JHVEPhoto

Thesis

Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) (“Google”) stock is trading at a valuation level that is simply too cheap to ignore. As I have highlighted in a previous article, the Internet giant’s stock should offer investors considerable upside no matter which valuation framework an analyst uses.

But sentiment towards digital advertising remains weak. And few investors have the courage to buy into Google’s equity before the next big earnings release – Q3 2022, which is scheduled for October 25. Here is what you need to know. But to give the key takeaway: I remain “Strong Buy”-rated.

For reference, Google stock has underperformed the S&P 500 (SPX) year-to-date, being down 32% versus 25% respectively – a rare observation.

Earnings Preview

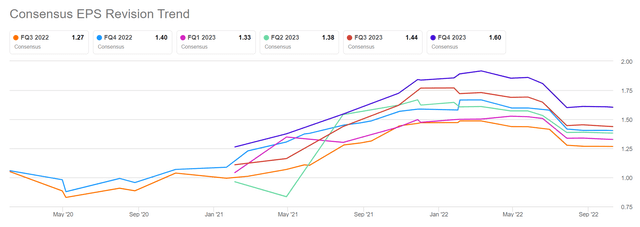

According to data compiled by Seeking Alpha, as of October 12th, 36 analysts have submitted their estimates for Google’s Q3 results. Total sales are expected to be between $67.83 billion and $73.02 billion, with the average estimate being $70.93 billion. So, the dispersion is actually quite wide. If an investor would assume the average as the anchor, Google’s Q3 sales are estimated to grow at about 8.9% as compared to the same quarter in 2021. EPS estimates are between $1.03 and $1.47. The average is $1.27, which would imply a year-over-year growth of negative 9.52%.

I would like to highlight three observations: First, revenue and EPS expectations show significant dispersion, indicating that uncertainty about Google’s Q3 results is high.

Second, investors should note that earnings expectations (EPS revisions) for Q3 have decreased by more than 20% versus the respective expectations in January 2022.

Third, analysts already discount a material year-over-year EPS contraction (-9.52%).

Reflecting on these three observations, I argue it is reasonable to assume that Google stock is pricing in lots of negativity. And accordingly, it should not take much positivity to deliver upside surprise.

It’s The Global Economy, Not Google

The first and most important point that I would like to make when reflecting on Google’s upcoming Q3 results is, that whatever “negativity” the company delivers is likely a function of the global economic slowdown, and not a result of a Google-specific problem. Respectively, this argument also applies to the 9% year-over-year EPS contraction as forecasted by analyst consensus.

Investors should consider that 2022 continues to be an exceptionally challenging year for businesses – as a consequence of rising cost and wage inflation, higher interest payment costs, lower equity valuations, geo-political tensions, and depressed consumer confidence.

Is Digital Advertising Really That Bad?

Building on a negative global economic outlook, digital advertising – which remains Google’s major revenue and profitability driver – has sharply slowed in 2022. Already in early Q2, Mark Zuckerberg, CEO of Meta Platforms, Inc. (META), as well as Evan Spiegel, CEO of Snap Inc. (SNAP), have voiced concerns about their ability to meet analyst expectations. META is down 60% YTD, and SNAP stock has lost about 77%.

But given all the bearishness, is digital advertising really in that bad a shape? Investors should consider that in Q2 2022, Google’s advertising business, which includes YouTube ads, Search ads and Network ads, has grown to $56.3 billion, a 12% year-over-year increase and a 3% quarter-over-quarter increase, respectively.

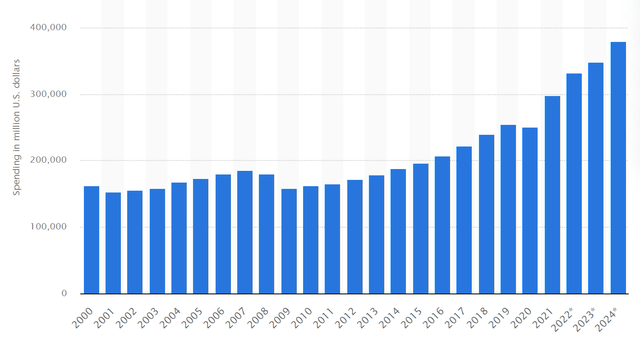

Moreover, even if investors would expect a 2008/2009 type recession, then the 9.52% EPS contraction as estimated by analysts is quite a bearish stretch. Notably, ad spending in the U.S. “only” decreased by about 6.5% in early 2000, after the dot-com bubble broke, and by some 10% during the financial crisis.

Thus, advertising spending should actually be more resilient than what markets might expect and price. And long-term the advertising market should undoubtedly continue to expand — with high ROI services best positioned to capture the opportunity.

Other (Upside) Considerations

Let us assume that Google’s Q3 advertising results are as bad as the market expects them to be — which is unreasonable in my opinion. But still, Google also has other opportunities to surprise to the upside. I would like to highlight two: a strong performance from Google Cloud and/or the announcement of a buyback bonanza.

Strong Google Cloud

Throughout the year, the three largest players – Microsoft (MSFT), Amazon (AMZN), and Google – have highlighted strong demand for cloud solutions and believes persist that cloud solutions could be a “deflationary force in an inflationary economy,” as Microsoft CEO Satya Nadella has highlighted.

Google Cloud still accounts for less than 10% of Google’s total revenues (as of Q2 2022), but the segment has grown to be a key business driver for the search giant. And a positive performance from GC would definitely support sentiment towards Google stock. For reference, the cloud business unit is expected to generate 2022 revenues of $26.9 billion and an operating loss of approximately $3.7 billion (Bloomberg Intelligence). If an analyst believes that a x10 EV/Sales multiple for Google’s cloud business is reasonable, any upside surprise for the revenue outlook could materially push the company’s valuation higher.

More Buybacks

I believe more buybacks from Google are highly likely. There are three considerations that I would like to point out.

First, Google has almost no debt ($96 billion of net cash). And accordingly, the discussion regarding if free cash flow should be used to retire debt or stock should be easily solved in favor of stock repurchase.

Second, Google stock is trading at a decade-low valuation, at a Price-To-Cash Flow ratio (TTM reference) of about x12.8. If Google management is shareholder friendly, as I continue to believe this is the case, a stock repurchase program should be strongly considered.

Third, Google can easily afford a multi-billion equity repurchase program, given that the Internet giant’s cash from operations touches $95 billion/year (TTM reference). If Google wants to be really aggressive, and also wants to draw on the idle cash balance, the company could aim for a 10% annual buyback yield.

For reference, during Q2 2022, Google repurchased $15.2 billion of stock, which implies an annualized yield of about 4.7%.

Risks To Q3 Earnings

Betting on earnings is risky — even for the FAANGS. Remember the 30% sell-off for Netflix (NFLX), twice, and the 30% sell-off for Meta Platforms. No matter how well-researched a company’s quarterly performance is, there always remains some uncertainty. And this uncertainty is a risk. Note, for example, how analysts estimate disperse, from $67.83 billion and $73.02 billion.

That said, investors should also consider that the risk may not be in the past Q3 quarter, but in the upcoming Q4 2022 and Q1 2023 quarters, which could preliminary disappoint due to a weak guidance.

Conclusion

I like the risk/reward of owning Google stock going into Q3 earnings, as I believe the market has excessively discounted the potential earnings headwinds — and Google stock is now trading at a ridiculously attractive valuation (my opinion).

Thus, I believe that any smaller positive – be it related to digital advertising, google cloud, share buybacks, or guidance – could spark a rapid share price appreciation.

I continue to believe that the fair valuation of Google stock should be anywhere between $156/share and $187/share. Reiterate Strong Buy recommendation.

Be the first to comment