chonticha wat

The interest rates are rising rapidly, the Fed’s members are getting increasingly hawkish, the inflation statistics in the US, the EU and the UK are near multi-decade highs. The central banks will tighten even further and many investors say this is bearish for gold… But this is just the top of the iceberg. In fact, the record money mass is simply ignored. What is more, the fact that inflationary pressures are building up and many central banks are on the verge of tightening further means there will probably be a recession quite soon. We all know how bullish that is for gold. But let me explain this in more detail.

Massive gold sale

I am a long-time gold bull. In my view, gold is an asset that is worth holding as a hedge against economic distress, market volatility and massive money devaluation. In fact, it is appropriate to have it in one’s portfolio even when the economy is in a good condition. So, even a massive sale on the gold market should not make gold bugs question their correctness. Just the opposite is true: a fall in the gold prices can be perceived as an excellent investment opportunity.

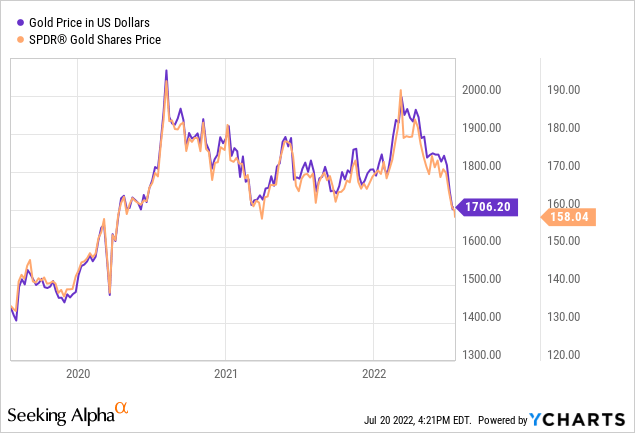

As can be seen from the diagram above, the gold prices have fallen sufficiently from their highs of $2000-$2050 to around $1700, a drop of about 18%. That is substantial for a reasonably stable market like gold. For comparison, the price of SPDR Gold Shares (GLD), one of the largest financial instruments on the gold market, also decreased by around 20% or from $190 to $158. The correlation between the two assets – gold and GLD – is very strong. Certainly, investors seeking to profit from gold’s excellent rally can do so by buying GLD but I would go for physical gold. The reason is very simple and I wrote about this earlier on – the supplies of gold are highly limited, whereas the supplies of “paper” gold are significantly higher. There is a substantial risk, therefore, that “paper” gold cannot be exchanged for physical gold.

On the graph, if we take purely technical analysis into account, it looks quite possible the gold prices will fall further in the near future since the prices started falling very abruptly. Among the fundamental factors we can see the Fed’s hawkish stance and high inflation numbers. Quite recently a few members of the Federal Reserve shared the view they would support rate hikes of up to 100 points all at once. This would make the base interest rate total 2.75% and be a dramatic rate hike over a few decades’ time. This might make the gold prices correct further in the near term. But this too shall pass. In other words, such a price fall is a very good opportunity to buy.

Recession

Recession can be described as an economic downturn with decreasing GDP, high unemployment numbers and a fall in the aggregate demand of the population. During recession sometimes there is also stagflation – inflation, poor GDP and low employment put together. In my view, this is something that is about to happen now. Whilst the employment numbers in the US are still high, GDP seems to be falling, whilst inflation is breaking multi-decade record highs. In order to lessen the inflationary pressures, the Fed will still keep tightening. But this will eventually stop since the Federal Reserve aims to keep high employment and low inflation. This means it will eventually have to ease the monetary policies in order to prevent the US economy from dipping into depression.

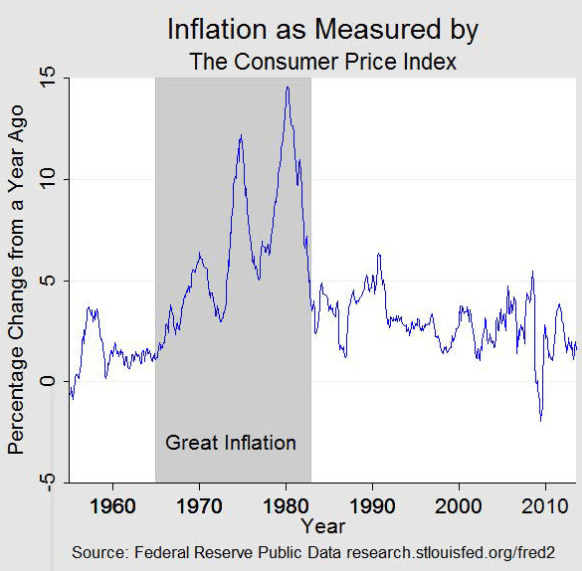

You might be wondering why this has not happened in the late 1960s – early 1980s. At the time, the inflation rate was very high and comparable to the inflation numbers recorded nowadays. The highest CPI rate during this time period was around 15%. It is quite possible we will end up having the very same numbers that we used to at the time.

CPI history, US

Federal Reserve

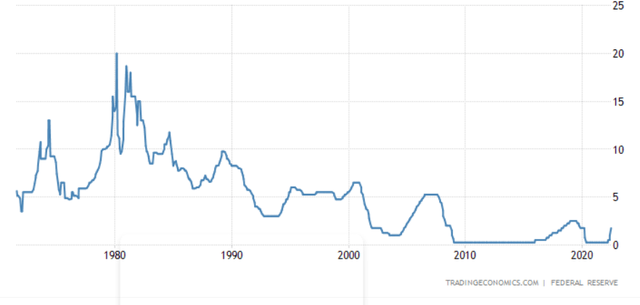

At the same time, the interest rates in the 1970s and 1980s were extremely high. In fact, in 1980 the maximum rate was 20%.

Fed’s fund rate

In addition to high inflation and very high interest rates, America’s economy at the time suffered from frequent recessions, marked with unemployment and falling GDP.

|

Duration |

Peak unemployment |

GDP contraction |

|

|

Recession of 1969-70 |

11 months |

6.1% (Dec 1970) |

-0.6% |

|

Recession of 1973-75 |

1 year 4 months |

9.0% (May 1975) |

-3.2% |

|

Recession of 1980 |

6 months |

7.8% (July 1980) |

-2.2% |

|

Recession of 1981 – 1982 |

1 year 4 months |

10.8% (Nov 1982) |

-2.7% |

Source: Prepared by the author

You might be wondering then why the interest rates stayed so high. Obviously, the Fed and the US government were able to afford this since the debt level was much lower at the time.

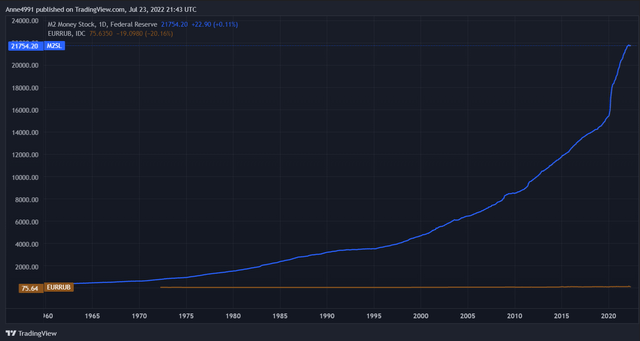

Massive money creation and debt

In 1973 the US abandoned the gold standard. With the gold standard, the US government agreed to convert paper money into a fixed amount of gold. But once this system stopped existing, the government and the Fed were allowed to print more dollars to finance the expenses. The US has been facing budget deficits for several decades and this massive money creation allowed the government and the Fed to “make the ends meet”. Obviously, the accumulated budget deficits turned into a very high national debt and the USD devaluation. But the largest amount of money was printed by the Fed during the pandemic in order to find a way out of the recession caused by the lockdown.

Money supply, US

The diagram above shows the money supply (M2) that increased dramatically in the past two years.

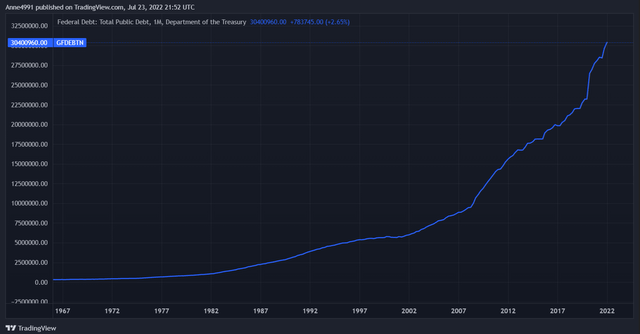

Federal debt

Obviously, both the money supply and the federal debt rose simultaneously.

Rising money supply is a great positive for the gold prices.

Raising the interest rates dramatically the way it was done in the 1970s would make the servicing of the debt very expensive. High interest rates are usually very bearish for the prices of the shiny yellow metal. However, the gold prices were really surging.

The gold price saw a more than 10 times surge between 1971 and 1980 as can be seen from the diagram below.

Gold price history

Gold price history (Trading View)

That is why, in my opinion, the gold price appears highly undervalued. The interest rates would most probably not rise to the levels seen 40-50 years ago, the money supply and the dollar devaluation are incredible, whilst economic uncertainty is high and rising.

What is more, quite recently the EU and the G7 refused to import Russian gold. This should reduce the supply of the yellow metal in many countries.

Gold market manipulations

My only explanation of why the gold prices are still quite low is the massive gold price manipulation. Earlier on, I wrote about physical and paper markets. Indeed, the situations in both of these markets are different. The supply of gold futures, options, XAU and other forms of paper gold sufficiently exceeds that of physical gold.

The paper gold market is very easy to manipulate. Quite recently several JPMorgan (JPM) bankers were accused of spoofing, other forms of price manipulation and fraud. They are all charged with placing false sell orders in order to keep the prices of both gold and silver low and pocket the difference. That was lasting for several years.

The case with JPM’s bankers is a very recent one. This case has also been discussed much in the world press. However, it is highly likely JPM’s traders are not the only ones manipulating the precious metals markets.

It looks obvious to me that the USD value against the broader basket of foreign currencies but most importantly gold is very exaggerated. In my opinion, the market would realize this sooner rather than later.

Conclusion

Given the US debt, the money mass in the US economy, high economic and political uncertainty, the gold prices are too low to be ignored. The only fundamental reason for investors’ pessimism is the expectation of some more rate hikes. But much of the downward pressure on the gold prices, in my view, is also due to manipulations on the “paper” gold market. The demand for physical gold is much higher than that for “paper” gold and I do prefer the former due to its limited supply.

Be the first to comment