swissmediavision

Investment Thesis

GoPro (NASDAQ:GPRO) is entering a tough environment. Consumer electronics demand has continued to deteriorate since I last covered the company. FX headwinds are a major issue for the business.

But the company is continuing to execute on its turnaround. Its subscription and direct-to-consumer segments are continuing to grow. I still think this is a risky stock, but I believe that there is potential value here.

GoPro’s Third Quarter Breakdown

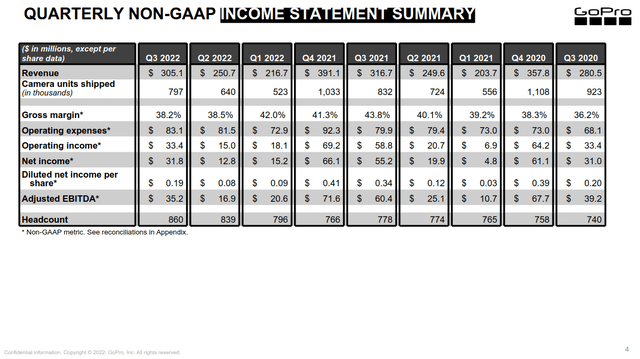

GoPro reported decent third quarter results. The business beat expectations on its top and bottom lines. It reported $305 million in revenue, down 3.2% since last year. The company sold about 700,000 units, in line with expectations.

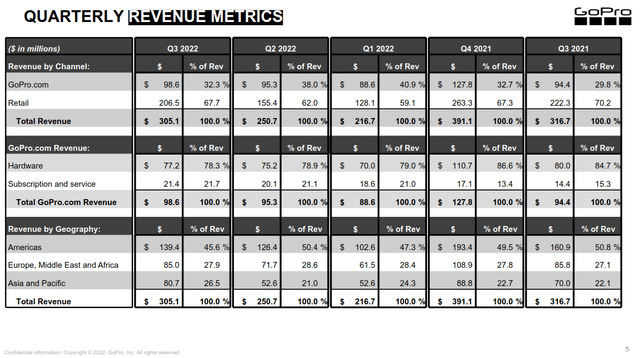

The business reported solid results in its EMEA and APAC operations. EMEA sales grew 14% in constant currency. APAC sales grew 22%. This offset mediocre performance in North America, where sales declined 13%.

GoPro Q3 2022 Preliminary Earnings Results Summary

FX headwinds were a major drag on GoPro’s results. Management said that the business would have grown by 2% if not for the poor currency exchange rates. The US dollar (USDOLLAR) has strengthened a lot in the past year. GoPro doesn’t hedge its currencies, so it is exposed to these fluctuations. In constant currency, GoPro boosted its average selling price by 6.4%. But after adjusting for FX, it reported ASPs up by only 0.6%.

Overall, I think that these results are decent. The environment for consumer electronics is weak right now, so some declines are expected. I like that the business is increasing revenues and ASPs, even if it’s only in constant currency. FX headwinds are likely to continue, so I wouldn’t consider this a positive yet.

Soft Q4 Guidance

My primary issue is GoPro’s guidance. The company expects a soft holiday season. The company’s fourth quarter projections call for about $325 million in revenue. This would be down 17% since last year. The business also expects severe margin pressure. Fourth quarter adjusted EBITDA is expected to decline by 70%. This is an 1180 basis point decline since last year.

| Q4 2022 Guidance | Q4 2021 Results | |

| Revenue | $325 million | $391 million |

| Gross Profit | $114 million | $162 million |

| Gross Margins | 35.0% | 41.3% |

| Adjusted EBITDA Margins | 6.5% | 18.3% |

Some of these poor projections are because of the FX headwinds I mentioned. Unfavorable currency exchange rates are expected to drag revenues down by 6.6%. These headwinds are a noticeable 55% drag on adjusted EBITDA.

There are large ranges on most of the company’s guidance numbers. This demonstrates how the environment is still very uncertain. It’s easy to see how an even worse holiday season could hurt the business’s bottom line. The company’s profitability is under a lot of pressure. I don’t see this changing until the demand environment starts to improve.

The Turnaround Is Still Under Way

Sales are falling off, and margins are deteriorating. But I think that GoPro has improved its positioning on a fundamental level. The company’s sales mix and revenue streams are better than in previous pullbacks. The key turnaround thesis I’ve previously discussed is still intact.

For one, GoPro is generating a lot more revenue through its direct-to-consumer channels. Sales through these channels generate higher margins. They also give GoPro the ability to retarget customers and upsell other offerings. DTC sales were up 14% in constant currency, while retail sales declined 3%.

The company projects that its website will generate between 35% and 40% of its revenue this year. This would be up from 34% last year and a large improvement from pre-pandemic levels of just 12%.

GoPro Q3 2022 Preliminary Earnings Results Summary

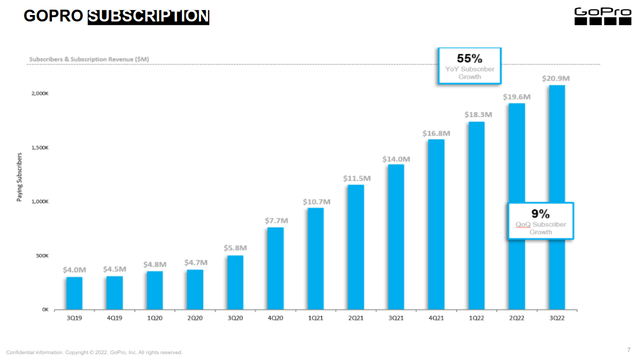

The other major turnaround driver is GoPro’s subscription offerings. Management says that these offerings are a core part of their long-term plans. The company’s main offering is a cloud video subscription for $50 per year per user. Storage services are sticky and often have low churn. I think that these services have the potential to make GoPro’s top line more stable.

I’m watching the impact on GoPro’s margins. Management estimates that these subscriptions can generate 70% to 80% gross margins. This would be a vast improvement for GoPro’s profitability. The business has struggled with its margins and cash flow for years.

GoPro Q3 2022 Preliminary Earnings Results Summary

The company reported 2.1 million subscribers, up from 1.9 million in the last quarter. This is up an impressive 55% year over year. GoPro is on track to meet its 2022 goal of 2.2 million subscribers.

I think that these metrics are promising, and the segment could be key to GoPro’s turnaround. But I will reiterate my concern about customer churn. GoPro doesn’t break out the retention rates for its subscription services. This could be an issue when the company is offering large signup discounts for new customers. Management said that retention improved by 5% in the quarter. This sounds good, but I can’t find any baseline or context for this statistic. I’m not too worried, but I will keep watch for any commentary about churn rates.

Cheap But Still Risky

Even after a 55% YTD drawdown, I still think that GoPro shares hold some risk. The company has a forward P/E of 10.8 times and a forward adjusted EV/EBITDA of 5.8 times. This is somewhat cheap, but the company’s profitability could easily deteriorate further. I’m slightly bullish, but this is still a turnaround play. To put it simply, management has to execute well. There’s a noticeable risk that shares go nowhere or see further downside.

GoPro Q3 2022 Preliminary Earnings Results Summary

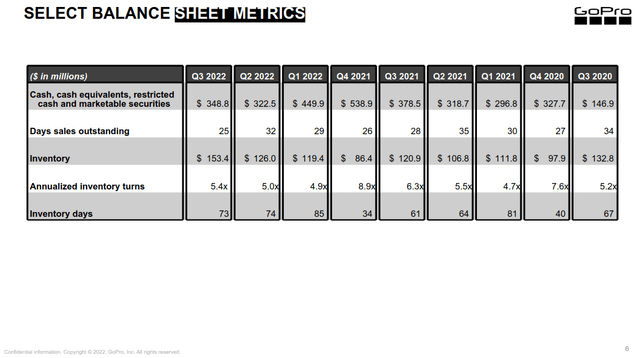

I think that the business can withstand some of these headwinds. Its balance sheet is quite healthy. The company has $350 million in cash and investments. This is equal to 46% of its market cap at the current prices. Management plans to exit the year with $400 million in cash. GoPro has been using some of this money to slowly repurchase its shares. It bought back 1.5% of its outstanding shares in the last six months.

GoPro also has over $150 million in inventory. This is the highest amount since the start of the pandemic. It’s 5.4 inventory turns on an annualized basis. Management aims to reduce this over the remainder of the year. They have a decent track record of improving their average selling prices, so this doesn’t worry me much. It could be a headwind to gross margins, so I’m keeping an eye on it.

Final Verdict

GoPro is facing some serious headwinds. Consumer electronics demand is suffering. FX headwinds are hurting margins, leading to soft fourth quarter guidance.

But the company is continuing to execute on its turnaround plans. The business is increasing sales through its website. Subscription revenues are growing at an impressive rate. This should help boost GoPro’s profitability and cash flow. The turnaround is backed up by a healthy balance sheet. I think that shares could have some upside for investors with a higher risk tolerance.

Be the first to comment