Justin Sullivan/Getty Images News

One popular saying is that all work and no play makes Jack a dull boy. But when you are talking about a company dedicated to play and entertainment, a firm such as Hasbro (NASDAQ:HAS), work and play almost always mean the same thing. At the end of the day, without a focus on play, Hasbro has no business model. But I digress. This firm, which has a long history of attractive growth for its top line and a volatile but generally positive bottom line, just got the attention of investors when management reported financial results covering the first quarter of the company’s 2022 fiscal year. Although the company missed expectations when it came to earnings per share, revenue matched what analysts were looking for and the business announced guidance that the market saw as favorable. On top of this, the company also announced that it was starting up its share buyback program again. All combined, this was enough to push shares of the business higher. But after this move, I would make the case that the stock is likely fairly priced.

Hasbro – A play-oriented business

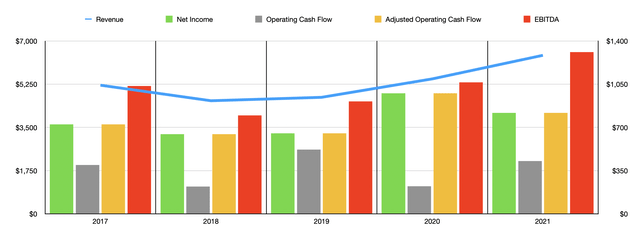

As I mentioned already, Hasbro is a company dedicated to play and entertainment. The company owns and licenses countless brands such as NERF, Magic: The Gathering, My Little Pony, Transformers, Play-Doh, Monopoly, and so much more. Despite the concerns centering around the COVID-19 pandemic and the impact it would have on consumer spending, the business continued to flourish. Although revenue dropped from $5.21 billion in 2017 to $4.58 billion in 2018, it has been climbing ever since. From 2019 to 2020, sales grew from $4.72 billion to $5.47 billion. Then, in 2021, sales expanded further to $6.42 billion. Growth largely came in recent years as a result of strong demand for its services. For instance, the increase in revenue from 2020 to 2021 was driven by strong demand for brands such as Magic: The Gathering and Monopoly. One of the most vital segments of the company has been Wizards of the Coast and Digital Gaming, a developer of tabletop and digital games. Revenue there jumped by 30% from 2020 to 2021 after jumping an impressive 19% from 2019 to 2020.

When it comes to the company’s bottom line, the picture has been a bit more volatile. Between 2017 and 2021, net income has been all over the place, jumping from a low point of $220.4 million in 2018 to a high point of $520.5 million just one year later. In 2020, profits declined to $222.5 million. But they quickly rebounded in 2021, coming in at $428.7 million. Also volatile has been the company’s cash flow. Over the past five years, this ranged from a low point of $646 million to a high point of $976.3 million. This high point was in 2020. Then, in 2021, cash flow dropped some to $817.9 million. The most consistent profitability metric for the company has been EBITDA. Despite plunging from $1.04 billion in 2017 to $796.5 million in 2018, it began a steady decline, eventually hitting $1.31 billion last year.

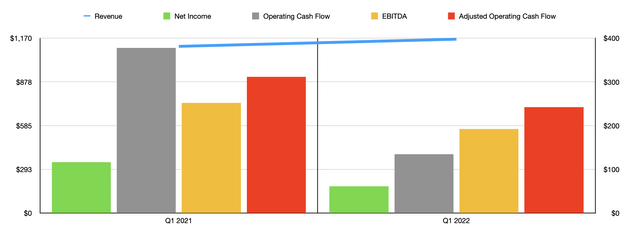

It stands to reason that such a high-quality business would likely fare well moving forward as well. But just as the past few years have been, the data reported for the first quarter of the company’s 2022 fiscal year when management announced its results on April 19th, were predictable. Revenue came in higher year after year, hitting $1.16 billion. Although that represented a year-over-year increase of just 4.3% compared to the $1.12 billion reported in the same quarter one year earlier, it actually was in line with what analysts anticipated. Earnings per share, however, did not fare so well. According to management, the company generated profits of $0.57 per share. That compares to the $0.64 per share that analysts anticipated. It seems as though the company was negatively affected by higher costs relative to sales. During the quarter, for instance, its operating margin was just 10.3%. That compares to the 13.2% achieved one year earlier. This weakness existed across the board. For instance, the Consumer Products segment saw its operating margin contract from 4.9% to 1.3%. Wizards of the Coast and Digital Gaming so its margin dropped from 45.4% to 40.5%. And the Entertainment segment saw its margin drop from 7.8% to 5.4%.

Other profitability metrics also suffered. Operating cash flow came in at $134.7 million. That compares to the $377.6 million reported one year earlier. If we adjust for changes in working capital, the picture was slightly better, with operating cash flow contracting from $311.3 million to $242.2 million. Meanwhile, EBITDA for the company also worsened, declining from $252 million to $192.1 million. Despite this pain, management does still have positive expectations for the 2022 fiscal year. They still see revenue expanding in the low single-digit rate. This comes despite a stronger dollar that hurts its competitiveness overseas and is in spite of around $100 million that could be at risk because of its operations in Russia. Even so, the company still sees operating cash flow coming in at between $700 million and $800 million. Considering the issues the company is facing, including inflation, this decline from the $817.9 million generated last year should not be frowned upon.

At the same time, management also continues to look for ways to create value for investors. For instance, in February of this year, the company increased its dividend by a further 3%. During that quarter, the business paid out $94.5 million to shareholders in the form of dividends. The business is also dedicated to buying back additional stock. They have since resumed repurchases of stock, with the target of buying back between $75 million and $150 million worth of shares throughout the rest of this year. That comes from a share buyback plan that has capacity of $367 million on it.

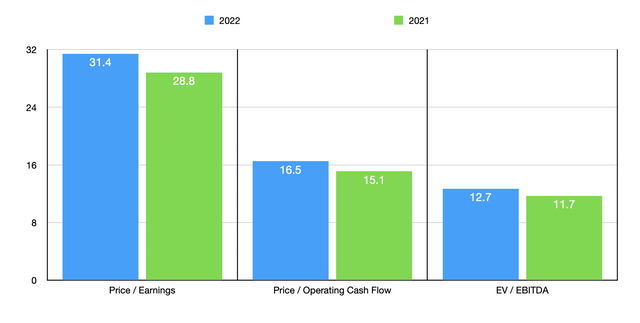

From a share price perspective, Hasbro isn’t exactly cheap. But for a quality operator and an industry leader, it’s not ridiculously pricey either. I would describe the stock as being tilted in the direction of being pricey. For instance, if we use the company’s 2021 results, then it is trading at a price to earnings multiple of 28.8. The price to operating cash flow multiple would be 15.1. And the EV to EBITDA multiple would come in at 11.7. If we assume that the drop in cash flow anticipated for this year it will translate to a similar percentage decline in earnings and EBITDA, then investors should anticipate net profits of $393.1 million and EBITDA of $1.20 billion. On a forward basis, these figures would imply a price to earnings multiple of 31.4, a price to operating cash flow multiple of 16.5, and an EV to EBITDA multiple of 12.7.

To put the pricing of the company into perspective, I decided to compare it with two other similar firms. On a price-to-earnings basis, only one of the companies had a positive multiple. And that multiple was 9.3. The two companies were trading at EV to EBITDA multiples of 9.9 and 10.7, respectively. In both of these cases, Hasbro was the most expensive of the group. Using the price to operating cash flow approach, the range was from 17.1 to 96.8. At least in this case, our prospect was the cheap one.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Hasbro | 28.8 | 15.1 | 11.7 |

| Mattel (MAT) | 9.3 | 17.5 | 10.7 |

| JAKKS Pacific (JAKK) | N/A | 96.8 | 9.9 |

Takeaway

All things considered, Hasbro strikes me as an innovative, quality company that would likely do well for itself and its investors over an extended period of time. The business is facing certain headwinds right now that will likely continue for the next several months. But at the end of the day, I suspect investors will be rewarded. Having said that, I don’t see the company as being a home run of any kind. Instead, I think that it’s a decent company that’s likely trading at a decent price. And because of that, I cannot rate it any higher than a ‘hold’ prospect at this time.

Be the first to comment