JST/iStock Editorial via Getty Images

Introduction

Hafnia (OTCPK:HFIAF, HAFNI.OL) is my favorite way to take advantage of the bullish scenario forming up in the clean tanker sector. A unique coincidence of historical accidents has created the perfect storm, and Hafnia is perfectly positioned to capitalize on it. Even if the share price has already had a remarkable run since the beginning of the war in Ukraine, plenty of upside still remains, with the additional prospect of significant returns to shareholders in the form of dividends.

A look at the tanker markets

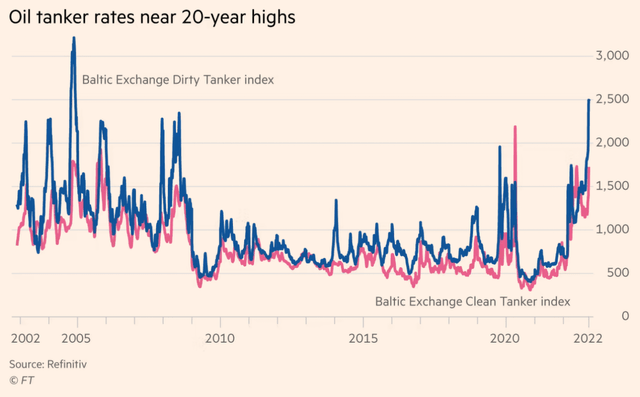

It is a good practice not to overstay one’s welcome at a party: the hangover of the following day may be cause for regret. In the tanker sector, a wild party has been triggered by the Russian invasion of Ukraine, with freight rates currently trading at levels near 20-year highs.

Both clean and dirty Baltic Exchange Tanker indices are near 20-year highs (Financial Times)

The primary driver of this rally has been the looming threat of an EU ban on Russian crude, which should come into effect on December 5. A similar ban for petroleum products is expected to become effective next year on February 5.

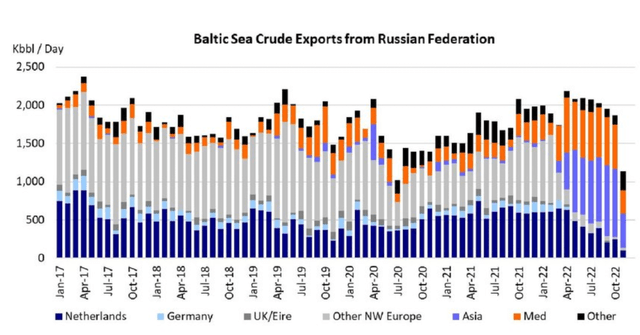

The ban will stop all EU imports of Russian crude and petroleum products. Since Europe has been the largest importer of Russian crude, the measure is forcing Russian producers to re-direct their flows mainly towards Asia (to China and India in particular).

Seaborne crude exports from the Russian Federation (Lloyd’s List Intelligence)

The consequences are longer voyages and significantly higher ton-miles (assuming Russian oil is not drastically cut off from the global supply), leading to higher freight rates for crude carriers.

The EU ban also includes a prohibition for EU companies to provide seaborne transportation, as well as financial services, to maritime voyages between the Russian Federation and a non-EU country, as well as between two non-EU countries, if the voyage involves crude or petroleum products of Russian origin. This measure is clearly aimed at reducing Russian revenues employed in financing the war in Ukraine. At least on paper, the measure has some real teeth, considering that about 90% of vessels are insured by the International Group of P&I Insurers, which is mostly based in the EU and UK.

There is, however, an exception to the bans. Transportation and insurance of crude oil can be provided if the oil is sold at a capped price to be agreed upon by EU members. The level at which the cap is going to be established has been a matter of speculation for months. The recent news is that the cap will be set at $60 per barrel. This is significantly higher than the $30 per barrel put forward at the beginning by some of the most hawkish EU countries. Such a low cap would have incentivized Russia to drastically cut production and take part of its crude off the market. The recent development is therefore bullish for crude tankers (especially Aframax and, to a lesser degree, Suezmax vessels). Since Urals oil already sells at $15-20 per barrel discount to Brent, Russian supplies will probably continue to flow to the market in a more or less regular fashion. The longer trade routes to the Middle East and Southeast Asia will keep ton-miles elevated and lead to higher freight rates. The higher freight rates are not only a reflection of the longer voyages, but also include a premium for transporting Russian crude, whose only alternative is the Russian dark fleet. At current rates, shipping costs are equivalent to around $25 per barrel.

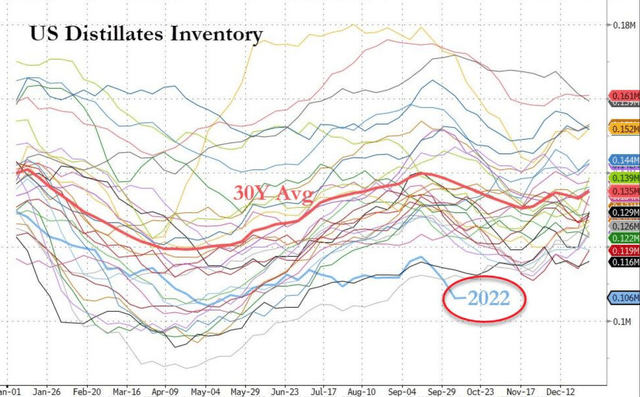

On the demand side, global demand for oil is expected to remain strong in the fourth quarter of 2023. It is forecasted to reach between 100.6 million and 102.9 million barrels per day by the end of 2023, supported by gas-to-oil switching by utilities, a partial reopening of the Chinese economy, and record low product inventories for petroleum products. In particular, diesel inventories in the US and EU are at all-time lows for this period of the year.

US distillates inventories are at their lowest since 1982 (oilprice.com)

Russia will be forced to reduce exports of petroleum products after February 5; however, significant new refinery capacity is expected to come online. About 1.4 million barrels per day of new refinery capacity have already been added since the end of October. Of these, 645 thousand bpd will come from the Al-Zour Refinery in Kuwait, 320 thousand bpd from Shandong Petrochemical in China, and 400 thousand bpd from Guangdong Petrochemical, also in China.

Distillate margins have been setting new records over the last few weeks, while gasoline crack spreads peaked last summer, but remain historically elevated. The higher profitability is incentivizing refineries to boost production. This is particularly true of refineries in China, India, and the Middle East, that plan to continue to import Russian crude at capped prices and export their products back to Western countries. The result is stronger demand for product carriers; in addition, as already mentioned, the new routes are longer than previously.

To summarize, the overall picture is as follows: Russia keeps its crude flowing to the market, but has to reduce its product exports, while new refinery capacity in the Middle and Far East comes online to capture the currently very high spreads, and re-export the finished products. While inefficient, the dislocations caused by the EU bans are bullish for both dirty and clean tankers, significantly adding to ton-miles and thus supporting higher freight rates.

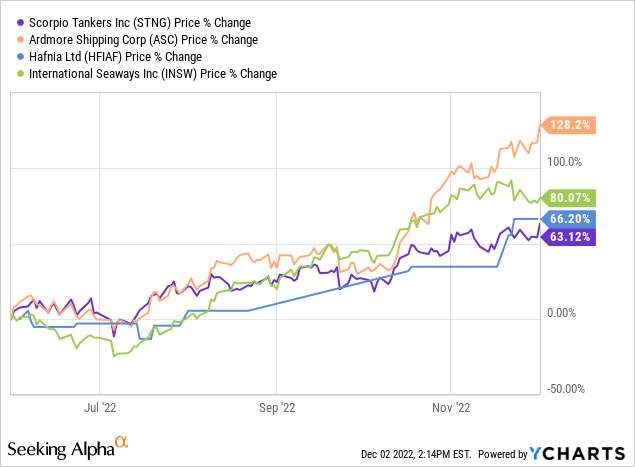

Freight rates have of course already reacted to these dislocations, reaching new historical highs and boosting companies’ profitability. Many clean tanker companies are trading near all-time highs.

Now, the fundamental question for investors is how long prices can remain elevated, and how much the current share prices already reflect the higher rates.

It is my opinion that the pricing environment for product tankers is going to remain strong for at least 1-2 years. This is based on the following considerations:

- Sanctions against Russia will stay in place for the foreseeable future. While an end to hostilities in the short-to-medium term is not off the table, it is difficult to imagine a return to the pre-war status quo.

- Despite recession fears, demand for crude and petroleum products will remain strong. Historically, even in an economic recession, oil demand has been remarkably resilient.

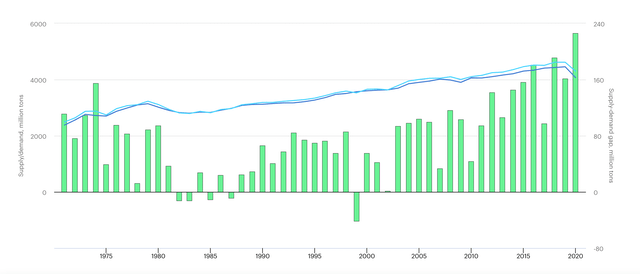

World oil supply/demand and supply/demand gap (www.iea.org)

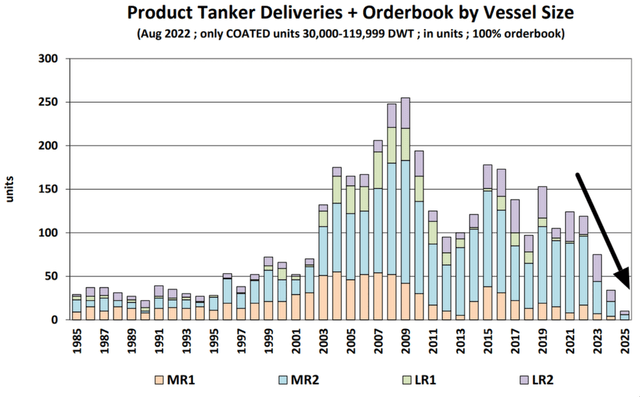

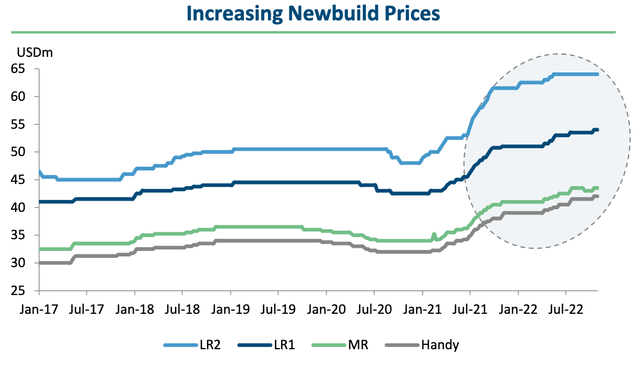

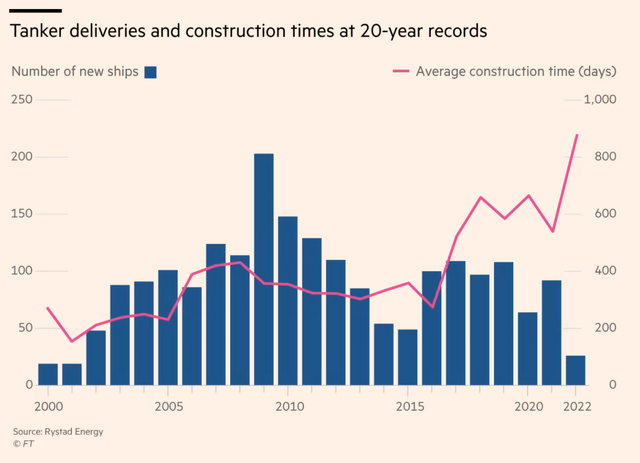

- Clean tankers supply is inelastic. The current orderbook stands at only 5% of fleet, which is a historical low. Meanwhile, delivery times stand at record highs. Yards are fully booked and orderbooks are dominated by containerships, which have a low risk of conversion to product tankers. Inflation pressures are increasing the costs of building new vessels, so ship owners are delaying new constructions and preferring to employ older vessels marked for scrapping.

Product tanker deliveries + order book (Banchero Costa) Newbuild prices are increasing (Hafnia Q3 2022 presentation) Delivery times are at 20-year records (Financial Times)

- On longer time scales, political regulations will also contribute to the bullish scenario. New environmental regulations are supposed to become effective in the near future, lengthening voyages even further in order to reduce carbon emissions. More generally, politicians have declared (at least in words) their intention to make the tanker industry progressively obsolete as a consequence of the energy transition away from carbon sources. Such considerations are going to constrain the flow of capital into the sector.

In conclusion, the easy money in the clean tanker sector has probably already been made; however, there is still considerable value, especially for the income-oriented investor. With record freight rates and an inelastic supply, the margin of safety has grown considerably compared to the start of the war. Tanker companies are looking at monstrous earnings for at least the next couple of years. This in turn entails exceptional forward dividend yields, the likes of which only a few rare gems can currently boast.

Why Hafnia

Hafnia is arguably the best operator in the product and chemical tanker sectors. It is the largest operator in the world, with a total fleet of 250 vessels, of which 116 are directly owned. The average vessel age is 7.6 years (below the global fleet average). As of Q3 2022, the NAV of the fleet stands at $2.9 billion, giving it a price/book ratio of around 0.9.

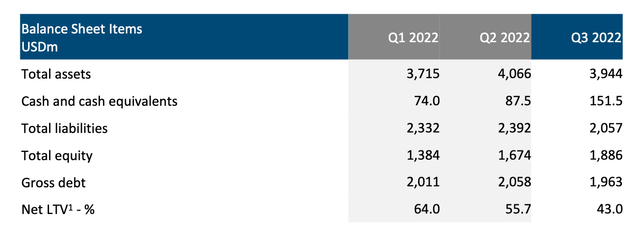

The company is well-managed and has a solid balance sheet.

Balance sheet as of Q3 2022 (company presentation)

Net debt is around $1.8 billion, with a total market capitalization of around $2.7 billion. Leverage has recently increased via a series of acquisitions, which appear to have been well-timed.

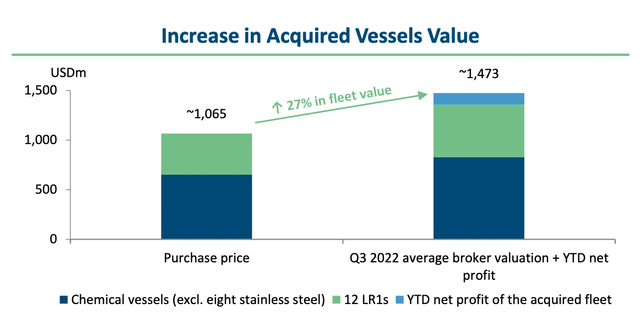

Increase in acquired vessels value (company presentation)

The weighted average effective interest rates per annum of total borrowings is a reasonable 5.1% (lower than peers). Since Q2 2022, Hafnia has been reducing its debt burden thanks to its strong free cash flows.

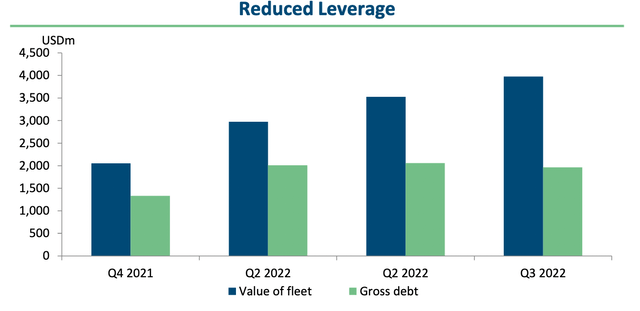

Hafnia is reducing leverage (company presentation)

It is doing so while the value of its fleet is growing considerably. The ratio between net debt and fleet value is an important metric since it is used by the company to determine its dividend payout ratio.

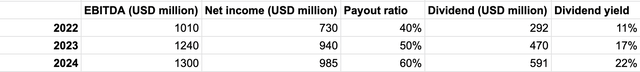

Unlike most peers that have started returning capital to shareholders only in 2022, Hafnia has been paying consistent dividends since its IPO in Q4 2019. This is the result of its lower operating cash breakevens. In fact, the company has already returned a total of $342 million in dividends since its IPO. Until recently, the dividend policy was to pay out 50% of net profits, but the company has just announced a revision to it. Going forward, the dividend payout will be increased, conditional on the Loan-to-Value ratio, as shown in the following table.

| Loan-to-Value ratio | Payout ratio |

| > 40% | 50% |

| <= 40% | 60% |

| <= 30% | 70% |

| <= 20% | 80% |

To be complete, the Loan-to-Value ratio is computed as follows (from the company’s Q3 earnings report):

Net loan–to–value is calculated as vessel bank and finance lease debt (excluding debt for vessels sold but pending legal completion) less cash divided by broker vessel values (100% owned vessels).

It currently stands just above 40% but is projected to fall below this threshold by next year, thus driving a 20% increase in the dividend payout ratio. Dividends are paid quarterly and (based on my experience) they are not subject to any withholding tax.

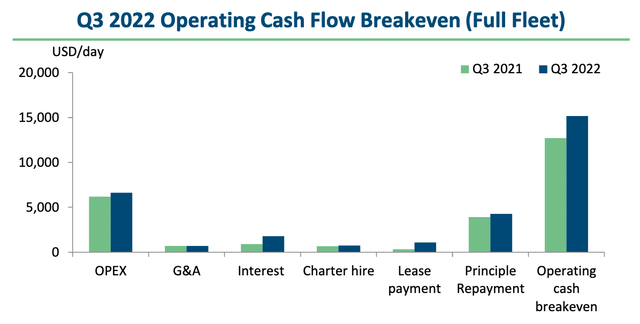

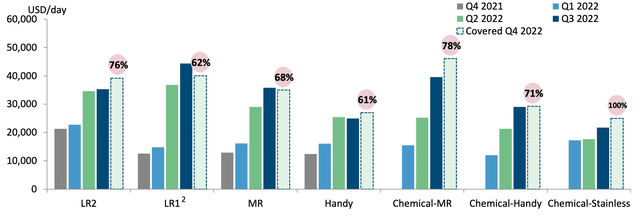

Q3 2022 earnings were spectacular, as predictable based on very high TCEs, with net income of $280.3 million ($487.8 million YTD). Q3 2022 average TCE was $36,367 per day, with LR1 coming in particularly strong at $44,345 per day. Operating cash breakevens were at $14,975 per day.

Operating cashflow breakevens (company presentation)

I don’t expect TCEs to drop going forward based on the sector outlook discussed before; in any case, Hafnia has already locked in very high rates for Q4 2022 and 2023.

Improvements in rates (company presentation)

Based on the company’s provided estimates, and taking into account numbers for covered rates, Hafnia is set to achieve brilliant financial performance in the near future. Of course, optimism about the stock is already partially reflected in its share price, which has increased 200% YTD. Nonetheless, Hafnia is still cheap. The tanker trade is cyclical, but the market appears to be discounting the possibility that the current rates stick around for longer than expected.

The company’s main listing is on the Oslo exchange. Unfortunately, it suffers from poor liquidity, as a consequence of its low free-float. On the plus side, however, strong management’s ownership ensures that interests are aligned with shareholders (insiders hold about 75% of the shares). In addition, the poor liquidity sometimes allows for picking up shares on the cheap.

Conclusion

Hafnia provides the comfort of a solid balance sheet, good management, a track record of good operating performance, and a relatively young fleet, while still offering plenty of upside in a bull market, especially via dividend returns. It is, in my opinion, the best way to participate in the product tankers party. The party still has a long way to go.

Be the first to comment