SomeMeans

Investment thesis

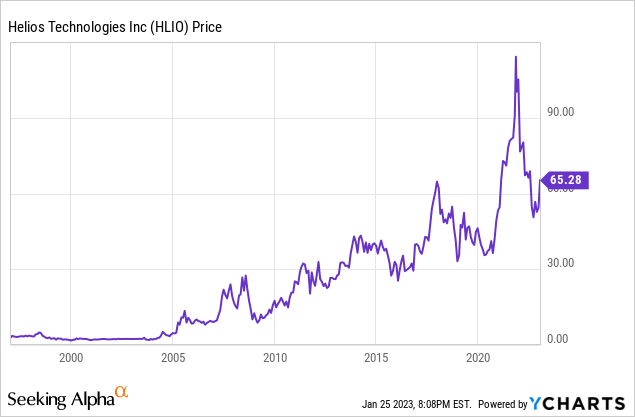

Helios Technologies (NYSE:HLIO) enjoys a very robust balance sheet and very high sales growth rates and margins, but despite this, the share price has declined by 42.44% since November 2021 as it is facing a series of headwinds derived from the current macroeconomic context. The war between Ukraine and Russia, current inflationary pressures and supply chain issues, shutdowns due to Hurricane Ian, and the growing risk of a recession as a result of continuous hikes in interest rates are keeping investors cautious. This is happening at a time when the company carries significant debt as a consequence of an aggressive M&A strategy, which increases the company’s vulnerabilities in the face of current obstacles.

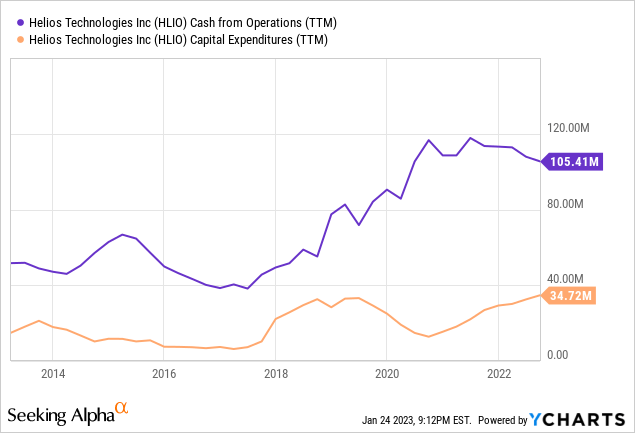

But despite this, cash from operations remains very high thanks to margins that remain at very healthy levels despite current headwinds, which allows the company to easily cover interest expenses, capital expenditures, and dividends, and generate surpluses with which to pay down its debt pile or continue making acquisitions. This is why I believe that the current headwinds and a potential recession are fully bearable for the company and that the current share price decline represents a good opportunity for long-term investors.

A brief overview of the company

Helios Technologies is a global manufacturer of highly engineered motion control and electronic controls technology for a wide range of industries, including construction, material handling, agriculture, energy, recreational vehicles, marine, and health and wellness. The company was founded in 1970 and its market cap currently stands at ~$2 billion, employing over 2,300 workers worldwide.

Helios Technologies (Heliostechnologies.com)

The company operates under two business segments: Hydraulics, which represented 59% of total net sales in 2021, and Electronics, which provided the rest. In the Hydraulics segment, the company designs and manufactures hydraulic cartridge valves and hydraulic quick-release couplings, and engineers complete hydraulic systems. In the Electronics segment, the company designs and manufactures customized electronic control systems and displays for end markets.

Currently, shares are trading at $65.28, which represents a 42.44% decline from all-time highs of $113.41 on November 18, 2021. This fall has been accompanied by an increasingly complex macroeconomic context marked by inflationary pressures, supply chain issues, and a potential recession as a consequence of rising interest rates by central banks to stabilize inflation just at a time when the balance sheet finds itself with a considerable debt load stemming from an aggressive M&A strategy. That is why I think investors are remaining cautious despite very high sales growth rates as profit margins have deteriorated while medium-term risks are greater.

An aggressive M&A strategy has allowed the company to expand in recent years

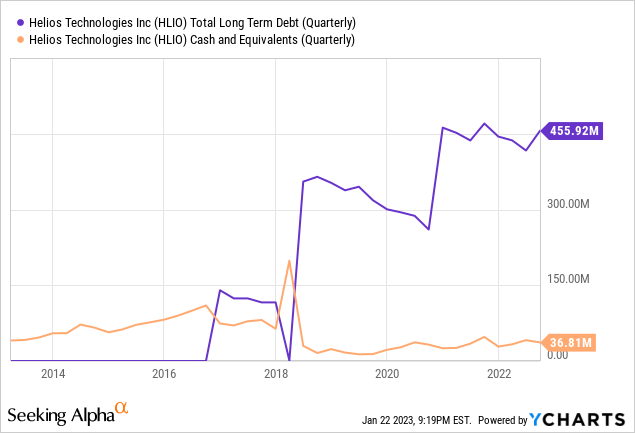

Until 2018, the company enjoyed a debt-free balance sheet, but with the acquisition of Faster Group in April 2018, a leading global manufacturer of quick-release hydraulic coupling solutions, for €430 million, a tradition of acquisitions began that continues to this day, and this has led to the current debt load. Soon after, the company purchased Custom Fluidpower.

After some deleverage, in November 2020, the company acquired Balboa Water Group, an innovative market leader in electronic controls for the health and wellness industry that operates in 47 countries, for $218.5 million. It also acquired NEM, an innovative hydraulic solutions company with a strong presence in Europe and Asia, in July 2021, and also acquired assets related to the electronic control systems and parts business of Shenzhen Joyonway Electronics & Technology in October 2021.

In July 2022, the company acquired Taimi, a Canadian manufacturer of innovative hydraulic components that offer ball-less design swivel products which improve the hydraulic reliability of equipment, increase the service life of components, and help protect the environment by reducing leakage. Taimi exports its products to 34 countries, so it has a wide geographical diversification. Two months later, in September 2022, it also acquired Daman Products, a recognized leader in complex manifold design and manufacturing for precision hydraulic manifolds and related fluid conveyance products, which are used in a wide range of industries, including oil and gas, railroad, construction, agriculture, forestry, mining, material handling, machine tool, robotics, and entertainment.

And finally, in January 2023, the company announced the acquisition of Schultes Precision Manufacturing, a manufacturer of precision machined components and assemblies for customers requiring very tight tolerances, superior quality, and exceptional value-added manufacturing processes in the hydraulic, aerospace, communication, food services, medical device, and dental industries. Schultes Precision Manufacturing generates ~$30 million in net sales per year, so it should be expected as a relatively minor acquisition, but the management expects to expand it to $100 million per year in the coming years.

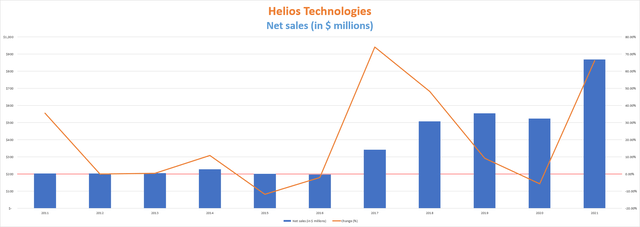

Net sales experienced explosive growth driven by acquisitions

Thanks to acquisitions made since 2018, net sales have increased at a dizzying pace from $342.84 million in 2017 to $869.19 million in 2021, but it is important to note that this growth is unsustainable in the long term since the company has exposed itself to a relatively high level of debt in order to carry out its aggressive M&A strategy.

Using 2021 as a reference, 48.95% of net sales are provided by operations from the Americas, 25.54% from EMEA, and 25.50% from the Asia-Pacific region.

Helios Technologies net sales (10-K filings)

As for 2022, net sales increased by 17.43% year over year during the first quarter, and by 8.17% during the second quarter, but declined by 7.18% during the third quarter. In this sense, net sales have remained quite stable despite the current macroeconomic headwinds, which is a very good sign. Furthermore, the company keeps launching new products quite often. For example, in November 2022, the company launched SpaTouch4, an advanced user interface control system for the spa market. This news came a month after the company launched the OpenView product family in order to expand the company’s product market reach to more applications.

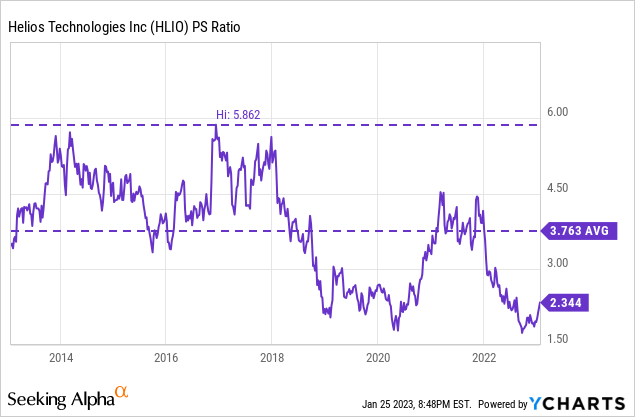

The great increase in net sales linked to the recent fall in the price of shares has sent the P/S ratio to very low levels compared to the past decade. In this sense, the P/S Ratio is currently at 2.344, which means the company generates net sales of $0.43 for each dollar held in shares by investors, annually.

This ratio is 37.71% lower than the average of 3.763 of the past decade, and 60.01% lower than the decade-highs of 5.862 reached in December 2017. This reflects the current pessimism of investors as a result of a fall in margins since 2015 and the current level of debt in a macroeconomic scenario marked by inflationary pressures, supply chain issues, the war between Russia and Ukraine, and a potential global recession as a result of rising interest rates by central banks in order to stabilize inflation at sustainable levels.

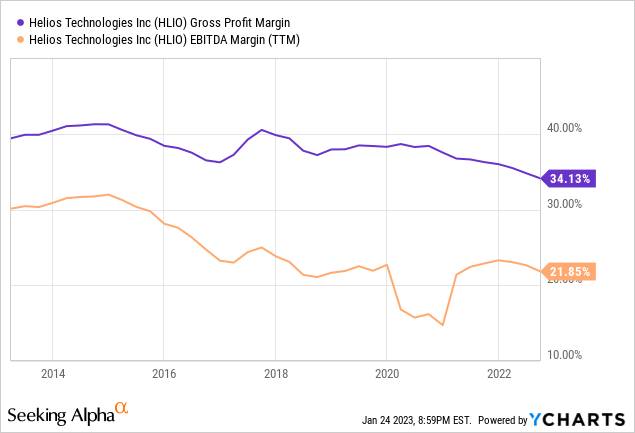

The company is highly profitable despite recent margin declines

The complexity of the products that the company manufactures allows it to maintain a strong pricing power that leads to quite high profit margins. In this sense, the trailing twelve months’ gross profit margin currently stands at 34.13%, and the EBITDA margin at 21.85%.

These margins have shown a recent worsening during the last quarter as they declined to 33.43% and 20.82% in gross profit margins and EBITDA margins, respectively, mainly due to lower volumes and shutdowns due to Hurricane Ian. But despite declining profit margins since 2015, cash from operations has doubled in the past decade thanks to increased net sales from acquisitions and is triple the amount of capital expenditures, suggesting that the company’s acquisitions have helped it to increase its profitability despite posting more moderate margins in the past few years. Furthermore, the company is currently optimizing the operations of recently acquired businesses, which often takes time.

In addition, if we take into account that interest expenses were $4.10 million during the past quarter, the company can easily assume interest expenses of ~$16.5 million per year after covering capital expenditures of ~$35 million thanks to annual cash from operations of over $100 million, which should allow it to reduce its current level of debt in the long term.

Current debt levels suggest a deleveraging phase will soon become a priority

The long-term debt has risen to $456 million since 2018 as a consequence of the acquisitions carried out since then, which means that the company’s growth rates might actually be unsustainable. I think this means that the company must, at some point, begin to reduce said debt levels in order to reduce interest expenses and have more margin to finance new acquisitions. But despite this, CFO Tricia Fulton stated that the management intends to make new acquisitions in the near future during the past quarter’s earnings call conference, so the deleveraging phase has not yet arrived.

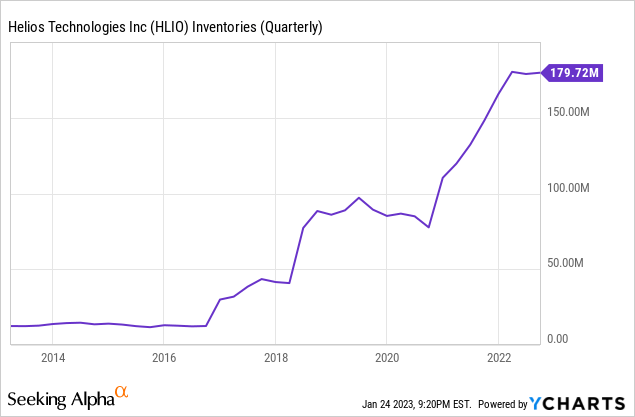

In addition, cash and equivalents are very low at $36.81 million, so the company might need to take on more debt in order to keep acquiring new businesses and cover interest expenses, and later reduce debt levels through positive cash from operations. Fortunately, inventories are at very high levels at $179.72 million.

This represents a great safety net to withstand a potential recession in the coming quarters or years as the company has the possibility of converting its inventories into cash. Furthermore, accounts receivable of $131.6 million are significantly higher than accounts payable of $64.9 million.

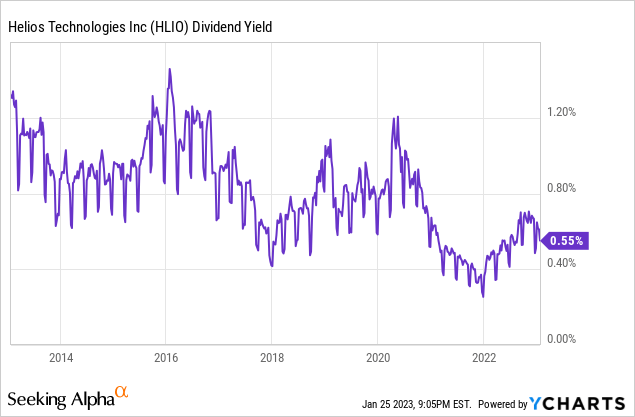

The dividend appears safe as the cash payout ratio is very low

The company has been paying a dividend for 25 consecutive years, although the dividend yield is very low as the company is in a period of full expansion. In this sense, it pays a quarterly dividend of $0.09 per share and there are no increases in sight as it has remained static over the past decade.

In this regard, the dividend yield currently stands at 0.55%, so this is a company that pays a very small dividend to shareholders as it spends its cash flows on acquisitions and, very likely, on debt reduction at some point in the coming years. Next, I present a table where I calculated what percentage of the cash from operations has been allocated each year to cover the dividend and interest expenses as, in this way, we can calculate the sustainability of the dividend through actual operations.

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| Cash from operations (in millions) | $47.12 | $62.85 | $49.90 | $38.51 | $49.38 | $77.45 | $90.48 | $108.56 | $113.20 |

| Dividends paid (in millions) | $9.44 | $38.36 | $12.00 | $10.74 | $10.26 | $11.00 | $11.53 | $11.55 | $11.61 |

| Interest expenses (in millions) | -$1.0 | -$1.6 | -$1.4 | -$0.79 | $3.78 | $13.88 | $15.39 | $13.29 | $16.87 |

| Cash payout ratio | 17.90% | 58.49% | 21.24% | 25.85% | 28.43% | 32.12% | 29.74% | 22.88% | 25.16% |

As we can see, the cash payout ratio has been quite low in recent years, which has made possible the growth in sales that the company has experienced thanks to the acquisitions carried out. As for the past quarter, the company generated cash from operations of $30 million, which is enough to cover the dividend and interest expenses for a whole year, which means that the current dividend is largely sustainable and the company has enough cash generation to face its current debt pile.

Risks worth mentioning

Thanks to high profit margins, growing sales, and a very low cash payout ratio, I consider Helios Technologies to have a fairly low-risk profile. Still, there are some risks that I would like to highlight.

- First, debt has increased significantly in recent years and is already generating an annual interest expense of ~$16.5 million. Although these interest expenses are covered with ease thanks to high cash from operations, such debt levels could continue to rise as the management is determined to continue acquiring new businesses, which could increase the risk profile of the company, especially if any significant acquisition does not deliver the expected results.

- Second, profit margins could continue to fall if the war between Ukraine and Russia continues to drag on and if inflationary pressures, as well as supply chain issues, continue to impact company operations and the broader global economy.

- And third, the continuous hikes in interest rates that central banks around the world are carrying out in order to stabilize high inflation rates could lead to a global recession, which could have a strong impact on the operations of the company in the sense that demand could decline, leading to lower volumes and therefore lower profit margins that would drive cash from operations significantly lower than current levels. It is very important to consider that this scenario would very likely have a very negative impact on the share price.

Conclusion

Certainly, the macroeconomic context marked by supply chain issues, inflationary pressures, and a potential recession justifies investors’ caution. But even so, I believe that the current fall in the share price represents a good opportunity for long-term investors as the company’s operations are actually in good shape.

On the one hand, profit margins continue to allow the company to generate enough cash from operations to amply cover capital expenditures, interest expenses, and dividends. Furthermore, there are still areas to optimize in recently acquired businesses, so there is still room for maneuvering to improve the company’s profitability. In addition, net sales have increased considerably in recent years thanks to acquisitions, which has led to a significant increase in cash from operations.

On the other hand, the debt is very manageable thanks to interest expenses of only ~$16.50 million per year vs. trailing twelve months’ cash from operations of over $100 million and, while this allows the company to reduce its debt pile with surpluses, the management remains determined to continue acquiring new businesses, so it will be very important to monitor debt levels as they could increase in the coming quarters or years before a deleveraging phase begins.

But despite this risk and the current headwinds, I believe that the positive aspects of the company in terms of sales growth rates, high profit margins, and a very manageable debt tips the balance towards considering the current share price decline more as an opportunity for the long term, and not so much as a risk.

Be the first to comment