tawatchaiprakobkit

On Tuesday, Golden Ocean Group Limited (NASDAQ:NASDAQ:GOGL) reported its third-quarter financial results and delivered a revenue beat worth $90.52 million. The company experienced a stronger-than-anticipated quarter, yet, its top-line receded by 27.2% year-over-year, causing the stock to lose 12.51% of its market value on the day.

We recently backed Golden Ocean stock to succeed amid its illustrious dividend yield and favorable valuation metrics. However, we now downgrade the stock to hold as key variables imply that the stock’s total risk-return profile is no longer favorable.

Here are a few factors to consider after Golden Ocean’s third-quarter earnings release.

Earnings Review

Golden Ocean’s third-quarter income statement was dented by receding TCE (time charter equivalent) rates. TCE rates are inextricably linked to shipping demand, which has clearly fallen in this latest quarter. For example, the port of Los Angeles experienced a 25% drop in cargo activity since October last year. The waning economy is the likely culprit for lower shipping revenue, which shouldn’t be a surprise as a drop in trade activity is part of the cyclical nature of our economy.

The slowing activity led to a $73.4 million drop in quarterly EBITDA for Golden Ocean. In addition, the company experienced a $59.6 million fade in net income. To expand on the line items, the company’s Capesize vessels raked in $22 658 TCE per day, while its Panamax vessels contributed $23 562 TCE per day. TGolden Ocean’s daily rates dipped significantly from its previous quarter, leaving investors with much to ponder about.

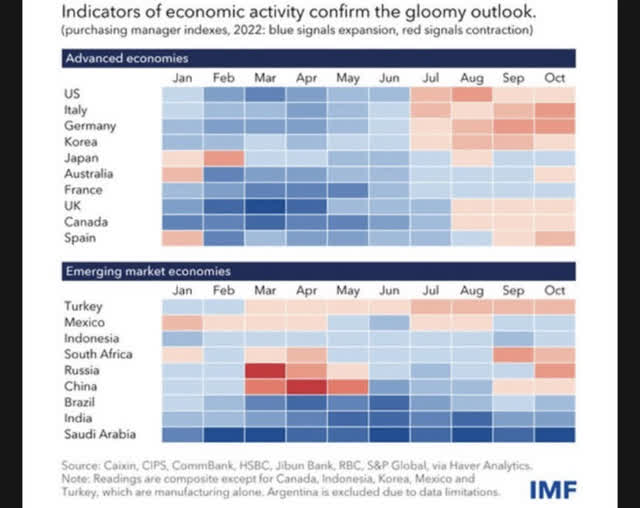

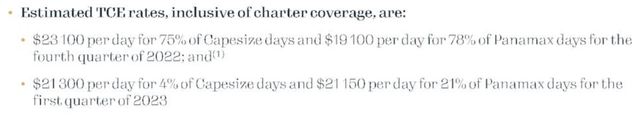

Looking ahead, the firm expects to deliver higher numbers during its fourth quarter, which we believe is highly unlikely, given the current economic climate. The IMF recently published an economic activity heatmap (see the diagram below), outlining the struggles of developed market consumers. We anticipate emerging markets to fall into the same pattern soon as their economic activity often mimics developed market patterns. Thus, it’s improbable that any global trade tailwinds will arise in the near term.

Global Economic Heatmap (International Monetary Fund)

Despite macroeconomic challenges, Golden Ocean does have a lifeline. The company’s presence in the Capesize space means it holds exposure to the rejuvenated coal industry. Global energy shortages have stimulated demand for coal from distant jurisdictions such as South Africa and Australia. Capesize vessels are ideally equipped to complete long-distance trips, and the signs are that carriers are replacing lackluster iron ore demand with coal. We don’t think this is a direct tradeoff, but it phases out much of the company’s cyclicality risk.

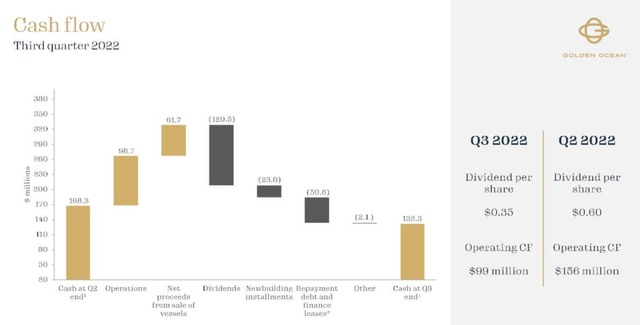

Investor Presentation (Golden Ocean)

Moving on to cash flow, Golden Ocean reported an operating cash flow worth $98.7 million in its third quarter, a steep decline from the $156 million it generated in its second quarter.

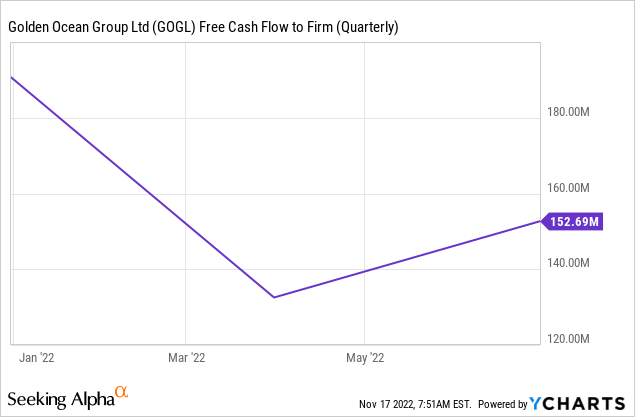

To garner a better understanding of cash flows available to investors, we converted the firm’s operating cash flow figure to “Free Cash Flow to Equity” (“FCFE”) by adjusting for non-cash costs, pre-distributions, and non-recurring events.

To arrive at our magic number, we re-added shareholder compensations and repayments of debt and finance. In addition, we subtracted net proceeds from vessel sales.

According to our calculations, Golden Ocean experienced a quarterly FCFE change of approximately $208.3 million, which is slightly higher than its Free Cash Flow to Firm and much higher than its reported operating cash flow.

| Reported OCF | $98.7M |

| Adjusted FCFE | $208.3 M |

Source: Seeking Alpha

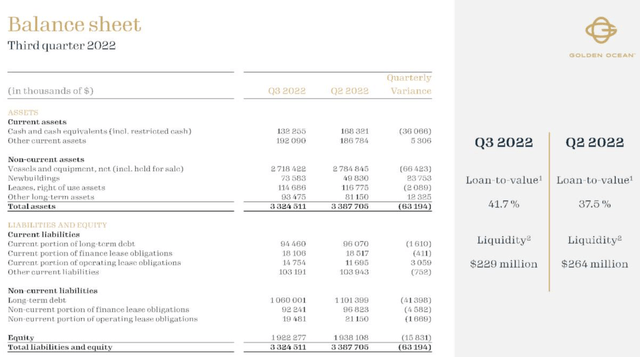

Furthermore, the firm’s balance sheet liquidity faded during its previous quarter. The company’s LTV (Loan-to-Value) rose to 41.7%, and its liquidity dipped by $35 million. We think the company’s general liquidity is in risky territory. Golden Ocean’s quick ratio is currently at a mere 0.56x, indicating that its current liabilities might not be adequately covered by cash and receivables.

Investor Presentation (Golden Ocean)

GOGL Action and Dividends

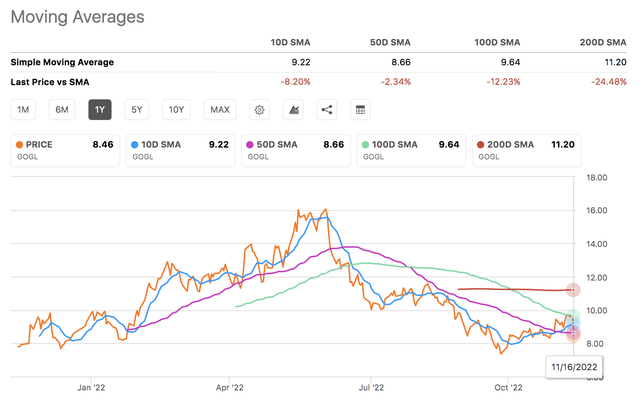

Golden Ocean stock currently trades below its long and short-term moving averages, indicating that mean reversion could be in the offing. In addition, the stock’s price-to-earnings ratio is at a mere 2.67x, and its price-to-book multiple is at only 0.88x.

Momentum Moving Averages (Seeking Alpha)

Despite its quantitative advantages, we believe Golden Ocean stock lacks economic support to revert to its previous heights. As previously mentioned, global economic activity is in dire straits, which could see market participants divest from cyclical assets such as Golden Ocean.

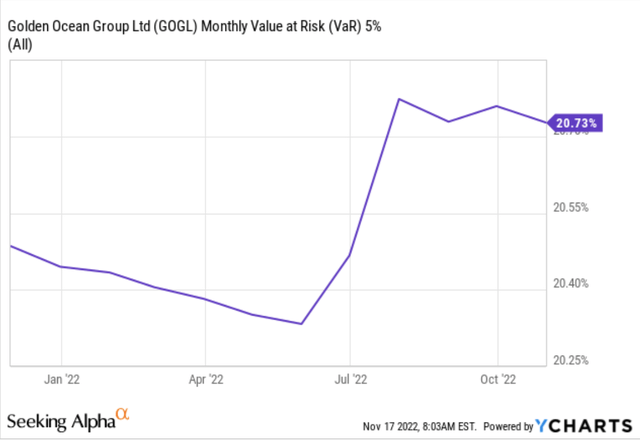

To juxtapose the preceding argument, let’s consider the stock’s dividend profile as well as its value at risk.

Along with its third-quarter results, Golden Ocean announced a dividend per share of $0.35, which adjusts the stock’s dividend yield to approximately 16.55% if we assume a constant payout and a static share price.

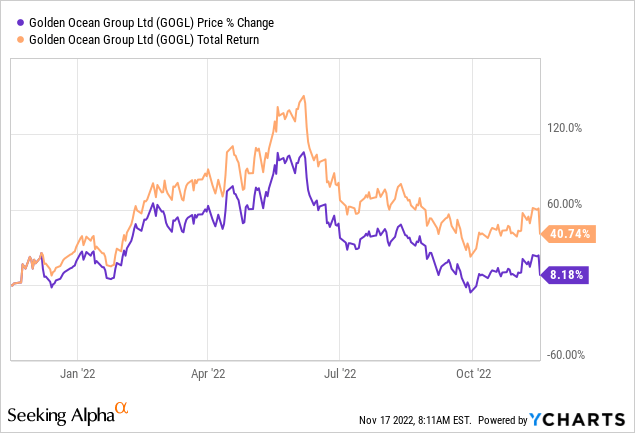

The dividend yield we assume for the stock phases out much of its 5% monthly value-at-risk. As such, its dividend profile could justify much of the asset’s price risk. For instance, notice the sizable arbitrage between the stock’s total return level during the past year and its price return.

Concluding Thoughts – Downgraded to Hold

Golden Ocean’s third-quarter financial results aren’t much of a surprise, given the state of the global economy. TCE rates have dropped sharply, and Golden Ocean’s income statement has taken a severe knock in the previous quarter. The company could benefit from increasing coal demand to replace a lackluster iron ore sphere. However, tangible results still need to be observed.

To juxtapose its operational headwinds, Golden Ocean’s stock is deeply undervalued and presents an attractive dividend. Moreover, there’s an apparent disparity between the company’s price and total return levels.

We downgrade Golden Ocean Group Limited stock to hold, and we’ll reassess our stance in due course.

Be the first to comment