Midnight Studio

Stresses, stresses, everywhere

The cannabis sector is being stressed from several directions simultaneously. Some stresses are company-related, like aggressive expansion that leaves one unprepared for a market slump. Other stresses are industry-related. Investors are aware of the recent margin compression and delays in legalization in some states. Companies are also running into aggressive regulators that will limit future profitability. This is particularly true in New York, a situation I have often warned about, but that’s a story for another day.

Finally, some stresses are related to the state of the overall economy. If the economy goes south, as they say, cannabis stocks will not be immune. In fact, cannabis may be hit harder than other sectors because they are high beta stocks (high beta stocks are those that move more than the general market). When bellwether stocks like FedEx (FDX) report that shipments have fallen off a cliff it is time to pay attention. Jeff Bezos said recently it’s time to “batten down the hatches.” If anyone has a sense of what consumers are thinking, it’s Bezos. I believe we all have the obligation to seriously assess our portfolios in light of the possibility of a deep recession. If there’s a silver lining, it’s that cannabis stocks are so beaten down much of the downside could be priced in.

Green Thumb Industries (OTCQX:GTBIF) on Wednesday was the first of the big cannabis companies to report third quarter results. In this article we will look at Green Thumb’s future prospects and what the latest report says about the state of the sector.

Green Thumb third quarter highlights

- Revenue increased 3% sequentially and 12% year-over-year to $261 million. Growth primarily driven by increased retail sales in New Jersey, increased retail sales in Illinois, 12 additional retail locations versus third quarter last year, and increased traffic in the 77 operating retail stores.

- Year-to-date 2022 revenue increased 17% to $758 million compared to the first nine months of 2021.

- Ninth consecutive quarter of positive GAAP net income, delivering $10 million or $0.04 per basic and diluted share. A year ago net income was $20.2 million, or $0.09 per basic share. Most of the $10 million difference was due to favorable adjustments to warrant values in the 2021 quarter, a non-cash expense making the 2021 quarter unusually high.

- EBITDA was $73.3 million or 28.1% of revenue versus $75.2 million or 32.2% of revenue for the comparable period. Adjusted Operating EBITDA grew 7% sequentially to $84 million or 32% of revenue. The adjusted figure removes stock based compensation and other non-operating expenses.

- Cash flow from operations of $48 million net of income tax payments of $31 million for the quarter.

Beyond the highlights

In general, the quarter was about what was expected given the slump in industry conditions. Revenue was up because of expansion, net income and EBITDA were down. In the conference call Green Thumb acknowledged inflation effects on labor and packaging costs, economic uncertainty affecting consumers, and pricing compression in wholesale and retail.

Green Thumb spent $49 million in capex during the quarter, $179 during the year, and plans for more in Q4. Uncharacteristically, they did not give a specific capex number for Q4 or 2023, saying only that they would allocate capital to “certain markets” while conservatively managing the balance sheet. It is safe to assume that, like all other cannabis operators, it will be less that planned at the start of the year. They have $147 million in cash, which will meet 2023 needs without raising additional capital. The last debt raise was in June 2021 and they are current on income taxes.

CEO Ben Kovler offered interesting insights on the state of the industry on the conference call. Industry-wide sales were $6.6 billion, which is a run rate of over $26 billion. That is a growth rate of only 3% year-over-year, considerably below industry projections of the past several years. Green Thumb’s growth rate was much higher at 13% YOY, primarily due to expansion in its markets, but no company can outgrow its market forever. He was very clear about positioning the company to rely on operational excellence, capital discipline and strategic creativity rather than untrammeled growth for success. Notable by omission was Green Thumb’s absence from international markets. Unlike companies such as Tilray (TLRY) and Aurora Cannabis (ACB), who seem to see international as a way to bail out domestic failure, Green Thumb believes staying true to one mission is the way to success.

The quarter was also about what was expected by company that is at the top of its industry in financial performance. Green Thumb had its ninth consecutive quarter of positive GAAP income. It was also the tenth quarter out of the last 11 with positive cash flow from operations. Green Thumb continues to be at or near the top on these important metrics, as shown in sample of companies in the tables below. All numbers in millions USD.

| Operating Cash Flow | 2019 | 2020 | 2021 | TTM |

| Verano Holdings (OTCQX:VRNOF) | -7 | 72 | 181 | 168 |

| Green Thumb Industries | -18 | 96 | 132 | 124 |

| Ayr Wellness (OTCQX:AYRWF) | 4 | 35 | -28 | -40 |

| Trulieve Cannabis (OTCQX:TCNNF) | 19 | 100 | 13 | -47 |

| Ascend Wellness (OTCQX:AAWH) | -41 | -6 | -42 | -50 |

| Curaleaf Holdings (OTCPK:CURLF) | -38 | 12 | -34 | -57 |

| TerrAscend Corp.(OTCQX:TRSSF) | -40 | -37 | -32 | -57 |

| Cresco Labs (OTCQX:CRLBF) | -25 | -8 | 14 | -326 |

| Net Income | 2019 | 2020 | 2021 | TTM |

| GTBIF | -59 | 19 | 80 | 100 |

| CRLBF | -65 | -93 | -297 | 34 |

| VRNOF | -18 | 39 | -15 | 13 |

| AYRWF | -164 | -25 | -17 | -25 |

| TRSSF | -161 | -139 | 3 | -45 |

| AAWH | -33 | -24 | -123 | -78 |

| TCNNF | 53 | 63 | 18 | -107 |

| CURLF | -57 | -109 | -116 | -137 |

A considerable amount of time on the conference call was dedicated to the recent announcement about opening an initial 10 stores at Circle-K locations in Florida. There is a lot of excitement around the company about this initiative, which could be a brilliant move and is at least ground-breaking. Convenience stores are all about being a go-to place to pick up items quickly and easily, as well as picking up items on the fly on an errand to buy gas or something else. It’s hard to imagine a better environment for a cannabis outlet, and the concept is based on a similar arrangement between Green Thumb and Circle-K’s parent in Canada that has been successful. The short-term financial impact will be minimal, but the long-term potential is huge.

Green Thumb stock chart

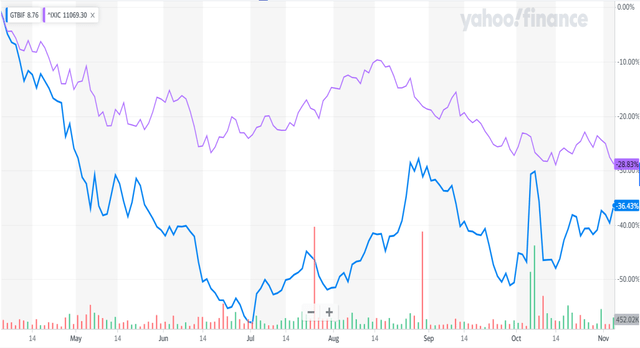

The six-month Green Thumb stock chart (in blue) is very interesting when compared to the NASDAQ (COMP.IND) (purplish).

Yahoo Finance

We can see the high beta, as the gap increases when the NASDAQ is going down and decreases when it goes up. Also, we see a general uptrend in Green Thumb since July as the share price rose a hefty 50% from 8 to 12. Green Thumb outperformed the NASDAQ, which admittedly was a low bar to get over. The price also had sharp increases in early July, August, and October, demonstrating the effect of political progress in Washington related to legalization and the SAFE Banking Act that occurred at those times. The share priced retrenched after those developments but much of the gain was retained, leading to that 50% gain.

After the latest report, the Seeking Alpha forward earnings estimate went from $0.32 per share to $0.31. With nine-month earnings at $0.26 this is easily achievable. The 2023 estimate remains at $0.38. This makes the estimated PE 37.2 for 2022 and 30.3 for 2023. These are lower than the other seven companies in the tables above, four of which have no earnings to calculate with.

Outlook for Green Thumb investment

Readers need to be aware that my time frame is long, as I outlined in My 5-Year Cannabis Investing Plan. I am sensitive to developments that affect companies in a shorter time frame, most recently in my writing on SAFE banking, but usually what happens to stock prices in the short term is uninteresting to me. It’s mostly noise that distracts from the goal of building wealth over time. I am interested in durable gains, not trading in and out for small profits. When I make a recommendation on Seeking Alpha, the time frame is a MINIMUM of 12 months, and if it takes several times longer that’s still within my expectations. I don’t give price targets, but for cannabis I am looking for gains of 100% over time.

With that in mind, Green Thumb continues to be my number one BUY recommendation for the cannabis sector. On a macro level cannabis will be a growth industry for the rest of the decade in the US. New states continue to come online, with Connecticut, Rhode Island, New York and others expected in 2023, and expansion in other states is going strong. There are potential political developments on the state and federal levels, like the SAFE Banking Act, that would measurably improve the cannabis business. There’s a good chance Florida will approve adult-use in 2024, which would double or triple that $2 billion market.

On an industry and national economic level there are headwinds that will hurt results across the sector as long as they continue. There will eventually be a sector shakeout and some companies will be weakened or not survive. In this scenario investors will want to own shares of the strongest companies, which are best suited to confront adverse conditions and take advantage of a different future industry landscape. This is not a time to grab small companies with unproven business ability. It’s a time to remember the “risk” side of “risk/reward.”

Green Thumb will be negatively affected by adverse industry or national economic conditions, so there is downside risk. We can’t control those things, but with good stock picking we can hitch a ride with the best management talent. The latest quarterly report is more evidence that Green Thumb is a good pick on that basis. Green Thumb offers good downside protection and the opportunity to participate in the continuing growth and public acceptance of cannabis in the US.

Be the first to comment