Justin Sullivan

Insurmountable competitive advantage, free cash flow margin above 20%, focus on the long term and no debt are just some of the strengths that characterize Alphabet (NASDAQ:GOOG). As of today, this company is 32% far from its all-time high, an opportunity I personally would not pass up.

What it means to invest in Alphabet

Investing for the long term is crucial if a company intends to endure. Achieving success in the short term while disregarding the long term is a strategy that often involves even the most important companies but that I personally do not agree with. One of the reasons why I consider Alphabet to be one of the best companies in the world is precisely related to this last aspect: despite having now achieved extreme success the company’s focus is still on the long term. If to date Alphabet possesses a winning mentality, however, it owes much to its CEO Sundar Pichai. This man, through his creative and collaborative mindset is considered by many to be one of the best leaders around and is probably one of the greatest strengths for this company. Before becoming CEO, he was actively involved in the development of Google Toolbar and Google Chrome, and since he has been CEO (2015), Alphabet has achieved remarkable growth in every respect. Here are the main ones.

Strong revenue and cash flow growth

Alphabet has basically become a money machine.

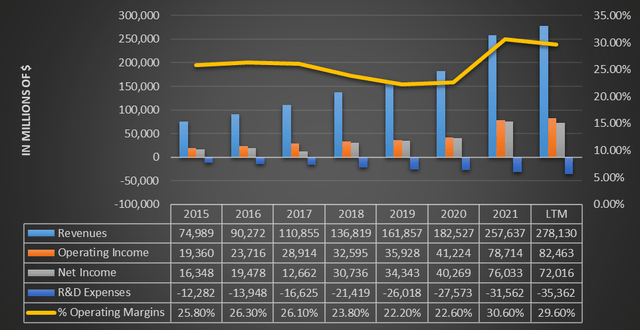

From 2015 to the last 12 months, revenues have increased by 20.59% CAGR, and this rate could be even higher if revenues in the last two quarters are higher than last year. Beyond this impressive growth for a company that was already generating $74.98 billion, it should be noted that Alphabet has even managed to increase margins as well. In the past 12 months the company reported an operating margin of 29.60% while in 2015 it was 25.80%, all without sacrificing costs related to research and development. In fact, the latter have tripled since 2015 and reached the exorbitant figure of $35.26 billion. Finally, it is interesting to note that in 2015 Alphabet generated revenues of $74.98 billion, in 2021 it generated profits of $76 billion instead.

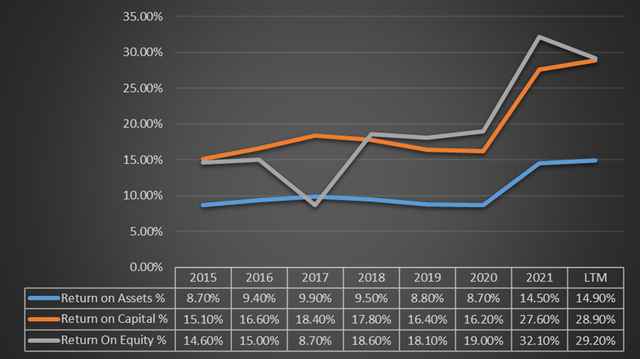

With revenues and margins on the rise, profitability ratios have also improved. Since 2015 ROE has doubled, Return on Capital has almost doubled, and ROA has improved by about 6%. These results often take a back seat to revenue growth, but I personally do not take them for granted at all. To improve so much the allocation of invested capital and the profitability of a company that was already dominating the international scene in 2015 is something that deserves attention.

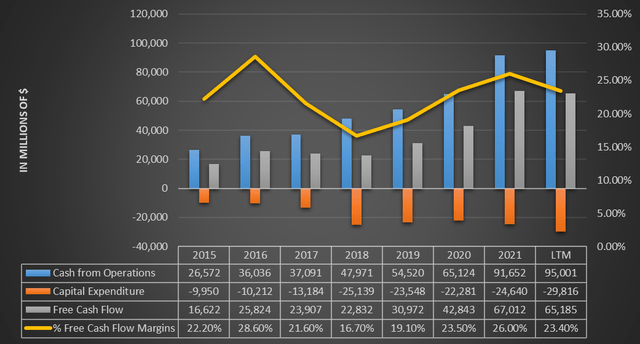

To conclude, you can see in this graph why I called Alphabet a money machine. Since 2015, free cash flow has increased by almost $50 billion despite the Capex increasing by about $20 billion. In light of what we have seen so far, there is no question that Alphabet is one of the best companies in the world from a cash flow perspective. The only two companies that present better values in terms of free cash flow are Apple (AAPL) and Microsoft (MSFT). The former presents a free cash flow (LTM) of $107 billion with an FCF margin of 27.80%, the latter also presents a free cash flow (FY2022) of $65 billion but with an FCF margin of 32.90%.

Market dominance

The main reason for such rapid growth for Alphabet is mainly due to its dominant position within its market.

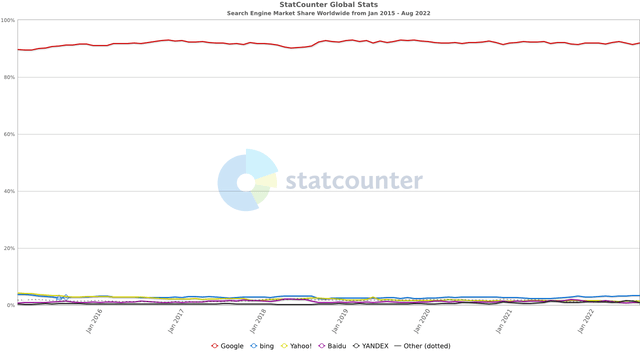

There are no search engines that can intimidate Google. The market share has been stable above 90% for years now, and this preference does not seem to be stopping. Not even Microsoft with the introduction of Bing has managed to turn the tide. However, Alphabet’s overwhelming power is not only about Google, but also about YouTube. The market share of online video platforms is dominated at 76.14% by YouTube, and in second place is Vimeo with 18.80%. From the third place onwards most of the competitors do not even reach 1%. So again, Alphabet has a significant competitive advantage. There are no signs that anything will change in the future, which is why I expect this company to dominate in the coming decades to come.

Financial and capital stability

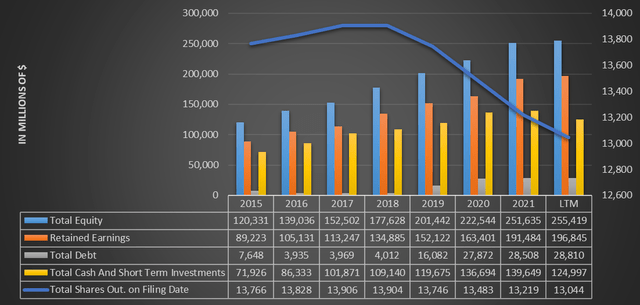

Alphabet had an excellent balance sheet and financial position even before Sundar Pichai became CEO; however, during his administration he has managed to improve the situation even more. The improvements made from an income standpoint have spilled over into the balance sheet, which to date has no weaknesses.

Equity more than doubled due to increased retained earnings but shares outstanding decreased. Total debt has increased by $21 billion but cash and cash equivalents reserves are 4.5 times larger. This company has a net debt of -$96 billion, makes buybacks and has increasing equity. What could be better?

Is $100 per share too much?

So far, I have explained what my reasons are for believing that Alphabet is one of the best companies in the world, but that in itself is not enough to justify a purchase. Even the best company in the world can turn out to be a bad investment if paid too much. In this section, therefore, I will evaluate Alphabet by various methods in order to understand whether at the current price it is reasonable to invest in it.

Technical Analysis

Graphically we can see that Alphabet is currently close to a very strong support located around the psychological threshold of $100 per share. Several times the $100 per share has acted as support, and this time too it could be so. It is good to remember, however, that nothing prohibits the price from falling below $100 per share and testing the next support at $85 per share. As for the RSI, we are currently close to an oversold zone, and it is also interesting to note that there is a divergence from the stock’s performance. As of May 23, the RSI signals a bullish trend while the price per share has remained virtually the same. Usually, financial analysts evaluate these divergences as a bullish signal for the stock.

For whatever my opinion is worth, from a technical point of view I believe the stock can also reach the next support at $85 per share, but this does not preclude a buy as early as $101. I consider it unlikely to reach even lower supports such as those around $70 per share.

Ratios

In this section I will analyze Alphabet’s valuation ratios and compare them with those of the past.

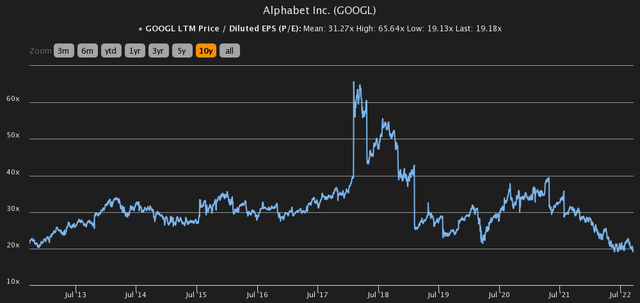

The P/E ratio is the lowest in 10 years and is even lower than that recorded in March 2020. It is currently around 19.1x when on average it is just above 30x. Growth expectations may have decreased compared to the past, but I personally do not justify such a low P/E. Alphabet has not stopped growing and we can see that in future growth estimates.

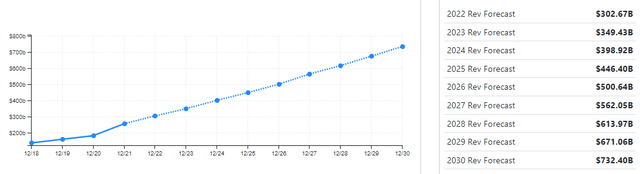

Analysts from stockforecast.com estimate that revenues will more than double by 2030. Not bad for a company that is the undisputed leader in its industry and has a P/E of 19x.

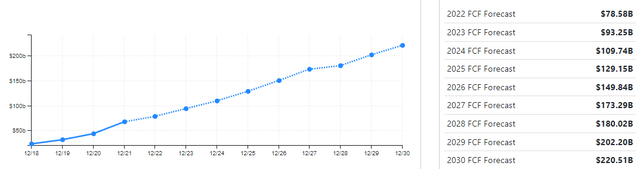

Free cash flow, on the other hand, is estimated to grow even more than revenues; therefore, analysts also expect profitability to improve. The P/E may fall further in the future, but already the current one is reasonable for a company of this magnitude.

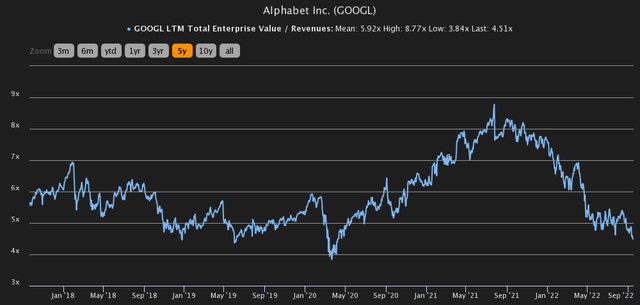

The next ratio I will analyze will be EV/Revenue, as I want to analyze a ratio that discounts within it Alphabet’s net financial position.

Again, this ratio is at its lowest in the past 5 years. The only time it was lower was in March 2020 after the Covid-19 outbreak. Currently the EV/Revenue is 4.51x while the 5-year historical average is 5.92x, peaking at 8.77x. If we were to consider a scenario in which Alphabet’s market cap was to continue to fall, this ratio would reach unreasonably low values in the coming months or years, which is why I believe that already at the current value we are almost at the limit. As we have seen above, double-digit revenue growth is expected in the coming years and net debt is also estimated to decrease in the future: according to TIKR Terminal analysts it could hit -$261 billion by 2026. If the estimates are correct this ratio would reach extremely low values, even lower than those obtained in March 2020. This seems to me an unlikely situation, not least because the last time this ratio fell below 4x, a 200% rally followed in just over 1.5 years.

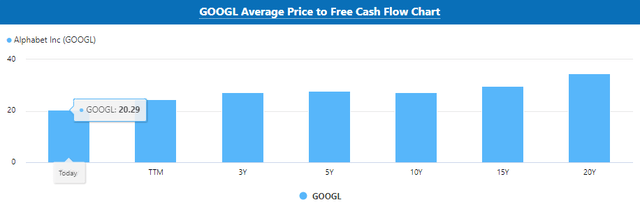

To conclude the ratios analysis, the last one we are going to evaluate is Price/Free Cash Flow. Missing from the list was a ratio that considers cash flow.

To date this ratio is 20.29x, which is lower than any average calculated over multiple time horizons. As we have seen above, expectations for future growth in free cash flow are quite positive; therefore, I believe that even according to this ratio Alphabet is undervalued. Unlike the previous 2, however, I believe that the latter presents a value that denotes a less pronounced undervaluation.

Discounted cash flow

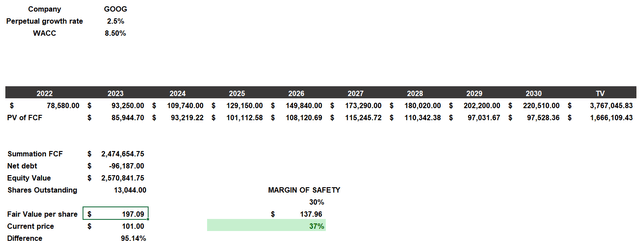

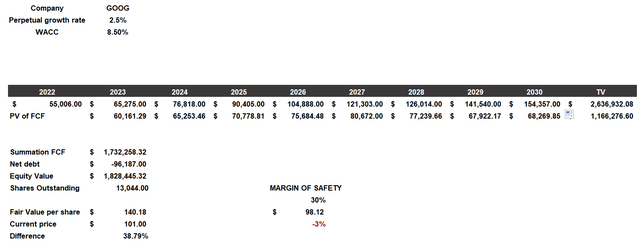

Any investment is the present value of future cash flows; therefore, I will use a discounted cash flow to calculate the fair value of Alphabet. This model will be constructed as follows:

- The cost of equity will be 8.50 % and considers a beta of 1.09, a risk-free rate of 3.75%, a country market risk premium of 4.20%, and additional risks of 0.25%. Since Alphabet has negative net debt, the cost of equity will equal the WACC.

- The inserted free cash flow from 2022 to 2030 will reflect the values estimated by stockforecast.com analysts.

- The source of shares outstanding and net debt is TIKR Terminal.

According to these assumptions, Alphabet’s fair value is $197.09 per share, so the company is highly undervalued. However, stockforecast.com analysts may have overestimated Alphabet’s ability to generate free cash flow in the future; therefore, I wanted to consider two additional alternative scenarios:

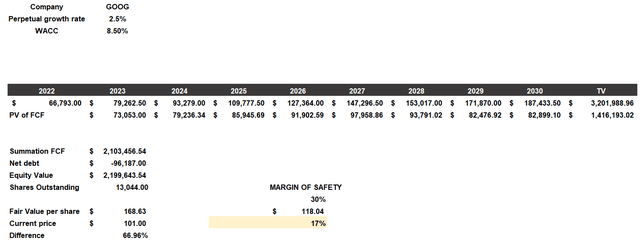

- One where each year’s free cash flow will be reduced by 15%.

- Another where each year’s free cash flow will be reduced by 30%.

Under the first assumption, Alphabet’s fair value falls to $168 per share, but the company remains highly undervalued despite systematically depreciating by 15% for each projected year.

In the second case Alphabet’s fair value is $140 per share, and again the company is undervalued. Any estimate is subject to error since one is trying to predict the future, but at the point when one discounts a 30% margin of error, I think it is unlikely that Alphabet will perform worse. Obviously, no one can know the future and anything can happen, but personally at $101 per share I think the odds are on my side that Alphabet is a good investment. I speak of probability because no one can be certain what will happen in the future; Alphabet also has risks, and I will expose them in the last paragraph.

The main risks

- The first risk is related to market performance. The current macroeconomic scenario is very controversial and can lead to drastic front flips, whether positive or negative. High inflation is negatively affecting stock market performance since the major central banks are adopting one of the most restrictive monetary policies in decades. Until inflation finds its peak we can expect interest rates to rise rapidly, leading to a deterioration in stock market performance. If interest rates rise, so does the risk-free rate, a key component in the calculation of WACC. A higher WACC leads to a reduction in the present value of future cash flows, and thus in fair value. Alphabet is also subject to this mechanism, so if inflation does not find a peak we can expect that $101 will not be the bottom.

- According to Q2 2022, 81% of Alphabet’s revenue comes from Google’s advertising business. As impressive as all this is, it should be pointed out that Alphabet does not have a strong diversification of revenue sources. If companies/people were to spend less on advertising, Alphabet will surely be the one to pay the price. At the moment, the company has shown strong resilience, but this does not detract from the fact that in the future its growth may be slowed by a lower propensity to spend on advertising. During a recession, variable costs such as advertising are among the first to be cut, so this is potentially a rather high risk for Alphabet.

- The last risk relates to Alphabet’s current market share. We have seen above how both Google and YouTube have currently a dominant position, but this is not necessarily the case forever. Bing is still run by Microsoft, however, and there can be no assurance that it will not gain significant influence as a search engine in the future. While small, some improvements have been there, and its market share continues to increase. As far as YouTube is concerned, the biggest competitor is Twitch, run by Amazon. Some YouTubers over the years have preferred to settle on this platform since it is more profitable and less restrictive in content. At the moment Twitch and Bing are not a problem as Google and YouTube continue to generate more revenue than ever, but we cannot know in advance how the situation will evolve.

Thank you for your attention.

Be the first to comment