da-kuk

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on June 22nd, 2022.

Gladstone Investment (NASDAQ:GAIN) is a position I’ve been holding for quite a while now. I think with the latest decline, it is presenting a potential opportunity to pick up some more shares or start an initial position for some investors. This is a business development company. The latest declines in the price have also pushed the name back down to its net asset value per share level.

BDCs And Interest Rates

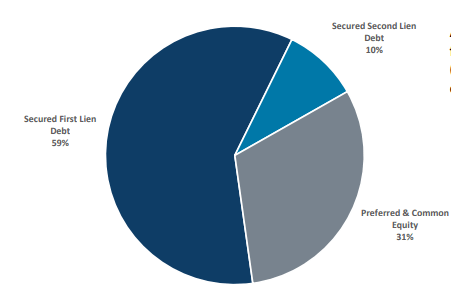

BDCs, in general, are seen as a potentially attractive investment in the current environment. They often invest in floating-rate loans and lend through fixed rates. For GAIN, this is also true, but they have a fair bit of exposure to equity securities.

GAIN Asset Exposure (Gladstone)

They note that it is “typically preferred equity with common equity participation.” This equity exposure can leave GAIN more volatile but also potentially leaves them with more capital gain potential.

At the end of Q1 2022, they had nothing withdrawn from their credit facility. Meaning all their leverage was at fixed-rates through their notes.

We had no outstanding borrowings under the Credit Facility as of March 31, 2022 and $22.4 million as of March 31, 2021. Our 2026 Notes had an outstanding principal balance of $127.9 million as of March 31, 2022 and 2021. Our 2028 Notes had an outstanding principal balance of $134.6 million as of March 31, 2022. Our then existing mandatorily redeemable preferred stock had an outstanding aggregate liquidation preference of $94.4 million as of March 31, 2021.

While the interest and dividend expenses for the fiscal year increased, they resulted from issuing more fixed-rate notes. Another impact was the credit facility had an increase in its unused commitment fee. This is an expense based on the undrawn portion of the credit facility.

Interest and dividend expense increased 17.3% during the year ended March 31, 2022, as compared to the prior year, primarily due to the issuance of the 2028 Notes in August 2021 as well as the 2026 Notes issued in March 2021, partially offset by a lower weighted-average balance outstanding on the Credit Facility and the redemption of the Series E Term Preferred Stock in the current year. The weighted-average balance outstanding on the Credit Facility during the year ended March 31, 2022 was $18.1 million, as compared to $82.6 million in the prior year. The effective interest rate on the Credit Facility, excluding the impact of deferred financing costs, during the year ended March 31, 2022 was 12.5%, as compared to 4.3% in the prior year. This increase in the effective interest rate on the Credit Facility was primarily a result of the increase in unused commitment fee on the undrawn portion of the Credit Facility.

It’s not great to be paying on something that isn’t being utilized to grow the portfolio. However, during this interest rate hiking cycle, it can still be better than drawing on this and having theoretically unlimited leverage expense increases. This also leaves them in a position where they are flexible to take advantage of investment opportunities as they come up.

The notes issued from GAIN are publicly traded under (GAINN) for the 5% notes due 2026 and (GAINZ) for the 4.875% notes due 2028. They mention in their investor presentation that they have “low leverage” at about 40% of total assets. Any leverage adds risks, and while this might be less than other BDCs, it’s still going to exaggerate both swings up and down in terms of the performance of the underlying portfolio.

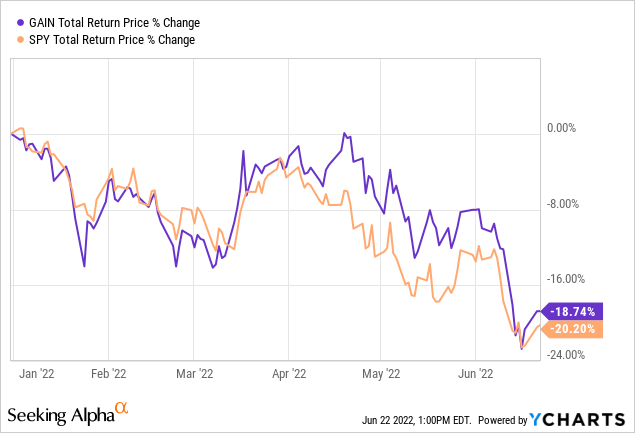

Valuation And The Opportunity Opening Up

There isn’t any specific bad news to GAIN. It seems to be a function of the broader market as a whole selling off through 2022, GAIN has also been falling. Here is a YTD comparison of total share price return on GAIN compared to the SPDR S&P 500 (SPY).

Ycharts

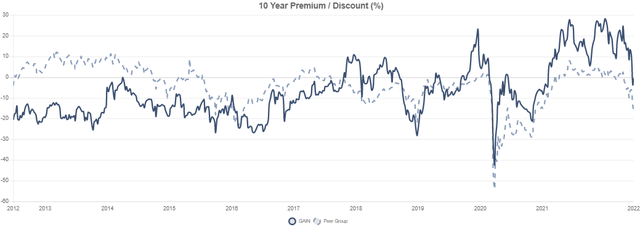

However, one more specific thing to GAIN is that the BDC is now right near its NAV per share that they reported at the end of the first quarter. Before this, GAIN was trading at some lofty premiums that haven’t been too common for the BDC.

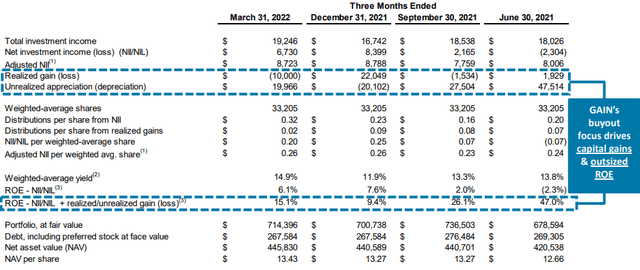

The NAV would have changed by now, but in the first quarter, the NAV actually increased. They finished the calendar year with a NAV per share of $13.27, which rose to $13.43 at the end of the first quarter. This was also a substantial increase from the $11.52.

The NAV is probably one of the most important metrics to watch for a BDC. It lets us know in the simplest way possible if the management is successful or not. If the NAV is increasing, that means the portfolio is working, and the dividends are also being covered. If it is decreasing, we know that they are generating losses, and the dividend could be at risk.

Since the share price can trade at a premium and discount, it is less reliable for letting us know how successful a management team might be. Of course, if a BDC is doing really well, it can often be rewarded with trading at a premium over its NAV.

Still, I don’t believe the latest declines are really highlighting any specific risk to GAIN here. It is more the overall environment for BDCs if we enter into a recession could come under stress. They lend to smaller companies that can be more economically sensitive. A recession increases the default risk of the portfolio.

GAIN’s Portfolio

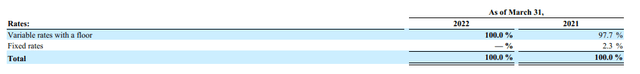

Speaking of the portfolio, we can see that their entire debt investments are invested in variable rates with a floor. That pairs nicely with the fixed-rate interest on their leverage. At least, fixed-rate at this time unless they draw on their credit facility.

GAIN Debt Exposure (Gladstone)

These are based on LIBOR, but since LIBOR is being discontinued, they note that there is fallback language in the loans. They are assuming SOFR replaces LIBOR and will be “adjusted appropriately to equate one-month LIBOR.”

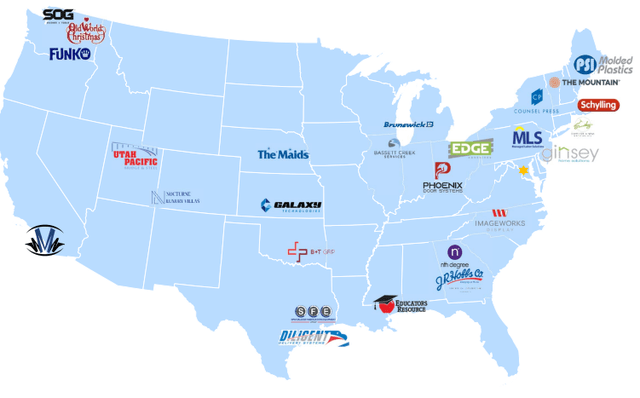

The portfolio comes with a fairly limited number of companies they invest in. That isn’t all that unusual for a BDC. They also have geographic diversification and some industry diversification to offset the greater risks that can come from a narrowly held portfolio. They have investments in each of the major U.S. regions.

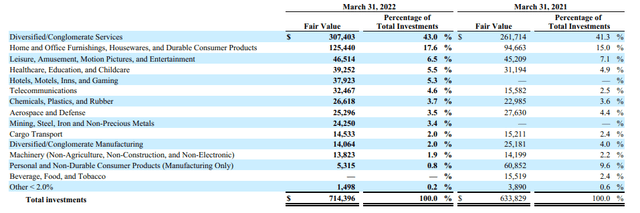

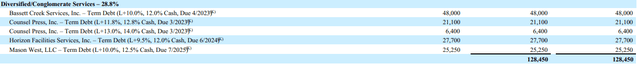

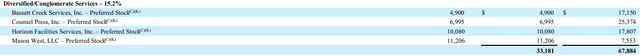

The industry breakdown has the largest allocation to “diversified/conglomerate services.”

GAIN Industry Breakdown (Gladstone)

Here is a look at the companies within that category listed as first-lien debt.

Then, after that, here are the names in the category listed as preferred equity investments.

What we can see is that they are the same names for the most part. With multiple investments within the same company, it highlights the concentration risks. They were invested in 26 total companies but had around 65 positions.

Conclusion

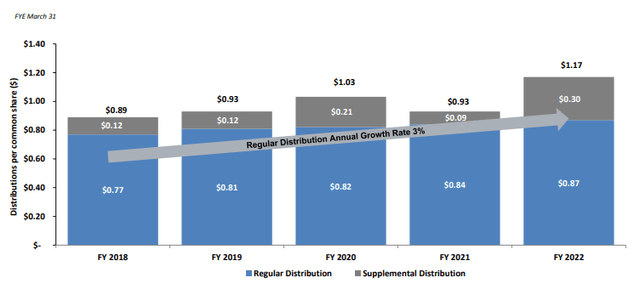

In the end, the BDC has been able to deliver not only a growing regular dividend but also supplemental distributions.

GAIN Dividend History (Gladstone)

These regular dividends are being earned through the income the portfolio has generated. That means stability and reliability. The supplemental has been a function of the capital gains they’ve generated on top of this.

So while we might be heading into a recession, as long as it isn’t another 2008/09, I believe that GAIN will be able to continue its regular dividend. The supplementals might come to a halt, but those were just an added bonus anyway.

GAIN Premium/Discount History (CEFData)

GAIN was trading higher than where it historically has been. So the declines have corrected this—making the price much more attractive at these levels than where it was trading just a few weeks ago.

Be the first to comment