Stefan Pinter/iStock via Getty Images

Investment Thesis

I think that Ginebra San Miguel Inc. (OTC:GBSMF) is in a solid financial position. My valuation implies that the company has a robust free cash flow yield, a high return over the last year, and is a prominent player in the beverage industry, specifically in the alcohol drinks market, which is why I rate the stock as a Buy.

Over the past year, the company has improved its performance according to its KPIs. We’ll also talk about the growing alcohol drinks market in the Philippines and how it can influence the company’s growth. From my perspective, anyone I’ve known here in the Philippines has tried, tasted, and drank some of Ginebra San Miguel’s ((“GSM”)) products. Although we can’t use my experience with the beverage to provide a solid example of how popular the beverage is, it’s an excellent place to start, and it shows how popular the beverage is in the Philippines and why investors would want to consider investing in GSM since it’s one of the recognized beverages in the Philippines.

Brief Overview Of The Company

Ginebra San Miguel Inc. was founded in 1834, headquartered in Mandaluyong City, Philippines, and is a San Miguel Food and Beverage, Inc subsidiary. The company and its manufacturers sell alcoholic beverages in the Philippines and internationally. GBSMF provides gins, brandies, wines, vodka, rum, and distilled spirits. They offer different alcoholic drinks and serve dealers, wholesalers, retailers, supermarkets, grocery stores, sari-sari stores, and convenience stores with the alcoholic beverages they produce.

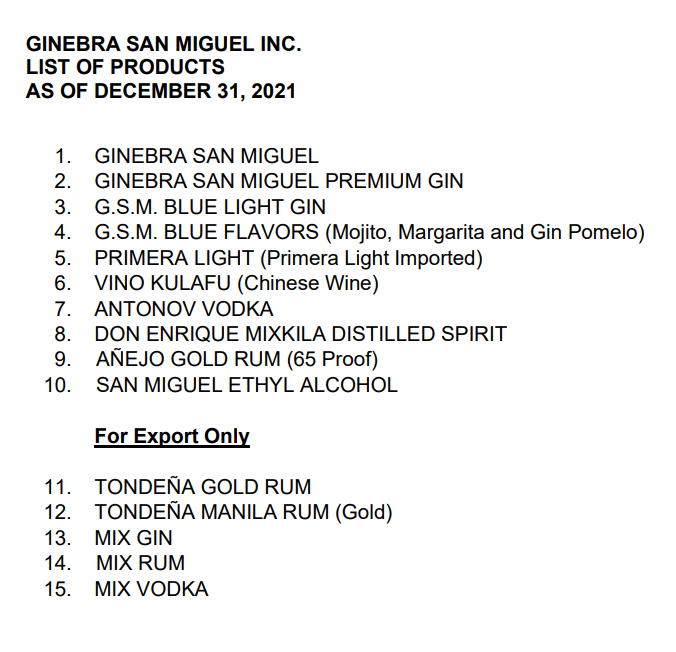

Source – GSMI SEC Form 17-A

Here are some of GBSMF’s products:

-

GINEBRA SAN MIGUEL

-

GINEBRA SAN MIGUEL PREMIUM GIN

-

G.S.M. BLUE LIGHT GIN

-

G.S.M. BLUE FLAVORS (Mojito, Margarita and Gin Pomelo)

-

PRIMERA LIGHT (Primera Light Imported)

-

VINO KULAFU (Chinese Wine)

-

ANTONOV VODKA

-

DON ENRIQUE MIXKILA DISTILLED SPIRIT

-

AÑEJO GOLD RUM (65 Proof)

-

SAN MIGUEL ETHYL ALCOHOL

For export only:

-

TONDEÑA GOLD RUM

-

TONDEÑA MANILA RUM [GOLD]

-

MIX GIN

-

MIX RUM

-

MIX VODKA

GBSMF is primarily in the alcohol drinks market, and the company is a prominent player in the market, recognized as the best-selling gin in the Philippines by mybest.ph. The company has been around for almost a hundred years, and it’s part of why I think that their gin is one of the most recognized alcohol drinks in the Philippines and is practically available even to the smallest sari-sari stores (small neighborhood retail shops) open in the Philippines.

Growing Alcohol Drinks Market

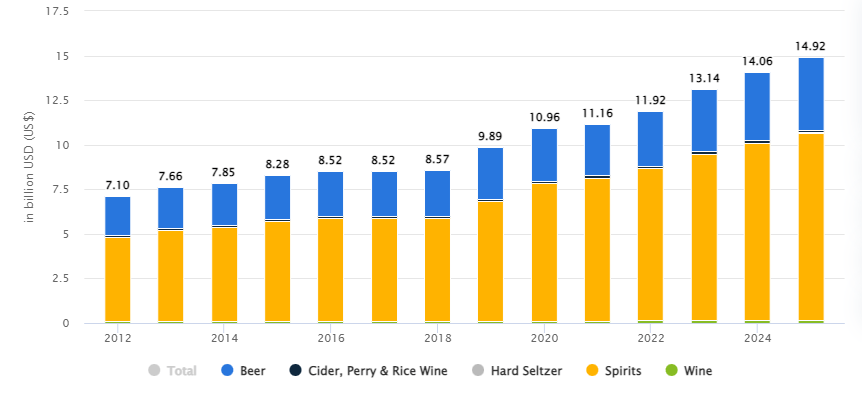

Source – Alcohol Drinks Market In The Philippines from Statista

Considering that GBSMF is one of the most recognized and “best-selling” spirit beverages in the Philippines, we can use the annual alcohol drinks market in the Philippines to see how much their potential customers/consumer volume will come from. The alcohol drinks market in the Philippines had an $11.16 billion revenue in 2021 and a CAGR revenue growth of 8.63% for the past five years (excluding 2022 because I want to have a solid figure, and the TTM growth might change that). GBSMF’s revenue grows as the alcoholic drinks market increases, which can be seen by its 18-20% average revenue growth over the past five years. I’d like to see GBSMF as a mature company that will be considered one of the Philippines’ “traditional” alcoholic beverages. I say “traditional” because it is considered almost everyone’s go-to when purchasing alcoholic beverages because of its affordable price and availability even in semi-remote areas in the Philippines (small barangays and barrios in municipalities).

Financial Performance & Analysis

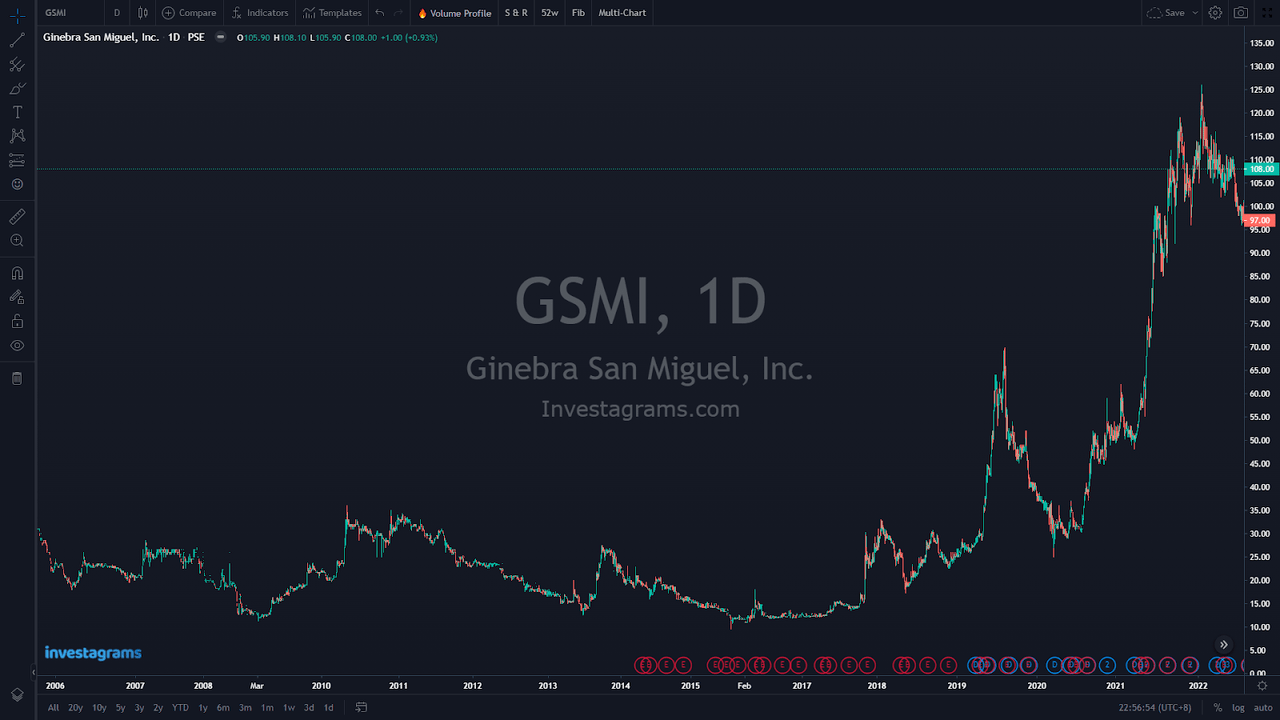

Source – GSMI Share Price Chart From Investagrams

GBSMF is currently trading close to its 5Y-high share price around PHP90-100. As previously mentioned, this could be driven by an increase in volume and demands for alcoholic drinks over the past three years, mainly when the COVID community quarantines started.

In the GBSMF’s second-quarter results, the company continued to sustain its distribution reach and strengthened brand equity during the first half of 2022. In the Q2’22 results, the company reported a volume growth for the first half of 2022, a 9% volume increase compared to H1’21, which meant consolidated revenues jumped by 15% to PHP23.1 billion, compared to last year’s PHP20.2 billion. GBSMF also reported additional spending for advertising, promotional activities, distribution expenses, and personnel costs which can be reflected by an 11% increase in operating expenses to PHP2.8 billion vs. last year. The company’s overall performance for the first half of the year closed with strong returns displayed by the 19% increase in net income to PHP2.5 billion from last year’s PHP2.1 billion.

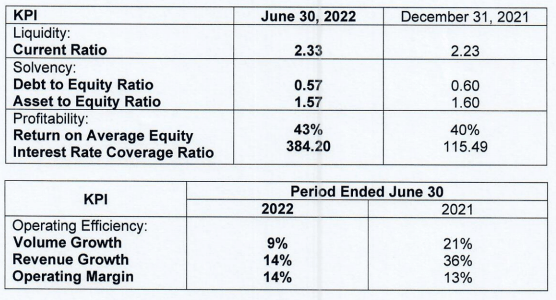

Source – SEC FORM 17-Q

GBSMF reported PHP6.92 billion in cash and cash equivalents from the company’s Q2’22 results and has PHP15.6 billion in total current assets while having PHP6.7 billion in total current liabilities giving us a current ratio of 2.33, no liquidity problems in the foreseeable future. They also have low debt levels, with a 0.57 debt to equity ratio shown in the company’s KPIs.

Valuation

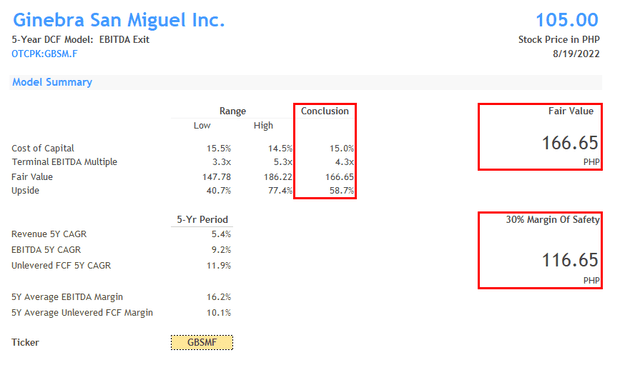

Source – Assumptions From Author & Model From Finbox

Using an EBITDA Exit to calculate the company’s terminal value in 5 years, my valuations show that the company is a Buy. GBSMF currently trades at PHP105, which is lower than the company’s fair value. With a 4.3x EBITDA multiple, we get a 60% upside if we have bought the stock right now. Even with an added 30% margin of safety, the company is still relatively cheap. I used a discount rate of 15% and forecasted a CAGR revenue growth of 5.4% (12% for 2022, displayed by an increase in demand and revenue momentum) 5Y EBITDA CAGR of 9.2%, which leads me to rate the stock as a Buy.

Risks

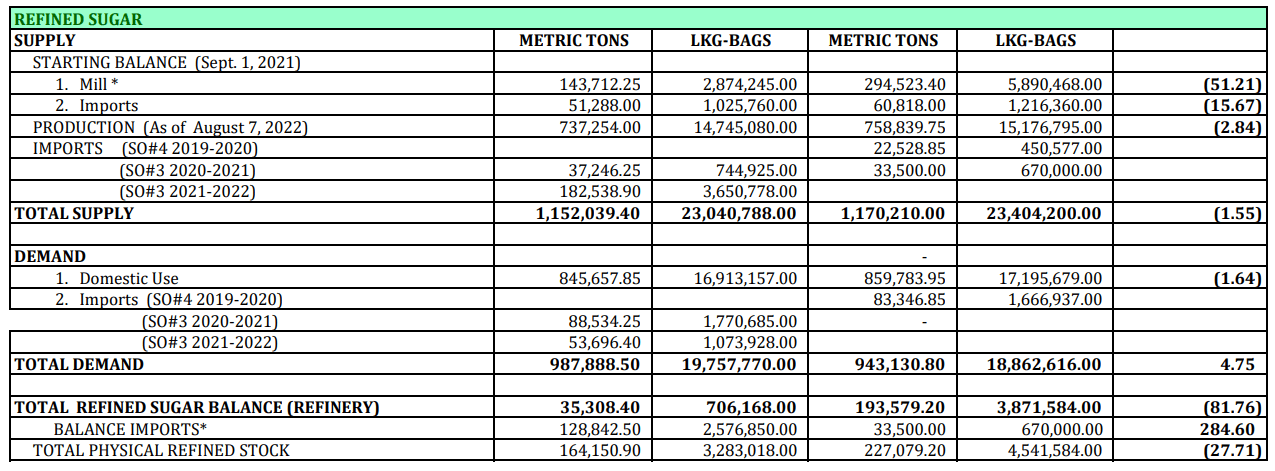

Source – Sugar Regulatory Administration

I think two risks will affect the company’s inflationary pressures and the sugar shortage in the Philippines. There’s still uncertainty in inflationary pressures that the Philippines is yet to experience. Sure, product prices have increased, but I believe we are not at the peak of inflation, and it’s better to brace for the worse effects than to be optimistic in an unfavorable market. There may be an increase in volume today, but we’ll have to see how the company will perform further into the year and if potential macro headwinds will affect the company. Although the palace has reported “sugar shortages,” the supply and demand statement provided by the Sugar Regulatory Administration shows that there’s enough supply for demands in the country. Those are the risks that I perceive will significantly affect GBSMF in the long term (it may be hard to recover from inflation) and short-term (the sugar shortage).

Investor Takeaway

I think that GBSMF is performing well despite the company performing in an unfavorable market where inflationary pressures can affect the wallets of its consumers, which can turn into a decline in demand, volume, and revenue. The alcoholic drinks market is steadily growing in the Philippines, and due to the company’s popularity, GBSMF can potentially increase its loyal customers that love its alcoholic beverages. The company has low debt levels and no short-term liquidity problems, and as proven by my valuation, the company has a fair value of PHP166. It is currently trading at PHP105, which signifies that the stock is cheap, leading me to rate GBSMF as a Buy. I would love to monitor the stock and would want to wait for further announcements from management if there are any significant updates from the company.

Thank you so much for your time, and thank you for reading. Have a great day.

Be the first to comment