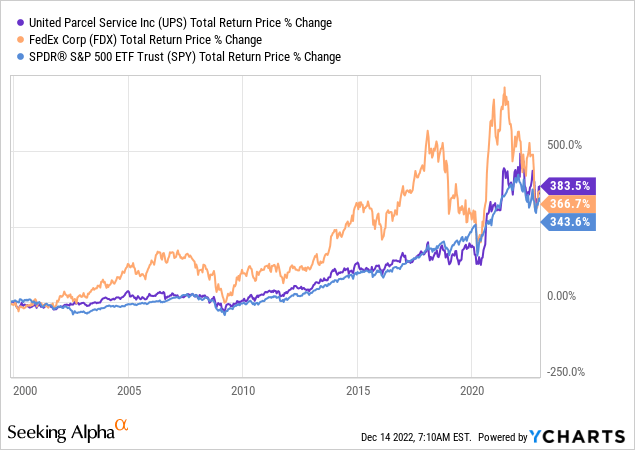

Over the last two decades both companies have generated a higher total return compared to the S&P 500 (SPY), although not by a very significant margin. We believe part of the reason is the massive capex that both companies had to spend in order to build their networks, and going forward we believe both companies will be able to leverage these past investments. Both are working hard on improving asset efficiency and finding cost reduction opportunities. For example, UPS with its ‘Better not bigger’ framework moved from a focus on volume share to value share. This resulted in better revenue quality, higher operating margins and significant improvements in its financials. UPS is now following with its new strategy called “Better and Bolder”, which aims to create a powerful offering of logistics as a service. Meanwhile FedEx has its “Deliver Today, Innovate for Tomorrow” strategy, which aims to reduce capex significantly as a percentage of revenue, and improve the efficient use of its existing assets. We therefore believe both are likely to outperform the market going forward, but we think UPS is a better option than FedEx for a number of reasons.

Business Focus

FedEx is strong with overnight shipping and expedited 2- and 3-day deliveries, while UPS is stronger in ground shipment. Something we don’t like about FedEx is that it is more exposed to business document shipping, which we believe is in secular decline. Both companies benefit from e-commerce growth, but we believe UPS is better positioned to take advantage of the business opportunity there. UPS is the top shipping carrier used by e-commerce companies with a ~30% market share of sites, compared to FedEx’s ~20% share. This places FedEx in the third place, behind the US Postal Service that is placed second with a ~25% market share.

Of course, both companies have to face the growing threat of Amazon Logistics (AMZN), which is taking market share at a breath taking speed. This might discourage some investors from taking a position in either UPS or FedEx. While we view Amazon Logistics as a real threat, we believe the most likely outcome is that it will reduce the e-commerce opportunity for both companies, but not that it will entirely disrupt them. Especially because it is likely that other e-commerce players will probably prefer working with the specialized shipping companies instead of feeding business to a competitor.

Financials

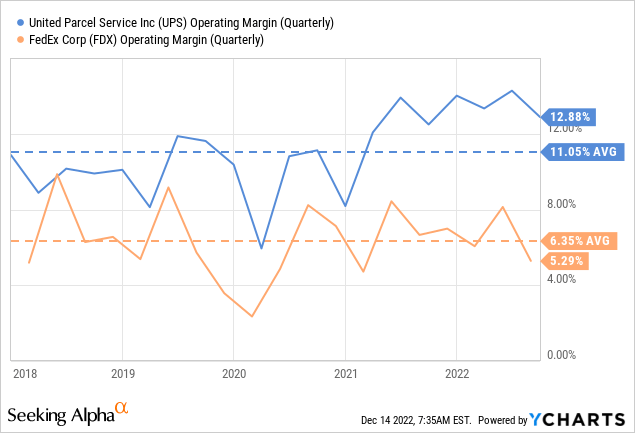

Another reason we prefer UPS over FedEx is that it has much stronger financials. For example, its operating margin has averaged roughly twice that of FedEx over the last five years. This also probably means that UPS has a stronger competitive moat that permits the company to earn better profit margins.

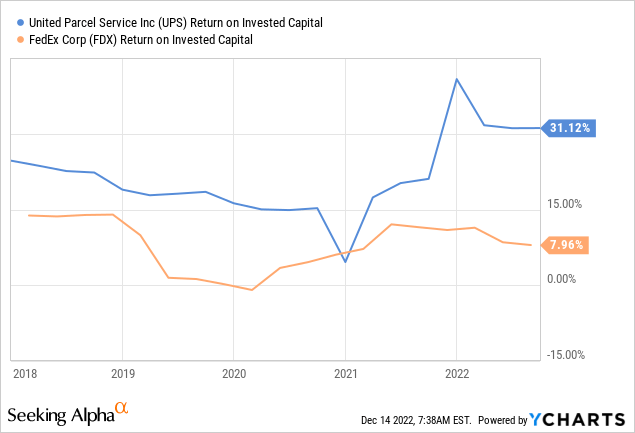

Similarly, UPS has a much higher return on invested capital compared to FedEx. This allows for faster investment returns compounding on the retained earnings. That said, we believe FedEx is likely to move closer to UPS as it reduces its capex intensity and focuses more on efficient asset utilization.

Growth

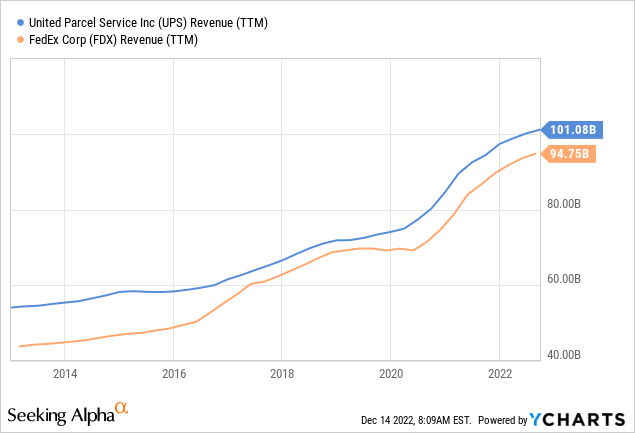

Ten years ago UPS was a much bigger company than FedEx, but FedEx was growing much faster. UPS still generates higher revenue, but they are very close today.

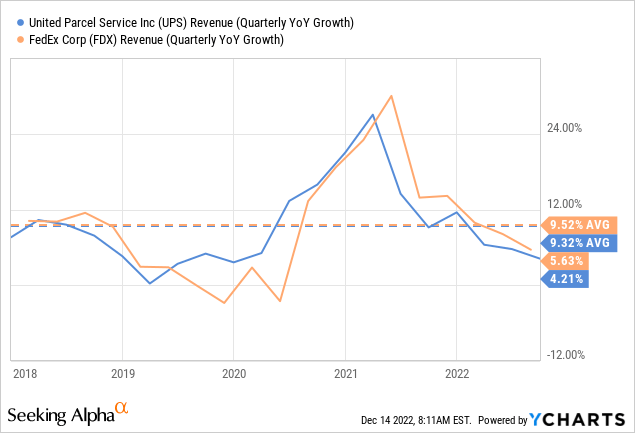

As FedEx grew almost as large as UPS, its growth rate decelerated. Ten years ago FedEx was growing much faster than UPS, but if we look at the average growth rate of the last five years, both companies are now growing at a very similar rate.

Balance Sheets

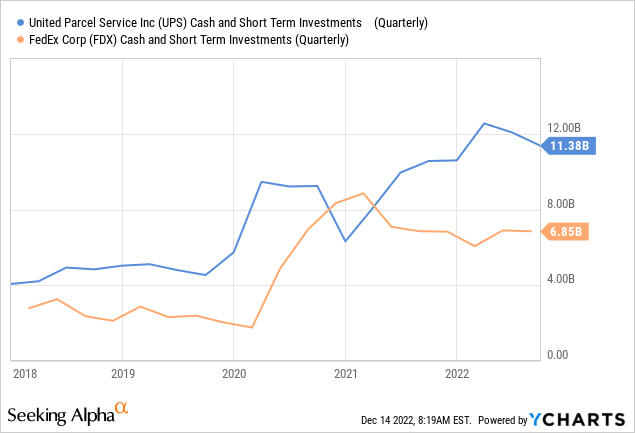

FedEx is rated ‘BBB’ by Standard & Poor’s, while UPS has an even higher investment grade credit rating of ‘A’. UPS has a bigger amount of cash and short-term investments compared to FedEx, which gives the company more liquidity and balance sheet strength.

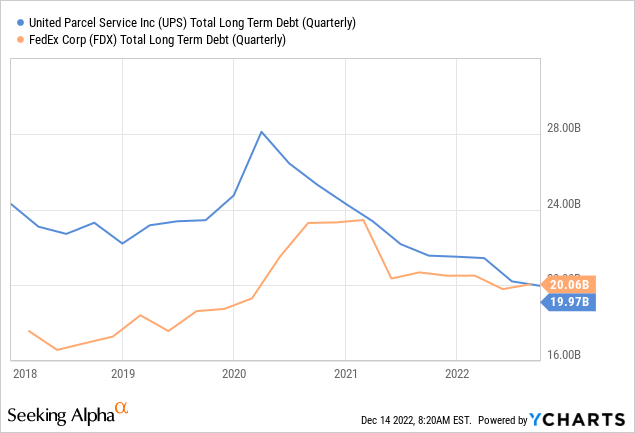

In terms of long-term debt, both companies carry similar amounts of ~$20 billion. Since UPS is considerably more profitable, its leverage its much lower. FedEx’s financial debt to EBITDA is ~2.1x, while UPS’s is a very low ~1.1x. In other words, both companies have solid balance sheets, but UPS is stronger and has more liquidity than FedEx. We are not too worried about the financial strength of either one.

Valuations

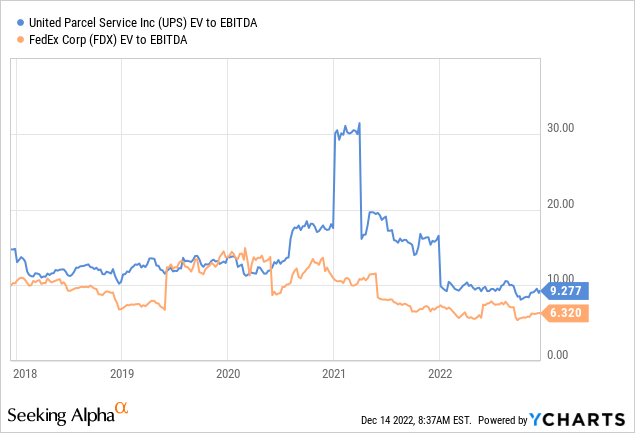

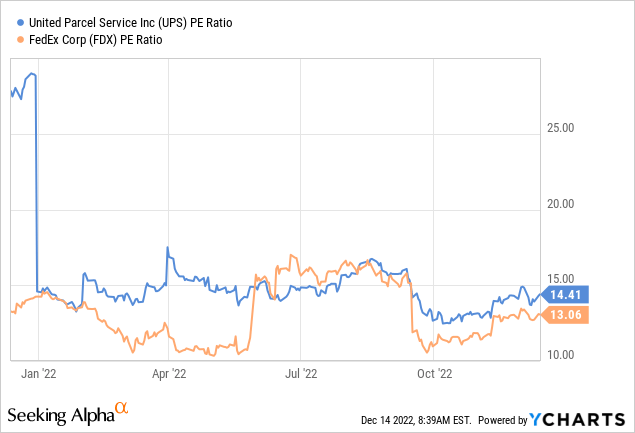

The one advantage we see FedEx having over UPS as an investment is that it currently sports a lower valuation. The EV/EBITDA is almost three turns lower, with UPS trading at ~9.2x and FedEx at ~6.3x.

The price/earnings ratio is a lot closer, however, with UPS having a p/e of ~14x, and FedEx ~13x. While it is clear that FedEx is slightly cheaper, we still believe UPS is a better value given its stronger balance sheet, higher profit margins, and higher ROIC.

Risks

We believe the biggest risk for both companies is the quick rise of Amazon Logistics, which is taking market share. We don’t think it will completely disrupt either company, but will probably decelerate the growth rate of both.

Conclusion

UPS and FedEx have both outperformed the S&P 500 over the past two decades. We believe both are likely to outperform the market going forward, but we like UPS better. It has a stronger balance sheet, better profitability and returns on invested capital, and we like its business focus more. FedEx does have a cheaper valuation, and historically had the faster growth rate. Taking everything in consideration, we believe UPS to be the better investment, and that FedEx’s slightly cheaper valuation is not enough to compensate for the higher risk.

Be the first to comment