vitpho/iStock via Getty Images

A Quick Take On Haoxin Holdings Limited

Haoxin Holdings Limited (HXHX) has filed to raise $15 million in an IPO of its Class A ordinary shares, according to an F-1 registration statement.

The firm provides temperature-controlled and urban delivery services in China.

Given the firm’s ongoing exposure to unpredictable government and regulatory risks, sharply reduced growth rate and far higher valuation at IPO, I’ll pass on the IPO.

Haoxin Overview

Ningbo, China-based Haoxin Holdings Limited was founded to provide urban delivery solutions along with temperature-controlled options for a variety of products.

The company currently operates a fleet of 90 tractors and 65 vans.

Management is headed by Chairman and CEO Mr. Zhengjun Tao, who was previously the founder of Zhejiang Zhoushan Yamei Container Transportation Co.

The company’s primary shipment service offerings include the following:

-

Electronic devices

-

Chemicals

-

Fruit

-

Food

-

Commercial goods

As of June 30, 2022, Haoxin has booked fair market value investment of $3 million in equity investment from investors including senior management and other investors.

Haoxin – Customer Acquisition

The firm markets its services directly to potential customers via an in-house marketing force.

Sales and Marketing expenses as a percentage of total revenue have trended lower as revenues have increased, as the figures below indicate:

|

Sales and Marketing |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Six Mos. Ended June 30, 2022 |

0.4% |

|

2021 |

0.6% |

|

2020 |

1.5% |

(Source – SEC)

The Sales and Marketing efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Sales and Marketing expense, was 27.4x in the most recent reporting period, as shown in the table below:

|

Sales and Marketing |

Efficiency Rate |

|

Period |

Multiple |

|

Six Mos. Ended June 30, 2022 |

27.4 |

|

2021 |

92.3 |

(Source – SEC)

Haoxin’s Market

According to a 2020 market research report by Mordor Intelligence, the Chinese market for cold chain logistics is forecast to grow at a CAGR of over 9% from 2020 to 2025.

The main drivers for this expected growth are an increase in the disposable income of China’s population, with a corresponding increase in demand for fresh agricultural products and improved food safety.

Also, some electronic parts and products are temperature sensitive, likely adding to demand from this large industry vertical.

The company faces a wide variety of competitors of various sizes and sophistication as road transport has historically had low barriers to entry.

Haoxin Holdings Limited Financial Performance

The company’s recent financial results can be summarized as follows:

-

Growing top line revenue, with a sharply decelerating growth rate

-

Lowered gross profit and variable gross margin

-

Reduced operating profit

-

A swing to cash used in operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2022 |

$ 11,809,268 |

13.3% |

|

2021 |

$ 29,925,498 |

114.5% |

|

2020 |

$ 13,950,545 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2022 |

$ 2,800,374 |

11.4% |

|

2021 |

$ 7,824,714 |

178.0% |

|

2020 |

$ 2,815,108 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

Six Mos. Ended June 30, 2022 |

23.71% |

|

|

2021 |

26.15% |

|

|

2020 |

20.18% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Six Mos. Ended June 30, 2022 |

$ 1,964,231 |

16.6% |

|

2021 |

$ 7,144,845 |

23.9% |

|

2020 |

$ 2,185,400 |

15.7% |

|

Comprehensive Income (Loss) |

||

|

Period |

Comprehensive Income (Loss) |

Net Margin |

|

Six Mos. Ended June 30, 2022 |

$ 903,113 |

7.6% |

|

2021 |

$ 5,414,093 |

45.8% |

|

2020 |

$ 1,764,457 |

14.9% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Six Mos. Ended June 30, 2022 |

$ (980,941) |

|

|

2021 |

$ 1,538,926 |

|

|

2020 |

$ 2,462,170 |

|

(Source – SEC)

As of June 30, 2022, Haoxin had $741,395 in cash and $10.9 million in total liabilities.

Free cash flow during the twelve months ending June 30, 2022, was negative ($1.6 million).

Haoxin Holdings Limited IPO Details

Haoxin intends to raise $15 million in gross proceeds from an IPO of its Class A ordinary shares, offering three million shares at a proposed midpoint price of $5.00 per share.

Class A ordinary shareholders will be entitled to one vote per share and Class B shareholders will receive twenty votes per share

The S&P 500 Index no longer admits firms with multiple classes of stock into its index.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $66.3 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 20.0%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

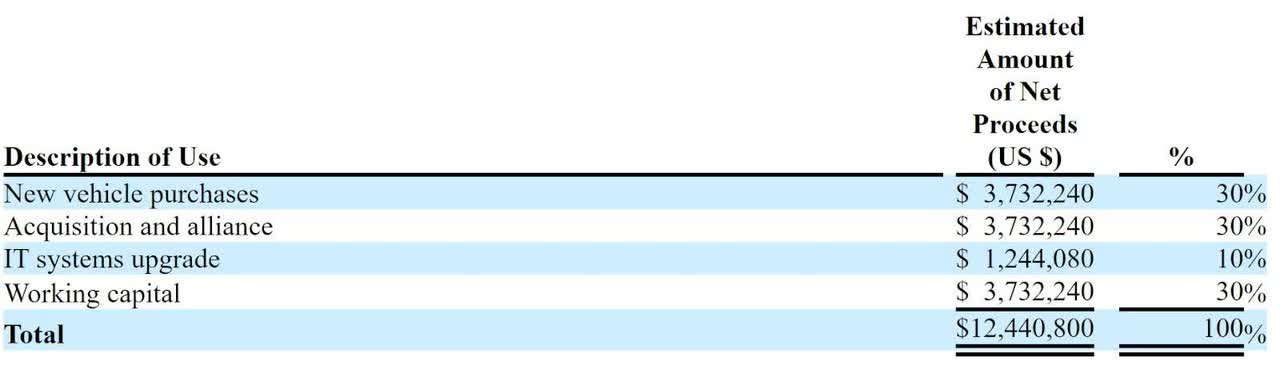

Management says it will use the net proceeds from the IPO as follows:

Proposed Use Of IPO Proceeds (SEC)

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management detailed a number of relatively minor legal claims against it, all of which have been concluded.

The sole listed bookrunner of the IPO is Univest Securities.

Valuation Metrics For Haoxin

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$75,000,000 |

|

Enterprise Value |

$66,268,526 |

|

Price / Sales |

2.40 |

|

EV / Revenue |

2.12 |

|

EV / EBITDA |

9.51 |

|

Earnings Per Share |

$0.30 |

|

Operating Margin |

22.27% |

|

Net Margin |

14.99% |

|

Float To Outstanding Shares Ratio |

20.00% |

|

Proposed IPO Midpoint Price per Share |

$5.00 |

|

Net Free Cash Flow |

-$1,611,045 |

|

Free Cash Flow Yield Per Share |

-2.15% |

|

Debt / EBITDA Multiple |

0.63 |

|

CapEx Ratio |

-12.78 |

|

Revenue Growth Rate |

13.26% |

(Source – SEC)

As a reference, a potential public comparable index basket to Haoxin would be the NYU Stern / Damodaran would be the Trucking industry. Shown below is a comparison of their primary valuation metrics:

|

NYU Stern / Damodaran Basket |

Industry Name: |

Trucking |

|

|

Metric |

Index Basket |

Haoxin Holdings |

Variance |

|

Price / Sales |

1.07 |

2.40 |

123.9% |

|

Net Margin |

1.29% |

14.99% |

1061.8% |

|

EV / Revenue |

1.45 |

2.12 |

46.0% |

|

Operating Margin |

9.18% |

22.27% |

142.5% |

(Source – NYU Stern / Dr. Aswath Damodaran)

Commentary About Haoxin’s IPO

HXHX is seeking U.S. public capital market investment to fund its corporate growth and working capital requirements.

The company’s financials have shown increasing top-line revenue, with a sharply decelerating growth rate, reduced gross profit and variable gross margin, lower operating profit and a swing to cash used in operations.

Free cash flow for the twelve months ending June 30, 2022, was negative ($1.6 million).

Sales and Marketing expenses as a percentage of total revenue have fallen as revenue has increased; its Sales and Marketing efficiency multiple was 27.4x in the most recent reporting period.

The firm currently plans to pay no dividends and to retain future earnings for reinvestment back into the firm’s growth and working capital requirements.

HXHX’s CapEx Ratio indicates it has spent lightly on capital expenditures despite its negative operating cash flow.

The market opportunity for providing cold chain logistics services in China is large and expected to grow at a moderate rate of growth in the coming years, although the firm faces myriad competitors of all sizes.

Like other companies with Chinese operations seeking to tap U.S. markets, the firm operates within a WFOE structure or Wholly Foreign Owned Entity. U.S. investors would only have an interest in an offshore firm with interests in operating subsidiaries, some of which may be located in the PRC. Additionally, restrictions on the transfer of funds between subsidiaries within China may exist.

The Chinese government’s crackdown on certain IPO company candidates combined with added reporting and disclosure requirements from the U.S. has put a serious damper on Chinese or related IPOs resulting in generally poor post-IPO performance.

Also, a potentially significant risk to the company’s outlook is the uncertain future status of Chinese company stocks in relation to the U.S. HFCA act, which requires delisting if the firm’s auditors do not make their working papers available for audit by the PCAOB.

Prospective investors would be well advised to consider the potential implications of specific laws regarding earnings repatriation and changing or unpredictable Chinese regulatory rulings that may affect such companies and U.S. stock listings.

Additionally, post-IPO communications from the management of smaller Chinese companies that have become public in the U.S. has been spotty and perfunctory, indicating a lack of interest in shareholder communication, only providing the bare minimum required by the SEC and a generally inadequate approach to keeping shareholders up-to-date about management’s priorities.

Univest Securities is the sole underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (42.3%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

As for valuation expectations, management is asking investors to pay an Enterprise Value/Revenue multiple of approximately 2.1x, which is 46% higher than the Trucking basket of U.S. companies.

Given the firm’s ongoing exposure to unpredictable government and regulatory risks, sharply reduced growth rate and far higher valuation at IPO, I’ll pass on the IPO.

Expected IPO Pricing Date: To be announced.

Be the first to comment