DanielPrudek/iStock via Getty Images

GreenLight Biosciences Holdings, PBC (NASDAQ:GRNA) is a pre-commercial stage synthetic biology company with a proprietary platform for production of cell-free RNA (ribonucleic acid). The company started off in 2008 with a genetic modification platform for agricultural products and naturally followed through into animal as well as human health, especially in the aftermath of the Covid-19 pandemic. RNA molecules have immense potential in pesticide-free protection of plants, and in creating mRNA (messenger RNA) based vaccines and gene therapies for human and animal health.

Platform

Conventional RNA production methods, such as cell-based fermentation, neither produces therapeutic quality for human health nor is economical for agricultural applications; and cell-free IVT (in vitro transcription) process is not economical either for agricultural applications while requiring complex, specialty inputs. The company’s platform, protected by numerous patents, has a differentiated and flexible manufacturing capability to make RNA of choice in multiple forms, and at scale up to metric-ton quantities, costing less than a dollar per gram for the production of technical grade active ingredient dsRNA (double-strand RNA).

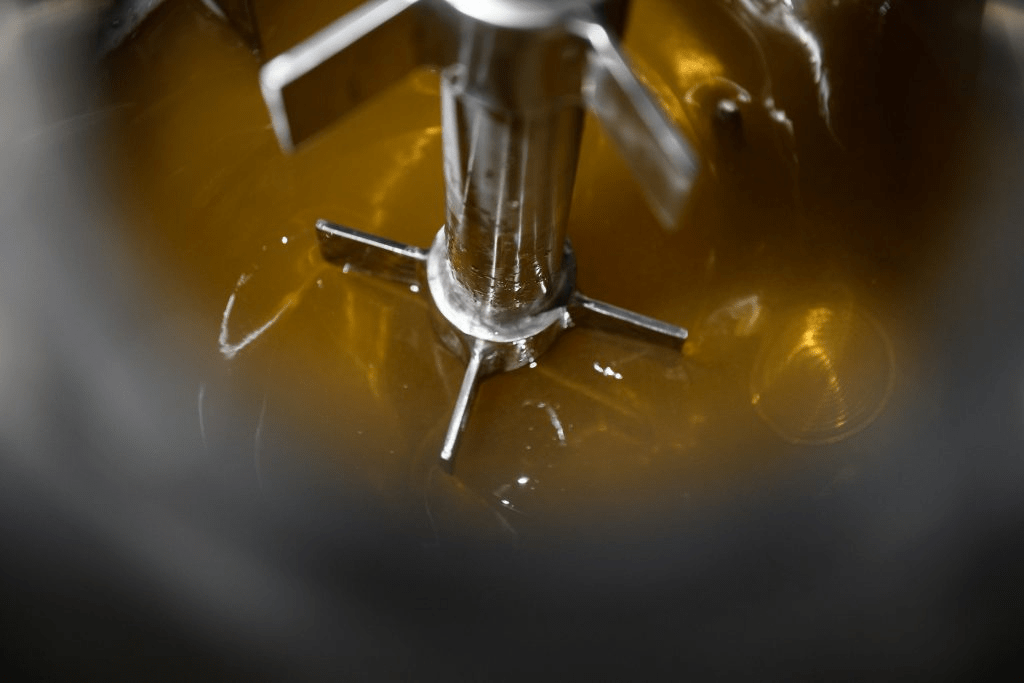

The company’s cell-free RNA synthesis process was demonstrated at lab scale a few years ago and is presently being set up to work on a larger scale at a pilot plant in Rochester, New York. The process uses harmless strains of E. coli to make the starting materials as well as the enzymes to catalyze the production and assembly of RNA molecules, while short rings of DNA called “plasmids” provide the instructions for the assembly. These are put into a large vat containing nucleosides floating in a soup, which are picked and energized by the enzymes. The nucleosides “snap together like magnets” and assemble in a line as per the plasmids’ instructions. This process is 10x faster at about three hours for a batch than bacterial-cell-based RNA production that requires about 30 hours. It produces approximately 50-65% pure product and is also cheaper. The plant has an installed capacity to produce 500 kg of RNA per year and can be expanded to twice the installed capacity.

A large vat containing the soup of nucleosides, at the Rochester plant (company website)

However, GreenLight’s scaling is not perfected yet. The initial lab demonstrations were with 50 microliters in a test tube, which was then scaled to 250ml, then to a bench-scale of 10 liters. The Rochester plant was started in 2019, first with a 150-liter reactor and is presently being scaled to 1,250-liter. The more the scale the more the reaction complexity and logistics. The company’s target is to reach the 20,000-liters reactor scale anticipated for commercialization. If demand scales up, the company may have to “number up” plants beyond that stage.

Intellectual Property

As stated in GreenLight’s most recent annual report (10-K), as of 3/22/2022, the company had approximately 40 patent families (patents and applications claiming priority to a common patent application) in various fields of its business. Issued patents in four patent families directed to RNA production platforms contain claims directed to methods of manufacture of RNA and/or related processes. One such family with expiry in 2037, includes U.S. Patent No. 10,858,385, the issued claims of which protect certain aspects of the company’s process for production of dsRNA. The company has an Assignment and License Agreement with Bayer CropScience LLP for IP assigned from Yissum R&D Co. of the Hebrew University, related to RNA technology used to control Varroa mites, Nosema, bee viruses, Colorado potato beetle and canola flea beetle. The last to expire U.S. Patent under the Yissum License is expected to expire in 2031. The company also has a development and option agreement with Acuitas Therapeutics to combine their LNPs with GreenLight’s RNA products.

Pipeline

One of the company’s lead agricultural products Calantha, designed to manage Colorado potato beetles, has been submitted to the EPA for approval. Consumption of the dsRNA causes the Colorado potato beetle to stop eating and expire from its own toxins. The product is safe for 100x consumption by non-target insects and mammals and degrades in soil and water in three days to benign, natural nucleotides. EPA approval is anticipated in 2022 and full commercialization in 2023, targeting a $350 million market.

Another lead candidate, the “Varroa destructor mite-control” is an RNA-based syrup targeting reproductive Varroa mites that destroy honeybees. The product is easy to use and degrades in soil and water, and is undergoing field trials in several states in the US. The company expects to submit an application in 2022 for EPA approval and to launch commercially in 2024. The product is based on portions of Bayer’s (OTCPK:BAYRY) topical RNA IP portfolio.

Other agricultural products in the pipeline include –

-

product for Botrytis cinerea, which causes gray mold and bunch rot, launch target 2025;

-

product for Fusarium Head Blight, a fungal disease affecting wheat and small grains, in the discovery stage;

-

product for two-spotted spider mite that has a wide crop host range, tests showed statistically significant mortality rates;

-

evaluating delivery technologies to control lepidoptera;

-

demonstrated disease control comparable to current leading chemical-control products for powdery mildew, the most common and destructive disease affecting grapes.

RNA-based vaccines for human use are currently in the preclinical stage, being evaluated to address the current viral pandemic and emerging pathogens. The first such candidate is a Covid-19 vaccine currently being tested on animals in toxicity studies. Subsequently, the company intends to file a CTA for human trials with the South African Health Products Regulatory Authority. Favorable results will lead to filing an IND with the FDA. Other candidates are yet to reach the pre-IND stage. Interestingly, the co-developer of Covid-19 vaccine, Barney Graham, MD, PhD., recently joined the company’s Human Health Scientific Advisory Board. Other human health candidates in the pipeline include a multivalent vaccine for influenza, and gene therapy for sickle cell disease.

Financials

GreenLight Biosciences was formed in 2008 and through 12/31/2021, raised an aggregate of approximately $218.8 million of net proceeds from the sale of preferred stock and another $67 million from the issuance of debt and convertible notes. The company’s market capitalization is approximately $1.22 billion at the last close price of $10.4, on 122.76 million shares outstanding, of which 47.09% is held by the public, 39.44% by PE/VC firms, 6.94% by institutions, 5.47% by Hedge Funds, and 1.07% by insiders. In February 2022, the company consummated a business combination with Environmental Impact Acquisition Corp. (ENVI), an SPAV sponsored by Canaccord Genuity affiliate – CG Investments Inc. VI. Accounted for as a reverse recapitalization, the business combination brought in net proceeds of approximately $111.4 million, which together with the cash and cash equivalents of $31.4 million as of 12/31/2021, is anticipated to provide a cash runway through 2H-2022.

The company has not yet recognized any revenue from product sales. All of the company’s revenue was derived from collaboration and license agreements with Ingredion Incorporated from 2015 through 9/30/2021, when the collaboration ended by mutual agreement due to GreenLight not being able to complete agreed milestones and changing development strategy. Revenue also accrued from a private grant of $3.3 million from the Bill & Melinda Gates Foundation to address sickle cell disease. The research work related to this grant is expected to complete in May 2022. The company on 3/11/2022 entered into a license agreement with Serum Institute of India Private Limited (‘SIIPL’) granting “SIIPL an exclusive, sub-licensable, royalty-bearing license to use GreenLight’s proprietary technology platform to develop, manufacture and commercialize up to three mRNA products in all territories other than the United States, the 27 member states of the European Union, the United Kingdom, Australia, Japan, New Zealand, Canada, South Korea, China, Hong Kong, Macau, and Taiwan. The first licensed product target will be a shingles product, and SIIPL has an option to add up to two additional product targets through the end of 2024.” GreenLight will receive an upfront license fee of $5.0 million, an additional $22 million across all three product targets, plus royalty on the sale of products resulting from the license. This collaboration is also a strategic initiative of the company to quickly reach markets outside the US and Europe.

Risks

GreenLight is an “Emerging Growth company” and a “smaller reporting company” and “non-accelerated filer” and may take advantage of certain exemptions from various reporting requirements, including but not limited to executive compensation disclosure rules.

Sales of substantial numbers of the company’s shares in the public market from time-to-time pursuant to PIPE finance agreements and investor rights agreements could create a negative perception resulting in reduction of the stock price.

The company had an accumulated deficit of approximately $253.6 million as of 12/31/2021. It will be several years before a positive cash flow is possible, and the company will certainly need to raise additional funding before end-2022, notwithstanding the SIIPL agreement.

As a public benefit corporation (‘PBC’), the company may be subject to increased derivative litigation concerning their inferred duty to balance public benefit interests vis-a-vis stockholders.

Furthermore, the company will be subject to enhanced regulatory scrutiny due to its core business being genetic modification utilizing mRNA. Hostile market reception is also a risk due to the nature of its business.

Bottom Line

GreenLight Biosciences is at the cutting edge of RNA technology, and its proprietary agriculture-targeted products look highly interesting. I will watch this company for how its first product fares with the regulators, and then take another look at GRNA.

Be the first to comment