Luis Alvarez/DigitalVision via Getty Images

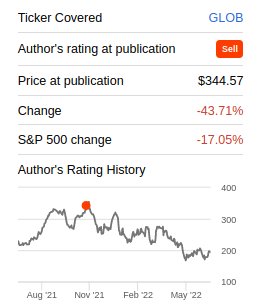

We covered Globant (NYSE:GLOB) at the end of last year, and in that article we introduced the company and shared why we believed it was extremely overvalued despite there being much we liked about it. Since then shares have significantly under-performed the market by a factor of more than 2x. In fact shares have been nearly cut in half, so we thought it might be a good time to revisit the company and see if the overvaluation has been corrected.

Seeking Alpha

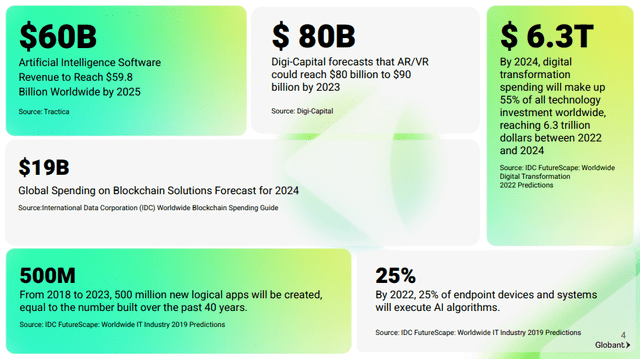

Addressable Market

One of the reasons shares got so expensive is because investors are excited by the massive addressable market the company is targeting. While we agree that this TAM is enormous, there are a lot of companies competing for it, and we do not see the company having a particularly strong competitive moat that would allow it to capture the majority of these markets.

Financials

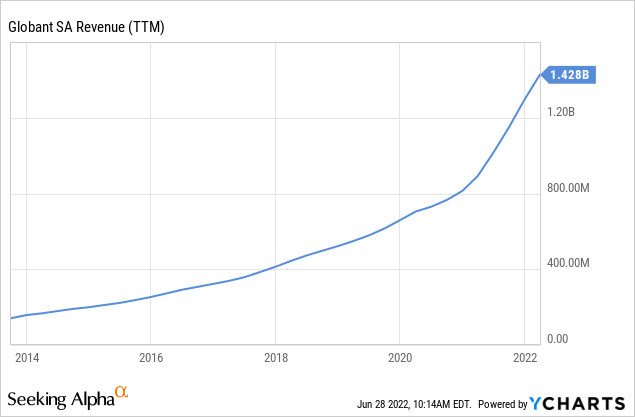

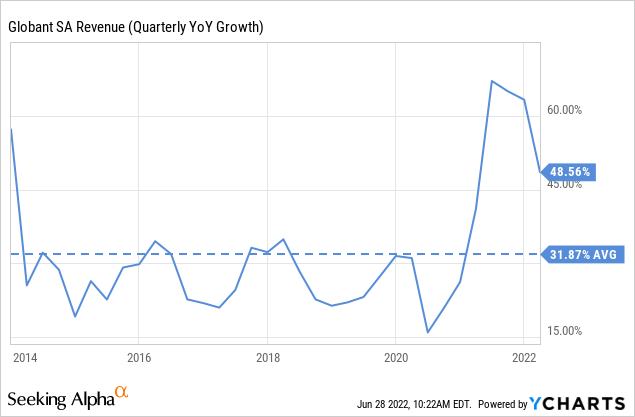

We have to give credit to the company, its revenue growth has been nothing short of impressive, and it has even accelerated in recent years.

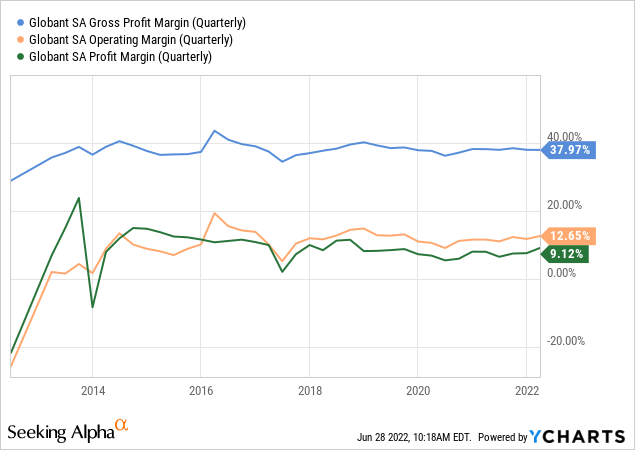

Also impressive, this has been profitable growth, with the company posting very decent and stable profit margins.

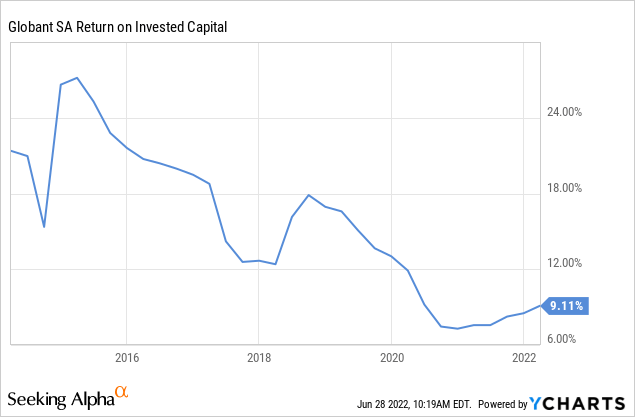

That said, these are the profit margins and returns on invested capital of a relatively normal company. If Globant had a strong competitive moat, we would expect much higher gross profit margins, and much higher returns on invested capital.

Growth

Since its IPO Globant has delivered average growth of ~31%, and it has accelerated recently, as can be seen in the graph below. The big question for us is how much longer Globant can sustain this level of growth, as competition is likely to intensify and we do not see any particular competitive advantage that would favor the company over the competition. Globant appears to be a very efficient operator, but that is not enough for the company to capture the majority of the growth in its markets.

Balance Sheet

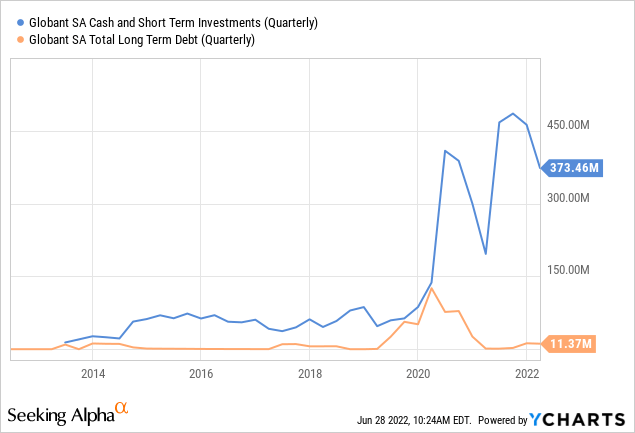

Globant has a very solid balance sheet, with about $373 million in cash and short-term investments, and very little in long term debt.

ESG

We like that Globant has a strong ESG approach, and that it appears to treat its employees well, judging by the very high Glassdoor rating the company has, and the high percentage of employees willing to recommend the company to a friend and approve of the CEO.

Glassdoor.com

Valuation

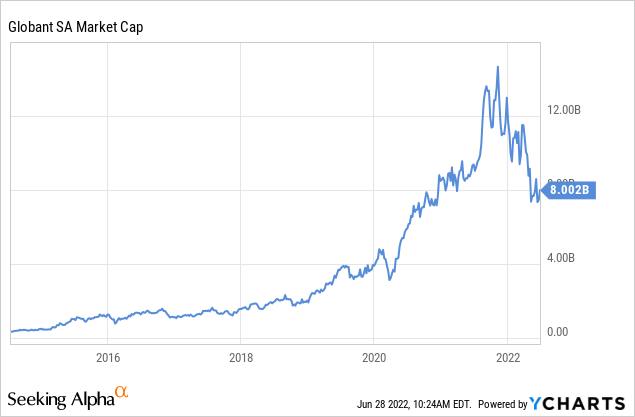

Another reason we worry that growth rates might start coming down is that Globant is no longer a startup, but a company with an $8 billion market cap with almost $1.5 billion in revenue. There is no rule that says that a bigger company has to grow at a slower pace, but it does mean that it has to win so many more contracts or much bigger contracts to maintain the same level of growth.

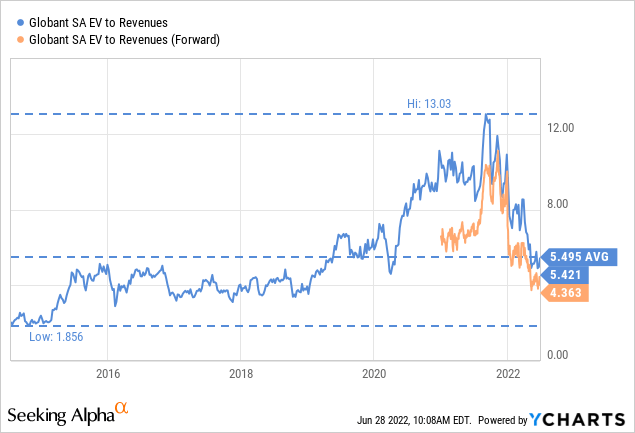

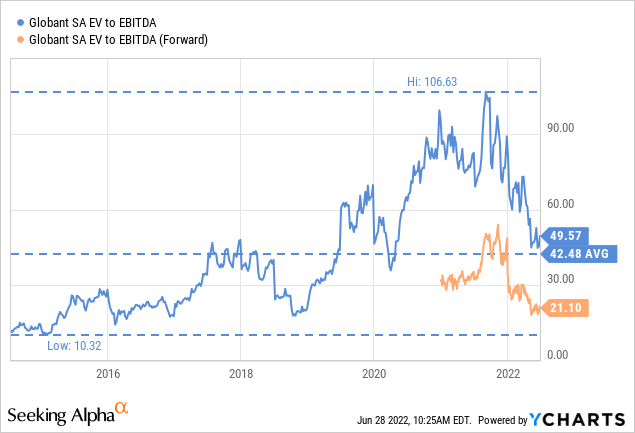

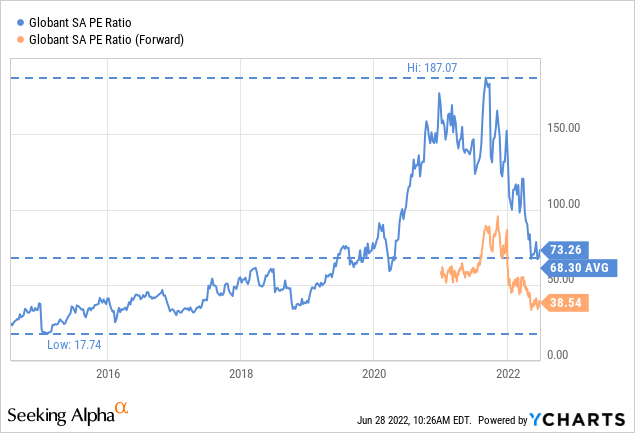

In any case it is good to see that the valuation has become more reasonable, with EV/Revenues at ~5.4x, after having reached an extremely expensive 13x multiple.

EV/EBITDA has also come down, and is now at ~42x for the trailing twelve months, and ~21x for the forward multiple. A 21x multiple certainly starts sounding a lot more reasonable, especially compared to the triple digits it previously reached. This is thanks to a combination of improving fundamentals, and a declining share price, that the valuation has readjusted so quickly.

The forward price/earnings ratio stands at ~38x, which does not sound like a bargain, but can be justified by the growth of the company.

To get a better sense on whether shares are still over valued we did an estimation of the net present value of the shares, which resulted in $193, which is very close to where shares are currently trading. The assumptions we used were the average earnings estimates for the next three years, as compiled by Seeking Alpha, and 15% growth thereafter until 2032. We then used a GDP-like 3% terminal growth rate, and discounted everything by 10%. The most controversial number is likely to be the 15% growth rate after 2024, with some investors likely thinking it is too conservative, and others believing we shouldn’t project such a high growth rate for so many years. We decided to use 15% because it is half of the average revenue growth for the company over the last ten years, so we wanted to see what a reasonable valuation would be if the company grows at half the speed compared to the previous decade.

| EPS | Discounted @ 10% | |

| FY 22E | 4.98 | 4.53 |

| FY 23E | 6.38 | 5.27 |

| FY 24E | 8.34 | 6.27 |

| FY 25E | 9.59 | 6.55 |

| FY 26E | 11.03 | 6.85 |

| FY 27E | 12.68 | 7.16 |

| FY 28E | 14.59 | 7.49 |

| FY 29E | 16.77 | 7.83 |

| FY 30E | 19.29 | 8.18 |

| FY 31E | 22.18 | 8.55 |

| FY 32 E | 25.51 | 8.94 |

| Terminal Value @ 3% terminal growth | 364.46 | 116.13 |

| NPV | $193.74 |

Risks

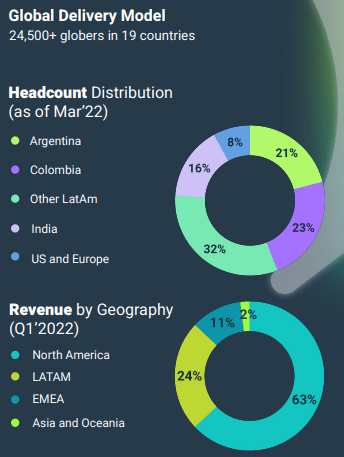

We believe the company has had a tremendous tailwind from the weakness in the currencies of emerging market economies, such as Latin American countries, where most of the company’s costs and headcount is located, and from the strength in the currency in which it receives most of its revenues, mostly US dollars. Should this trend reverse it could become a headwind instead, and make the company less competitive.

Another risk we see for the company is that of intensifying competition, as it operates in large markets which are likely to attract more and more competition, especially as the size of the market grows.

Globant Investor Presentation

Conclusion

After a significant share price decline, and continued improving fundamentals for Globant, we no longer believe shares to be absurdly overvalued as we believe they were. We think the current share price can be justified, but there is still a high level of uncertainty, since it is difficult to estimate the growth rate for the company for the next few years. We believe that at least going forward investors should see returns more in line with business fundamentals, now that shares are trading at a more reasonable valuation.

Be the first to comment