Gearstd

Authors Note: All funds listed in Canadian currency unless otherwise noted.

Investment Thesis

Hamilton Enhanced Multi-Sector Covered Call ETF (TSX:HDIV:CA) is designed to provide diversified monthly income from a multi-sector portfolio of covered call exchange-traded funds (“ETFs”). At launch, HDIV:CA had a targeted distribution yield of 8.5%; at current levels, the fund is yielding 9.5%. HDIV:CA uses 1.25X leverage along with a covered call strategy to produce high levels of income from a globally diversified underlying asset mix that has a similar sector composition to the S&P/TSX 60.

Fund Overview

HDIV:CA holds seven distinct ETFs provided by a variety of third-party fund managers. These seven holdings are mostly covered call funds that represent a broad range of sectors to create an income-focused, broadly diversified ETF. Since inception in July 2021, HDIV:CA has attracted $278M in assets under management (“AUM”). This rapid growth underscores the investor appetite for a diversified monthly income vehicle with returns that can stay ahead of high rates of inflation.

HDIV:CA’s stated investment objective is to “provide attractive monthly income and long-term capital appreciation from a diversified portfolio of primarily covered call ETFs focused on Canada.” The enhanced income goal is primarily achieved by focusing on dividend paying holdings and writing covered calls to create income. The fund’s 25% cash leverage to enhance is added to create the potential for a higher total return. While HDIV:CA maintains a similar sector composition to S&P/TSX 60, the fund is geographically diversified with approximately 2/3 of holdings outside of Canada. This ensures that income sources are diversified by sector and by country of origin.

HDIV Holdings by Geography (Hamilton ETFs)

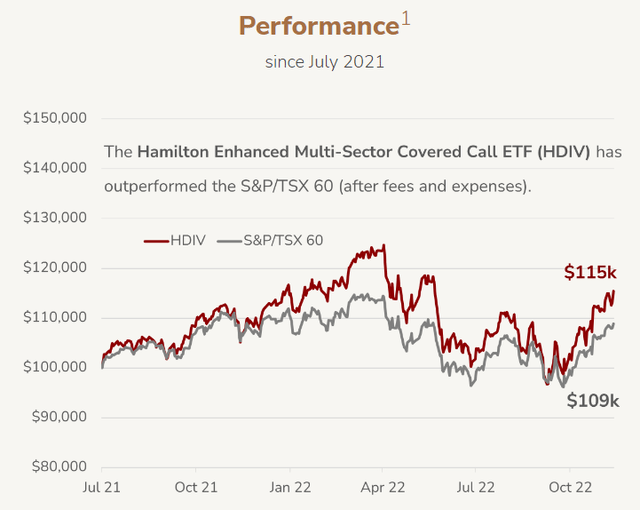

This leverage acts to enhance both gains and losses, making the fund potentially more volatile than the sum of its underlying holdings. HDIV:CA trades on the Toronto Stock Exchange with average daily volume of 62,000 units. The fund has a not-insignificant management fee of 0.65% and an MER of 2.09%. Despite these fees, the fund has outperformed the S&P/TSX 60 since inception and has paid steady monthly income.

HDIV Performance (Hamilton ETFs)

Covered Call Income

HDIV:CA’s ETF holdings are used to write calls on the underlying securities held in their funds to generate premium income. As the premium income is generated by the fund manager selling options on individual holdings at a future date and strike price, the fund is, in effect, capping its potential for capital appreciation in exchange for current income. HDIV:CA’s strategy is to offset this foregone upside potential by adding leverage. According to Rob Wessel, Managing Partner at Hamilton ETFs:

There are 70 covered call ETFs listed in Canada with assets under management of over $10B. And 48 of those are invested in sector-focused covered call ETFs, which pay higher distributions than broad-index covered call funds. However, because sector-focused funds are less diversified, they have higher volatility. Overall, HDIV[:CA] is designed to mitigate the yield/return tradeoff of covered call funds by minimizing the structural underperformance. Our strategy is to add modest leverage by offering the potential for both higher long-term returns and yield.

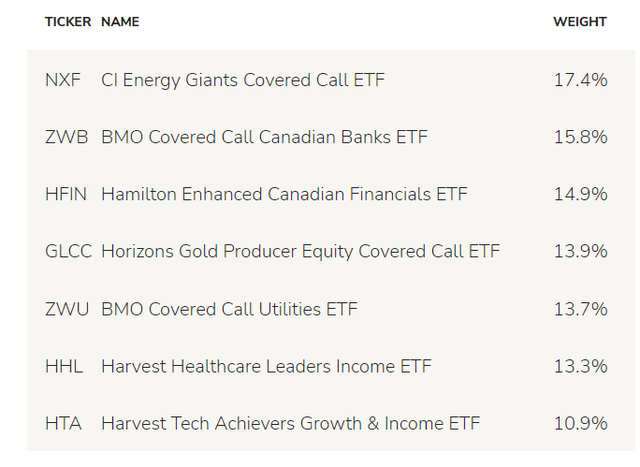

HDIV Holdings

HDIV:CA is the aggregate of seven other ETFs, six of which are sector specific covered call ETFs. Sector exposure is concentrated within the: financial, utilities, gold, technology, healthcare, and energy sectors. Specifically, the fund holds:

- CI Energy Giants Covered Call ETF (NXF:CA)

- Hamilton Enhanced Canadian Financials ETF (HFIN:CA)

- BMO Covered Call Utilities ETF (ZWU:CA)

- Harvest Healthcare Leaders Income ETF (HHL:CA)

- Horizons Gold Producer Equity Covered Call ETF (GLCC:CA)

- BMO Covered Call Canadian Banks ETF (ZWB:CA)

- Harvest Tech Achievers Growth & Income ETF (HTA:CA)

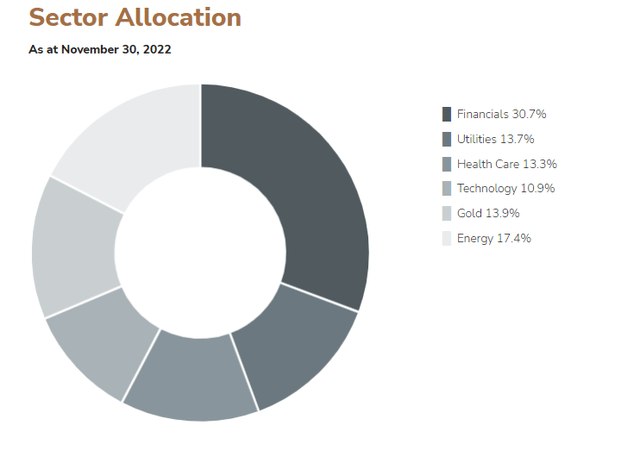

While the fund is largely similar to the S&P/TSX 60 in terms of sector allocation, it lacks exposure to materials, industrials, real estate, and consumer discretionary and cyclical (the BMO Covered Call Utilities ETF maintains some exposure to telecommunications.)

HDIV:CA’s holdings have been curated to mirror the sector mix of the S&P/TSX 60, but with greater international diversification and greater yield. The fund has recently made some intentional changes to better mimic the sector mix of the S&P/TSX 60, such as removing U.S. Lifecos and adding additional exposure to Canadian financials. This was achieved by adding the Hamilton Enhanced Canadian Financials ETF. HFIN does not employ a covered call strategy, however it does use leverage to enhance the distributions from its underlying holdings. HFIN has a current yield of approximately 6.5% and helps to reduce the fund’s overall management fee as it is within the Hamilton ETF family.

HDIV:CA is more diversified and less concentration risk than the S&P/TSX 60 Index benchmark. For example, the ten largest positions within HDIV:CA’s underlying funds total approximately 20% versus approximately 37% for the ten largest positions in the S&P/TSX 60 Index.

HDIV Sector Allocation (Hamilton ETFs)

Modest Leverage

HDIV:CA’s use of leverage is important to offset the effect of covered calls in achieving long-term capital gains. With 25% magnification, if the market moves by 10%, HDIV gains or loses 12.5% depending on the direction of the move. This leverage will be a tailwind in bull market cycles, but will magnify losses in down cycles.

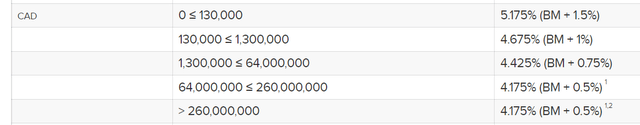

The fund’s cash leverage is provided to the fund by National Bank of Canada (NA:CA) at institutional rates. For investors looking to enhance returns, utilizing fund-based leverage is an easy way to borrow at a significantly cheaper rate than through an individual retail margin account. Margin rates in Canada range from 4.2% to 7.5% or higher at discount brokerages:

Current Margin Borrowing Rates

Margin Costs (Interactive Brokers)

Distribution Yield

In February 2022, HDIV:CA increased the monthly distribution from $0.1175 to $0.1250, for an annualized payout of $1.50. At current prices, this works out to a yield of 9.5%. The fund was launched with a target distribution yield of 8.5%. The fund manager indicates that over time, the yield should be similar to the weighted average of the yields of its underlying holdings multiplied by the 1.25X leverage ratio, less management fees. Given the diversified nature of the underlying holdings across multiple sectors and fund managers, HDIV:CA carries less risk of distribution reductions compared to individual sector covered call ETFs.

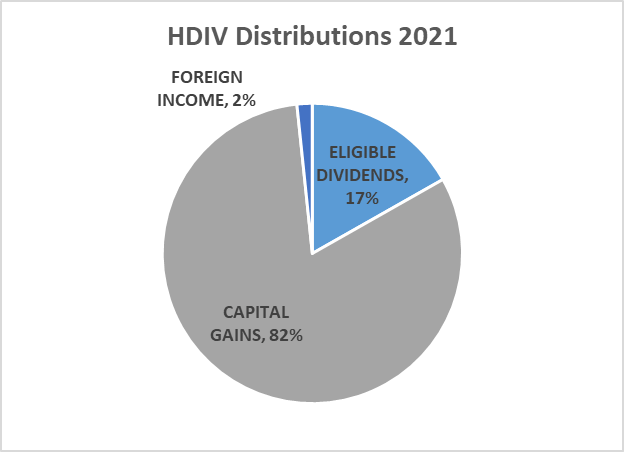

HDIV Distributions 2021 For Tax Purposes (Data Source: Hamilton ETFs)

For tax purposes, the majority of the distribution is considered capital gains. Distributions are not subject to further withholding taxes, as withholding taxes have already been paid by the underlying holdings.

Risk Analysis

There are no free lunches in investing; HDIV:CA’s 9.5% yield carries several risks. Specifically, the combination of a covered call strategy and the use of leverage adds variables to this fund that could see its performance deviate from that of its underlying holdings.

The chief risk with using a covered call strategy is that the fund could underperform the market in periods of market strength. Conversely, the premium income generated from this options strategy will buoy the fund during periods of poor market performance.

HDIV:CA employs a strategy of 1.25X leverage to enhance dividends and returns by borrowing from a financial institution. Rising interest rates could make HDIV:CA’s leverage strategy less attractive by increasing the cost of borrowing. Any use of leverage in a fund may also increase volatility and affect liquidity.

Hamilton ETFs rates the volatility of the fund as medium risk. HDIV:CA is comprised of sectors that tend to have more exposure to higher-yielding securities, such as utilities and financials. These sectors could underperform in periods of rising interest rates as dividend stocks become less attractive relative to fixed income and GICs. With a portfolio that lacks exposure to sectors such as: materials, industrials, real estate and consumer discretionary and cyclical, HDIV:CA won’t participate if these sectors experience outperformance.

Investor Takeaways

HDIV:CA is a welcome addition to the ETF market as it addresses several shortcomings from existing covered call ETFs. The use of leverage serves to mitigate the tradeoff of income and long-term capital appreciation that is inherent to covered call ETFs. The fund’s multi-sector and global diversification profile limits the risk of income distribution cut through sector-specific or regional risks. While HDIV:CA’s MER of 2.09% is not miniscule, its 9.5% current yield provides an excellent passive income option for investors seeking a high yield.

Be the first to comment