GOCMEN

The increasing power of TikTok (BDNCE) has Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL) pushing further into short-form videos on YouTube. With other tech giants aggressively pushing into online videos, YouTube has lost a lot of luster over the last few years. My investment thesis remains Bullish on the stock, with a rebound at YouTube as an overall growth driver for Alphabet.

YouTube Struggles

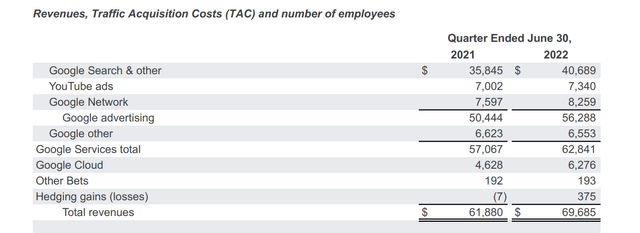

YouTube primarily derives revenues from ads shown during videos on the platform. For Q2’22, YouTube ad revenue was only up ~5% to $7.3 billion while the overall ad business was growing far faster.

Alphabet Q2’22 earnings release

The Service makes additional money off TV services with YouTube TV. Those revenues are reported under the Google other in another category with limited to no growth.

The primary reason for the limited growth is that the company hasn’t monetized YouTube Shorts until now. Alphabet is now turning on money-earning opportunities for short-form videos with ads shown in between videos.

YouTube has been very slow to monetize these videos after introducing the video option all the way back in 2020. Even the new monetization program doesn’t start until 2023.

Content creators will share 45% of the ad revenue and are required to hit 1,000 subscribers with 10 million Shorts views over 90 days to earn money. In addition, creators can generate income via Fan Funding features like Super Thanks, Super Chat, Super Stickers and Channel Memberships.

CEO Sundar Pichai had recently shared that YouTube Shorts were seeing an impressive 30 billion views per day from at least 1.5 billion monthly users. The short-form video platform has already reached an incredible scale.

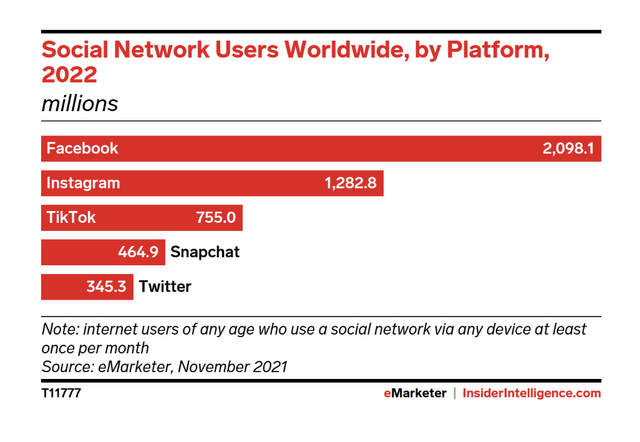

The number is interesting considering TikTok claimed only 1.0 billion MAUs while eMarketer forecast around 755 million. While TikTok gets all the attention for short-form videos, YouTube and Facebook/Instagram (META) apparently have far more MAUs.

The big issue is that Meta only generates ~$1 billion from their Reels videos, and YouTube is at least 3 to 4 months away from launching their program. TikTok is already estimated to generate billions in revenues from short-form videos.

Research from Forrester has TikTok only slightly more utilized by US adults on a weekly basis than YouTube Shorts at 23% versus 17%. Reels is only used by 9% of US adults on a weekly basis in a distant third place in the group.

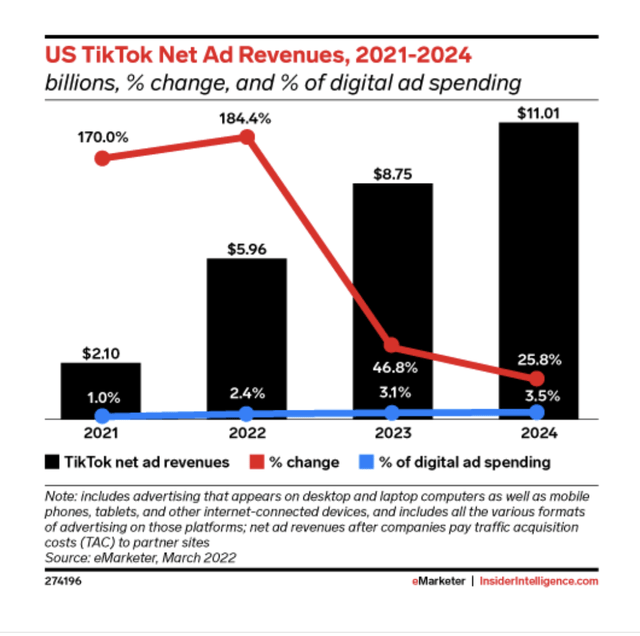

The problem facing Alphabet is that TikTok has eaten into the ad revenue growth for online videos. In just the US market alone, TikTok is forecasted to produce nearly $6 billion in net ad revenues from primarily short-form videos. The number is forecasted to jump to $11 billion in 2024, but TikTok US revenues are only expected to account for 3.5% of all digital ad spending.

In total, TikTok is estimated to have topped $1.6 billion in revenues for Q2’22 placing the company on pace for probably $7+ billion in revenue this year. Bloomberg estimates the company will triple revenues to $12 billion this year.

Either way, TikTok is set to grow revenues this year by $3 to $8 billion. These revenues are disappearing from the growth potential of both Meta and Alphabet. YouTube aggressively monetizing short-form videos with payments to creators should help alleviate the spiraling lost revenues to TikTok.

Next Leg Up

Alphabet is already cheap, and the company focusing on a 20% increase in productivity falls perfectly into retooling YouTube. The company doesn’t need to invent the next great product, Alphabet needs to fully monetize existing products while advancing other growing opportunities with self-driving cars and Google Cloud. The company doesn’t lack for options to improve the business with highly functional businesses that just need some tweaking, such as the current plans to monetize YouTube Shorts.

As highlighted in the previous research, Alphabet already has the potential for a $7+ EPS in 2023 when stripping out ~$1.25 in stock-based compensation. Along with the 20% productivity boost, YouTube Shorts could either help the company achieve this goal or contribute to more upside

The stock has fallen below $100 now offering an incredible deal at 14x non-GAAP EPS targets, even before Alphabet is able to boost numbers.

Takeaway

The key investor takeaway is that Alphabet is far too cheap here. The stock trades as if the tech giant has no growth in the future, yet the company is set up for vast improvements at YouTube in a push for a huge productivity gain.

Be the first to comment