bluebay2014/iStock via Getty Images

By John Welling

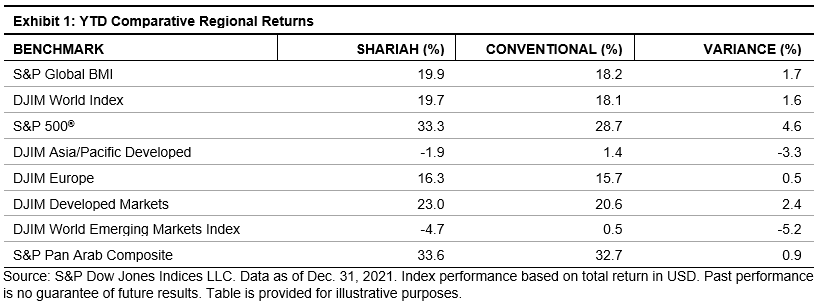

Global equities gained in the last quarter of the year, climbing 5.8% as measured by the S&P Global BMI. Shariah-compliant benchmarks, including the S&P Global BMI Shariah and Dow Jones Islamic Market (DJIM) World Index, outperformed their conventional counterparts by approximately 2.5% in the quarter due largely to their overweight in the U.S. Information Technology sector, which gained nearly 14% during Q4. Global Islamic indices finished the year with a near 2% advantage, while the performance differential varied across regions, as the Asia Pacific developed and emerging markets underperformed their conventional benchmarks.

S&P Dow Jones Indices LCC

Drivers of 2021 Shariah Index Performance

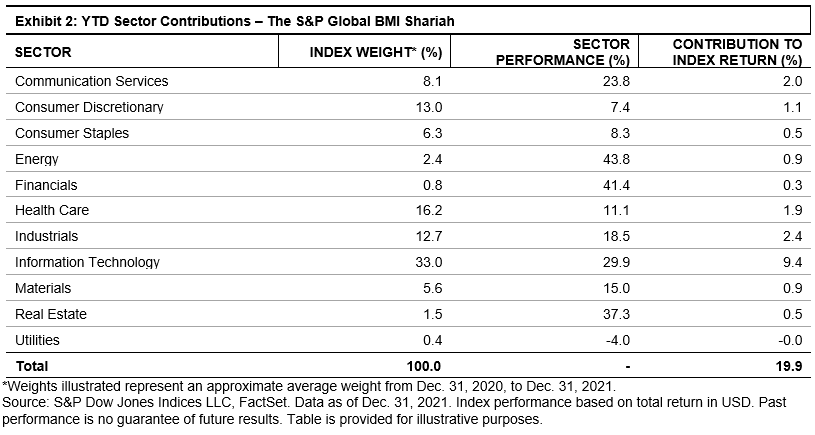

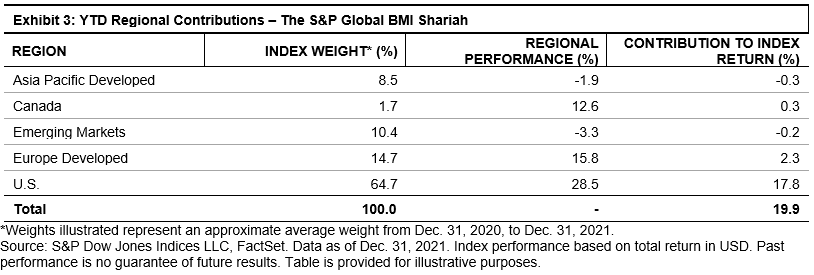

While global equities enjoyed broad gains throughout 2021, the greatest contributors of Shariah index performance were at the sector and country-level (see Exhibits 2 and 3).

Energy-which enjoyed a substantial rebound in 2021 after poor performance in 2020-was the best-performing sector. Due to its low weight in indices, however, performance impact was muted. Meanwhile, Information Technology-which tends to hold an overweight position in global Islamic indices-gained nearly 30%, contributing one-half of annual gains.

S&P Dow Jones Indices LCC

On a regional basis, high average weight toward the U.S. favored the S&P Global BMI Shariah during 2021, as the country enjoyed the best regional performance. The underperformance of the Asia Pacific developed and emerging markets regions limited overall gains, as Shariah-compliant stocks in Japan, South Korea, and China suffered during the period.

S&P Dow Jones Indices LCC

MENA Equities Continued to Gain in 2021

MENA regional equities gained considerably in 2021, as the S&P Pan Arab Composite advanced 32.7%. All MENA country indices finished the year in positive territory, led by the S&P United Arab Emirates BMI, which gained an impressive 50.8%, followed by the S&P Saudi Arabia BMI, up 34.8%. The S&P Egypt BMI led performance during Q4, rallying 16.3% and sending the country index into positive territory at year-end.

This article was first published in IFN Volume 19 Issue 02 dated the 12th January 2022.

Disclosure: Copyright © 2020 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI please visit www.spdji.com. For full terms of use and disclosures please visit Terms of Use.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment