imaginima/E+ via Getty Images

No, really the Core CPI did come down, and I am making a point.

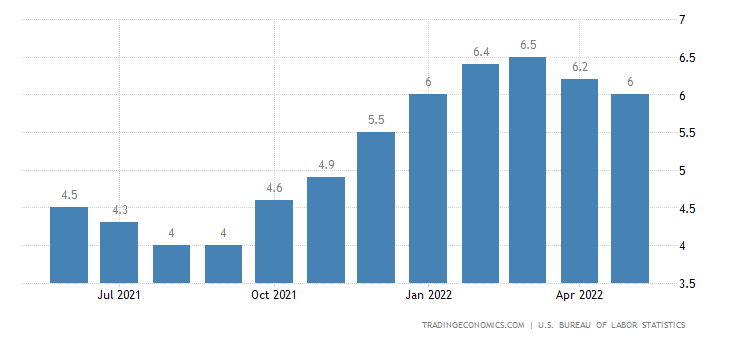

What can come down is coming down, here’s the chart from the Bureau of Labor Statistics:

Bureau of Labor Statistics

it’s just that it can’t overcome the huge leap in energy and food prices. Just as an aside both food and energy were going up way before Putin’s war. Food and energy are inextricably tied together. Food production runs on diesel both on the farm and getting products to market. One way to get food costs down is to hurt the economy enough so that people are thrown out of jobs and that will lower labor costs. Something tells me that policies and regulations need to change to raise productivity. Of course, Putin’s War is pressuring food costs as well. All this will take time to work out, but it will happen. One thing that can be done in North America is to make sure that every acre of arable land is farmed. This is not just for our comfort, but because millions are likely to starve without making up for the loss of grain output from Ukraine.

This analysis is not about what I wish would be but is what I judge to be actually happening or the odds are in favor of it happening. Sad to say that no matter how many trips Biden makes to Saudi Arabia and cozies up to murderous Maduro of Venezuela there won’t be enough oil. It is true that fracking to extract oil is faster to set up than conventional oil exploration and production, but it still takes time. The issue is glaring, there has been minimal investment in conventional EnP. The cost for offshore drilling, which is one of the few locations where conventional drilling is still possible (except for places like Alaska) is multiples higher than the cost of fracking. The upside is that once a conventional well is drilled (hopefully over a giant reservoir), it will produce for decades. This is what we are missing, new giant fields. The problem is the financial community’s newfound animus toward the oil and gas industry, which is being expressed through the ESG movement is hampering such undertakings. Also, the current president ran on the platform of destroying the energy industry. Not too long ago, many on the left wanted oil executives prosecuted.

Naturally, oil executives decided that it is ludicrous to plan oil projects that take years to get to production. At risk was the cost for multiple billions that will need many years of production to pay it off. In short, policies worked against this vital source of capacity. A very similar mechanism worked against not only building more refining capacity, but rebuilding refining capacity lost to fire as in the huge Philadelphia refinery destroyed a few years ago and never rebuilt. Very simply we have fallen behind in refinery capacity. Combine that with the fact that NatGas is too expensive in Europe to run their refineries so now the US refining industry can make more money shipping diesel there. Do you remember how I started this paragraph? Diesel cost is key to food cost, but also that fertilizer is dependent on NatGas. Also, a myriad of plastics, and especially chemicals. Basically, this is not a problem that can be changed by hiking the Fed Funds Rate and Quantitative Tightening.

Eventually, US fracking will produce more, and the huge profits refineries are making will be a big incentive for them to expand capacity. What is not well understood is the role that productivity in other areas will help bring down costs in ways that were science fiction just 5 years ago. What do I mean? Uber and Waymo, a division of Alphabet, have just inked an agreement that connects Uber Freight to Waymo-powered autonomous semi-trucks without human drivers. In a very short while unmanned long-distance trucking will be commonplace. That will lower the cost and raise the capacity of logistics tremendously. It will also free up labor to be used in (hopefully) higher-value work. This will take time, but in a million different ways large and small; productivity will eat away at logistics costs.

Now to list all the ways that Headline CPI is soaring

-

U.S. consumer inflation reached its highest level in over four decades in May.

-

Headline CPI rose 8.6% YoY, with broad-based gains across categories.

-

To state the obvious, the man on the street doesn’t care that Core CPI is falling. Every time they shop for food and get gas, they feel it.

-

Energy stocks rose close to 4% from the prior month and were up nearly 35% year over year.

-

Fuel and oil prices climbed close to 17% from the previous month and are now up more than 106% yearly.

Another piece of disheartening news…

Consumer sentiment for June came in at a record low of 50.2 points. That’s a 14% month-over-month decline, and a steep +40% year-over-year. That may be more telling for second-quarter earnings.

U.S. weekly jobless near five-month high; labor market still very tight

-

Weekly jobless claims increased 27,000 to 229,000

-

Unadjusted claims rise 1,008 to 184,604

-

Continuing claims unchanged at 1.306 million

-

Unemployment at a more than 52-year low at the end of May

-

unemployment rate at 3.6% for a third straight month

What is obvious to even the most casual observer of the market’s action is that today’s readings extinguished market participants’ hopes that peak inflation was indeed behind us.

I have no comforting words for you, we will likely test 3800 tomorrow. In spite of my prior pronouncements, I am not certain that 3800 will hold. Obviously, if 3800 holds that could be the start of a great bounce to sell into. On the other hand, if 3800 doesn’t hold, the next level is supposed to be 3500. I don’t think that will happen. Even if the market has to discount a recession it was already discounted at 3800. So somewhere around 3800 and if under then 3700. Why do I say that? There have been plenty of hot air expended on the economy failing to grow. Plenty of CEOs are already cutting hiring, and just want to get it over with. Personally, I still believe this economy can take the higher rates.

The argument that we are now in the grips of a bear market will soon be answered

I don’t believe we are in a true bear market, not one that is a sustainable multi-year bear. Truly, the headline inflation number going higher is a disappointment. I already stated that I am no longer confident that 3800 will hold. That said, I think the economy still has plenty of oomph left in it. As this 2nd quarter ER is coming to a close, we will see how profitable the quarter was. I believe we will have growing profits once again. There is no denying that we are now likely going to see more .50% raises. Powell is going to carefully titrate that rate of raises while at the same time starting quantitative tightening. He can easily say he is slowing rate raises while quantitative tightening is going on. The attempt to tighten quantitatively at the rate planned is unprecedented. I think he will do it gradually in spite of mounting pressure to crash the economy in order to save it. He may have to do so, I don’t deny that, but only if he absolutely must. Even at this point, I don’t see that happening.

Tomorrow market participants will most likely continue selling, more than that I can’t say. I will be very interested to see where the support is strong enough to see stocks basing.

My Trades:

For much of the week, I called for holding on to the cash that I generated last week. I also pressed for hedging or shorting a variety of stocks. The way it turned out you could short almost anything and have done well if you held them into the CPI announcement. I found it disconcerting that there were several attempts for stocks to rally culminating in a huge leap on Friday morning pre-market. I didn’t buy any of it, and I am still perplexed why that happened. Even from my expectation of an improvement in the CPI such a rise in stocks would make it more likely to have a sell-off after the news. Last week I had said that I had closed all my oil names, I saw that they had been taken down in the midst of the market meltdown and took advantage. I went long Devon Energy (DVN) Calls, I also reapplied the multi-leg Bull Put and long call structure on the multi-leverage bullish US Oil ETF (UCO). The most important move was holding cash.

I kept all my longs from the previous week. I will deploy that cash hopefully as close to the bottom as possible. I plan to deploy ⅓ of my cash on Monday, another ⅓ on Tuesday, then wait. I am going to have a mix of shorts and longs. Longs will likely be the oil names that I have enumerated many times already. As for shorts, they will present themselves during the next rally, which could be as soon as Thursday.

Good Luck, and remember to trade the market you have, not what you wish it to be.

Be the first to comment