kemalbas

Looking for a high-yielding piece of the venture capital market? Take a look at Hercules Capital (NYSE:HTGC), a Business Development Company, a BDC, which focuses on companies which are already backed by venture capital firms. These VC firms don’t want to lose their investments, and will continue to support these companies. This has been crucial during the pandemic, and will continue to be so going forward.

Company Profile:

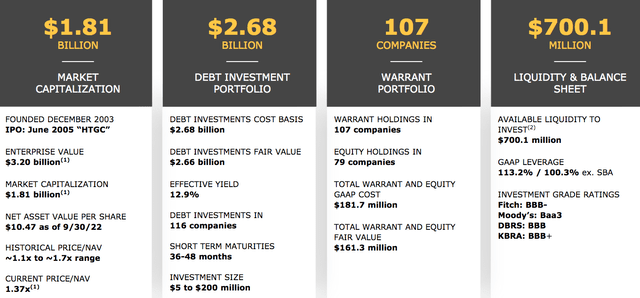

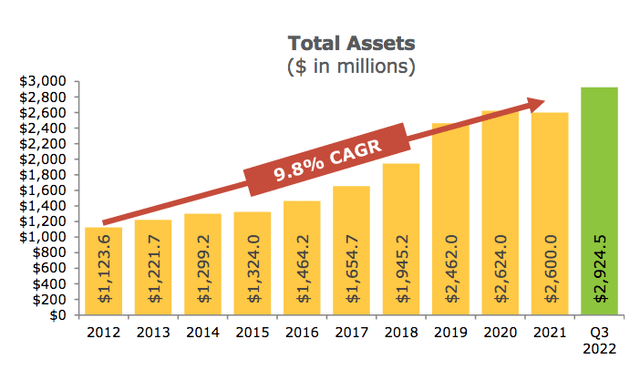

HTGC focuses primarily on pre-IPO and M&A, innovative high-growth venture capital backed companies at their expansion (venture growth) and established stages in a broadly diversified variety of technology, life sciences and sustainable and renewable technology industries. It has a $2.68B debt portfolio, and also holds warrants for 107 companies, which add more upside potential to its investment portfolio.

HTGC site

The asset base is 73% 1st position Senior Secured Loans, 20% 2nd position Senior Secured Loans, ~5% Equity Investments, plus some Warrant and unsecured Debt positions. 95% of HTGC’s debt portfolio is at floating rates:

HTGC site

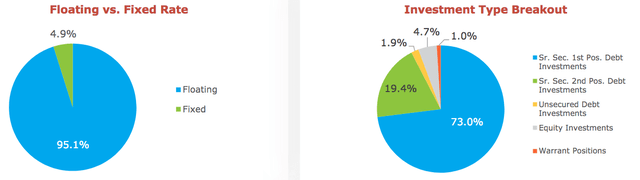

Benefits From Rising Rates:

Management estimates that a 200-point increase in rates would earn HTGC an additional $.36/share, while a 75-point increase would earn an additional $.14/share:

HTGC site

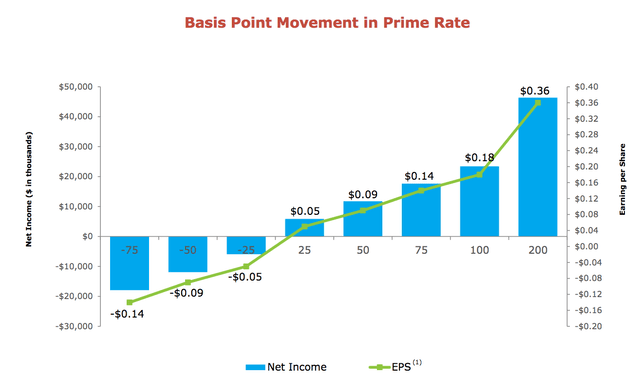

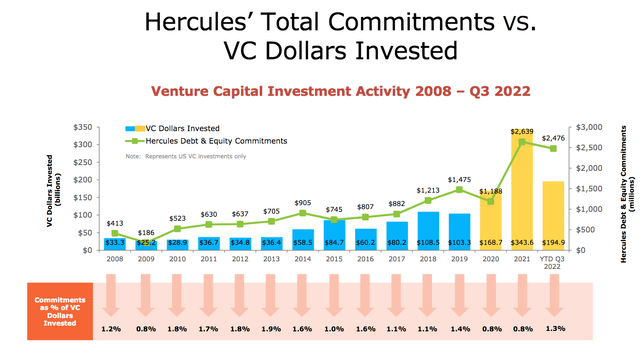

Management has grown HTGC’s asset base by 9.8% since 2012, with Q1-3 2022 already above full year 2021 and 2020:

HTGC site

A key point is that HTGC typically has much less than 2% invested in these private companies compared to the VC firms’ commitments. So far in 2022, HTGC has invested $195B, vs. $2,476B invested by VC firms. HTGC is in the game, but with much less exposure.

HTGC site

Earnings:

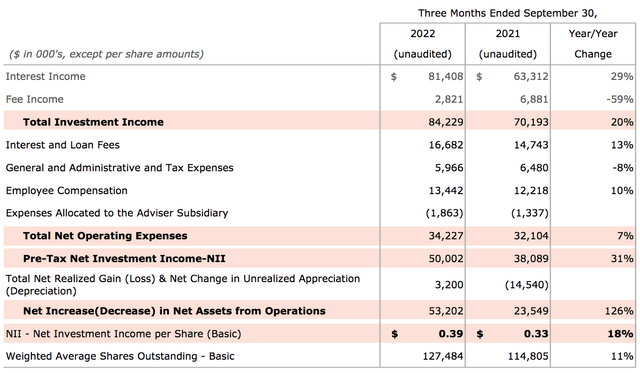

Q3 ’22 total Investment Income rose ~29%, while NII/Share rose 18%, to $.39, vs. $.33 in Q3 ’21, due to an 11% jump in the share count. The $.39 provided 108% Coverage of HTGC’s recently increased base distribution.

HTGC site

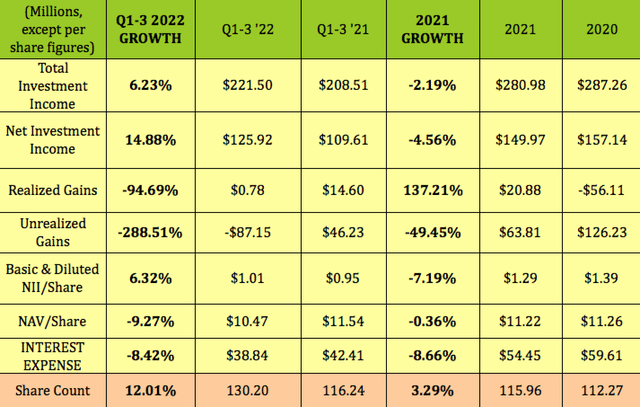

For Q1-3 2022, HTGC had a 6% rise in total Investment Income, and a 15% rise in NII, reversing the downward trends seen in 2021. NII/Share rose 6.3%, while NAV/Share was $10.47, down 9.27% vs. $11.54 in Q3 ’21. The share count has risen 12% so far in 2022.

Management continued to improve on Interest expense, whittling it down another 8.4% in Q1-3 ’22, similar to the 8.7% improvement seen in 2021:

Hidden Dividend Stocks Plus

Portfolio Ratings:

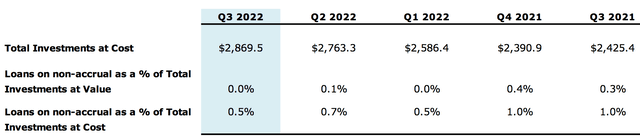

The total portfolio has risen 18%, to $2.87B as of 9/30/22, vs. $2.43B a year ago. Even with that growth, the loans on non-accrual % has decreased to 0.5%, vs. 1% in Q3 ’21.

HTGC’s total realized loss since inception of ($52.2) million represents ~34 basis points, or 0.34 %, of cumulative debt commitments, or an effective annualized loss rate of 1.9 bps, or 0.019 %.

HTGC site

Dividends:

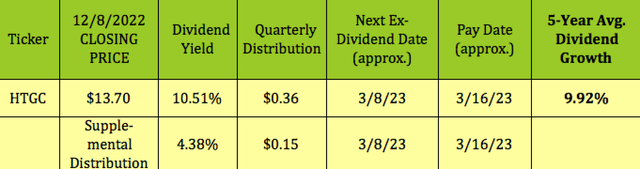

Management raised the base distribution by a penny to $.36/share, and continued to pay a $.15/share supplemental distribution in Q4 ’22. At its 12/8/22 closing price of $13.70, HTGC’s base yield is 10.51%, and its supplemental yield is 4.38%, for total yield of 14.89%.

HTGC pays quarterly, and should go ex-dividend next on ~3/8/23, with a ~3/16/23 pay date.

As you’ll see in the valuations section of this article, HTGC typically gets premium P/NAV valuations. One of the reasons for that is that it has one of the highest five-year dividend growth rates, nearly 10%, in the BDC industry.

Hidden Dividend Stocks Plus

Profitability and Leverage:

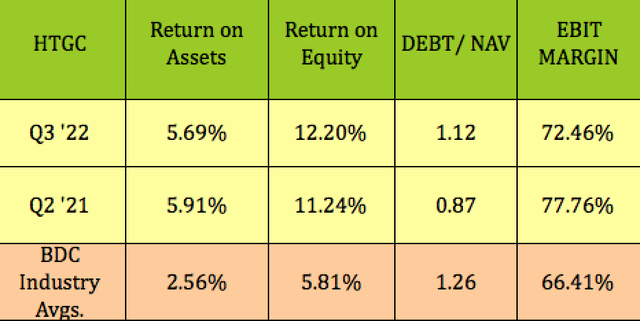

Trailing ROA was slightly lower, while ROE rose to over 12% in Q3 ’22, and both metrics remained far above BDC industry averages. Like many other BDC’s, HTGC’s management has increased leverage in 2022, in order to grow the portfolio. Still, HTGC’s debt/NAV remains below the BDC industry average. EBIT/margin was lower in Q3 ’22, but still above average.

Hidden Dividend Stocks Plus

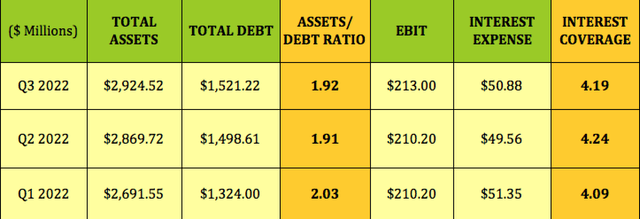

EBIT/Interest coverage has remained at 4X-plus in 2022, while the assets/debt ratio has been ~1.9X for the past two quarters:

Hidden Dividend Stocks Plus

Debt and Liquidity:

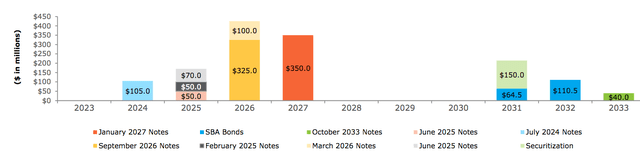

As of Sept. 30, 2022, there were $ 102M in outstanding borrowings under Hercules’ $545M committed credit facility with MUFG, and $25M of outstanding borrowings under Hercules’ $225M committed credit facility with SMBC.

HTGC has no maturities until 2024, when $105M in SBA bonds comes due, followed by $170M in Notes coming due in 2025. 2026 is its biggest bump in maturities, at $425M. Moody’s rates HTGC’s debt at Baa3 Stable.

HTGC site

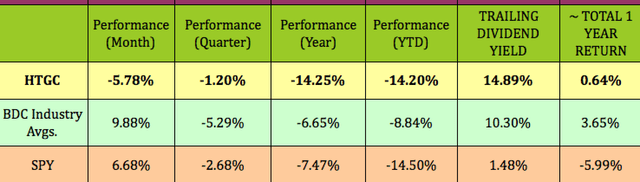

Performance:

While HTGC has lagged the BDC industry over the past year and so far in 2022, it outperformed the S&P on a total return basis over the past year.

Hidden Dividend Stocks Plus

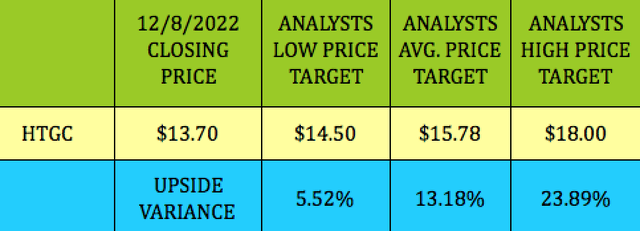

Analysts’ Price Targets:

At its 12/8/22 closing price of $13.70, HTGC is 5.5% below analysts’ $14.50 lowest price target, and 13% below the $15.78 average price target.

Hidden Dividend Stocks Plus

Valuations:

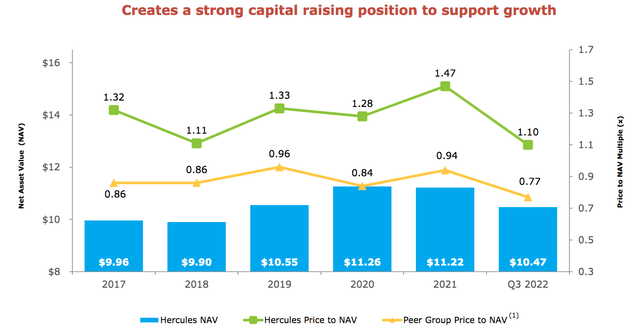

HTGC has traditionally received a premium Price/NAV valuation, running as high as 1.47X in 2021, which offers management an opportunity to raise additional capital via share issues.

HTGC site

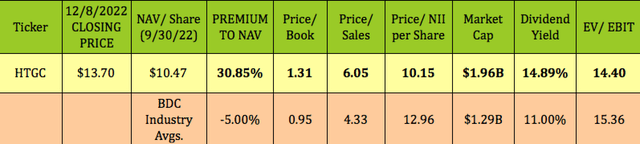

Today is no different – at $13.70, HTGC trades at a 31% premium to NAV/share, vs. the -5% BDC industry average.

But take a look at its earnings multiple, its Price/NII per share is 10.15X, much lower than the 12.96X BDC industry average.

While HTGC’s regular yield is 10.5%, throw in the supplemental dividend and that rises to nearly 15%.

Hidden Dividend Stocks Plus

Parting Thoughts:

HTGC had some attractive entry points in late October, at below $12.00. There is an April $12.50 put option that has a bid of $.85 that would give you an $11.65 breakeven. Short of that, you could wait for the next market pullback for a lower entry point.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Be the first to comment