jaturonoofer

Introduction

I like to write about companies that lack coverage on SA and today I’m taking a look at Grand City Properties (OTCPK:GRNNF). It’s a Frankfurt-listed residential property company whose market valuation has taken a beating over the past few months as fears about a crash in the European real estate market mount. In my view, Grand City Properties looks undervalued considering the dividend yield stands at 8.44% as of the time of writing and the loan-to-value (LTV) ratio is just 35%. In addition, there are no debt maturities until Q2 2024 and about 95% of the debt is fixed or interest-hedged.

Overview of the business and financials

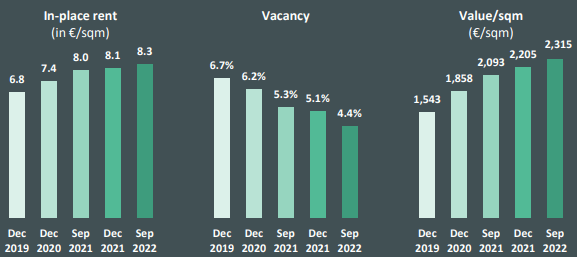

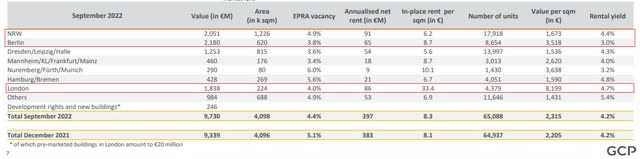

Grand City Properties specializes in buying, optimizing, and repositioning real estate properties so I think you can view it as a fixer-upper. The idea is to buy underdeveloped properties in areas with strong demographic fundamentals and boost rents and occupancy rates by improving the quality of the asset by renovating the apartments and the public areas and installing elevators and playgrounds. This strategy has been working out well over the past three years as rent per square meter has increased by over 20%, the value per square meter has soared by 50%, and the vacancy rate is down to 4.4% as of September 2022.

Grand City Properties

Grand City Properties focused on the city of Berlin as well as the western German state of North Rhine-Westphalia, which account for almost half of its portfolio in terms of value. North Rhine-Westphalia is considered to be the industrial center of the country, while Berlin is seen as Germany’s start-up hub. The company also has a significant presence in London and its property portfolio included just over 65,000 residential units as of September.

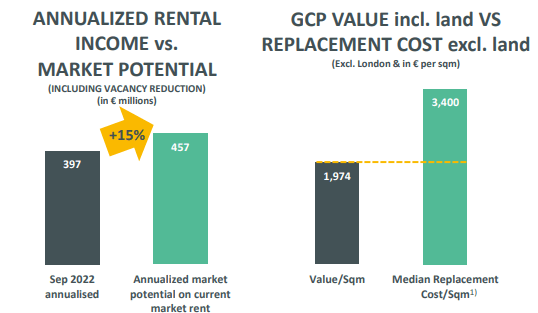

I think the valuation of the portfolio ex-London is conservative considering the replacement cost is almost double at the moment and Grand City Properties thinks that there is room for improvement of annual rental income by about 15%. Still, the potential for optimization is much lower compared to 2019 and the portfolio is starting to look mature.

Grand City Properties

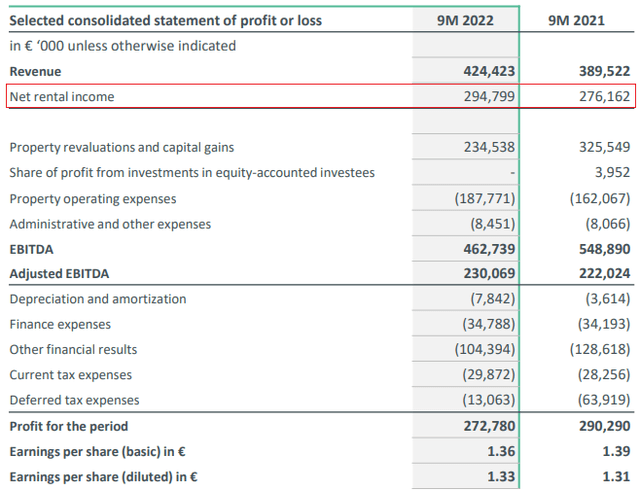

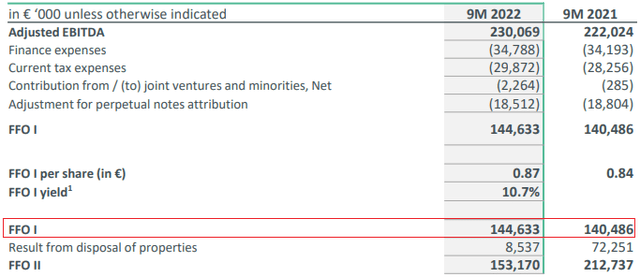

Turning our attention to the financial performance of Grand City Properties, you can see from the table below that net rental income grew by a healthy rate of 6.7% over the first nine months of 2022. Like-for-like net rental income rose by 3.1% as in-place rent rates increased by 2.3% while occupancy rates improved by 0.8%. Funds from operations (FFO) before disposals inched up by 3% to €144.6 million ($148.6 million) and the FFO yield stands at an impressive 10.7%.

Grand City Properties Grand City Properties

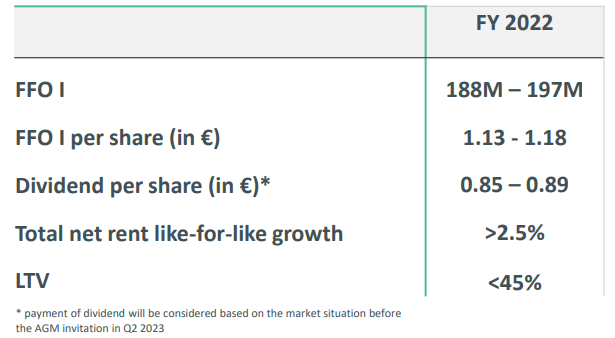

The financial results for the fourth quarter of 2022 are expected to be similar to the ones for the previous few quarters as the current guidance for the full year includes FFO of between €188 million ($193 million) and €197 million ($202 million).

Grand City Properties

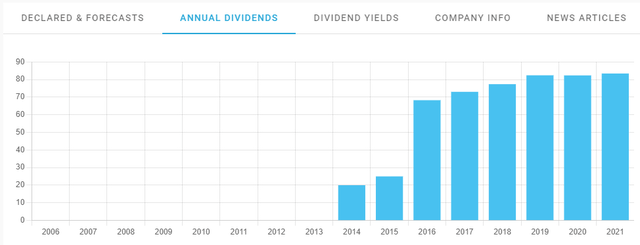

As you can see, dividends are expected to come in at €0.85 ($0.87) and €0.89 ($0.91) per share this year which translates into a yield of between 8.62% and 9.03% as of the time of writing. Looking back, dividend distributions have been growing steadily over the past few years as Grand City Properties grows its business.

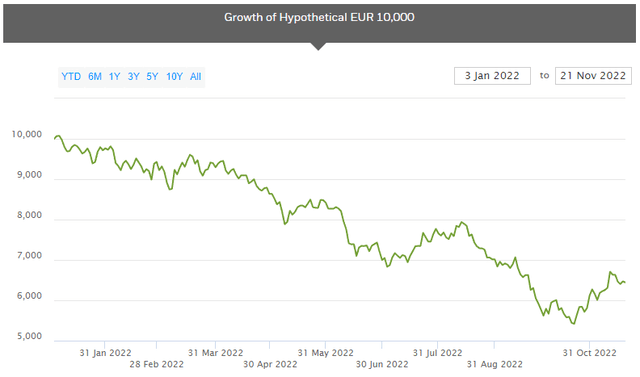

So, why is the dividend yield so high? Well, the answer is that the share price has slumped by over 50% in Frankfurt since the start of 2022.

Overall, the entire property sector in the EU is having a bad as the continent is facing a recession due to rising interest rates and an energy crisis brought about by the Russian invasion of Ukraine. The share prices of the major REITS on the continent have been decimated in 2022 and the iShares European Property Yield UCITS ETF is down by 35.58% year to date as of the time of writing.

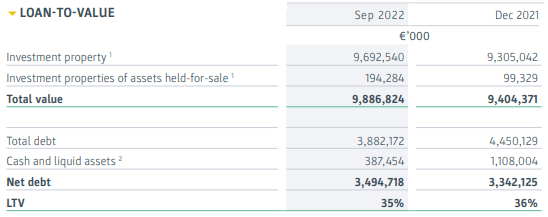

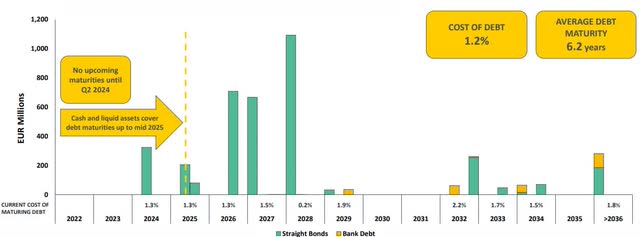

In my view, the fears for the EU’s property sector are well-founded but some good quality companies like Grand City Properties are getting oversold at the moment. I think that what sets this company apart from many of its European competitors is its strong balance sheet and low debt level. You see, Grand City Properties repaid over €615 million ($631.8 million) of debt in the first nine months of 2022 which pushed the LTV ratio to just 35% at the end of September. The cost of debt is only 1.2% with an average maturity of 6.2 years and about 95% of the debt is fixed or interest-hedged. In addition, the company is well-positioned to weather a storm in the credit markets as there is little debt maturing until 2025.

Grand City Properties Grand City Properties

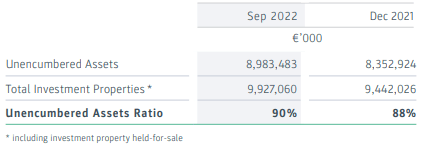

Even if Grand City Properties has to sell properties to keep its LTV ratio low, unencumbered assets account for about 90% of the portfolio of some €9 billion ($9.23 billion).

Grand City Properties

Looking at the valuation of Grand City Properties, I think the margin of safety is more than robust. The EPRA NTA per share is €30.60 ($31.44) which is more than 3 times higher than the current share price. Even if the value of the company’s property portfolio crashed by 60%, it would still be trading below the value of its net tangible assets.

Turning our attention to the risks for the bull case, I think the major one is that I could be underestimating the severity or the duration of the unfolding downturn in the European real estate market. The main idea here is that Grand City Properties is better positioned for a bust than most of its competitors due to its low debt load and no debt maturities until Q2 2024. The company would be in trouble if this downturn lasted several years.

Investor takeaway

Grand City Properties was among the darlings of the Frankfurt stock exchange over the past few years due to its track record of boosting rents and occupancy rates. However, it hasn’t been spared by investors in 2022 as the entire European property market is being sold off. In my view, the company looks cheap at the moment as its debt profile is robust and there could be room for improvement of annual rental income by about 15%. Overall, I rate this one as a speculative buy.

Be the first to comment