Don White/iStock via Getty Images

Investment Thesis

During the last three years, we have seen a lot of volatility in the market due to the pandemic, high inflation, recessionary pressures, and the Russia-Ukraine conflict. The pandemic is now viewed as a benchmark to identify and evaluate resilient companies that stood fast during the pandemic and the harsh market conditions.

According to a McKinsey Report, the past year in the capital markets has underplayed the growing pace of change. Several cyclical correlations played an important role in various industries, for instance, a downward trend observed in consumer discretionary and upward price movement in commodity-related stocks due to the commodity super cycle.

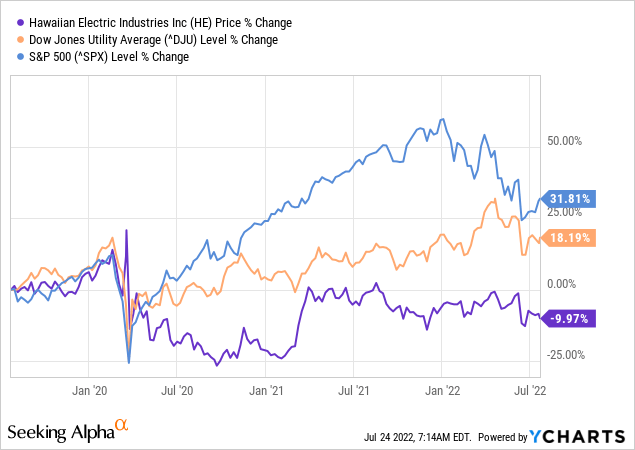

Hawaiian Electric Industries, Inc. (NYSE:HE), the largest electricity supplier in the state of Hawaii, has been on a very monotonous ride since Covid-19. Observing the last 3 years’ price movement compared to the pre-Covid and post-Covid returns with Dow Jones Utility Average returns during the same period shows that the company hasn’t kept up with DJU in the post-Covid period.

At the same time, the company’s sluggish price momentum in the last 3 years underperformed the S&P 500 by more than 40% in the last three years.

Investors in a bear market are hesitant to act boldly, and a recent surge in inflation has caused investors to be more risk averse. Moreover, fearing a recession-type market situation, investors are more inclined toward recession-proof industries.

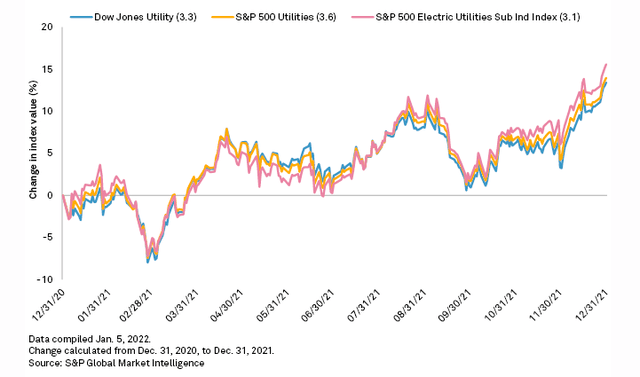

Observing the returns from Hawaiian Electric Industries, it’s clear that when a sector is performing well, correlated with the macro indicators, it doesn’t necessarily mean that all companies in the respective sector will be profitable. The utility sector has generated stable returns in the previous year compared to other sectors. According to S&P Global, the last quarter of 2021 saw electric and multi-utility stocks rally, with indexes reaching peaks of 12.1% to 13.4%, easily the sector’s best performance during the year.

With a highly leveraged capital structure, slow growth compared to its peers, and recent insider selling, I would rate the stock as a “sell.”

Company Overview

Hawaiian Electric, an NYSE-listed public company with a market cap of $ 4.32 billion, engages in the electric utility, banking, and renewable infrastructure investment businesses in Hawaii. With more than 16 years of experience in the utility sector, Hawaii Electric is responsible for providing essential electric services to more than 1.40 million individuals, or 95% of the population of Hawaii, having a monopolistic hold on the state’s energy supply. The company generates 1794 megawatts of electricity by operating four company-owned power plants and another four IPPs.

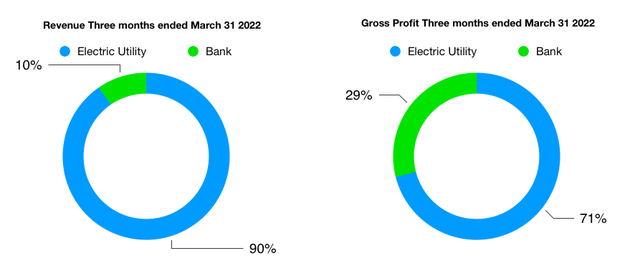

On the other hand, American Savings Bank, a subsidiary of Hawaiian Electric Industries, is one of the largest financial institutions in Hawaii, with more than $9 billion in assets.

The company generated a revenue of $2.9 billion in the MRQ with a YoY growth of 17.56%, with its banking subsidiary responsible for 10% and the electric utility segment accounting for 90% of the total revenue, respectively.

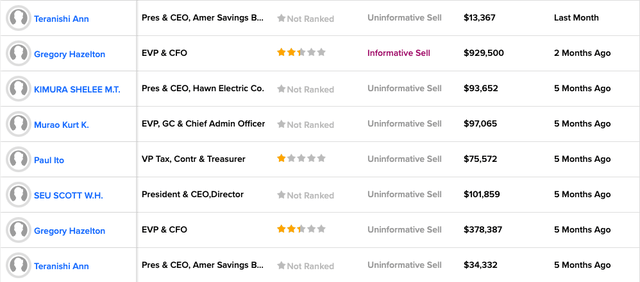

Insider Selling

Investors usually see insider buying and selling as an indicator of future stock performance. Hawaiian Electric has a relatively high percentage of insider sells, with almost a million or about 1% of the total outstanding shares sold within the past 3 months. This higher percentage can be partly attributed to its relatively larger board body, as 6 new directors have joined the board in the last 3 years.

Hawaii Electric has seen significant insider selling in the past year. With CFO Gregory Hazelton selling more than $0.9 Million worth of shares in May 2022 and $1.4 million shares sold by CEO Constance Lau in December 2021, the investor sentiment is not positive.

Source: Hawaiian Electric Stock Insider Trading Activity – TipRanks

Valuation

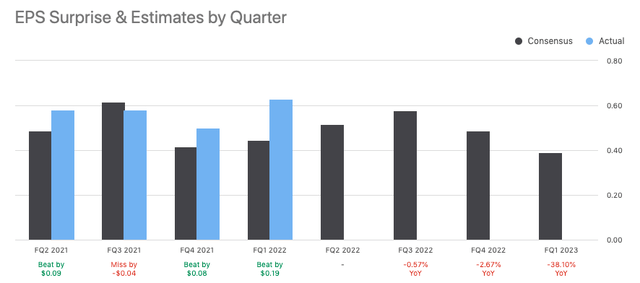

Earnings per share have been on a flat path for the last five years, with the MRQ EPS at $0.63. Interestingly, these earnings aren’t impacting its high P/E multiple of 17.36x as much as it should have. Growth slower than the market and an inferior earning outlook can result in a share price decline, risking the current shareholders’ investments. This could also mean that new investors looking to invest in the company will pay a high premium on the share price.

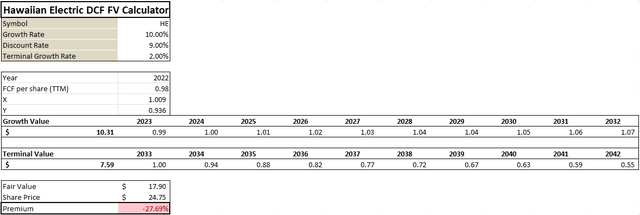

So how much premium? If we run an FCF-based DCF fair value model, with a decent 20 long-term growth rate of 10%, a discount rate of 9% representing the high leverage, and a terminal growth rate of 2%, the stock churns out a fair value of $17.90, almost 30% lower than its current price tag.

According to Forbes, the DJUA’s current yield is 2.3 times what the typical S&P 500 ETF pays. And best in class companies have a clear path to increasing dividends by at least 6 to 8 percent annually, good enough to match even the current inflation rate. Unfortunately, HE’s dividend growth history doesn’t paint a good picture. The growth prospects aren’t just there, with the most recent dividend growth rate of 3.01% compared to the sector median’s 5.50% and a 3-year, 5-year, and 10-year dividend CAGR of 3.08%, 2.16%, and 1.08%, compared to the industry’s 3.86%, 5.7%, and 4.47%.

Additionally, its FCF yield of 2.46%, lower than its dividend yield, and the cash dividend payout ratio of 1.4x curb any dividend growth prospects.

High Debt is High Risk

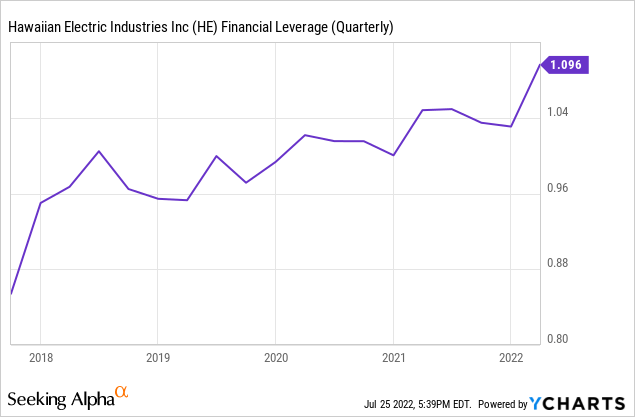

HE’s debt to equity ratio has increased from 86.7% to 108% over the past 5 years and 114.49% in MRQ. The operating cash flow to debt ratio of 0.16x suggests the debt is not well covered with the current operating cash flow.

The company would require a major re-capitalization if it had to pay off its creditors anytime soon. Still, the LT debt to EBITDA ratio of 3.2x and its EBIT covering its interest expense 4.1 times shows that the company can handle the current leverage as being a capital-intensive sector. Additionally, since almost the entire debt is long-term, the company’s current and quick ratio of around 12x means its short-term is secured with a strong cash balance.

The high leverage is mostly in response to high post-pandemic working capital requirements due to high accounts receivable balances and write-offs, primarily because of high inflation affecting consumers’ ability to make timely payments. By the MRQ, about $38 million (approximately 10%) of the Utilities’ accounts receivables were 30 days past due, including approximately 23% on payment plans. The delayed collection has led to an account receivables turnover time of 44 days, which, if not addressed promptly, will lead to the company looking for further WC financing.

Nevertheless, it doesn’t mean HE can afford more debt, as it would not want itself to be exposed to high levels of creditors’ risk, especially considering its high debt to FCF ratio of 56x and its completely consumed balance on the revolving credit facility.

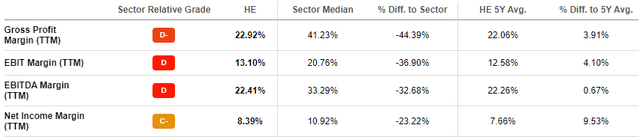

Since debt is cheaper than equity, high leverage should result in a lower cost of capital and higher profitability, meaning that the higher risk should be compensated with higher rewards. However, the company’s profit margins are mediocre at best.

What’s the Upside?

Being the sole electricity provider for most of Hawaii’s population, the company can become an attractive investment if it can improve its cash flows and sustain a higher yield than its current 3.4%. In the future, the high costs imposed by inflation will likely affect the company’s short-term profitability. Still, it could turn the tables in the long run by making the risk-reward dynamic more favorable through either deleveraging or improving its growth metrics.

This could be done in multiple ways, including paying off its long-term debt to lower the interest payments, optimizing its working capital through expediting accounts receivables, and investing in high ROI assets.

Given that the company has missed 5 out of the previous 8 analyst revenue targets but beaten 7 out of 8 EPS targets, it is apparent that HE can achieve operational optimization through meticulous resource management.

Conclusion

According to Deloitte, In 2021, the power and utility industry tackled tough challenges, made measurable progress, and received clean energy encouragement from a new administration. But the utility sector has been performing well recently. As the US economy began to emerge from its pandemic-induced recession, electricity sales rose 3.8% through August 2021 over the prior year.

This hasn’t been the case for Hawaii Electric in the past years as it has been reinvesting capital and generating low returns for its shareholders, including a lower-than-industry dividend growth of 2.16% CAGR for the last five years while its peers averaged around 6.80%.

Investors could generate much better returns by investing in other income or growth stocks as Hawaiian Electric’s weak performance and negligible growth indicators appear to be indicators of a selling call.

Be the first to comment