Just_Super

Welcome to the October edition of the graphite miners news.

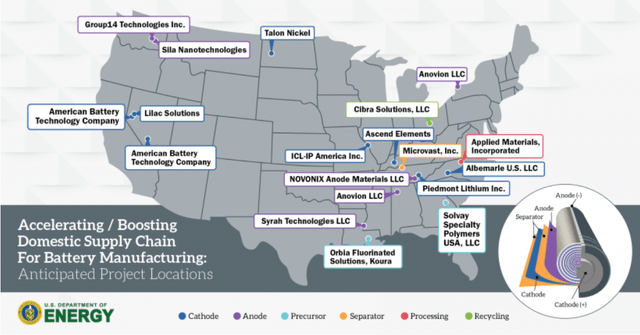

October saw some good news from the U.S. government with the US$2.8b of grants awarded to help support the building of a U.S. lithium-ion battery and EV supply chain – Syrah Resources & Novonix were graphite related winners.

Graphite price news

During the past 30 days, the China graphite flake-194 EXW spot price was up 1.66%. The China graphite flake-199 EXW spot price was up by 1.23%. Note that 94-97% is considered best suited for use in batteries; it is then upgraded to 99.9% purity to make “spherical” graphite used in Li-ion batteries. The spherical graphite 99.95% min EXW China price was up 1.58% the past 30 days.

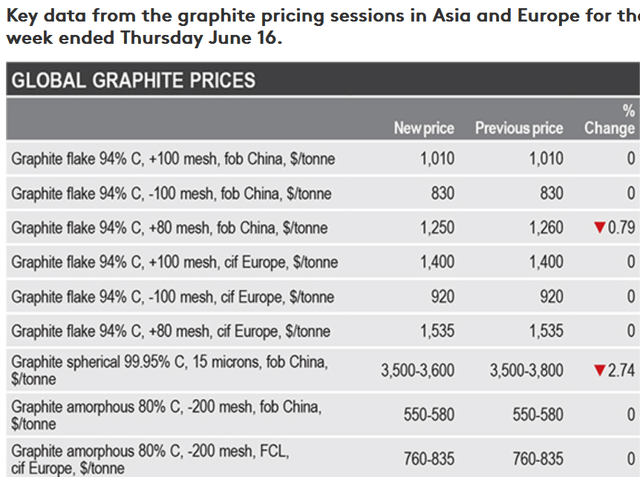

Fastmarkets (see below, not updated) shows China graphite flake 94% C (-100 mesh) prices at US$830/t and Europe graphite flake 94% C (-100 mesh) prices at US$920/t. Note: Fastmarkets stated recently: “The most recent price assessments for graphite flake, 94% C, -100 mesh, cif Europe, and graphite flake, 94% C, -100 mesh, fob China, were $800 and $810 per tonne respectively on September 22.”

Fastmarkets graphite prices the week ending June 16, 2022 (not updated)

Note: You can read about the different types of graphite and their uses here.

Graphite demand and supply forecast charts

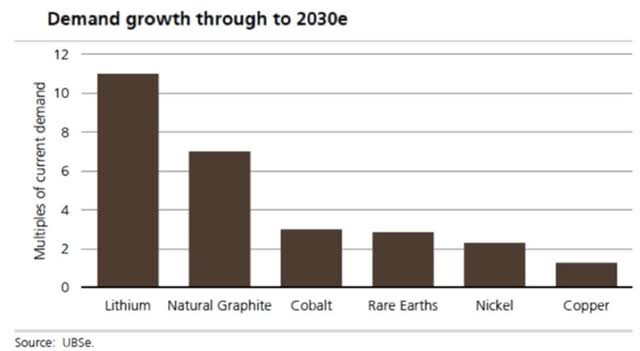

UBS’s EV metals demand forecast (from Nov. 2020)

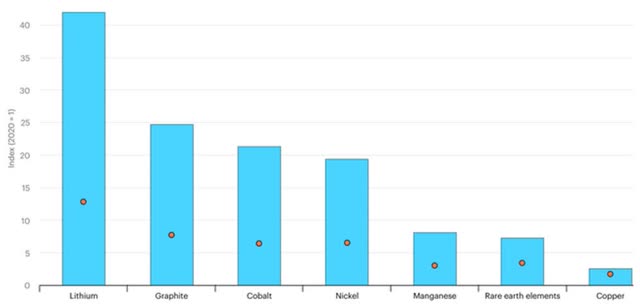

2021 IEA forecast growth in demand for selected minerals from clean energy technologies by scenario, 2040 relative to 2020 – Increases Of Lithium 13x to 42x, Graphite 8x to 25x, Cobalt 6x to 21x, Nickel 7x to 19x, Manganese 3x to 8x, Rare Earths 3x to 7x, And Copper 2x to 3x

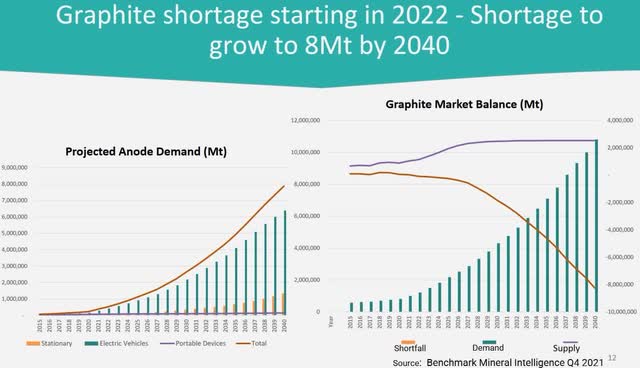

2022 – BMI forecasts graphite deficits to begin from 2022 as demand for graphite grows strongly

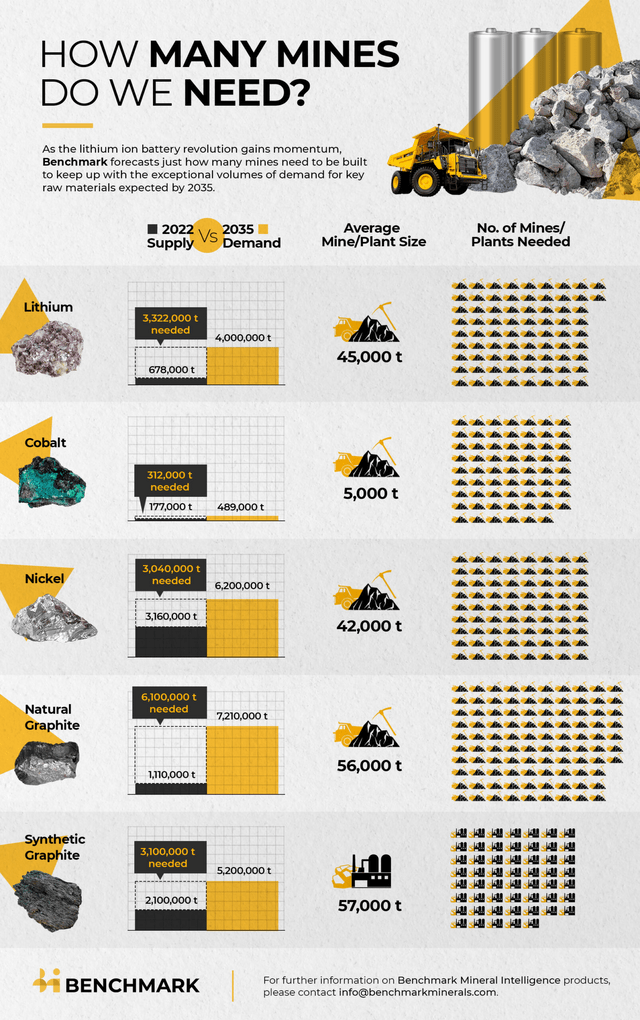

2022 – BMI forecasts we need 330+ new EV metal mines from 2022 to 2035 to meet surging demand – 97 new 56,000tpa natural flake graphite mines

Graphite market news

On October 12 Fastmarkets reported:

Recent graphite price weakness masks phenomenal demand growth… Price declines have been relatively modest, however, given the collapse in steel sector demand… In contrast to the expected decline in graphite consumption in traditional applications this year, Fastmarkets has forecast that demand for graphite from the battery sector in 2022 will rise by 40% year on year, in line with growth in the EV sector… We expect to see the graphite market tip back into deficit in late 2022… Graphite prices are in a lull, but this lull will prove to be temporary and may well be the calm before the storm.

Note: Bold emphasis by the author.

On October 14 The Financial Post reported:

Canada will fast-track energy and mining projects important to allies: Freeland… Canada will have to fast-track energy and mining projects if it is to help its democratic allies and achieve its own net-zero ambitions, Deputy Prime Minister Chrystia Freeland said in a speech this week in Washington… Freeland also addressed calls for the federal government to create incentives to decarbonize on par with those in the U.S. Inflation Reduction Act – legislation that could prompt a surge in investment in emissions reduction and renewables south of the border over the next decade.

On October 19 CNBC reported:

“Elon Musk addresses Twitter takeover, possible recession on Tesla earnings call. “Tesla wrote, in its shareholder deck, “We continue to believe that battery supply chain constraints will be the main limiting factor to EV market growth in the medium and long terms.”

Note: Bold emphasis by the author.

On October 19 the White House released:

Bipartisan Infrastructure Law: Battery Materials Processing and Battery Manufacturing Recycling Selections | Department of Energy. Funded with $2.8 billion through the Bipartisan Infrastructure Law, the portfolio of 21 projects supports new, retrofitted, and expanded commercial-scale domestic facilities to produce battery materials, processing, and battery recycling and manufacturing demonstrations.

Location map showing the planned project locations of the DoE 21 grant recipients – Syrah Resources & Novonix were graphite related winners

On October 19 Energy.Gov announced:

Biden-Harris administration awards $2.8 Billion to supercharge U.S. manufacturing of batteries for electric vehicles and electric grid. The 20 companies will receive a combined $2.8 billion to build and expand commercial-scale facilities in 12 states to extract and process lithium, graphite and other battery materials, manufacture components, and demonstrate new approaches, including manufacturing components from recycled materials. The Federal investment will be matched by recipients to leverage a total of more than $9 billion to boost American production of clean energy technology, create good-paying jobs, and support President Biden’s national goals for electric vehicles to make up half of all new vehicle sales by 2030 and to transition to a net-zero emissions economy by 2050… DOE anticipates moving quickly on additional funding opportunities to continue to fill gaps in and strengthen the domestic battery supply chain… The President also announced the launch of the American Battery Material Initiative… The Initiative will coordinate domestic and international efforts to accelerate permitting for critical minerals projects, ensuring that the United States develops the resources the country needs in an efficient and timely manner, while strengthening Tribal consultation, community engagement, and environmental standards to build smarter, faster, and fairer.

Graphite miners news

Graphite producers

I have not covered the following graphite producers, as they are not typically accessible to most Western investors. They include – Aoyu Graphite Group, BTR New Energy Materials, Qingdao Black Dragon, National de Grafite, Shanshan Technology, and LuiMao Graphite.

Note: AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF) is also a “diversified producer”, producing graphite, vanadium, and lithium. SGL Carbon (ETR:SGL) is a synthetic graphite producer and Novonix [ASX:NVX] (OTCQX:NVNXF) is commercializing their synthetic graphite product. Graphex Group Limited [HK:6128] (OTCQX:GRFXY) makes spherical graphite.

Syrah Resources Limited [ASX:SYR][GR:3S7]( OTCPK:SYAAF)(OTC:SRHYY)

Syrah Resources Limited owns the Balama graphite mine in Mozambique. Syrah is also working to become a vertically integrated producer of natural graphite Active Anode Material (“AAM”) at their Vidalia facility, Louisiana, USA.

On October 20, Syrah Resources Limited announced:

Balama update. Employees and contractors have returned to Balama site and camp, Balama processing facility and other infrastructure have been assessed to be in good working order, full operational capability has been restored and several logistics movements have been undertaken. However, further illegal industrial action disrupted a full operational restart and limited logistics movements. Industrial action continues to be driven by a small contingent of local employees and contractors.

On October 20, Syrah Resources Limited announced: “Syrah enters into MOU with LG Energy Solution.” Highlights include:

- “Syrah enters into a non-binding memorandum of understanding with LG Energy Solution, a leading global manufacturer of lithium-ion batteries.

- Syrah and LG Energy Solution will evaluate natural graphite active anode material (“AAM”) supply from the Vidalia AAM facility in USA.”

On October 20, Syrah Resources Limited announced: “Syrah selected for US Department of Energy grant of up to US$220m for Vidalia expansion.” Highlights include:

- “Syrah selected for a US Department of Energy (“DOE”) grant of up to US$220 million.

- DOE grant will support the financing of the potential expansion of the Vidalia AAM facility in Louisiana, USA to a 45ktpa AAM production capacity.

- Syrah and DOE to finalise a binding funding agreement for the grant.”

On October 20, Syrah Resources Limited announced: “Quarterly activities report for the three months ending 30 September 2022.” Highlights include:

- “Demand growth for Balama natural graphite end uses, with global electric vehicle (“EV”) sales up 68% in September 2022 quarter, versus the September 2021 quarter, to approximately 2.8 million units1 and Chinese anode production increasing to above 130kt per month in the September 2022 quarter.

- Record 55kt natural graphite sold and shipped with 38kt produced at Balama at 80% recovery during quarter.

- Weighted average sales price increased to US$688 per tonne (CIF).

- Balama C1 cash costs (FOB Nacala/Pemba) of US$615 per tonne, impacted by operational interruption due to industrial action, disproportionately high product logistics costs and higher diesel costs.

- Maiden positive Balama net operating profit after C1 and C2 costs for the quarter.

- Three ~10kt spot breakbulk shipments from Pemba port completed in the September 2022 quarter.

- Forward sales order book of nearly 70kt natural graphite, with increased demand expected prior to and through the winter period of lower Chinese production.

- Detailed engineering on Vidalia’s initial expansion to 11.25ktpa AAM production capacity (“Vidalia Initial Expansion”) more than 89% completed.

- Construction of Vidalia Initial Expansion project advancing within the planned schedule and budget with a targeted start of production in the September 2023 quarter.

- Definitive Feasibility Study (“DFS”) underway on expansion of Vidalia to a 45ktpa AAM, inclusive of 11.25ktpa AAM, production capacity.

- Syrah signed a memorandum of understanding (“MOU”) with Ford and SK On to evaluate AAM supply from Vidalia to the BlueOval SK joint venture.

- Syrah signed a MOU with LG Energy Solution to evaluate AAM supply from Vidalia.

- Syrah signed a five-year binding offtake with Hiller Carbon to supply all by-product spherical graphite fines from the 11.25ktpa AAM Vidalia facility for further processing and sale into industrial markets.

- Assessing potential development options for a large-scale AAM facility in Europe through partnership.

- Entered into binding US$102 million loan from US Department of Energy (“DOE”) to support financing for Vidalia Initial Expansion project.

- Selected for a DOE grant of up to approximately US$220 million to support financing of Vidalia’s proposed expansion to a 45ktpa AAM production capacity.

- Quarter end cash balance of US$136 million, representing a US$33 million cash outflow for the quarter of which US$28 million related to investing activities.”

You can view the latest investor presentation here.

Catalysts:

- September 2023 quarter – First Stage 11.25ktpa AAM Vidalia facility targeted to start production.

Ceylon Graphite [TSXV:CYL] [GR:CCY] (OTC:CYLYF)

Ceylon Graphite has ‘Vein graphite’ production out of one mine in Sri Lanka with 121 square kilometers of tenements.

No news for the month.

Mineral Commodities Ltd. (“MRC”) [ASX:MRC]

Skaland Graphite is 90% owned by MRC. Skaland is the highest grade flake graphite operation in the world and largest producing mine in Europe; with immediate European graphite production of up to 10,000 tonnes per annum with regulatory approval to increase to 16,000. MRC plans to demerge its Norwegian graphite assets into a newly incorporated Norway company branded as Ascent Graphite.

On September 26, Mineral Commodities Ltd. announced: “Critical Minerals grant funding.” Highlights include:

- “Government confirms Critical Minerals Grant funding for MRC to build pilot scale battery anode plant in Australia as part of MRC’s vertically integrated active anode materials business.

- MRC to accelerate its downstream battery anode development strategy.

- Pilot scale battery anode plant will finalise commercial scale battery anode plant design and provide final battery anode product qualification samples for Skaland and Munglinup graphite feedstock.

- Grant will support an FID decision on vertically integrated Munglinup Graphite Ore to Coated Purified Spherical Graphite development, targeted for Q3 2023, intended to significantly increase graphite concentrate production.

- Munglinup FID decision will also support MRC transition to 90% ownership of the Munglinup Joint Venture.

- Grant funding of approximately $3.94M.

- Grant agreement likely to be executed in October.”

On October 3, Mineral Commodities Ltd. announced:

MRC secures funding support for growth strategy… plans to raise up to A$15.7 million in additional funding towards its growth strategy as outlined in the Company’s Five Year Strategic Plan 2022-2026 (Strategic Plan).”

Tirupati Graphite [LSE:TGR]

On September 30, Tirupati Graphite announced: “Proposed acquisition of Suni Resources SA.” Highlights include:

- “The Company has agreed to procure the issue of a bank guarantee required to be furnished by Suni Resources S.A to Instituto Nacional de Minas de Moçambique (“INAMI”) in relation to the grant of a mining concession for the Balama Central Project owned by Suni Resources S.A.

- The long stop date to complete the acquisition has been extended to 31 December 2022, with the Company having the option to extend by up to a further 12 months if required to facilitate the receipt of all necessary Mozambique government approvals for the transaction.

- The total consideration of AU$12.5 million and cash and shares split remain unchanged…”

On September 30, Tirupati Graphite announced:

Final results. Tirupati Graphite plc, the fully integrated, revenue generating, specialist graphite producer and graphene and advanced materials developer, is pleased to announce its Final Results for the year ended 31 March 2022… The Company continued to focus on fast-track development across its two projects in Madagascar with the target to reach the globally significant 30,000 tons per annum (“tpa”) capacity at the earliest. The 3,000 tpa pre-existing proof of concept plant continued to operate during the year and the Company commissioned an additional 9,000 tpa plant during the year. Construction of an additional 18,000 tpa plant was initiated during the year and substantially progressed…”

Northern Graphite [TSXV:NGC][GR:ONG] (OTCQX:NGPHF)

Northern Graphite purchased from Imerys the Lac des Iles producing graphite mine in Quebec and the Okanjande graphite deposit/Okorusu processing plant in Namibia. They also own the Bissett Creek graphite project located 100km east of North Bay, Ontario, Canada and close to major roads and infrastructure. The Company has completed an NI 43-101 Bankable final Feasibility Study and received its major environmental permit.

On October 5, Northern Graphite announced: “Northern Graphite acquires Mousseau West Graphite Project.”

You can view the latest investor presentation here and the latest Trend Investing article on Northern Graphite here or the very recent and excellent Trend Investing CEO interview here.

Graphite developers

NextSource Materials Inc. [TSX:NEXT] [GR:1JW] (OTCQB:NSRCF)

NextSource Materials Inc. is a mine development company based in Toronto, Canada, that’s developing its 100%-owned, Feasibility-Stage Molo Graphite Project in Madagascar. The Company also has the Green Giant Vanadium Project on the same property. The Molo mine is fully-funded and scheduled to commission in December 2022.

On October 25 AccessWire reported:

NextSource Materials announces Molo Mine update, management appointments and exercise of warrants by Vision Blue Resources for proceeds of US$16.9M… Completion of construction activities and the start of mining activities is expected in November. Completion of plant commissioning is expected in December followed by a ramp up period prior to declaring commercial production. Phase 1 of the Molo Mine is designed to operate at a production capacity of 17,000 tonnes per annum.

Investors can view the latest company presentation here or the latest Trend Investing article here.

Talga Group [ASX:TLG] [GR:TGX] (OTCPK:TLGRF)

Talga Group is a technology minerals company enabling stronger, lighter and more functional materials for the multi-billion dollar global coatings, battery, construction and carbon composites markets using graphene and graphite. Talga 100% owned graphite deposits are in Sweden, proprietary process test facility is in Germany.

On September 27, Talga Group announced: “ACC and Talga sign non-binding Offtake Term Sheet for Swedish lithium-ion battery anode… ACC is co-owned by automotive brands Mercedes-Benz and Stellantis “

On September 30, Talga Group announced: “2022 financial report.”

On October 7, Talga Group announced: “Successful Talga A$22M institutional placement.”

On October 19, Talga Group announced: “Talga attains ISO 14001 Environmental Accreditation…”

On October 24, Talga Group announced: “Talga Share Purchase Plan closes early.”

You can view the latest investor presentation here.

Westwater Resources (NYSE:WWR)

Westwater Resources Inc. is developing an advanced battery graphite business in Alabama. The Coosa Graphite Plant (2023 production start) plans to source natural graphite initially from non-China suppliers and then from the USA from 2028.

No significant news for the month.

You can view the latest investor presentation here.

Magnis Energy Technologies Ltd [ASX:MNS] (OTCQX:MNSEF)

Magnis is an Australian based company that has rapidly moved into battery technology and is planning to become one of the world’s largest manufacturers of lithium-ion battery cells. Magnis has a world class graphite deposit in Tanzania known as the Nachu Graphite Project.

On September 27, Magnis Energy Technologies Ltd. announced: “Bankable Feasibility Study update confirms strong financial and technical viability for the Nachu Graphite Project.” Highlights include:

- “Update to the 2016 BFS confirms the Nachu Project as a world class graphite project with strong technical and financial viability combined with impactful sustainability outcomes.

- The update optimises process plant design to produce a higher-grade product and protect flake size during processing.

- The Project’s unique combination of larger flake sizes and high purity concentrate positions it as a leading future supplier to meet the rapidly growing demand by the Lithium-ion battery market.

- Post-Tax Life of Mine (LOM) Project NPV 10 of US$1.2bn1 (A$1.8bn) and Project IRR of 51%1 with a payback period of 19 months. Nachu is the only graphite project to be awarded a Special Economic Zone licence in Tanzania to produce advanced graphite products, including very high purity Jumbo and Super Jumbo Flakes as well as downstream products for Lithium-ion batteries.”

On October 13, Magnis Energy Technologies Ltd. announced: “Lithium-Ion Battery Anode Active Material Manufacturing Plant.” Highlights include:

- “Plans to establish a downstream anode active material (AAM) processing plant with a number of locations in the US being investigated.

- Plans to become a superior anode material supplier to meet the booming demand from the global Lithium-ion battery market.

- Strong alignment with Magnis’ vision of vertical integration of strategic assets in Lithium-ion battery supply chain.

- Secure supply of high-grade flake graphite feedstock from Magnis’ NachuGraphite project in Tanzania.

- Innovative and sustainable graphite anode processing technology eliminating harsh chemical and thermal purification.

- Over 6 years of Pilot Plant testing in New York shows significant low-energy, low-cost downstream operations producing high performing materials.

- Advanced discussions with several potential offtake partners to produce and supply AAM.”

Gratomic Inc. [TSXV:GRAT] [GR:CB82] (OTCQX:CBULF)

Gratomic’s Aukam Graphite Project is located in Namibia, Africa. The Project is undergoing ‘operational readiness‘. Gratomic also 100% own the Capim Grosso Graphite Project in Brazil. Gratomic is also collaborating with Forge Nano to develop a second facility for graphite micronization and spheronization.

On September 21, Gratomic Inc. announced: “Gratomic reaches extraction of 730 tonnes of graphite at the Aukam Benching Program…”

On September 26, Gratomic Inc. announced: “Gratomic announces addition of four new licenses to its Capim Grosso Project. Gratomic Inc…”

On October 12, Gratomic Inc. announced: “First 2,600 tones extracted at Aukam Graphite mine In Namibia.”

On October 12, Gratomic Inc. announced: “Bench-mining Program enters full mining phase after completion of road construction at Aukam.”

Black Rock Mining [ASX:BKT]

On October 10, Black Rock Mining announced:

Black Rock completes front end engineering design, reconfirming Mahenge as Tier 1 scale project with compelling projected returns… FEED outcomes support debt financing for Module 1, term sheets expected Q4 CY22.

Nouveau Monde Graphite [TSXV:NOU] (OTCQX:NMGRF) (NYSE:NMG) and Mason Graphite [TSXV:LLG] [GR:M01] (OTCQX:MGPHF)

Nouveau Monde Graphite (“NMG”) own the Matawinie graphite project, located in the municipality of Saint-Michel-des-Saints, approximately 150 km north of Montreal, Canada. NMG (51%) and Mason Graphite (49%) have agreed to JV (subject to approvals) on the Lac Guéret Project.

On October 20, Nouveau Monde Graphite announced: “NMG, Panasonic Energy and Mitsui Announce Offtake and Strategic Partnership supporting the supply of active anode material plus US$50 million private placement by Mitsui, Pallinghurst and Investissement Québec.” Highlights include:

- “Framework agreement between NMG, Panasonic Energy and Mitsui for the development and further commercialization of NMG’s integrated anode material operations in Québec, Canada.

- Signed memorandum of understanding to confirm intentions for a multi-year offtake agreement between NMG and Panasonic Energy for a significant portion of NMG’s active anode material out of NMG’s fully integrated “ore-to-anode-material” facilities.

- A total investment of US$50 million from Mitsui, Pallinghurst and Investissement Québec will support the next operational milestones for the project financing activities on both the Matawinie Mine and the Bécancour Battery Material Plant.”

You can view the latest investor presentation here.

South Star Battery Metals [TSXV:STS] (OTCQB:STSBF)

South Star Battery Metals owns the Santa Cruz Graphite Project in Brazil. Plus, the right to earn-in to up to 75% for the Graphite Project in Coosa County, Alabama.

On October 12, South Star Battery Metals announced:

South Star Battery Metals announces full mining license application submittal and update on Phase 2/3 environmental permitting at its Santa Cruz Graphite Project, as well as drill mobilization and pilot-scale metallurgical testing update for Alabama Graphite Project. South Star Battery Metals Corp. (“South Star” or the “Company”) (TSXV: STS) (OTCQB: STSBD), is pleased to announce that it has submitted the Planned Economic Analysis (“PAE”) and the request for the final mining license (“concessão de lavra”) to the Brazilian Mining Authority (“ANM”) on September 28th, 2022 for two additional claims (871.052/2011 & 872.874/2010), which are east and west extensions on strike of where the Phase 2 and 3 facilities are planned… The proposed PAE doubles the Santa Cruz production capacity presented in the previously released PFS (March 2020) and incorporates a third phase of project development. The planned production schedule follows: 2 years with 5,000 tonnes per year (“tpy”) of concentrates (Phase 1). 2 years with 25,000 tpy of concentrates (Phase 2). Life of mine (“LOM”) with 50,000 tpy of concentrates (Phase 3).

Greenwing Resources Limited [ASX:GW1] (OTCPK:BSSMF) (formerly Bass Metals [ASX:BSM])

No significant news for the month.

You can view the latest company presentation here.

Triton Minerals [ASX:TON][GR:1TG]

Triton Minerals Ltd. engages in the acquisition, exploration and development of areas that are highly prospective for gold, graphite and other minerals. The company was founded on March 28, 2006 and is headquartered in West Perth, Australia. Triton has two large graphite projects in Mozambique, not far from Syrah Resources’ Balama project.

No significant news for the month.

You can view the latest investor presentation here and the latest article on Trend Investing here.

Eagle Graphite [TSXV:EGA] (OTCPK:APMFF)

The Black Crystal Project is located in the Slocan Valley area of British Columbia, Canada, 35km West of the city of Nelson, and 70km North of the border to the USA. The quarry and plant areas are the project’s two main centers of activity.

On October 21, Market Screener reported:

Eagle Graphite confirms cease trade order and suspension of trading… The CTO was issued as a result of the Corporation’s failure to file its interim financial statements, management’s discussion and analysis, and certificate of the foregoing filings for the period ended May 31, 2022.

SRG Mining Inc. [TSXV:SRG] [GR:18Y] [Formerly SRG Graphite Inc.]

SRG is focused on developing the Lola graphite deposit, which is located in the Republic of Guinea, West Africa. The Lola Graphite occurrence has a prospective surface outline of 3.22 km2 of continuous graphitic gneiss, one of the largest graphitic surface areas in the world. SRG owns 100% of the Lola Graphite Project.

No news for the month.

You can view the latest investor presentation here.

Leading Edge Materials [TSXV:LEM] (OTCQB:LEMIF)

Leading Edge Materials Corp. is a Canadian company focused on becoming a sustainable supplier of a range of critical materials. Leading Edge Materials’ flagship asset is the Woxna Graphite Project and processing plant in central Sweden. The company also owns the Norra Karr REE project, and the 51% of the Bihor Sud Nickel-Cobalt exploration stage project in Romania.

On September 28, Leading Edge Materials announced:

Leading Edge Materials reports quarterly results to July 31, 2022. Subsequent to July 31, 2022:

- On August 30, 2022, the Company announced a change in senior Management with the resignation of Mr. Filip Kozlowski, CEO of the Company, effective as of October 14, 2022. Mr. Eric Krafft, Director of the Company will be named interim CEO.

On October 13, Leading Edge Materials announced: “Leading Edge Materials approves contractor to open Bihor Sud Adits…”

Investors can view the latest company presentation here.

Renascor Resources [ASX:RNU](OTC:RSNUF)

Renascor Resources Ltd. is an Australian exploration company, which focuses on the discovery and development of economically viable deposits containing uranium, gold, copper, and associated minerals. Its projects include graphite, copper, precious metals, and uranium.

No news for the month.

You can view the latest investor presentation here.

EcoGraf Limited [ASX:EGR] [FSE:FMK] (ECGFF)

On September 29, EcoGraf Limited announced: “EcoGraf expands BAM Facility Development Plans. European and North American Markets requiring accelerated lithium-ion BAM production to meet EV demand.” Highlights include:

- “…Potential for micronizing and spheronizing operations in Tanzania to optimise supply chain efficiencies for regionalised EcoGraf™ battery anode material facilities.

- Original EcoGraf™ Battery Anode Material Facility stage 1: 5,000tpa followed by stage 2: 20,000tpa production model to be replaced by single-phase ~25,000tpa development, delivering faster ramp-up, construction schedule efficiency, economies of scale and significant market position.

- Dynamic market changes with EV manufacturers seeking significantly higher volumes, resulting in a single-phase ~25,000tpa development.

- Simplified commercial development model will be supported by a new stage 1 product qualification facility that is targeted to be in operation mid 2023.

- Larger, single-phase development to support proposed debt financing arrangements with Export Finance Australia.

- HFfree purification patent processes in progress in key battery markets.

- EcoGraf anode recycling capability strengthens value proposition in Europe and North America.”

On October 4, EcoGraf Limited announced: “Further positive results for enhanced HPA anode coatings.”

On October 20, EcoGraf Limited announced: “Independent ISO-compliant LCA study confirms CO2Advantages of EcoGraf HFfree™…”

You can view the latest investor presentation here.

Lomiko Metals Inc. [TSXV:LMR] (OTCQB:LMRMF)

Lomiko has two projects in Canada – La Loutre graphite Project (flagship) (100% interest) and the Bourier lithium Project (70% earn in interest).

On September 29, Lomiko Metals Inc. announced:

Lomiko announces the third round of analytical results from the infill and extension exploration drill program at La Loutre Graphite property, drilling wide high-grade intersections at 11.02% Cg over 120m at the northern end of EV Zone…

On October 12, Lomiko Metals Inc. announced: “Lomiko announces further results from its infill and extension exploration drill program at the La Loutre Graphite property in Québec, including 15.09% Cg over 60.0m in the EV Zone.” Highlights include:

- “Consistent, near-surface graphite mineralization in the mid-north section of EV Zone.

- High-grade graphite values and significant widths.

- 9 out of 10 holes intersected significant mineralization.

- Up to 8.14% Cg over 148.5m from 6.0 to 154.5m in hole LL-22-035 including 15.09% Cg over 60.0m from 13.5m to 73.5m.

- Hole LL-22-042 encountered 8.68% Cg over 94.5m from 4.5 to 99.0m and 6.64% Cg over 94.4m from 121.0 to 215.4m

- Up to 13.84% Cg over 42.0 meters from 169.0 to 211.0 in hole LL-22-031.

- Holes LL-22-038, LL-22-040 and LL-22-042 all bottomed in mineralization.

- Graphite intervals in 8 of 10 holes remain open; additional assay results pending.”

On October 24, Lomiko Metals Inc. announced: “Lomiko announces further results from the infill and extension exploration drill program at its La Loutre Graphite property in Québec, including 10.06% Cg over 40.5m in the EV Zone.”

Focus Graphite [TSXV:FMS][GR:FKC] (OTCQB:FCSMF)

No news for the month.

Metals Australia [ASX:MLS]

No graphite news for the month.

You can view an August 2022 Metals Australia update video here.

Investors can read the last quarterly report here, which discusses their Lac Rainy Graphite Project in Quebec, Canada. A bulk concentrate sample has been despatched to ProGraphite in Germany for spherical graphite and lithium-ion battery charging and durability testing. Results expected soon.

Sovereign Metals [ASX:SVM] [GR:SVM][LSE:SVML]

No news for the month.

You can view the latest investor presentation here.

Sarytogan Graphite [ASX:SGA]

Sarytogan Graphite has a 209mt @ 28.5% TGC Inferred Resource (60mt contained graphite) in Central Kazakhstan.

On October 12, Sarytogan Graphite announced: “Battery anode product strategy driven by premium pricing.” Highlights include:

- “92.1% purity graphite concentrate produced by our Australian lab partners using flotation, low-temperature caustic roasting, leaching with a weak sulphuric acid and a final calcine step.

- Preferred product strategy identified as battery anode material at an optimal micro-crystalline sizing which attracts a premium product price.

- Further test work now commencing at leading specialist graphite laboratories Pro-Graphite and Anzaplan in Germany.

- Optimisation is aiming to improve on the 98.6% purity historically achieved on Sarytogan graphite samples (refer Prospectus dated 23 February 2022).”

BlackEarth Minerals [ASX:BEM]

On October 4, BlackEarth Minerals announced:

BlackEarth set to complete Feasibility Study on Maniry Graphite Project. Maniry is ideally placed to capitalise on the forecast graphite supply deficit which will result from surging lithium battery demand.

Zentek Ltd. [TSXV:ZEN] (ZTEK) (formerly ZEN Graphene Solutions Ltd.)

On September 27, Zentek Ltd. announced: “Zentek’s ZenGUARD™ patent application allowed by the Canadian Patent Office…”

Other graphite juniors

Armadale Capital [AIM:ACP], BlackEarth Minerals [ASX:BEM], DNI Metals [CSE:DNI] (OTC:DMNKF), Eagle Graphite [TSXV:EGA] [GR:NJGP] (OTC:APMFF), Electric Royalties [TSXV:ELEC], Graphite One Resources Inc. [TSXV:GPH] [GR:2JC] (OTCQX:GPHOF), Green Battery Minerals Inc. [TSXV:GEM] (OTCQB:GBMIF), International Graphite [ASX:IG6], New Energy Metals Corp. [ASX:NXE], Volt Resources [ASX:VRC] [GR:R8L], Walkabout Resources Ltd [ASX:WKT].

Synthetic Graphite companies

- SGL Carbon (ETR:SGL)

- Novonix Ltd [ASX:NVX](OTCQX:NVNXF)

Graphene companies

- Archer Materials [ASX:AXE]

- Elcora Advanced Materials Corp. [TSXV:ERA](OTCPK:ECORF)

- First Graphene [ASX:FGR] (OTCQB:FGPHF)

- Graphene Manufacturing Group Ltd [TSXV:GMG]

- NanoXplore Inc. [TSXV:GRA] (OTCQX:NNXPF)

- Strategic Elements Ltd [ASX:SOR]

- Zentek Ltd. [TSXV:ZEN] (ZTEK)

Conclusion

October saw slightly higher flake and spherical graphite prices.

Highlights for the month were:

- Canada will fast-track energy and mining projects important to allies: Freeland.

- DoE awards $2.8b of grants through the Bipartisan Infrastructure Law to a portfolio of 21 projects to support commercial-scale domestic facilities to produce battery materials, processing, and battery recycling and manufacturing demonstrations… The American Battery Material Initiative will coordinate domestic and international efforts to accelerate permitting for critical minerals projects.

- Fastmarkets: We expect to see the graphite market tip back into deficit in late 2022. Graphite prices are in a lull, but this lull will prove to be temporary and may well be the calm before the storm.

- Syrah Resources enters into MOU with LG Energy Solution. Syrah selected for U.S. DoE grant of up to US$220m for Vidalia expansion.

- Mineral Commodities – Government confirms Critical Minerals Grant funding for MRC to build pilot scale battery anode plant in Australia.

- Tirupati Graphite – Proposed acquisition of Suni Resources SA.

- NextSource Materials completion of plant commissioning is expected in December, followed by a ramp up period prior to declaring commercial production.

- ACC (owned by Mercedes & Stellantis) and Talga sign non-binding Offtake Term Sheet for Swedish lithium-ion battery anode.

- Magnis Energy Technologies – BFS update confirms strong financial and technical viability for the Nachu Graphite Project. Magnis plans to establish a downstream anode active material processing plant in USA.

- Gratomic – Bench-mining Program enters full mining phase after completion of road construction at Aukam.

- Nouveau Monde Graphite, Panasonic Energy and Mitsui announce Offtake and Strategic Partnership supporting the supply of active anode material plus US$50 million private placement.

- EcoGraf expands BAM facility development plans.

- Lomiko Metals drills 11.02% Cg over 120m and 15.09% Cg over 60.0m at their La Loutre graphite Project in Canada.

As usual, all comments are welcome.

Be the first to comment