Spencer Platt/Getty Images News

Investment Thesis

Due to its unfavorable product ratings in comparison to rivals, I believe that GoDaddy (NYSE:GDDY) might struggle with the increasing competition. Furthermore, GoDaddy’s price to gross profit value multiple is nearly equivalent to those of Wix and Squarespace, while they have substantially stronger sales growth. For these reasons, I am recommending a “sell” for GoDaddy.

Introducing GoDaddy

GoDaddy, Inc. is a cloud-based solution provider that assists people, corporations, and organizations in establishing an online presence, connecting with clients, and managing their endeavors.

The company offers apps as well as access to third-party products and platforms. It provides a number of solutions, including domains, hosting and presence, business apps, and integrated commerce.

Registrations, Aftermarket, and Domain Name Add-Ons are among its domain products. Shared Website Hosting, Website Hosting on Virtual Private Servers and Virtual Dedicated Servers, Managed Hosting, and Security. Websites + Marketing, Marketing, and Social Media Management are among its presence offerings.

According to its latest annual report, revenue in 2021 was generated by:

-

Domains, 47%

-

Hosting and Presence, 34%

-

Business applications, 19% (primarily from third-party productivity applications)

Historical Performance

Growth rates (Year-over-year)

|

Index |

2019 |

2020 |

2021 |

Last 4 Quarters |

|

Revenue |

12% |

10% |

15% |

14% |

|

Gross Profit |

11% |

10% |

13% |

12% |

Source: Seeking Alpha

Margins (% of revenue)

|

Index |

2019 |

2020 |

2021 |

Last 4 Quarters |

|

Gross Profit |

65% |

65% |

64% |

63% |

|

Selling, General & Admin |

23% |

22% |

22% |

21% |

|

Research & Development |

16% |

16% |

18% |

18% |

|

Net Income |

4% |

-14% |

6% |

7% |

|

Free Cash Flow Margin |

21% |

21% |

20% |

20% |

Source: Seeking Alpha

According to its latest annual report, the 15% percent rise in total revenue was driven by 2.8% growth in total customers, 9.7% growth in ARPU (Average Revenue Per Unit/User), and increased revenue from acquisitions. The 2.8% growth in total customers seems to be rather low, which I will get more in-depth about further along in this article.

Its net income margin is relatively low, but positive and improving.

Market Outlook

The COVID-pandemic had a significant impact on the hosting and web hosting market. E-commerce sales grew by $244.2 billion, or 43 percent, in 2020, the first year of the pandemic, climbing from $571.2 billion in 2019 to $815.4 billion in 2020, according to the most current 2020 ARTS report. Furthermore, individual consumers spent significantly more time at home. As a result, existing web services saw a significant increase in traffic. Moreover, the time at home allowed entrepreneurs to work on online ideas more. According to a Fortune Business Insight report, the global market for web hosting services is estimated to have reached a whopping USD 83.99 billion in 2021.

I do expect the web hosting market to significantly grow in the long-term as well, due to trends such as increasing internet and e-commerce use worldwide, increasing required features of web hosting packages, and increasing the online presence of companies. However, I do think, in the short term, it might be difficult to sustain the growth rates seen during the COVID pandemic, as the same causes mentioned for increased revenue during the pandemic might stagnate or even reverse post-COVID for a bit.

Competition and Product Review

As the “online presence” market is a large one with very high growth rates, competition is intense and getting increasingly more intense as new entrants try to grab their share of the market. Several companies’ players are

• Domain registration services and web-hosting solutions from Donuts, United Internet, Namecheap, WPEngine, Bluehost, and Hostgator;

• Website creation and management solutions from Shopify (SHOP), Squarespace (SQSP), and Wix (WIX);

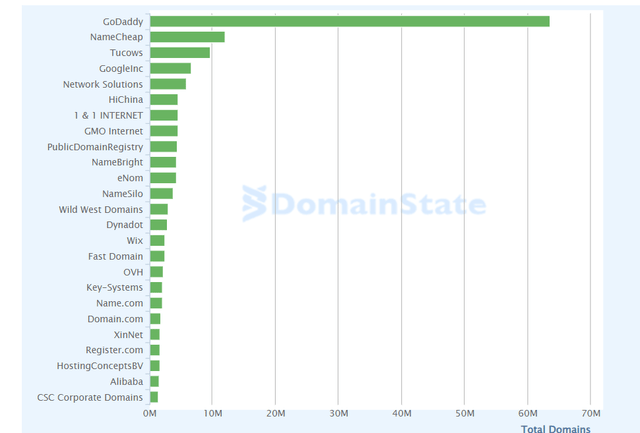

A domain registrar comparison shows GoDaddy is the absolute dominant leader when it comes to the domain registration industry:

Domain Registrar Stats (domainstate.com)

I believe that part of the reason why it’s such a dominant player is its successful marketing through its many Superbowl ads between 2005 and 2015. Nonetheless, a large user base doesn’t have to correlate with the quality of the products offered.

I believe that GoDaddy services are rated very negatively by Reddit users (Source 1, Source 2). The arguments mentioned are bad service, slow loading times, lack of complexity, and high prices. The same sources mention other services providing better functionality and support for a cheaper price, such as Squarespace, Shopify, and Wix.

A comparison between Shopify and GoDaddy claims that GoDaddy lacks the advanced features in trade for ease of use. You may only add up to 5,000 goods to your GoDaddy online store, and neither user involvement nor VAT expenditure can be tracked. You can only connect your business with UPS, Shippo, and DHL for shipments. In contrast, you can have an endless number of goods in your Shopify store, as well as various product variations (like color and size). It also has an abandoned cart recovery tool, which encourages clients to complete a transaction if they leave your website without paying. It’s integrated with many major shipping companies, including USPS, DHL Express, UPS, and Canada Post, and you can print labels if you’re headquartered in the US, allowing you to personalize your shipments. Furthermore, the comparison claims that the GoDaddy templates are rather simple, whereas Squarespace is believed to have many flashier templates. Another source claims that Wix has a much more comprehensive editor than GoDaddy. Overall, I believe that the products of Wix, Shopify, and Squarespace seem to offer more comprehensive and advanced features than GoDaddy does.

I do believe that consumers’ expertise and level of expectation using websites will increase in the future. As a result, I think that customers will be attracted by the more advanced features of the products of the competitors mentioned.

While GoDaddy has managed to market its brand quickly as the best web hosting and domain provider due to heavy marketing, I believe that they are not safe from the increasing competition from these other providers, which are really working on getting their brand out there. This might be the reason why GoDaddy only grew its total customer base by 2.8% in 2021.

Comparison of valuations and other stats

I computed several statistics related to valuation and financial performance and compared them to companies that are engaged in the same market:

|

PS Ratio |

PE Ratio |

Gross Margin |

Price to Gross Profit |

3Y Sales Growth |

|

|

GoDaddy |

2.88 |

40.99 |

63% |

4.57 |

13% |

|

Shopify |

8.17 |

260.85 |

53% |

15.42 |

60% |

|

Wix |

2.68 |

– |

61% |

4.39 |

26% |

|

Squarespace |

3.81 |

– |

83% |

4.59 |

27% |

Source: Seeking Alpha

GoDaddy seems to be the more established company in its later business phase as it is already profitable but has a lower sales growth rate. However, leaving the profit margin out, the price to gross profit is almost equal to the valuation of Wix and Squarespace, despite them having much higher sales growth rates. Furthermore, as argued before, I believe that GoDaddy will have a tough time competing against the competitors.

Factors that Could Drive the Price Up

GoDaddy is the only firm in the competitor group that has a manageable P/E ratio yet. While I do believe its future competitive position to be rather weak, it could be that the product offerings will keep attracting not only new customers but also retain and increase current customer revenue. The revenues of current customers have increased quite a bit in 2021. This indicates quite strong customer relationships. This could potentially see them become a decent P/E company, which could drive their price up significantly.

Final Take

Personally, I wouldn’t feel comfortable holding the GoDaddy stock in my portfolio, as other competitors are priced almost the same when it comes to the price to gross profit valuation, while also having a much better growth outlook in my opinion. For these reasons, I set the GoDaddy stock recommendation at “sell”.

Be the first to comment