Justin Sullivan

Investment Thesis

After reviewing the updated management outlook for the company, I analyzed its potential growth using a 10-year discounted cash flow model and additional research and analysis. While there is potential for the company, at present it is fairly valued. Thus, I recommend a hold rating until it becomes clearer if the planned cost-cutting measures will result in improved operating margins and if they will not squander the massive potential that Wizards of the Coast has in the future.

I like to have a look at companies right before the big earnings come out, and for Hasbro (NASDAQ:HAS) it is on the 16th of February. I wanted to see if the company is a good investment before the full-year earnings release, by looking at the historical figures over the last few years, taking into consideration the management’s guidance for FY2022, and setting up reasonable growth assumptions for the next 10 years.

The article will mostly focus on a 10-yead DCF model and the factors that influenced the revenue growth numbers and the margins that the management is aiming to achieve in the next few years, which will be part of the best-case scenario in the model, as I have my opinions on the current management not delivering what they set out in the previous guidance over the last while and kept falling short of their estimates.

Revenues

In their latest report, revenues across all segments decreased y-o-y with the entertainment segment falling the most, however, this segment produce a much lower operating loss, going from -74.3 to -2.4.

The management, particularly, the CEO Chris Cocks, said that they expected Q3 to be their most challenging quarter of 2022. In more recent news the company announced that they are expecting softer numbers for the 4th quarter in all but the Wizards of the Coast segment, which they estimate grew 22%, while the other segments are down low double digits.

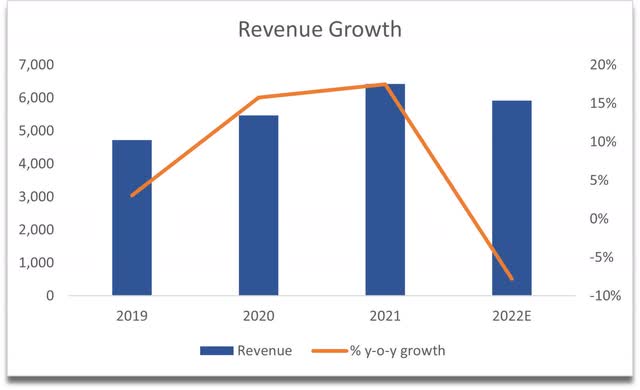

Looking at the last 5 years of revenues at the company, I can see that it is not very stable, which makes it quite hard to put a number on future growth prospects. In the last 10 years, the company averaged 5.5% of revenue growth. This gives me a start for a simple model.

Revenue growth (Own Calculation)

Wizards of the Coast and Digital Gaming

This segment may not be the biggest revenue generator; however, it generated around 80% of operating profits for the company and a lot of opinions are going around that the new CEO, who was previously the President and COO of WotC is squandering the potential of the segment by being overly greedy and is losing the interest of a lot of consumers of Magic: The Gathering by overproducing new expansion sets and diluting the pool of cards, which makes harder to keep up for the average player, or even the most advanced player. There are 8 expansions planned for 2023 so far, and there have been 12 releases in 2022 which contained a lot of reprints and card packs that cost a minimum of $1000 because they come in a set of 4 packs.

A lot of seasoned players of the tabletop game have stopped their hobby in the last year or two mainly because of corporate greed and predatory actions to get as much money from their player base as possible. I’ve seen many posts of people quitting; however, it is hard to say if that is the vocal minority or if will people start to leave the game and stop purchasing whatever the company produces in the future. From preliminary results, we see that the segment performed quite well overall.

Another factor that did hurt the company’s reputation recently was the announcement of and subsequent retraction of some of the most controversial updates outlined in Dungeons & Dragons OGL 1.1 which got many players in an uproar and called the company very greedy for even attempting such a thing.

Another factor that usually affects the company’s revenue is the release of a new Transformers movie. Every time a new movie comes out, revenues increase by around 20% for that quarter. Expect revenues to increase similarly in June of 23 due to the next film and in 2024. The increases are short-lived and so they will not have a massive role in my valuation model.

Management’s Optimistic Outlook

In the past, the management would keep an optimistic outlook even after missing earnings and most recently announced that they are planning to improve profits by 50% in 2025 and increase operating margins to 20% by 2027. I will take this outlook of the company into my valuation, however, I will be more pessimistic and will put this outcome into my best-case scenario as mentioned, rather than the base case, as I feel that Chris is being too overly optimistic about the future, and I expect lower growth numbers over the next few years, mainly because I feel that the management is not capable on delivering such results if we look back at what has been happening historically.

Financials

Let’s have a look at the balance sheet to see how the company is doing. Gross and operating margins have been quite consistent over the 5 years, however, my estimates show a slight decline for FY22. Chris Cocks said he intends to bring 6% more in operating margins from the 2021 figure by 2027, which to me right now does not look possible, and that is why I kept his forecasts as a best-case scenario for the company. Nonetheless, these margins are more than acceptable as they stand.

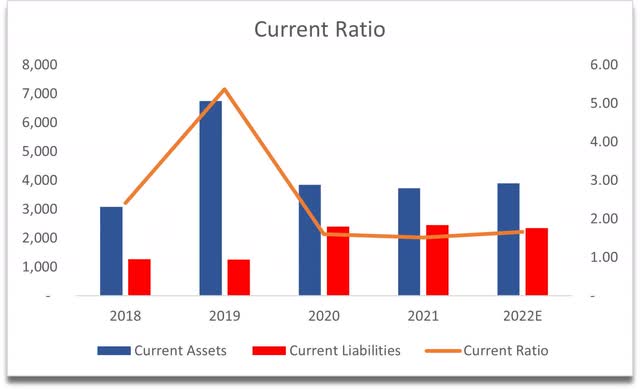

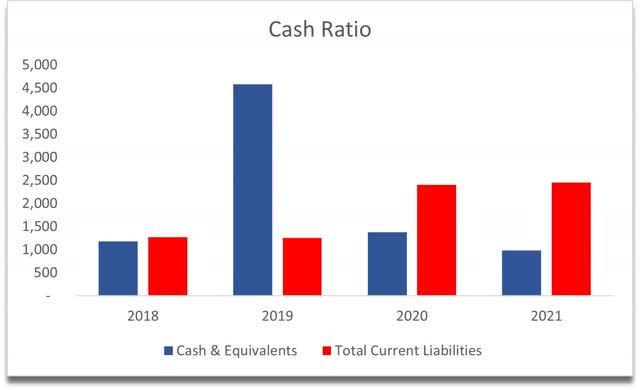

The next important thing to look at in my opinion is the cash against its total current liabilities. Here, the company is not performing very well, which could lead to some problems if the management makes some mistakes in the future and may face liquidity problems.

The company, on the other hand, does have a decent current ratio, but just about the minimum that I would like to see on the books.

Current Ratio (Own Calculations)

The amount of debt the company has can seem a little alarming, however, if used correctly it is more good than bad. Debt to asset ratio has been below 0.5 which is considered acceptable. I personally do not like when companies take on debt.

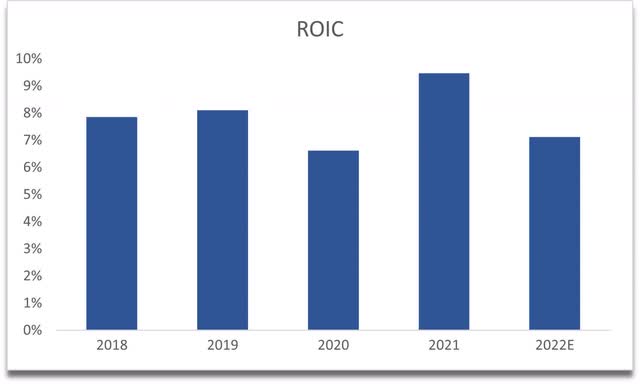

Return on Invested Capital has been below 10 since 2018, which is still acceptable as anything above 0 is acceptable, however, some companies have much higher ROIC which could make for a better investment. In the future, I’d like to see ROIC trending upward, however, right now it fluctuates.

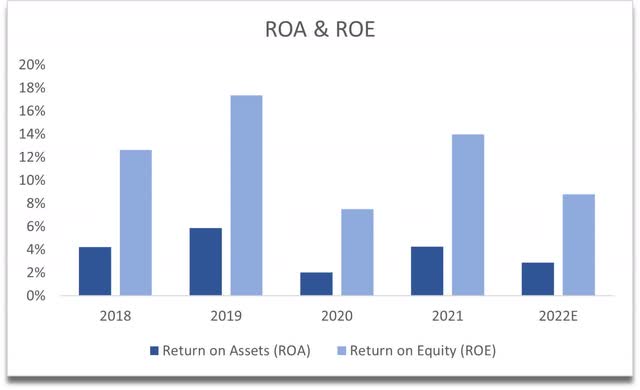

ROA and ROE figures are a mixed bag, with ROA being quite low and ROE being around acceptable numbers in my opinion.

ROA and ROE (Own Calculations)

The financials of the company left me with mixed feelings. Sometimes I find companies that have stellar books and almost warrant an investment on that alone, however, I do not feel the same way about Hasbro’s books.

Valuation

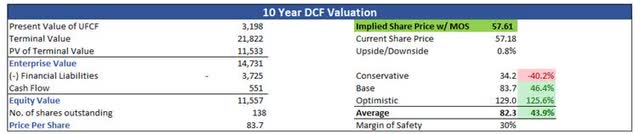

With the above analysis of future growth that the management believes it can achieve over the next 5 years or so, I built a 10-year DCF model that takes all of that into account. I feel that the outlook the company gave is a bit optimistic in my opinion and so it will go down into the Optimistic Case scenario. In this scenario, the revenues of the company will hit $8.5B by 2025 and increase operating profits by 50%. The next thing I modeled in this scenario is reaching 20% operating margins by 2027. All these assumptions led me to have a 9.6% average revenue growth from 2025 onwards.

Going from the optimistic case, I adjusted my base case to be a little more pessimistic when looking at the future potential of the company, where the company is not able to reach $8.5B but $8B in 2027 and operating margins of 17%. This to me seems to be more realistic and conservative enough, giving us an average revenue growth from 2025 of 7.6%.

To give myself a range, I also modeled a worst-case scenario, which is more conservative than the base case. I modeled revenue growth at the historical average of 5.5% per year, reaching $7.3B by 2027 and 15% operating margins.

To be even more conservative, I added a 30% margin of safety to my calculations, as it is better to be safe than sorry and buy the company based on the assumptions outlined. With that being said, the model suggests that the company is currently priced fairly, giving me a 57.61 price per share.

DCF Valuation (Own Calculations)

Closing Remarks

As with all valuation analyses you see on the website, take this one with a grain of salt also. I’ve been asked to cover Hasbro stock by a person that is interested in investing, because of a big drop in share price in the last 4 years or so. I had to do a lot of research for this analysis as I was only vaguely familiar with how the business operates and what is the main driver of profits and that is why the article is mostly based on assumptions of what I think the company may be able to achieve over the long run, without going into too much detail on its main products. So based on these assumptions, the company is fairly priced right now, and with earnings around the corner, I’d hold off on buying the company for now and see how everything develops over the next couple of quarters.

Be the first to comment