naveen0301/iStock Unreleased via Getty Images

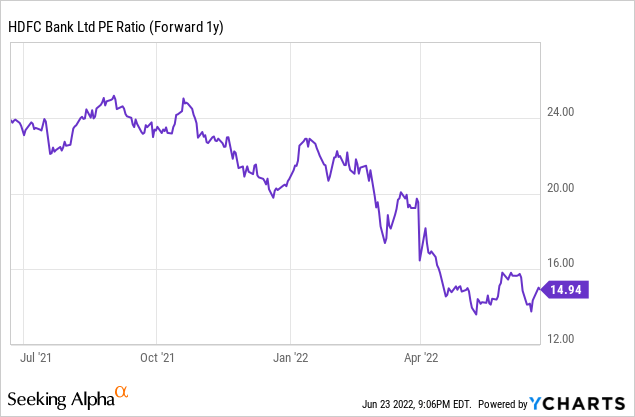

HDFC Bank Limited (NYSE:HDB) is entering a new chapter in its growth story with the HDFC merger. Post-transaction, the bank will see accelerated balance sheet growth, allowing it to ramp up investments in capability-building across its people, physical and digital channels. The most prominent strategic shift will likely be in the mortgage growth runway, which will receive a major boost post the merger of HDFC Limited into the bank. While near-term merger uncertainties could weigh on earnings, this seems to be largely priced in at the current valuation discount relative to historical levels (~15x fwd earnings). This provides a compelling entry point for patient, long-term investors to realize the long-run RoE accretion as cost benefits kick in post-merger.

Pressing the Retail Growth Pedal Post-COVID

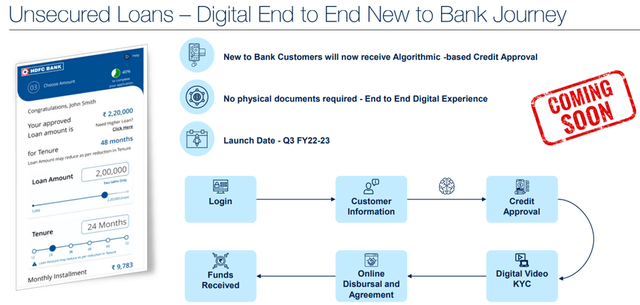

HDB’s commentary at the recent investor day and earnings call were similarly positive, emphasizing the pick-up in retail segment growth across product lines coming out of the pandemic (recall that the bank had previously pulled back on retail loans during COVID). As the biggest GDP contributor and a source of strength for HDB through the years, the focus on housing makes sense, with HDB planning to grow the home loan book aggressively to make up for lost ground. In addition, HDB will also leverage its superior value proposition in auto and unsecured loan categories (e.g., credit cards and personal loans), where it currently holds the leading market share. HDB cited gold loans as a potential growth area as well, with plans to triple or quadruple the branch count offering this product. Innovative offerings such as the ten-second personal loan product are also being rolled out to new-to-bank customers, potentially expanding its universe of addressable market opportunities going forward.

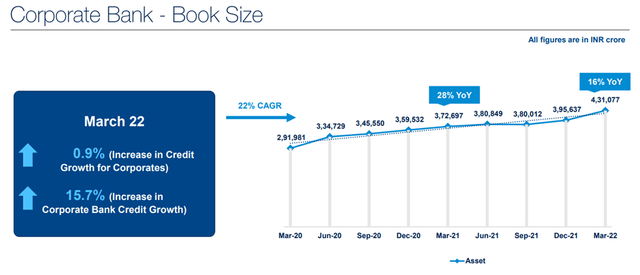

Robust Corporate Growth Numbers to Continue

To make up for the retail segment slowdown during the pandemic, HDB has opportunistically leaned on asset growth in its corporate business. The strength here was led by an impressive ~16% growth in corporate loans in FY22 (vs. ~1% for the system) on expectations of a broader capex revival. Supported by government expenditure, public sector capex should do well, while the focus on private sector capex makes sense given the need for supply chain finance amid the ongoing disruptions. The bank is less interested in participating in lending via corporate bonds, though, which should mean its best-in-class cost ratios and credit costs remain intact. Instead, HDB will move deeper into the multinational corporations (MNC) sector in the coming years – although MNCs represent a relatively smaller addressable market opportunity, the outsized fee and forex income generation could be a nice earnings tailwind.

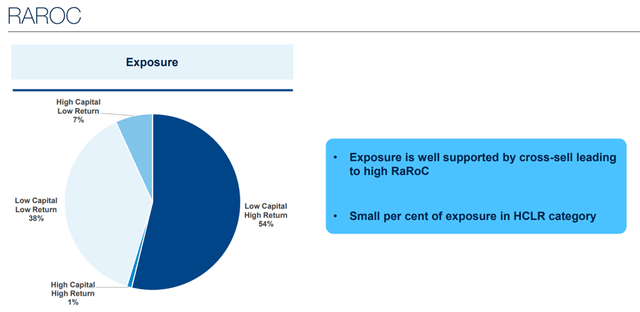

The overarching takeaway from HDB’s corporate presentation, in my view, is its continued focus on maintaining industry-leading corporate risk-adjusted return on capital (RAROC). Initiatives here should keep the ROA profile healthy, even without the benefits of cross-selling from other lending products. Asset quality likely stays pristine as well, with ~54% of the portfolio in the “low capital, high return” bucket and ~87% rated AA/above. Plus, HDB has ample room to maneuver for better yields without compromising its RAROC model, given the bank is still under-penetrated among corporates – it has yet to establish a relationship with 617 corporates (revenue of >INR10bn) within its eligibility criteria, equating to a combined INR11tn debt size.

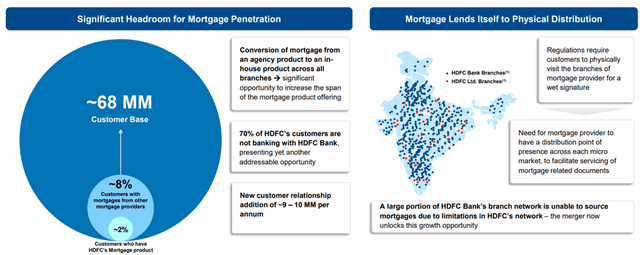

Near-Term Merger Uncertainties Outweighed by Favorable Long-Term Economics

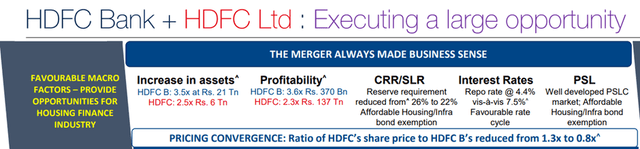

Thus far, HDB stock appears to have priced in the margin and profitability overhang from the pending HDFC-HDFC Bank merger. While the near-term concerns are valid, the long-term economics from this deal seem overwhelmingly positive, given the benefits from a lower funding cost to the mortgage book as well as other post-merger synergies, including cross-selling opportunities. The latter is key – less than 2% of the HDB customer base has a home loan from HDFC, and ~5% have taken a home loan from another lender, so penetration here could significantly extend the growth runway. Plus, the outlook for Indian housing is bullish, and by harnessing HDFC’s expertise, HDB will be better positioned to capitalize on future opportunities.

In the meantime, various merger-related concerns remain top of mind. In particular, managing regulatory costs in the form of the Cash Reserve Ratio (CRR) and the Statutory Liquidity Ratio (SLR) reserve maintenance will be key to ensuring a ROA/ROE accretive outcome. The excess liquidity buffer of HDFC and HDB should help, though, while the cost of priority sector lending certificates (PSLC) purchases is guided to have a manageable 5-10bps near-term drag on the RoA. Given regulatory approval terms, the proposed structure will also likely be a relatively straightforward HDFC + HDFC Bank merger (as opposed to a Non-operative Financial Holding Company (NOHFC) structure). This implies a preference to hold a >50% stake in its subsidiaries, although there is flexibility here given management’s comfort in holding <30% depending on regulatory requirements. Still, the merger base case remains for the transaction to be book value accretive and ROA neutral/positive in the mid-term, although ROEs are projected to take three to five years to revert to bank-level. HDB management’s execution track record has been pristine thus far, so I feel comfortable underwriting the case for an accretive post-merger outcome over the long run.

Best-in-Class Indian Bank Weighed Down by Transitory Headwinds

Overall, I see HDB (pre-and post-merger) as offering best-in-class asset quality within the Indian banking sector. Case in point – the bank delivered sector-leading profitability through the cycles (even during the demonetization period in 2016 and COVID in 2020), a track record no other Indian bank can match. With strong customer acquisition and ample cross-selling opportunities (post-merger) to its massive customer base also set to drive more market share gains, the HDB future looks bright. Valuation-wise, HDB has suffered a de-rating since I last covered the stock and now trades at a discount relative to historical levels amid the merger-related uncertainty. This presents an opportunity to long-term investors, in my view, as revenue and margins look set for continued growth into the coming years, while further clarity on the HDFC merger should ease the overhang in the months ahead.

Be the first to comment