CHUNYIP WONG

Investment Thesis: While the fall in the combined ratio across the Core Commercial segment has been encouraging, stronger performance across the Personal Lines segment would significantly strengthen the bullish case for this stock, in my view.

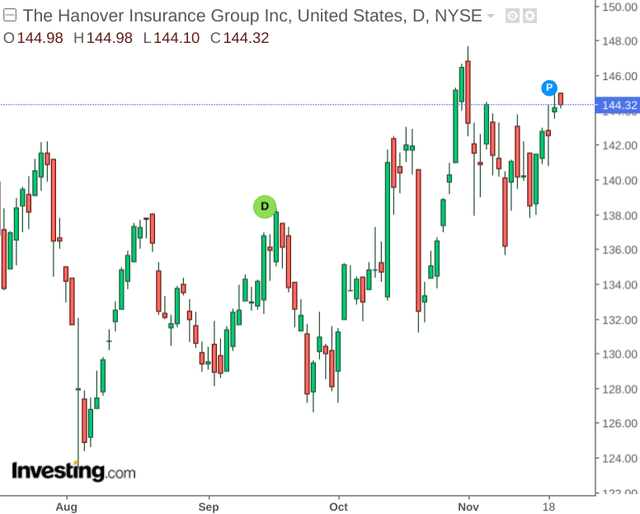

In a previous article back in September, I made the argument that Hanover Insurance Group (NYSE:THG) could see modest growth in the short to medium-term on the basis of a potential for a rise in catastrophic losses, but has the potential for longer-term growth on the basis of gross premium growth and a reduction in the combined ratio across the Core Commercial segment.

With that being said, the stock has shown encouraging growth since then – up by over 10% since my last article:

The purpose of this article is to analyse the main drivers behind the recent stock growth and whether Hanover Insurance could have further upside from here.

Performance

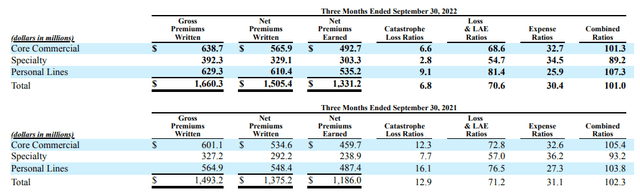

When looking at underwriting results for September 2022, we can see that the combined ratio for Core Commercial is lower than that of September 2021.

Hanover Insurance Group: Form 10-Q Q3 2022

Given that Hurricane Ian saw the company’s total Q3 catastrophic losses reach $90 million – which was $22 million above that originally forecasted – the fact that we have seen the combined ratio remain below that of last year’s (both for Core Commercial and across the total ratio) is highly encouraging. Excluding catastrophic losses, Hanover Insurance Group saw a combined ratio of 94.2%.

For context, a lower combined ratio is better for an insurance company as it indicates that the company is spending less in servicing insurance claims relative to premiums collected.

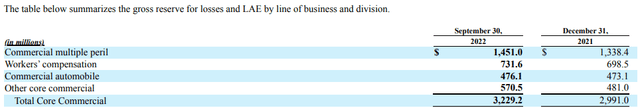

Additionally, we have seen Hanover Insurance Group’s gross reserve for losses and LAE across the Core Commercial segment continue to grow since last December.

Hanover Insurance Group: Form 10-Q Q3 2022

Additionally, total reserves for Core Commercial are up on that of June 2022 as well – when gross reserves for Total Core Commercial amounted to $3,105.7 million.

From this standpoint, Hanover Insurance Group appears to have demonstrated an increased ability to handle catastrophic losses and this is evidenced by a lower combined ratio – which appears to have been a significant driver of growth in the stock.

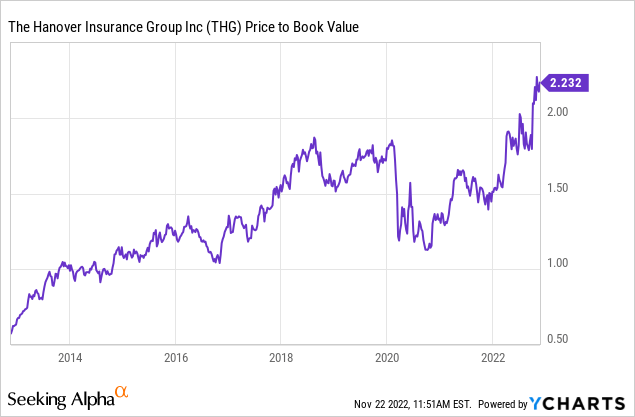

On a longer-term basis, we can see that the company’s price to book ratio is trading at a 10-year high:

ycharts.com

While this indicates that the stock is more expensive than previously – I take the view that if Hanover Insurance Group continues to show a decline in its combined ratio while mitigating the impact of catastrophic losses – then further upside in the stock is quite plausible.

Looking Forward

Going forward, I take the view that investors will continue to look for evidence of an overall decrease in the combined ratio including catastrophic losses.

With that being said, Q3 2022 results have indicated that while the combined ratio has decreased overall – that of Personal Lines is up significantly from 103.8 in September 2021 to 107.3 in September 2022.

The company indicates that this was driven significantly by the effects of inflation and supply chain issues resulting in higher costs across auto and homeowner claims. For instance, higher inflationary pressure on auto parts and labour costs has resulted in an increase in the loss ratio across this segment, while an increase in large fire loss activity in Q3 2022 (as compared to a lower than expected frequency in Q3 2021) along with an increase in water-related losses resulted in higher losses across homeowners’ property lines.

From this standpoint, while the reduction in the combined ratio across Core Commercial has been encouraging – the increase in the combined ratio across Personal Lines is concerning given that this was the second-largest segment by gross premiums written in the most recent quarter.

As such, while Hanover Insurance Group could have potential for further upside given relatively strong performance across the Core Commercial segment, a fall in the ratio across the Personal Lines segment and a fall in the total combined ratio below 100 would be desirable.

Conclusion

To conclude, Hanover Insurance Group has seen strong performance across the Core Commercial segment – I take the view that growth in the stock could accelerate significantly if we see a lower combined ratio across the Personal Lines segment as well.

Should Hanover Insurance Group demonstrate evidence of this in the next financial quarter, then my view on the stock would become significantly more bullish.

Be the first to comment