NeilLockhart

It’s been a rough year thus far for the gold producers (GDX), with a litany of headwinds thrown at the group. This included COVID-19-related exclusions in Q1, inflationary pressures, a tight labor market, and extreme weather events in some cases. The result is that many producers were forced to revise cost guidance higher, impacted by higher than expected fuel, labor, and reagents costs, exacerbated by supply chain headwinds. In the case of sticky inflation, this could affect sustaining capital costs in the future, so this isn’t just a short-term hit.

While this is disappointing and has led to one casualty so far with Great Panther Mining (GPL) squealing ‘uncle’, the precious metals royalty/streaming companies are largely immune from these headwinds, yet we’ve seen a steep decline in share prices. One name that’s been hit especially hard is Gold Royalty Corporation (NYSE:GROY), which is down 41% year to date. Fortunately, this has pushed its valuation from ridiculous levels to more palatable levels, but it rarely pays to chase a rally. Hence, while recent developments have been positive on balance, I continue to see better opportunities elsewhere.

Q2 Results

Gold Royalty Corporation (“GRC”) released its fiscal Q3 results last month, reporting a quarterly attributable gold-equivalent ounce [GEO] volume of 1,031, a significant improvement on a sequential basis (Q2 2022: 345 GEOs). This was helped by the commencement of royalty payments from Newmont’s (NEM) Borden Mine, with the royalty contributing over $1.3 million in the period. This has pushed the year-to-date attributable volume to 1,664 GEOs, with GRC on track to finish above the 2,000 GEO mark in its first full year as a public company.

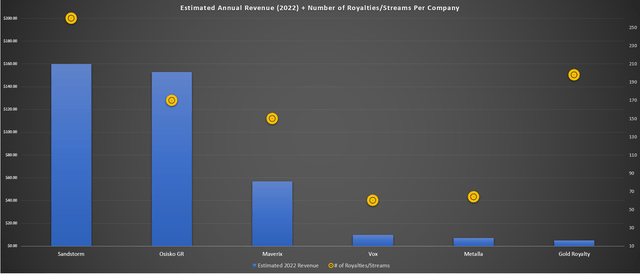

Royalty/Streaming Companies – Annual Revenue vs. Portfolio Size (Company Filings, Author’s Chart & Estimates)

Looking at GRC’s portfolio above, some investors might assume it would trade at a higher valuation, boasting a royalty portfolio in line with the mid-point of two of its largest peers (200+ royalties following a recent transaction). However, it’s important to note few royalties are created equal. While GRC may have a more extensive portfolio than a ~$1.9 billion company like Osisko GR (OR), it generates only a fraction of the revenue. Even with GRC’s strong Q3 results (revenue: $1.91 million), it is expected to generate less than 4% of the revenue Osisko GR will generate this year despite having a larger portfolio. Hence, a bigger portfolio is not always better.

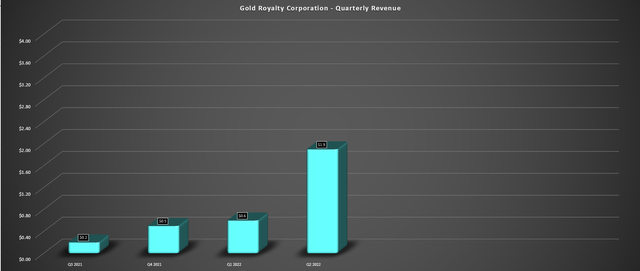

Gold Royalty Corp – Quarterly Revenue (Company Filings, Author’s Chart)

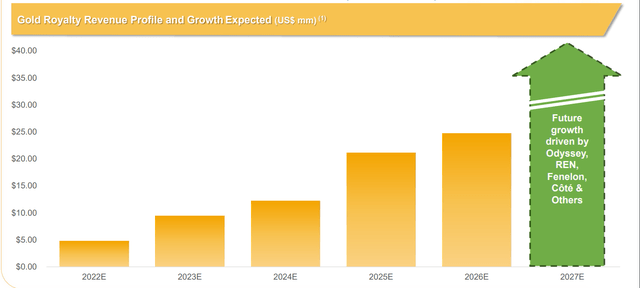

That said, revenue is trending in the right direction despite a lumpy contribution from Borden, and GRC’s revenue hit a new record in fiscal Q3. The good news is that this trend is expected to continue. And even though Monarch (OTCQX:GBARF) reported the unfortunate news that its Beacon Mill restart has been slower than expected, and it’s planning to slow down Beaufor mine production, GRC should still generate over $7 million in revenue in FY2023. On a longer-term basis, multiple assets should push this figure to $24+ million by FY2026. Let’s dig into some recent developments below.

Recent Negative Developments

Beginning with the negatives, and there are quite a few, the major one seems to be the slower-than-expected ramp-up at Monarch’s Beacon Mill. While this was a key asset for GRC, especially after it raised its exposure to the asset recently, all isn’t lost, and this looks to be deferred revenue rather than a fatal flaw. For now, milling is continuing at a rate of 500 tonnes per day with the processing of stockpiles, with the goal being to optimize its mining method and get production up to the goal of 750 tonnes per day. Given the slower ramp-up, I would be surprised to see more than 20,000 gold ounces produced next year, but this asset should contribute meaningfully in FY2024 (40,000+ ounces), padding GRC’s revenue.

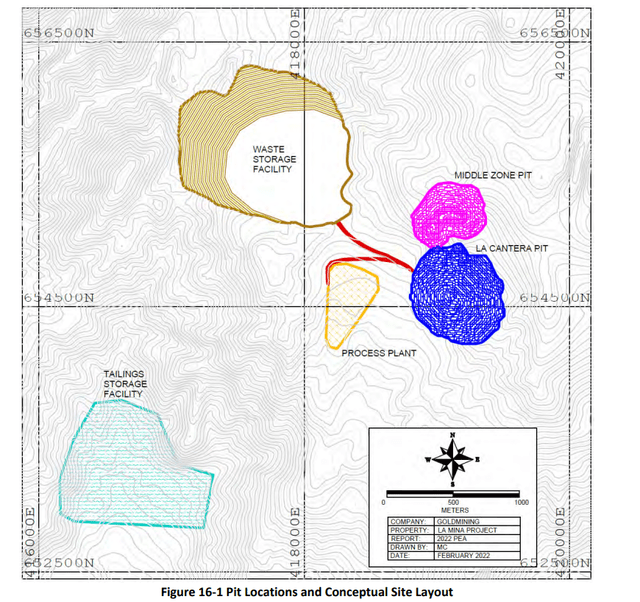

La Mina Conceptual Site Layout (Company Technical Report)

The other negative development occurred in the company’s development portfolio, with the Presidential win by Gustavo Pedro looking like it could prevent the development of open-pit mining projects in Colombia under his tenure. This does not benefit GRC, which has royalty assets on two open-pit projects in Colombia that were being advanced (Titiribi, La Mina), and while I had valued these assets at next to nothing, given that I am not impressed at all with GoldMining Inc. (GLDG), the decision not to assign any value to these assets looks to have been the correct move and confirmed by the negative development from a political standpoint.

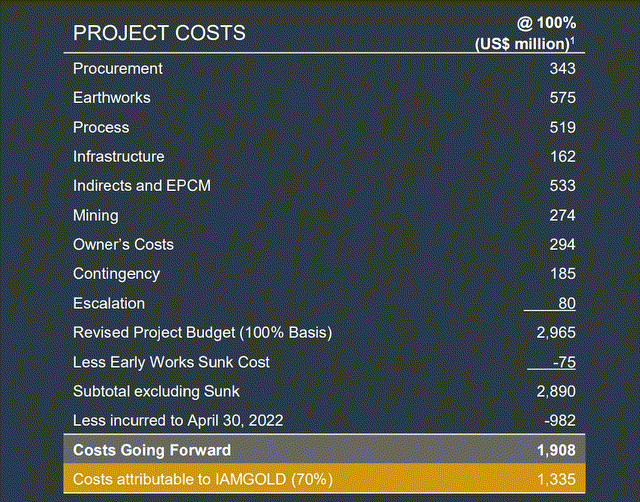

Cote Remaining Funding (Iamgold Presentation)

Lastly, Iamgold’s (IAG) Cote Project saw another massive capex increase and has been delayed further, with commercial production now looking like it will begin in Q1 2024. This was initially supposed to be a decent contribution for GRC in FY2023 based on its 0.75% net smelter return [NSR] royalty. Still, I wouldn’t expect much contribution next year (September 2022 to September 2023 fiscal year) based on the updated schedule. The good news is that GRC is immune from this capex blowout, being a royalty holder vs. the operator.

The bad news is that Iamgold has a significant funding gap currently (~$600 million), and if this can’t be funded, we could see further delays in completing the construction of the mine. I don’t see this as a huge risk, but it can’t be ruled out. The silver lining is that this is a massive project in a Tier-1 jurisdiction. So, if construction were halted due to an inability to successfully fund the remaining capex, a large miner could step in to acquire Iamgold, divesting its mediocre assets and holding onto its majority stake in Cote. Therefore, revenue from this asset attributable to GRC seems to be a matter of when – not if.

While these negative developments certainly aren’t ideal, two look to be a case of slower than expected revenue generation. That said, the potential ban on new open-pit mining projects is more serious. However, I did not assign much value to its Colombian assets, meaning that the impact here is minimal to GRC’s estimated net asset value. Let’s dig into the recent positive developments to see if they’ve made up for the negative ones.

Recent Positive Developments

- Jerritt Canyon ramp-up: First Majestic (AG) expects to increase production from the Nevada asset, potentially increasing production by up to 70% (~170,000 ounces) by 2024, boosting GRC’s contribution from this asset.

- Fenelon PEA commissioning: Wallbridge Mining (OTCQX:WLBMF) is planning a new resource and commissioning a PEA for its high-grade Quebec gold project and is exploring the underground opportunity. GRC holds a massive 2.0% NSR royalty, given that the underground should be easier to fund, with the potential for up to ~170,000 ounces per annum, or ~3,400 GEOs attributable to GRC in 2028.

- Nevada portfolio acquisition from NGM: While I have not been that impressed with deals done by GRC to date, this was a solid one and looks like it could easily pay back its acquisition price of ~$27 million and further increase the company’s revenue and diversification post-2024.

- Orla’s (ORLA) acquisition of Gold Standard: This has significantly increased the probability of South Railroad heading into production, sped up the timeline for this to occur, and increased the probability of regional exploration success. The reason is that Orla is much better financed being cash-flow positive vs. Gold Standard, which was burning cash and had to be conservative with its cash balance.

- NGM’s continued exploration success at Ren: The current high-grade resource of ~1.25 million ounces looks set to grow with a new mineralized corridor west of existing infrastructure, and plans are in place to advance this to feasibility – great news for GRC, which holds a meaningful royalty on the asset (1.5% NSR, 3.5% NPI).

- Odyssey resource growth: The Odyssey Underground Project continues to grow and is ahead of schedule and on track for production in early 2023. While the exploration success benefits Osisko much more, the fact that the team isn’t missing does bode well for other deposits, and points to a longer mine life than initially envisioned at this asset, where GRC has a 1.5% – 3.0% NSR.

In summary, the positives outweigh the negatives and combined with a significant decline in the share price, some of the valuation issues regarding owning GRC stock are improving. Let’s take a look at the current valuation below.

Valuation & Technical Picture

Based on ~165 million fully diluted shares and a share price of $2.90, GRC trades at a market cap of ~$479 million, a steep valuation for a company that’s expected to generate less than $11 million in revenue in FY2023 (~45x forward sales). That said, this is one clear case where valuing a royalty/streamer on a price-to-sales basis would be a mistake, given that GRC is expected to enjoy an industry-leading compound annual revenue growth rate north of 50% over the next few years. This is based on the company’s solid pipeline, with most of this revenue expected to come from Tier-1 jurisdictions (Canada, United States).

The Tier-1 jurisdictional focus separates GRC from some of its larger peers, and if its partners can execute, it could translate to a premium valuation down the road.

Gold Royalty Corporation – Revenue Upside (Company Presentation, Analyst Estimates)

Based on an estimated net asset value of ~$480 million for its producing/development portfolio and $40 million in upside for its exploration portfolio, GRC’s fair value comes in at $520 million. However, this assumes that a fair multiple for the stock is 1.0x P/NAV, and I would argue that GRC can easily command a P/NAV multiple of 1.20x by 2024 as new assets come online and others are advanced closer to production. Using this multiple, GRC’s updated fair value comes in at $624 million, or $3.67 per share, based on an estimated year-end 2023 fully-diluted share count of 170 million.

If we compare this figure to GRC’s current share price of US$2.90, this points to a 26% upside for the stock to its 18-month price target. However, when buying small-cap names, I prefer a minimum 35% discount to fair value to justify starting new positions. If we apply this discount to an estimated fair value of US$3.67 (18-month target price), the ideal buy zone for GROY would come in at US$2.38 or lower, requiring an 18% correction from current levels. Let’s look at the technical picture:

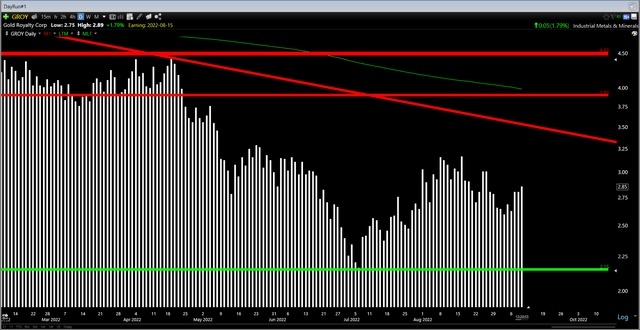

GRC Daily Chart (TC2000.com)

Looking at the technical chart of GROY above, we can see that a new short-term support level has been established at $2.15, but that resistance levels are stacked overhead at $3.30, $3.90, and $4.50. Using the mid-point of the first two resistance levels ($3.60) translates to $0.70 in potential upside to resistance and $0.70 in potential downside to support (1.0 to 1.0 reward/risk ratio). Given that I prefer a 5 to 1 reward/risk ratio to push the odds in my favor from a technical standpoint, GROY is nowhere near a low-risk buy zone. Hence, while I am warming up to its portfolio, I am Neutral from a technical standpoint after this 30% rally.

Summary

While the recent positive developments in GRC’s royalty portfolio have outweighed the negatives, the stock is now back to trading near 1.0x P/NAV, leaving more mature royalty/streaming names trading at more attractive valuations. This doesn’t mean that the stock can’t go higher, but I prefer to buy the highest-quality companies with the best growth at the most attractive price possible, and I continue to see better bets out there, with one of these being Osisko GR. That said, if GROY were to dip below $2.20, where it would trade at ~0.75x P/NAV, this should present a buying opportunity.

Be the first to comment