Fahroni

One of my favorite companies on the market today is none other than automotive retailer Group 1 Automotive (NYSE:GPI). As a rule, I run a very concentrated portfolio, with only six holdings in it today. This particular firm, at 18.2% of my total holdings, is my third largest. Clearly, I am incredibly bullish about the company. Recently, management has given me and other investors even more great news that should help to push shares up even further moving forward. And despite seeing its share price rise nicely over the past couple of months, the stock is still trading at incredibly cheap levels given current market conditions. Because of this, I have decided to retain my ‘strong buy’ rating on the enterprise for now.

A fantastic business that keeps getting better

Back in the middle of June of this year, I wrote an article discussing the opportunity that is Group 1 Automotive. I told my readers that strong fundamental performance from the company was being ignored because of concerns over the automotive retail space and the broader economy. However, I remained adamant that the company was tremendously undervalued and, as a result, I ended up rating it a ‘strong buy’. Since then, things have gone quite well. Why are the S&P 500 has risen by 7.8%, shares of Group 1 Automotive have generated a return for investors of 12.1%. This is still not the kind of return I have in mind for the enterprise. But it’s strong enough to leave me satisfied for the moment.

Part of this recent upside likely has to do with the market recognizing that shares were just too cheap. However, there were some real fundamental drivers behind the share price appreciation as well. For starters, on July 27th, management announced financial results covering the second quarter of the company’s 2022 fiscal year. Numbers came in strong, with revenue for that quarter totaling $4.15 billion. That represents an increase of 14.3% over the $3.63 billion generated the same time one year earlier. It is true that part of the rise can be chalked up to management’s decision to continue buying dealerships and collision centers. However, to truly appreciate what we are seeing, we should dig a bit deeper into the numbers.

The real driver for the company was an increase in the number of retail used vehicles sold. Across its network, this number increased from 44,502 to 48,907 for the second quarter alone. In addition to that, the company also saw the average sales price per unit climb from $26,601 to $30,781. From a sales perspective, there were some areas of weakness though. On the new vehicle side, the number of retail units sold dropped by 6.3% from 41,442 to 38,822. And the number of wholesale used vehicles sold declined by 11.3% from 10,730 to 9,514. Despite these declines, the average sales price for new vehicles sold through the retail channel did increase from $43,567 to $47,686. The company also benefited from a 19.2% rise in revenue associated with financial and insurance products and a 31.2% increase in parts and services sales.

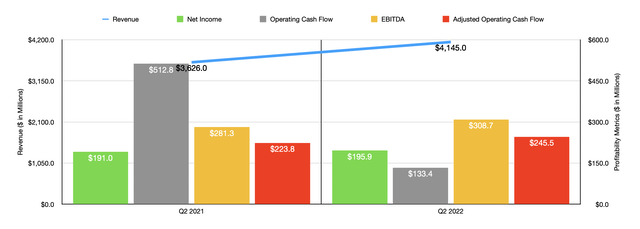

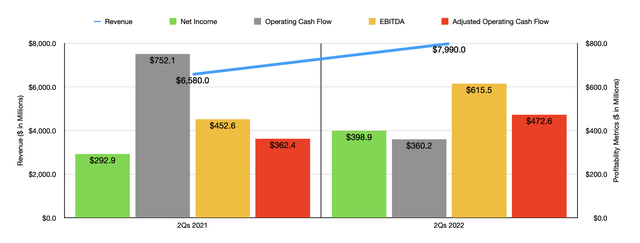

From a profitability perspective, the picture was somewhat mixed. Net income, for starters, increased slightly from $191 to $195.9 million. Operating cash flow did fall, dropping from $512.8 million to $133.4 million. But if we adjust for changes in working capital, it would have risen from $223.8 million to $245.5 million. Meanwhile, EBITDA for the company also improved, rising from $281.3 million to $308.7 million. Although the used retail side was the key driver of revenue growth for the company year over year, profitability for this part of the enterprise worsened, with gross profits dropping from $108.1 million to $89.5 million for used vehicle retail sales. Although the number of units sold and the average sales price increased, the gross profit of used vehicles dropped from $2,430 to $1,830. At the same time, new vehicle retail sales saw gross profit per unit climb 40.2% from $3,863 to $5,416 while used vehicle wholesale units saw their profits decline from $831 to $81.

Fundamentals aside, the company has also announced some other interesting things. On August 16th, for instance, management announced that they were increasing their share buyback program by $130 million to $250 million. Already in that year-to-date period, the company had repurchased nearly 1.55 million shares for a combined $273.5 million. For context, that works out to roughly 9% of all shares outstanding. At the same time, the company also increased its quarterly dividend by $0.01 per share to $0.38. I didn’t buy Group 1 Automotive for the dividend, but every penny helps. The company also announced, on July 11th, that it had acquired 5 franchises in Louisiana that should bring $110 million in annual revenue to the company. That brings annual revenue purchased by the company this year up to $660 million. Of course, the company is not afraid to sell assets as well. In that same announcement, they said that they had sold two properties for an undisclosed sum that bring in $75 million annually on a collective basis. And on July 5th, the company sold its operations in Brazil, consisting of 16 dealerships, for roughly $100.7 million. That particular transaction will cost the company about $335.8 million in revenue annually.

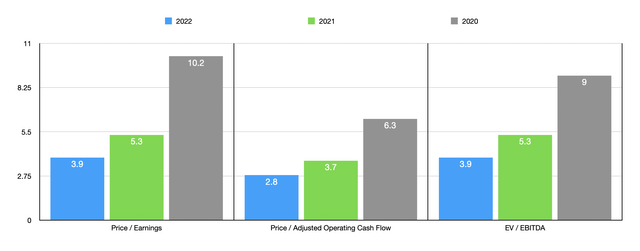

Unfortunately, management does not really offer any guidance for the fiscal year. But if we annualize results experienced so far, we should anticipate net income of $751.9 million, adjusted operating cash flow of $1.04 billion and EBITDA of $1.46 billion. If this comes to fruition, it implies that the company is definitely trading on the cheap. The price-to-earnings multiple would be 3.9. The price to adjusted operating cash flow multiple would be even lower at 2.8, while the EV to EBITDA multiple for the company would be about 3.9. As you can see in the chart above, even a return to the levels of profitability seen in 2021 or even 2020 would make shares quite cheap. As part of my analysis, I also compared the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 5.1 to a high of 6.7. Using the price to operating cash flow approach, the range is between 3.7 and 6.3. And using the EV to EBITDA approach, the range is between 5.4 and 7.4. In all three cases, Group 1 Automotive was the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Group 1 Automotive | 3.9 | 2.8 | 3.9 |

| Sonic Automotive (SAH) | 5.9 | 3.7 | 6.8 |

| Lithia Motors (LAD) | 5.8 | 6.2 | 6.6 |

| AutoNation (AN) | 5.2 | 5.3 | 5.4 |

| Penske Automotive Group (PAG) | 6.7 | 6.3 | 7.4 |

| Asbury Automotive Group (ABG) | 5.1 | 5.0 | 5.9 |

Takeaway: GPI is a ‘strong buy’

Based on all the data provided, I cannot help but to be incredibly bullish about Group 1 Automotive. I think that shares are significantly underpriced and that the company’s long-term outlook is favorable. Absent some material change in fundamentals, I don’t see that picture changing for the worse. Overall, the picture today leads me to keep my ‘strong buy’ rating on the company for now.

Be the first to comment