golfcphoto

The Global X Research Team is pleased to release the distribution and premium numbers for our covered call ETFs for August. Global X’s Covered Call suite of ETFs invest in the underlying securities of an index and sell call options on that index. These strategies are designed to provide investors with an alternative source of income, while offering different sources of risks and returns to an income-oriented portfolio.

Click here to download the August 2022 Covered Call Report

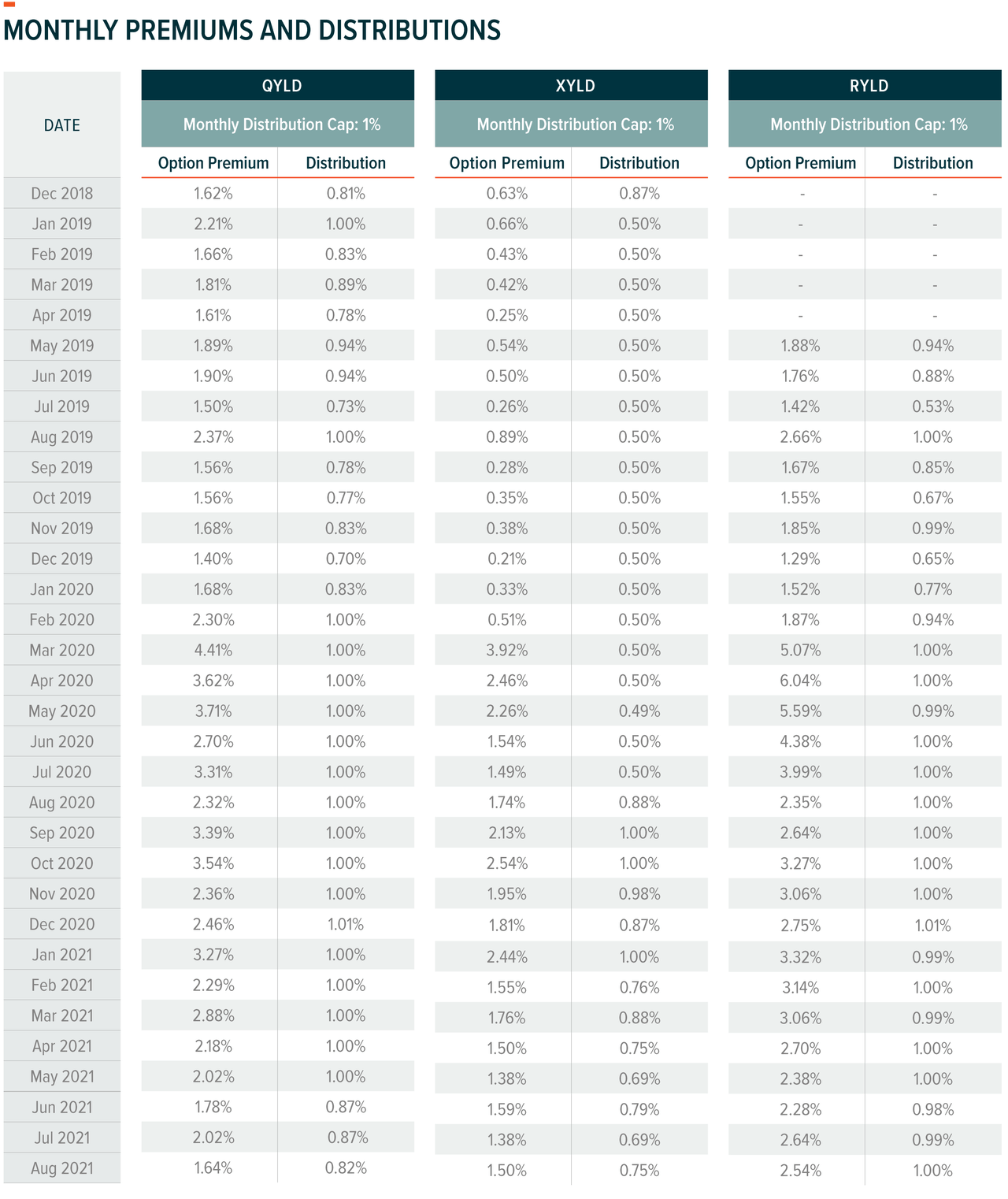

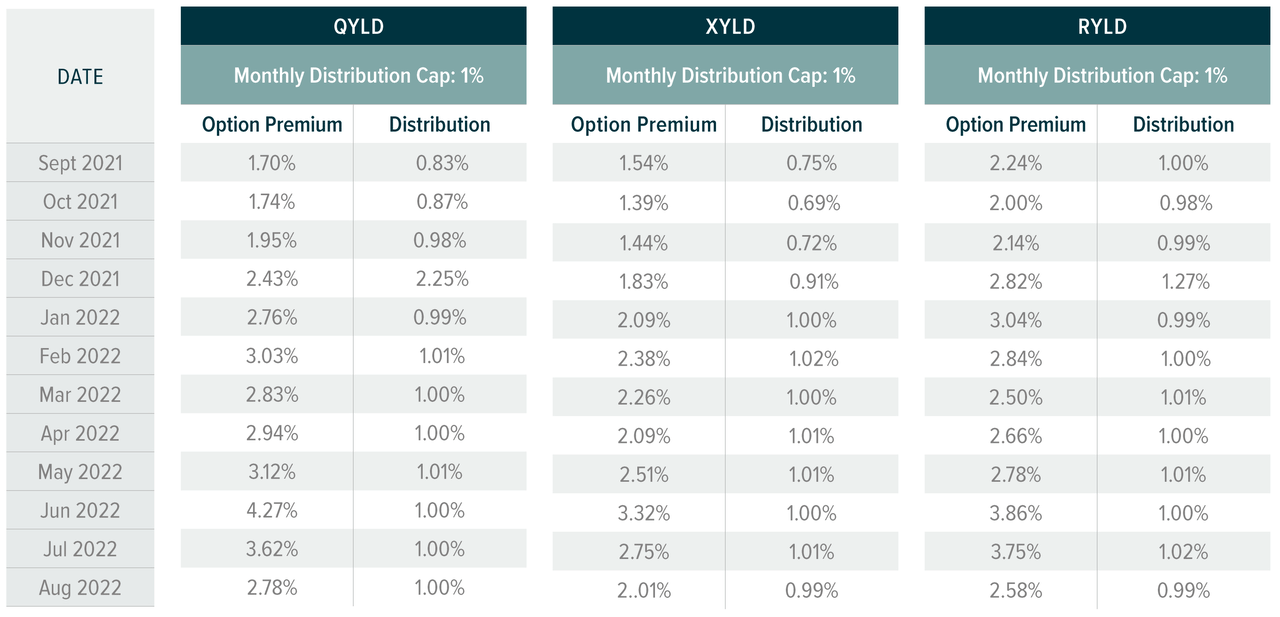

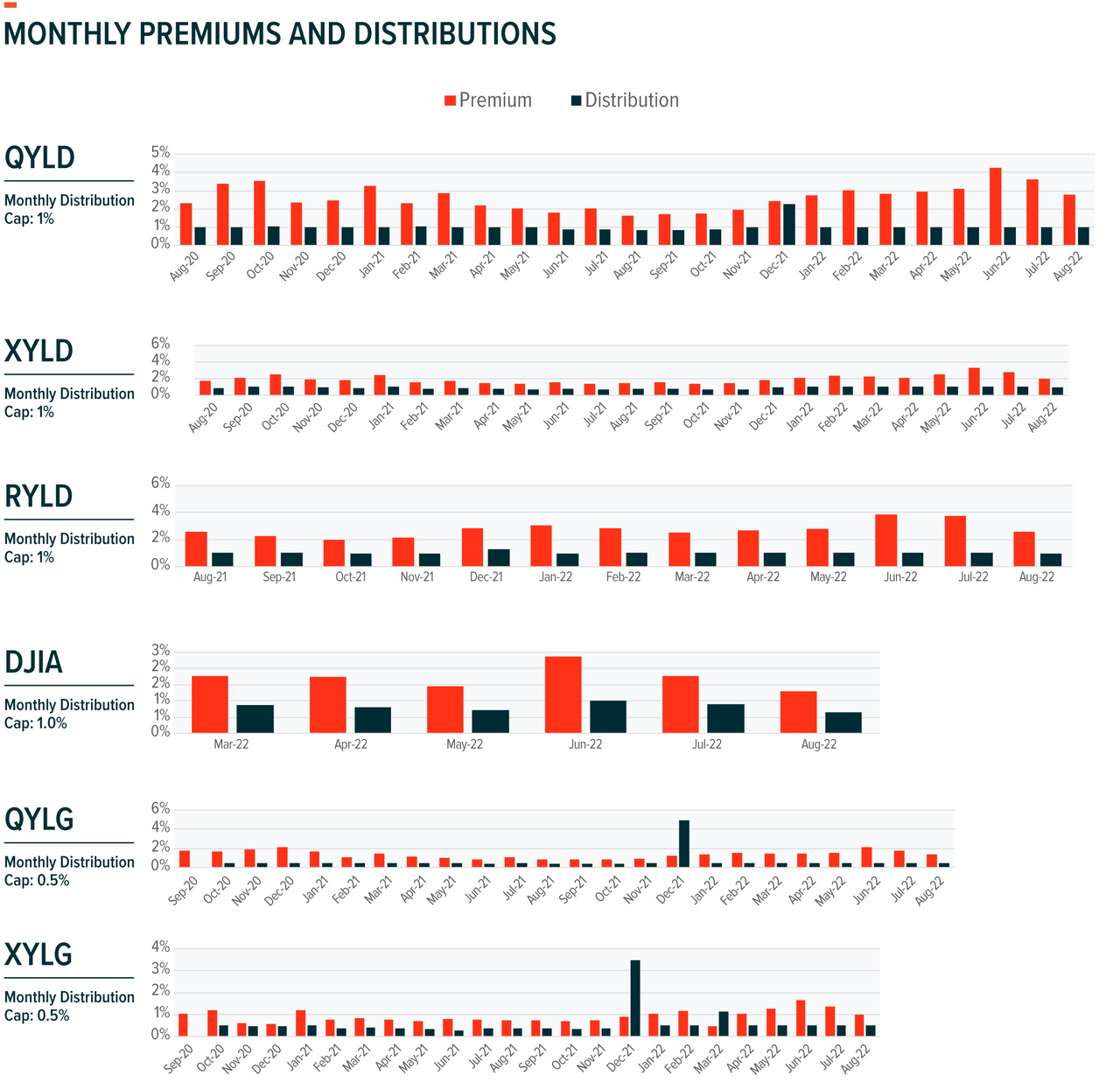

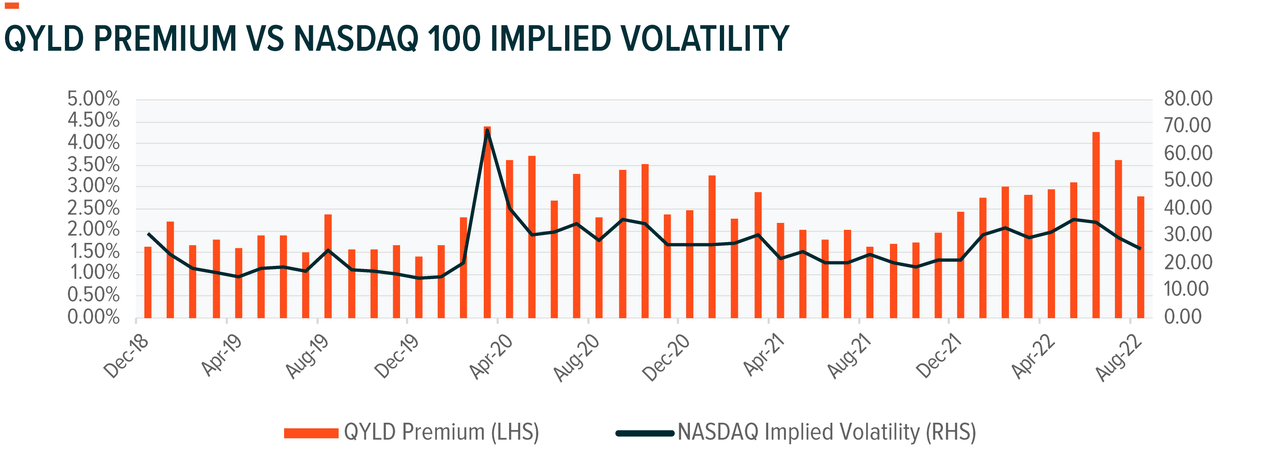

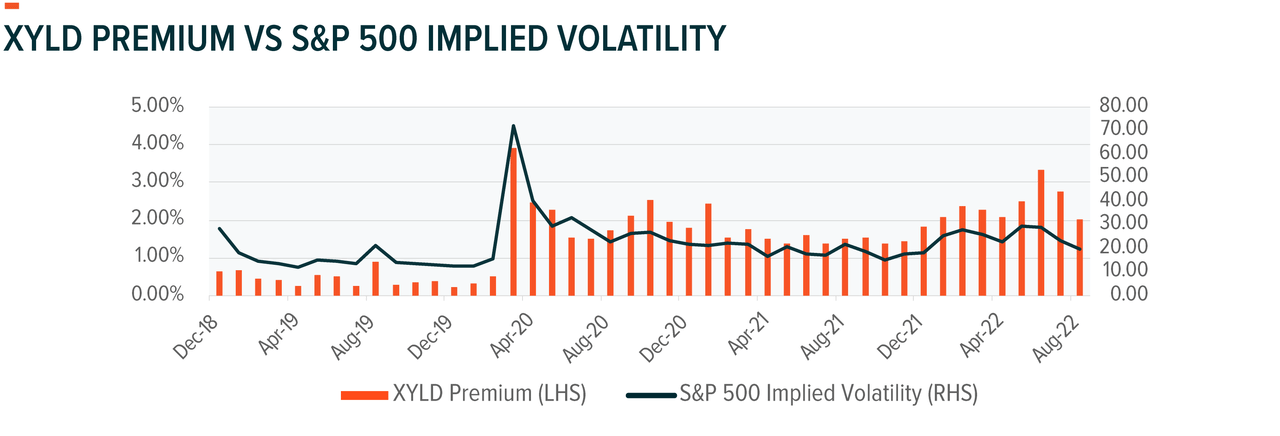

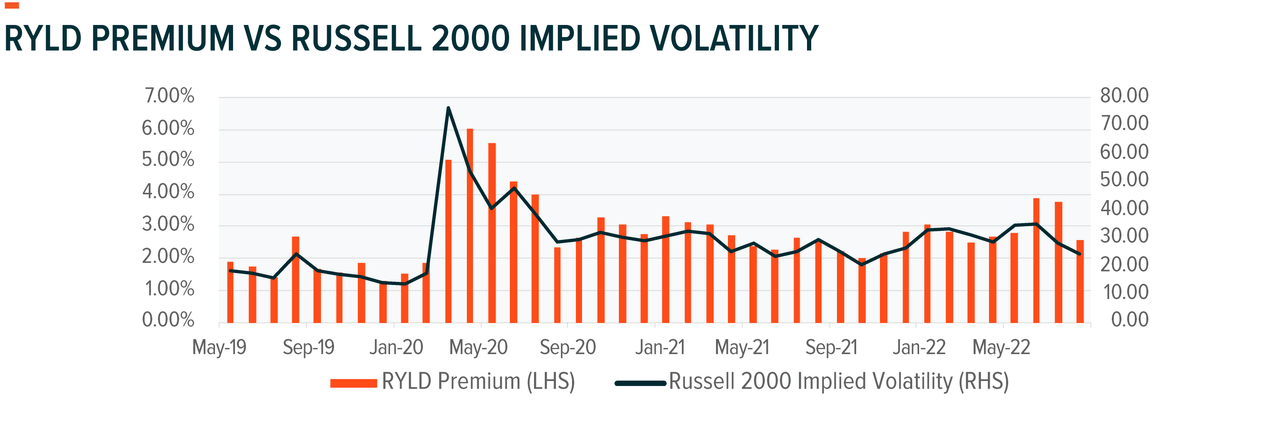

In the month of August, the VIX increased from 22.84 to 25.87. This relatively elevated volatility level compared to historical averages led to higher premium levels in the month of August for our covered call funds.

For instance, QYLD had an August premium of 2.78%. However, volatility is still below where it was in the late spring and early summer months, as markets have now become accustomed to the Federal Reserve’s rate hiking path, and their reinforcement of current policies.

In the month of August, treasuries also sold off, with 10yr yields rising to 3.20% from 2.65%. Major indexes like the S&P 500, Nasdaq 100, and Russell 2000 all sold off in the month of August, with the Nasdaq 100 leading the pack down over -5.1%.

This compares to a -4.1% decline for the S&P 500 and -2.1% decline for the Russell 2000 in that time span. With the pressure that rising rates has put on equities, this has subsequently led to this increased volatility in the market, leading to a continuation of elevated options premiums on covered call writing strategies relative to historical norms.

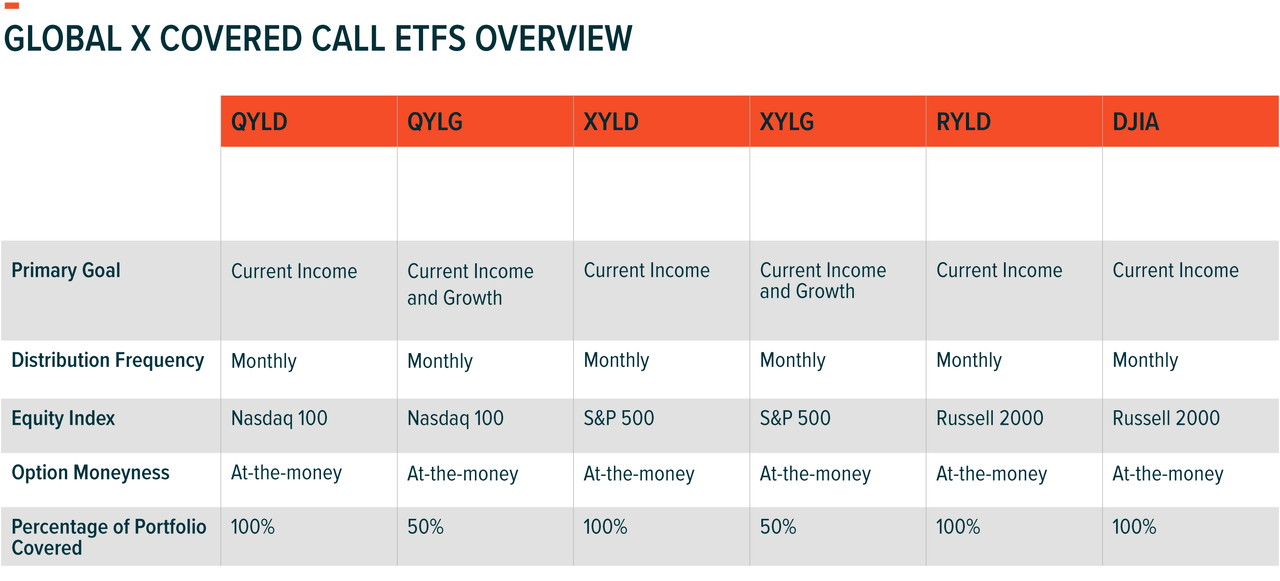

Global X Covered Call ETFs Overview

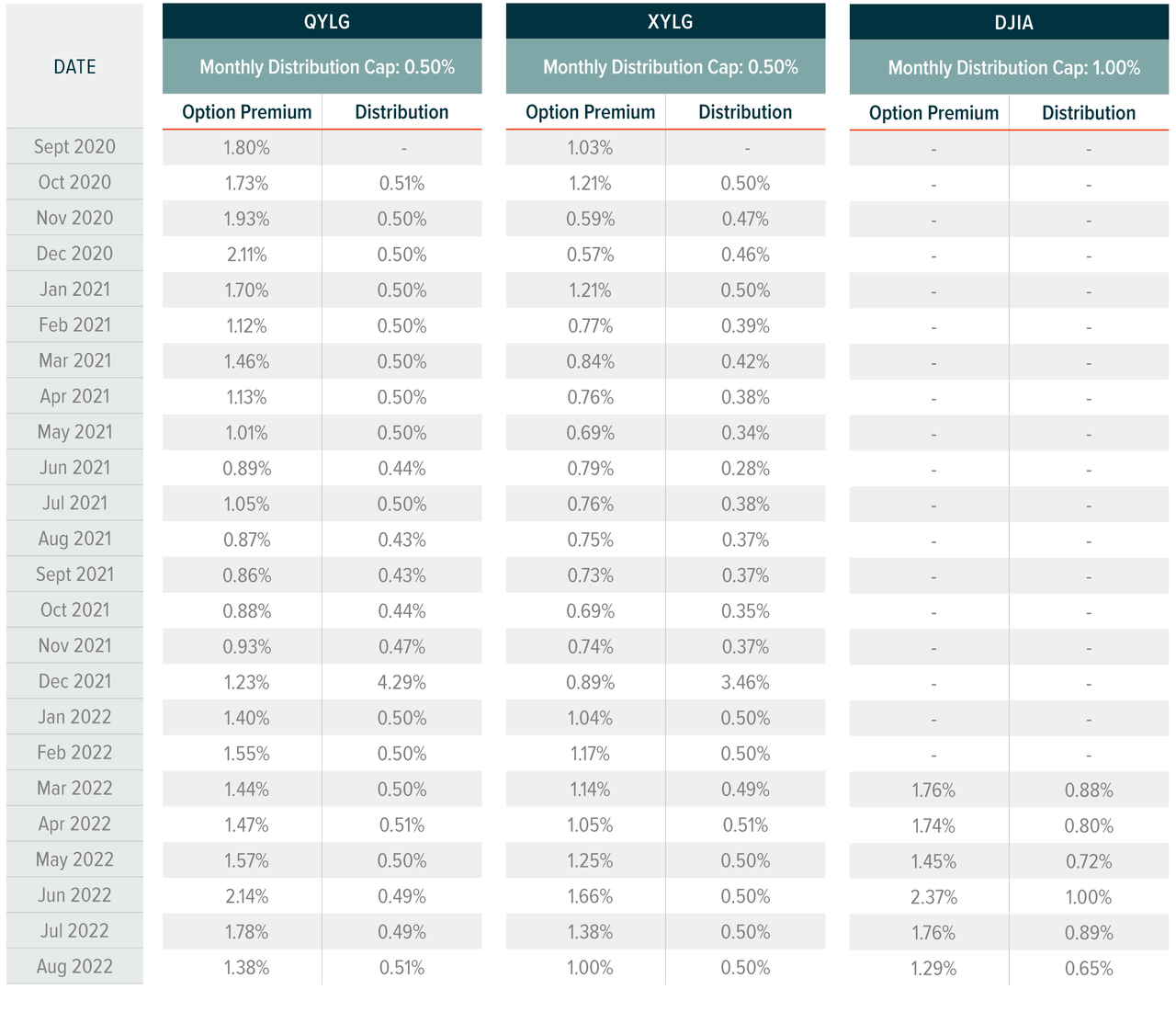

As a general guideline, the monthly distribution of each fund is capped at the lower of: a) half of premiums received, or b) 1% (for QYLD, RYLD, XYLD and DJIA)/0.5% (for QYLG and XYLG) of net asset value (NAV). The excess amount of option premiums received, if applicable, is reinvested into the fund. Year-end distributions can exceed the general guideline due to capital gains that are paid out at the end of the year.

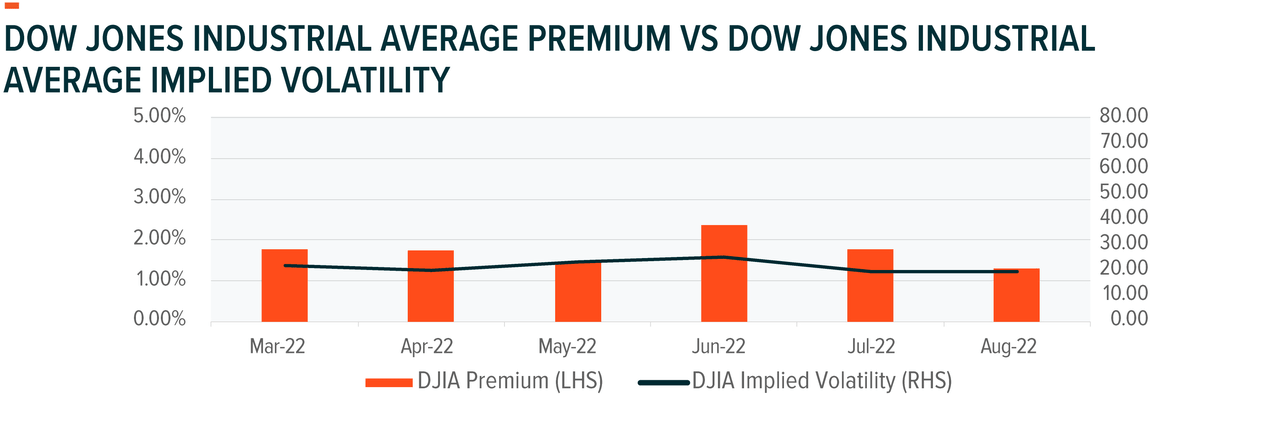

Fund Premiums and Implied Index Volatility

Related ETFs:

QYLD: The Global X Nasdaq 100 Covered Call ETF follows a “buy-write” (also called a covered call) investment strategy in which the Fund buys a basket of stocks, and also writes (or sells) call options that correspond to the basket of stocks. The Fund uses this strategy in an attempt to enhance its portfolio’s risk-adjusted returns, reduce its volatility, and generate monthly income from the premiums received from writing the call options.

XYLD: The Global X S&P 500 Covered Call ETF follows a “covered call” or “buy-write” strategy, in which the Fund buys the stocks in the S&P 500 Index and “writes” or “sells” corresponding call options on the same index.

RYLD: The Global X Russell 2000 Covered Call ETF follows a “covered call” or “buy-write” strategy, in which the Fund buys exposure to the stocks in the Russell 2000 Index and “writes” or “sells” corresponding call options on the same index.

DJIA: The Global X Dow 30 Covered Call ETF follows a “covered call” or “buy-write” strategy, in which the Fund buys the stocks in the Dow Jones Industrial Average (also known as the Dow 30 Index) and “writes” or “sells” corresponding call options on the same index.

QYLG: The Global X Nasdaq 100 Covered Call & Growth ETF follows a “covered call” or “buy-write” strategy, in which the Fund buys the stocks in the Nasdaq 100 Index and “writes” or “sells” corresponding call options on approximately 50% of the value of the portfolio of stocks in the same index.

XYLG: The Global X S&P 500 Covered Call & Growth ETF follows a “covered call” or “buy-write” strategy, in which the Fund buys the stocks in the S&P 500 Index and “writes” or “sells” corresponding call options on approximately 50% of the value of the portfolio of stocks in the same index.

Click the fund name above to view current holdings. Holdings are subject to change. Current and future holdings are subject to risk.

Glossary

VIX: The Chicago Board Options Exchange Volatility Index commonly referred to as VIX, reflects a market estimate of future volatility of the S&P 500 Index, based on the weighted average of the implied volatilities.

Investing involves risk, including the possible loss of principal. Concentration in a particular industry or sector will subject the Funds to loss due to adverse occurrences that may affect that industry or sector. Investors in the Funds should be willing to accept a high degree of volatility in the price of the fund’s shares and the possibility of significant losses.

The Funds engages in options trading. An option is a contract sold by one party to another that gives the buyer the right, but not the obligation, to buy (call) or sell (put) a stock at an agreed upon price within a certain period or on a specific date. A covered call option involves holding a long position in a particular asset and writing a call option on that same asset with the goal of realizing additional income from the option premium. By selling covered call options, the Funds limit their opportunity to profit from an increase in the price of the underlying index above the exercise price, but continue to bear the risk of a decline in the index. A liquid market may not exist for options held by the fund. While the fund receives premiums for writing the call options, the price it realizes from the exercise of an option could be substantially below the index’s current market price. QYLD, XYLD, RYLD, DJIA, QYLG and XYLG are non-diversified.

Index returns are for illustrative purposes only and do not represent actual fund performance. Index returns do not reflect any management fees, transaction costs or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Carefully consider the funds’ investment objectives, risks, and charges and expenses before investing. This and other information can be found in the funds’ full or summary prospectuses, which may be obtained at globalxetfs.com. Please read the prospectus carefully before investing.

Global X Management Company LLC serves as an advisor to Global X Funds. The Funds are distributed by SEI Investments Distribution Co. (SIDCO), which is not affiliated with Global X Management Company LLC. Global X Funds are not sponsored, endorsed, issued, sold or promoted by Standard & Poors, MSCI, Dow Jones or NASDAQ nor do these companies make any representations regarding the advisability of investing in the Global X Funds. Neither SIDCO nor Global X is affiliated with Standard & Poors, MSCI, Dow Jones or NASDAQ.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment