TU IS

Thesis update

This is an update to my original thesis for HashiCorp (NASDAQ:HCP).

With its ability to capitalize on the growing popularity of public cloud computing, HashiCorp remains, in my opinion, one of the best places to invest in open source infrastructure software. HashiCorp provides their customers with a standardized approach and consistent workflows when it comes to automating critical processes involved in delivering cutting-edge, cloud-native applications. HashiCorp’s foundational products offer customers a unified, standardized method for automating the most critical steps in application deployment across a wide range of cloud and on-premise deployment environments.

HashiCorp’s approach to the market combines a direct sales strategy aimed at large corporations with a bottom-up adoption model among developers. It’s a virtuous cycle: more users means more integrations and more contributions to the ecosystem, which in turn increases the value of the platform and draws in even more users. HashiCorp benefits from this because of how popular their product is among developers and how many companies and programs use it.

Earnings takeaway

The company’s 3rd quarter revenue growth of 52% was driven by an increase in new business from existing customers, an increase in recurring revenue from existing customers (NRR of 134%), and an increase in multi-year renewals. I think this reflects customers’ readiness to streamline their HashiCorp spending in light of the company’s growing strategic importance in the context of ongoing cloud migrations. Thanks to revenue outperformance and stricter cost discipline, the company’s operating margin came in at -24%, well above the -58% target it had set for itself. The company also showed high incremental margin from sales rep productivity, which should help it achieve its F24 operating margin expansion target.

I was heartened to see that HashiCorp was able to raise its revenue guidance for both the fourth quarter and the full year on the back of consistent RPO trends and a more hospitable new business environment, despite the fact that deal signings remained under close scrutiny in the third quarter. Furthermore, despite the overall market decline, HashiCorp Cloud Platform achieved its highest sequential net new revenue to date. The platform’s outperformance may be temporarily hampered, however, by factors such as the slowing of spending by SMBs and the trend toward self-management within enterprises. HashiCorp’s extensive product catalog and the relatively greenfield opportunity it provides lead me to believe that it will eventually become the industry standard for cloud enablement.

Earning update

Due to strong expand and extend momentum within its installed base of larger enterprise customers, HashiCorp’s 3Q23 revenue of $125 million was 52% higher than the consensus estimate of 35% growth, as evidenced by NRR of 134% compared to NRRs of 134% in the preceding quarters and 127% in 3Q22, as well as improved multi-year contracts with cohorts up for renewal. Management speculated that the above-trend growth in multi-year contract renewals was due to customers locking in pricing in a high-inflation environment, but they also saw it as a sign that customers were beginning to standardize on HashiCorp and consolidate their spending with a single vendor. As the company gained traction in the market, the HashiCorp Cloud Platform saw a 140% increase in revenue and delivered record net new revenue of $2.2 million, up from $1.8 million in 2Q and $1.9 million in 1Q.

HCP has been successful, but I believe the company’s ability to maintain high growth in the segment over the medium to long term will depend on enterprise customers’ willingness to migrate from self-managed infrastructure, where there has been little progress due to the mission-critical nature of core infrastructure. Despite reporting a longer deal cycle in Q3, HashiCorp still delivered a strong cRPO of 44%, which should boost the company’s top line going into F24. With better-than-expected revenue and tighter cost discipline, HashiCorp was able to post a -24% operating margin in F3Q23, well below the -58% operating margin it had projected. This came as the company was emerging from a multi-quarter investment cycle. The HCP’s promise of an increase in operating margin in F24 is encouraging, but I should point out that the company doesn’t expect to turn a profit until the second half of 2026, according to its midterm guide.

Valuation

Price target update

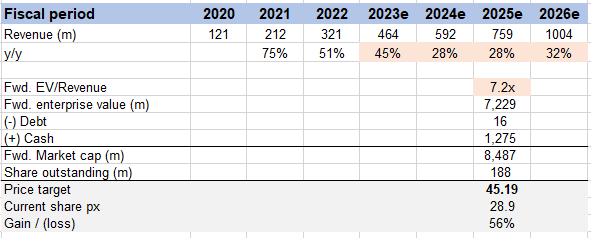

My model still predicts a significant upside from the stock’s current price. Despite the lower 4Q guidance, growth momentum has been strong thus far, and that is all that matters in my opinion. HCP should continue to invest all of their resources in order to grow as quickly as possible, which is the central assumption of my model.

Note that my model uses similar figures as consensus estimates because it is what the “market” expects. Using consensus figures and the same revenue multiple in FY25, I expect significant upside.

Own’s estimates

Conclusion

To conclude, I still believe the upside for HCP is worth a lot more than it is today. HashiCorp, as the market leader in open source infrastructure software, stands to benefit greatly from the public cloud’s rising popularity and drive sustained growth over the next few years. In order to deploy cutting-edge, cloud-native applications, the company’s flagship products provide customers with a standardized and consistent method of automating critical processes and infrastructure. HashiCorp combines a top-down, direct sales strategy for large enterprises with a bottom-up, adoption model. The company’s popularity among developers, as well as the extensive ecosystem of partners and integrations it supports, creates a virtuous cycle in which the platform grows in value and in turn attracts more users, partners, and integrations.

Be the first to comment