Sabur Ahmed Jishan

Meal kit delivery provider HelloFresh (OTCPK:HLFFF) has seen a sharp, unsurprising dip in share price in 2022, coming off sharply from the run-up seen during the pandemic. This article looks at the impact of the post-pandemic environment, in the context of a weak economy, high inflation and rising interest rates, on the company and its stock price. It concludes that there are excellent reasons to refrain from buying the HelloFresh stock right now, even though its market-leading position in its key geography and good growth prospects for the meal kit delivery market make a case for its long-term potential.

HelloFresh’s demand growth slows down

Right off the bat, its outlook says it all. In its half-year earnings report, the company says that “accelerating inflation throughout the world, the war in Ukraine, and a material reduction in consumer confidence” have resulted in a downgraded earnings outlook for 2022. It now expects revenue to increase between 18% and 23% on a constant exchange rate (CER) basis, down from 20-26% earlier. That this is less than half the growth rate of 61.5% seen during 2021 puts the numbers in perspective.

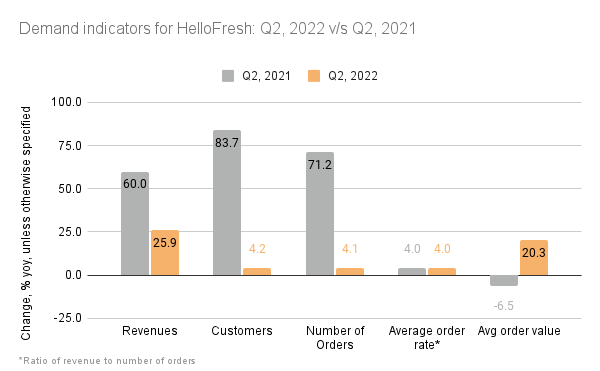

Declining growth is already visible in its second quarter (Q2 2022) results, with revenue growth as measured in EUR (at CER) at just 15.9% year-on-year (YoY). Even at market exchange rates, its revenue has risen by 25.9%, which is a sharp decrease from the 60% rise seen in Q2 2021. While this looks disappointing on the face of it, the numbers need to be in context. In Q2 last year, the pandemic push on revenue was still visible. This means, that even without the current macro challenges, some correction in growth was to be expected. In fact, its initial forecasts had already pencilled in much lower growth for 2022.

However, the latest quarterly CER revenue growth rate is even slower than the lower end of its 2022 projection range, indicating that demand has also been affected by the current economic situation. A significant winding down is also visible in the growth in active customers and the number of orders. Its average order rate, which is the number of orders per customer, has also remained flat. Interestingly though, its average order value has grown compared to a decline in Q1 2021 (see chart). It hardly makes up for the pull-back in all other demand indicators, however.

Source: HelloFresh Half-Year Reports

Earnings under pressure

HelloFresh also appears to be struggling to fight-off inflation. Its gross margin, while still quite high at 65.6%, has remained flat compared to Q2, 2021. Its contribution and operating margins have fared worse, with the former at 24% (Q2 2021: 58.3%) and the latter at 4% (Q2 2021: 8.4%), indicating that its ability to pass on higher costs to customers is limited. If inflation, especially food inflation continues to stay elevated, these metrics will be affected further.

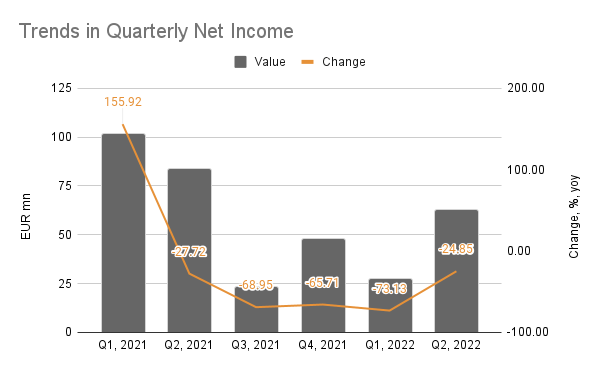

The impact is visible down to its net profits, which have dipped 24.9% YoY, making it the fifth consecutive quarter of shrinking earnings growth (see chart), a trend also seen in its operating profits. While its operating costs have also seen falling growth, which could be some solace, with inflation still quite high, especially in its biggest market, the US, it may well change resulting in further pressure on earnings.

Source: Seeking Alpha

Healthy debt levels

On the upside, HelloFresh’s debt levels are low and even declining, which is an unmissable positive at a time when interest rates are rising at break-neck speed. Both its debt-to-equity ratio and current ratio declined in Q2 2022 to 0.17x (Q2 2021: 0.19x) and 1.1x (Q2 2021: 1.7x) respectively. Its interest coverage ratio has also declined to 16.2x (Q2 2021: 27.3x), but it still remains quite healthy indicating that the company has more than enough earnings to pay off its interest obligations. Its healthy debt-related figures can also provide breathing room for it if there is further pressure on both revenue and earnings in the coming quarters.

Unconvincing market valuations

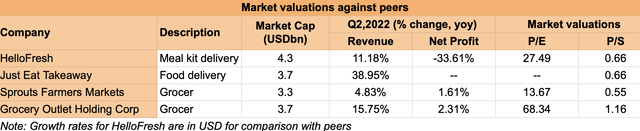

However, with declining revenue and profit growth rates, right now its muted debt levels are probably not enough to justify its relatively high market valuations. HelloFresh stock trades at a price-to-earnings (P/E) ratio of 27.5x, higher than the 21.5x for the consumer staples sector and even higher than that for the S&P 500 as such at 19.4x.

Comparing it to related companies with similar market capitalizations reveals that of the three companies considered (see table), its earnings ratio is lower only than Grocery Outlet Holding Corp (GO), which is at 68.3x. HelloFresh has a P/E higher than Sprouts Farmers Markets (SFM) at 13.7x, though. Just Eat Takeaway (OTCPK:TKAYF) doesn’t enter into this comparison because it’s loss-making right now. Considering that its earnings have fallen drastically, while its profitable peers have seen a small rise in income, HelloFresh’s P/E is not entirely convincing.

A price-to-sales (P/S) comparison reveals that all companies considered are trading at low valuations by any standards. That said, its P/S is exactly the same as that for Just Eat Takeaway at 0.66x, even though the latter has a far higher sales growth. Keeping these in mind along with its higher than industry average P/E makes it even less attractive.

Sources: Seeking Alpha, Yahoo Finance

Think long term only

These valuations, coupled with an uncertain outlook in a challenged economy, give little hope that the HelloFresh stock might start rising anytime soon. After two years of 200%+ growth rates in 2019 and 2020 and touching an all-time high in August 2021, the stock has largely been falling. In 2022 so far alone it’s down by 68%.

However, if it comes out relatively unscathed from the current drag on consumer spending, it could be a rewarding stock to buy. The pandemic proved beyond doubt the potential of the e-commerce market and in particular, the meal kit delivery business has exciting growth prospects over time. It is expected to more than triple by 2030 from a size of USD 15 billion in 2021. HelloFresh is well placed to take advantage of these trends, given its considerable meal kit market share of 71.5% in the US, which accounts for more than half of its revenues. For now, though, there is likely to be more downside to it, so it’s better to hold for now than buy the stock.

Be the first to comment