Jitalia17

Although the Guggenheim Strategic Opportunities Fund (NYSE:GOF) pays an attractive current distribution yield of 14.3%, I think investors should stay away. First, I am concerned that GOF is paying way above sustainable distribution levels (16.9% distribution rate on NAV), which means a large part of the distribution is simply investors’ own capital being returned. This drives up the premium to NAV to unsustainable levels. Furthermore, levered credit funds are facing a strong headwind from the Federal Reserve intent on taming inflation through economic pain. Until the market breaks (high yield spreads > 8%), the Fed is unlikely to pivot and credit funds are unlikely to see relief.

Fund Overview

The Guggenheim Strategic Opportunities Fund (“Fund”) is a closed-end fund (“CEF”) focused on current income and capital appreciation. The fund primarily invests in bonds and other fixed income instruments, but may also employ other equity and alternative investment strategies. GOF has $1.4 billion in net assets.

Strategy

The GOF is lead managed by Scott Minerd, a frequent guest of financial shows like CNBC and BloombergTV. The fund employs a variety of strategies to achieve its investment objectives. For example, looking through the annual report, we see the fund mention equity covered calls, SPACs, high yield bonds, mortgage securities, asset-backed securities, CLOs, structured products, and credit relative value trading. Arguably, the GOF fund acts like an open-ended hedge fund that has been wrapped into a retail product.

The GOF fund also employs leverage to enhance returns. As of September 16, the fund had $420 million in leverage against $1.85 billion in managed assets for 23% leverage.

Portfolio Holdings

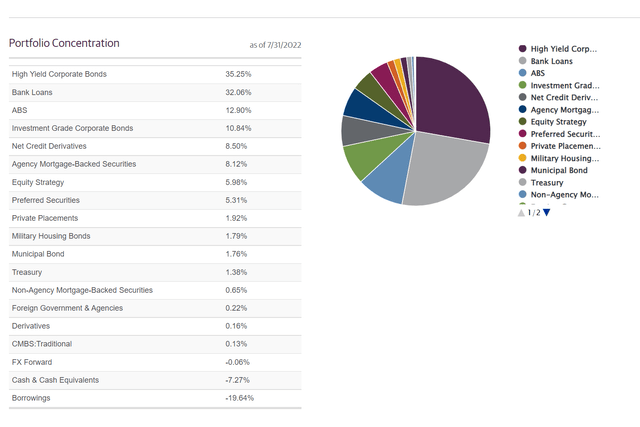

As mentioned above, the GOF fund resembles an open-ended credit hedge fund, and this is reflected in the investment portfolio (Figure 1). We see that the fund has a 35% weighting in high yield (“junk”) bonds, 32% weighting in bank loans, 13% weighting in asset-backed securities, 11% in investment grade bonds, and various asset classes.

Figure 1 – GOF portfolio (guggenheim.com)

Note that the asset allocations can vary quite a lot in between reporting periods. For example, common equities were 21% of the portfolio as of the May annual report but were only 6% of the portfolio as of July.

Fund Merger Increased GOF Size

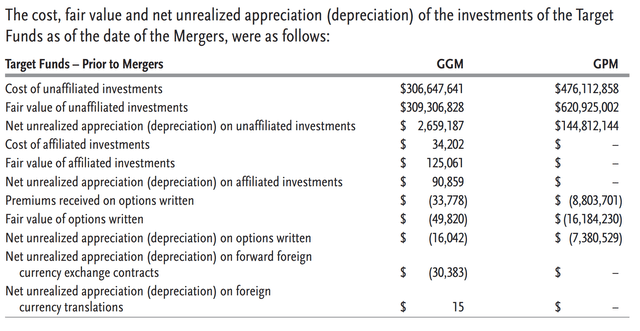

Investors should note that the Guggenheim Strategic Opportunites Fund was merged with the Guggenheim Enhanced Equity Income Fund (“GPM”) and the Guggenheim Credit Allocation Fund (“GCM”) in October 2021. The merger added $930 million in fair value assets to the GOF fund.

Figure 2 – GOF merged with GPM and GCM (GOF 2022 Annual Report)

Returns

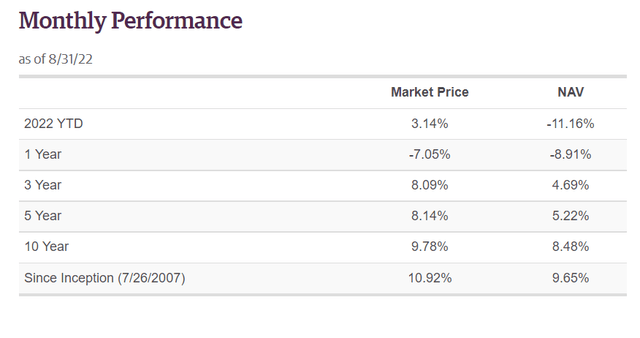

The GOF fund has modest long-term total returns of 4.7%/5.2%/8.5% for 3/5/10 Yr periods, respectively. Note that the total return figures are inclusive of reinvested distributions (Figure 3). Interestingly, although the fund has lost 11.2% YTD on a NAV basis, its market price has actually gained 3.1%.

Figure 3 – GOF returns (guggenheim.com)

Distribution & Yield

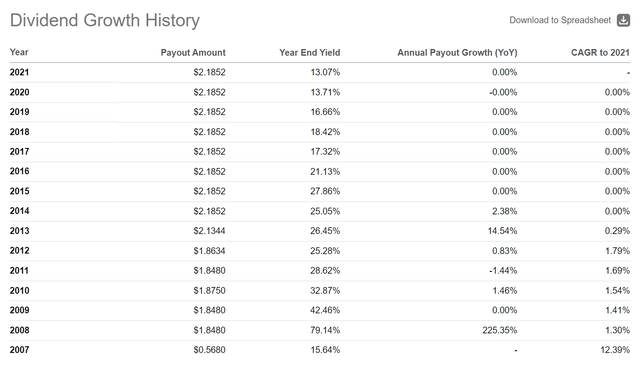

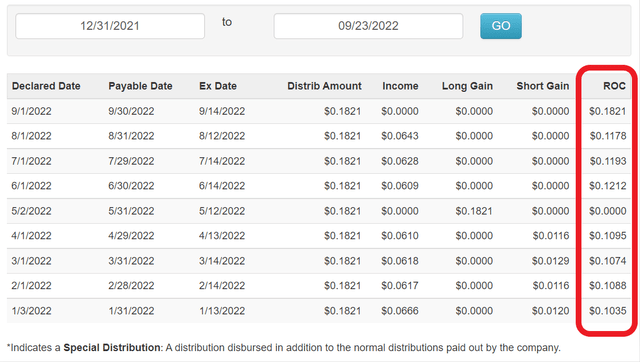

The GOF fund pays a very high distribution yield. Currently, it is paying a monthly distribution of $0.1821/share, which translates to a current yield of 14.3%. The current annual distribution amount of $2.1852/share has been held constant since 2014.

Figure 4 – GOF distribution (Seeking Alpha)

Some might argue that this distribution yield is unsustainable, as YTD, 59% of the $1.64 in distributions paid/payable have come from return-of-capital (“ROC”). In the fiscal year ended May 2022, 44% of the distributions paid was characterized as ROC.

Figure 5 – 59% of GOF YTD distribution from ROC (Cefconnect.com)

In fact, the current annual distribution rate of $2.1852/share equates to 16.9% distribution yield based on current NAV of $12.94. This is almost double GOF’s 10yr total returns of 8.5% per annum. With the distribution far above total returns, this suggests investors are simply getting their own money back in the form of a distribution.

Fees

As of the fiscal year ended May 2022, investors were charged an expense ratio of 1.83%, which is moderately high. Actual management fees are calculated as 1.00% of managed assets, which worked out to 1.40% of net assets for fiscal 2022.

Risks

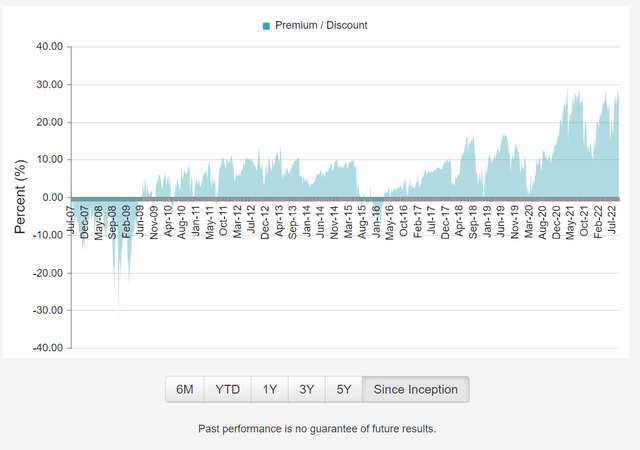

Unsustainable Premium

One of the biggest risks I can see with the GOF fund is its unsustainable premium to NAV. Currently, the GOF is trading at a 23% premium to its NAV. This is near the highest ever for this fund, and likely reflects investors’ desire for a stable distribution yield.

FIgure 6 – GOF premium to NAV (cefconnect.com)

However, as we have shown above, if the current distribution rate is 16.9% of NAV, and the fund only earns total returns of 5-8% of NAV, then every distribution includes a large percentage of ROC and the premium to NAV grows. Eventually, the distribution rate becomes unsustainable and management will have no choice but to cut the distribution and the premium to NAV may collapse overnight.

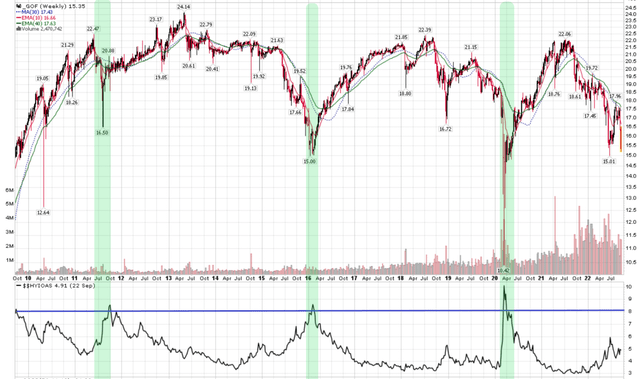

Economic Sensitivity

Similar to my recent articles on other levered credit funds like PDI, OXLC, and ECC, it appears the GOF fund is more suitable as a trading vehicle. Investors can consider establishing a position in GOF when high yield spreads reach an unsustainable level (8% in the figure below), and play for credit normalization.

Figure 7 – GOF vs. HY Spreads (Author created with price chart from StockCharts.com)

Currently, with the Federal Reserve intent on causing economic pain to battle inflation, the tide is against investors in credit funds like the GOF.

Conclusion

In summary, although the Guggenheim Strategic Opportunities Fund pays an attractive current distribution yield of 14.3%, I think investors should stay away. First, I am concerned that GOF is paying way above sustainable distribution levels (16.9% distribution rate on NAV), which means a large part of the distribution is simply investors’ own capital being returned. This drives up the premium to NAV to unsustainable levels.

Furthermore, levered credit funds are facing a strong headwind from the Federal Reserve intent on taming inflation through economic pain. Until the market breaks (high yield spreads >8%), the Fed is unlikely to pivot and credit funds are unlikely to see relief.

Be the first to comment