PashaIgnatov

The most exciting thing going on in the gold and silver market these days is the trial of JPMorgan traders in a federal courtroom in Chicago. Judge Edmond E. Chang presides over the jury trial of Michael Nowak, Jeff Ruffo, and Gregg Smith. Mr. Nowak was the leader of the worldwide precious metals trading department at JPMorgan, Mr. Ruffo was an institutional salesperson dealing with hedge funds, and Mr. Smith was a senior trader on the desk.

The three traders were highly compensated over the past years. According to the US Justice Department, the defendants earned the following from 2008 through 2016:

Michael Nowak earned $23,700,074

Jeff Ruffo was paid $10,425,064

Gregg Smith’s total compensation was $9,890,044

The jury heard the earnings of the three charged with various offenses stemming from trading precious metals over the period. The trial is ongoing as of July 26, with the accused facing charges of manipulating prices over an extended time. Their fate is in the hands of a jury, but the compensation levels will not likely provide any sympathy. Meanwhile, a fourth defendant, Christopher Jordan, will face a jury soon. One of the highlights of the government’s case is the RICO charges typically reserved for organized crime defendants.

JPMorgan is one of the leading precious metals dealers worldwide. The financial institution has already settled with the government to the tune of $920 million, including a $436 million criminal fine. In September 2020, Assistant Director of the FBI’s New York Field Office, William F. Sweeney Jr., said, “For nearly a decade, a significant number of JP Morgan traders and sales personnel openly disregarded US laws that serve to protect against illegal activity in the marketplace. Today’s deferred prosecution agreement, in which JP Morgan Chase and Co. agree to pay nearly one billion dollars in penalties and victim compensation, is a stark reminder to others that allegations of this nature will be aggressively investigated and pursued.” As part of the investigation, the Department of Justice obtained a superseding indictment against Messrs. Smith, Nowak, Jordan, and Ruffo, accusing the four of “Racketeering Conspiracy.” Deceptive orders to benefit “key” clients, JPMorgan, and themselves are at the heart of the charges.

Gold, silver, platinum, and palladium prices have been trending lower since early March, when gold and palladium reached all-time peaks. The Aberdeen Physical Precious Metals Basket Shares ETF product (NYSEARCA:GLTR) holds physical gold, silver, palladium, and platinum bullion. While prices are trending lower, the trial in Chicago is in the spotlight of the precious metals markets.

Gold falls to a new low for 2022

Nearby COMEX gold futures reached a record $2072 per ounce in March 2022 when Russia invaded Ukraine, and inflation rose to the highest level in decades.

Long-term COMEX Gold Futures Chart (Barchart)

The long-term chart highlights the decline to a low of $1679.80 in July, an 18.9% drop to the lowest level since March 2021 and just above the $1673.70 low. August COMEX gold futures settled at $1717.70 on July 26, a lot closer to the recent low than the March 2022 high.

Silver and PGMs do worse

Silver tends to be more volatile than gold, and the price often underperforms the yellow metal on the downside.

Long-term COMEX Silver Futures Chart (Barchart)

The chart shows nearby COMEX silver futures fell from $27.32 in March 2022 to $18.00 in July. Silver fell 34.1% to the lowest level since July 2020, and the price of the September futures contract settled at $18.535 on July 26.

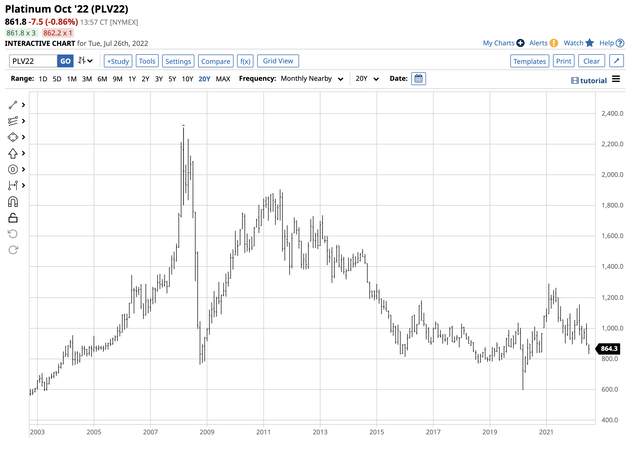

Long-term NYMEX Platinum Futures Chart (Barchart)

NYMEX platinum futures reached $1,154 in March 2022 and fell to $830.60 in July, a 28% drop. October platinum futures settled at $864.40 on July 26. Volatile palladium futures did even worse.

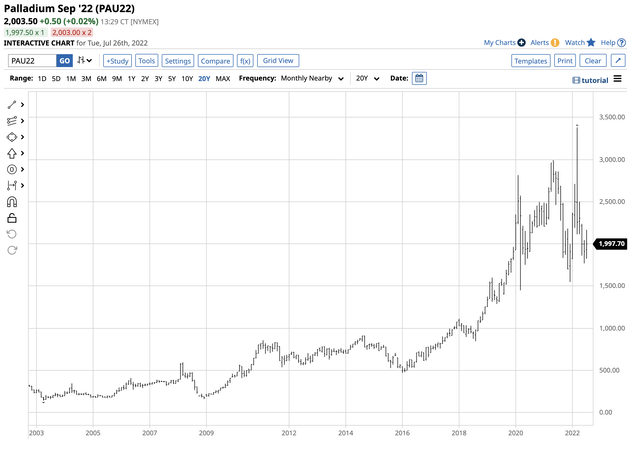

Long-term NYMEX Palladium Futures Chart (Barchart)

Nearby NYMEX palladium futures reached an all-time peak in March at $3,380.50 per ounce. The decline to $1,769.20 in June, a 47.7% plunge. September palladium futures were at the $2,011.20 level on July 26.

Gold fell nearly 19% from the March record high, but silver, platinum, and palladium underperformed the leading precious metal.

Bull markets in three of the four precious metals over the past years

Platinum’s record high came in 2008 when it traded to a high of $2308.80 per ounce. The price hasn’t been above $2000 in 14 years, and platinum made a lower high of $1905.70 in 2011. The last time the price was north of $1,500 was in 2014.

Meanwhile, silver’s peak came in 1980 at $50.36, and the volatile silver market made a lower high of $49.52 in 2011. Meanwhile, silver’s price has been trending higher over the past two decades after reaching a low of $4.026 in late 2001.

Palladium has been in a bull market for over two decades, making higher lows and higher highs since 1999, and gold has been on the same path. Gold reached rock bottom at $252.50 per ounce in 1999, and the price has not been below the $1,000 level since 2009.

Bull market corrections can be nasty

Over the past decades, we have witnessed many bull market corrections in gold and silver. The most recent example in gold came from 2011 through 2016.

COMEX Gold Futures- 20 Years (Barchart)

The chart highlights the decline from the 2011 $1911.60 high to the 2016 $1046.20 low that took gold over 45% lower in five years but did not violate the bullish long-term trend. The example in silver is more recent.

COMEX Silver Futures- 20 Years (Barchart)

Silver spiked lower from $19.54 in September 2019 to $11.7350 in March 2020, with the bulk of the move coming in March. The 39.9% drop, with nearly 38% coming from February to March, is another example of ugly selloffs that can shake the confidence of even the most committed bulls.

Meanwhile, long-term gold, silver, and palladium trends remain bullish despite the short-term bearish price action.

Precious metals abusers face serious consequences- GLTR on the dip as the metals correct

Over the past few months, rising interest rates and the strongest dollar in two decades have been bearish for gold, silver, platinum, and palladium prices. The dollar index rose to a 109.14 high in July, a level not seen since 2002. During that year, precious metals reached the following peaks:

- Gold’s high was below $351 per ounce.

- Silver’s peak was under $5.16 per ounce.

- Platinum’s 2002 high was below $615.

- Palladium traded to a high of under $450 in 2002.

Two decades later, in 2022, inflation is at an over four-decade high, and the geopolitical landscape remains a mess. Precious metals prices may be down, but they are not out.

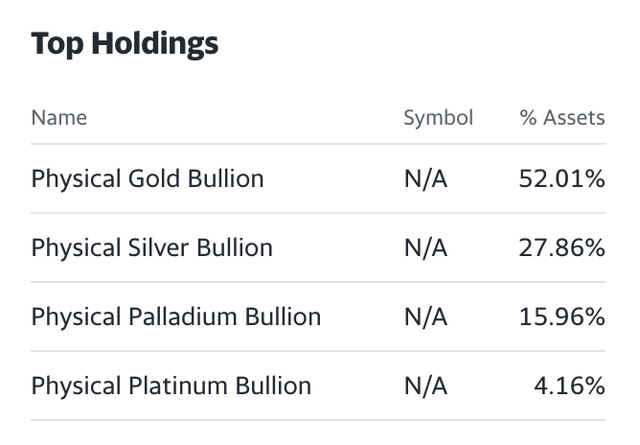

The most direct investment route for precious metals is via the physical market for bars and coins. COMEX futures and futures options in gold and silver and NYMEX futures in platinum and palladium are direct investments as they offer a physical delivery mechanism. The Aberdeen Physical Precious Metals Basket Shares ETF product (GLTR) offers market participants looking for exposure to a portfolio of precious metals an alternative as the ETF trades on the stock market, making it an accessible asset to hold overall investment portfolios. The most recent top holdings of the GLTR ETF include:

Top Holdings of the GLTR ETF Product (Yahoo Finance)

At $81.55 per share on July 26, GLTR had more than $972.766 million in assets under management. The ETF trades an average of 89,713 shares daily and charges a 0.60% management fee.

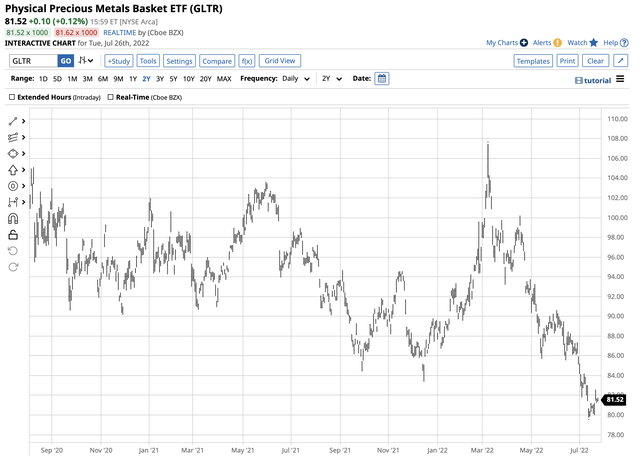

Chart of the GLTR ETF Product (Barchart)

The chart shows the decline in the GLTR ETF from $107.47 in March to a low of $79.75 in March as it dropped 25.8%. The ETF underperformed gold because of the exposure to silver, palladium, and platinum, but it outperformed the other three precious metals.

I favor buying GLTR on a scale-down basis, leaving plenty of room to add to long positions on further declines. As we have learned over the past years bull market corrections can be nasty, but the prices have come roaring back. The inflationary environment and geopolitical landscape continue to favor the upside for the precious metals.

Meanwhile, the prosecution rested its case against Messrs. Nowak, Smith, and Ruffo, and the defense is now attempting to convince the jury to acquit the trio on charges that could send them to prison for years. Christopher Jordan’s fate could depend on the verdicts for the other three former JPMorgan traders. Guilty verdicts are in the cards if the past trials are a guide. A pair of Merrill Lynch traders, Edward Bases and John Pacilio, were convicted on similar charges in August 2021 and await sentencing as they appeal the convictions. A judge sentenced two former Deutsche Bank traders to one year and one day in prison in another related case. As the prices of precious metals continue to melt under the weight of increasing interest rates and a rising US dollar, the most exciting thing going on in precious metals is the trial. The proceedings in Chicago will determine three traders’ futures and leaves an ugly stain on the world’s leading bullion trading institution, JPMorgan Chase, which already paid nearly $1 billion to settle its’ misdeeds. The bigger they are, the harder they fall. Stay tuned…

Be the first to comment