Sherry Smith/iStock Editorial via Getty Images

An Intro To Global Ship Lease

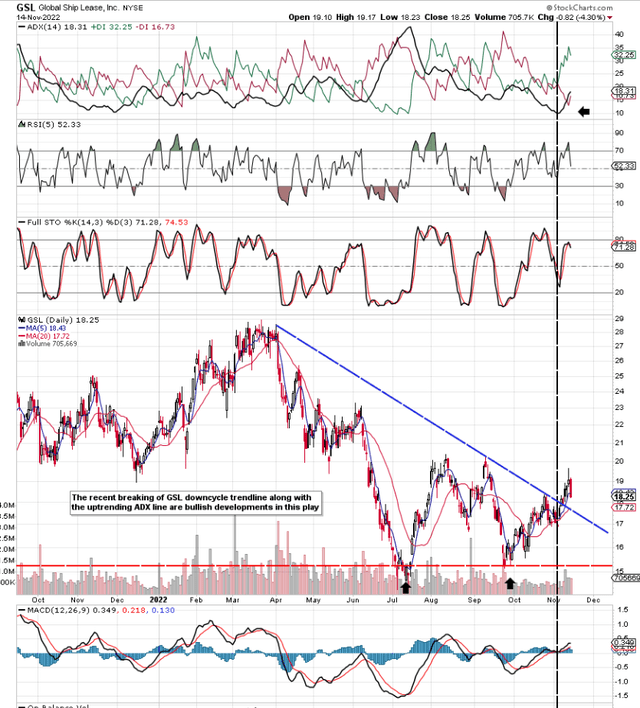

If we look at a technical chart of Global Ship Lease, Inc. (NYSE:GSL), we see that investors who are attracted to this play from the long side may have the possibility to put a long position (which would have limited downside risk) to work or adding to an existing position. Although the company announced a sales and earnings beat last week for its fiscal third quarter, which spurred a rally almost up to the $20 level, shares of GSL gave up the lion’s share of those gains on Monday the 14th by dropping back to almost the $18 level.

However, this could be a blessing in disguise for the longs as a better entry point may be attained presently. We state this because of the current bullish technicals in play in GSL. For one, breaking that downcycle trendline (resulting from that Q3 earnings beat) was a strong signal that GSL’s pattern of lower lows since March of last year has ended. Secondly, despite the steep drop yesterday in the share price (November 14th), shares have finally begun to trend. Suffice it to say, if the share price can bottom here shortly, that ADX line should continue to move northward where a move over the 20 mark (currently 18.31) would certainly bring more trend-followers into this space. Remember, these “signals” are the result of the known fundamentals in GSL at this moment in time. We continue to believe that a double-bottom reversal formation is playing itself out here, where we will have confirmation when the price breaks through the $20 barrier.

GSL Bullish Technicals (StockCharts.com)

Elevated Earnings To Continue

Suffice it to say, the market is keyed into the fact that as long as GSL can generate enough sales to keep its earnings and cash flows buoyant, then sustained investment back into the company will keep on growing value over time. Speaking of value, GSL’s valuation looks compelling from both earnings & cash-flow standpoints. After reporting net profits of $92 million and operating cash flow of $115+ million in Q3, GSL shares now trade with a trailing GAAP earnings multiple of 2.47 and a trailing cash-flow multiple of 1.59. Although nobody can predict how rates, for example, will pan out going forward in this industry, GSL’s current valuation is an excellent starting point.

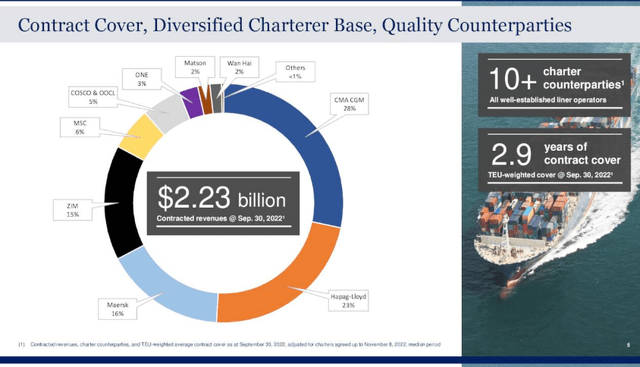

Based on this very strong valuation base, there are a number of trends that demonstrate that the company’s very high profitability will continue. For one, as we see below, GSL has managed to secure very strong contract cover totaling almost $3 billion over the next 3 years alone. This cash will easily cover the company’s generous dividend, ongoing buybacks, and capital investment over the next five quarters at least. Management currently pays out $1.50 a year in dividend payments, which is sustainable (15% payout ratio) and ongoing buybacks will continue to boost that earnings per share.

GSL Contract Cover (Seeking Alpha)

Improving Balance Sheet & Quality Fleet (Assets)

Secondly, with the recent US private placement of $350 million, management has managed to reduce the cost of the company’s debt to just north of 4.5%. This means that automatically more of the company’s EBITDA will now be able to drop to the bottom line and consequently free cash flow. Shareholder equity rose aggressively to just north of $915 million at the end of Q3, with the forward book multiple now coming in at a very attractive 0.53. We acknowledge that all book multiples need to be weighed up differently in this industry, but when one goes through GPL’s fleet, there is a lot to like here from an asset perspective.

From mid-size Post-Panamax to High Reefers to smaller Containerships, GSL looks well covered to meet the demand of its customers. These assets plus well over $100 million in cash make up 90%+ of the company’s assets on the balance sheet, with idle capacity remaining very low. Although management cannot predict future trading conditions regarding asset values and charter rates, etc., you can bet that any forward-looking investments will be prudent, to say the least in this ever-changing industry.

Conclusion

After recently announcing a Q3 earnings beat, Global Ship Lease from a technical, valuation, and profitability standpoint looks particularly attractive at present from the long side. Let’s see if support can hold here if this present down-move gains more traction. We look forward to continued coverage.

Be the first to comment