Sundry Photography

Gilead Sciences (NASDAQ:GILD) appears misunderstood and underappreciated by the market, creating an attractive and defensive investment opportunity. Our investment case for Gilead is based on the following key pillars:

- Gilead is a high-quality pharma company with a protected market position, attractive Return on Invested Capital over time, an adequate balance sheet and underappreciated growth potential.

- Gilead’s current valuation is attractive, partially due to the market misunderstanding the growth potential of the company, recent noise from acquisitions and the resilience of its HIV business – and additionally, the current value of the company is essentially covered by just the reliable HIV business.

- Investors receive a solid dividend while waiting for the market to get clarity regarding the growth potential of the company.

We will now walk through each of these points in detail with a degree of evidence supporting what we conclude is an attractive investment case for Gilead Sciences.

Gilead is a high-quality pharma company with a protected market position, attractive Return on Invested Capital over time, an adequate balance sheet and underappreciated growth potential

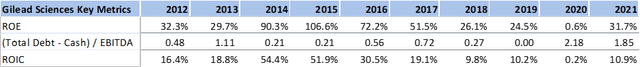

We call the company a high-quality pharma company with a protected market position. The quality of the company is evidenced by its ability to produce an attractive level of Return on Invested Capital (‘ROIC’) and Return on Equity (‘ROE’) over time. There have been a couple years recently that were less attractive due to large acquisition dynamics which are not optimal, but the company still maintained a reasonable level of value creation for the most part. More importantly, the main business that is capable of producing ROIC near 20% is still in-tact and growing – the HIV business. The company should also be done with outsized acquisitions for some time, eliminating the one-off hits to ROIC that have occurred in recent years. There is no guarantee of that, but management has repeatedly stated that will be the case, and their current portfolio and pipeline means there is little need for transformative acquisitions anymore. On the company’s Q1 2022 Earnings Conference Call, EVP and CFO Andrew Dickinson stated,

“So you should not expect that we’re going to go out chasing commercial assets or large deals. The guidance is very clear. It’s ordinary course partnerships, maybe smaller commercial acquisitions. Again, we’ll be opportunistic. But that’s not where our focus is today.”

We therefore are quite convinced that the company will continue to produce highly attractive levels of ROIC going forward. The below shows the historical ROIC/ROE profile, and we would expect the current climb back up to continue, especially in 2023 and beyond. We do not expect the heights of 2014 and 2015 to be reached as the Hepatitis C business is no longer booming as it was then, but a high-teen level for ROIC should be more than achievable without large scale acquisition noise as was experienced in 2020 through the Immunomedics acquisition.

Gilead ROE and ROIC (Refinitiv)

Source: Refinitiv

Regarding the protected market position, there are several factors that give us comfort of continued solid value creation from Gilead. First off, they have almost no major patent expirations for about a decade. As Johanna Mercier, Chief Commercial Officer at Gilead put it after the company recently resolved key patent challenges,

“I don’t think I’ve ever been in a role where I can honestly say, in the next 10 years there is no patent concerns at Gilead. I honestly haven’t been in an organization where I’ve been able to say that.”

That is rather incredible in the pharma space, and we would argue is one of the most attractive patent protections in the whole industry. The important patents on their main HIV products like Biktarvy for example do not expire until 2033. That means the company has a huge runway to transition to next generation HIV products (already being approved now in the form of Lenacapavir/Sunlenca) while the rest of the pipeline is demonstrating attractive growth. The incredible and continuing success of Gilead’s most important HIV product (Biktarvy), which has few prospective competitors, gives us additional confidence in the protected market position of their main business for the next decade or so, even if new products do not extend that protection beyond 2033. Their Cell Therapy (think CAR-T, Yescarta and Tecartus) business also has major barriers in the form of patents and also the complication and capex surrounding production facilities in that area – and that business is now growing quickly with a run-rate of well over $1 billion in revenues a year. As an additional indicator, Morningstar gives Gilead a Wide moat rating stating,

“We think patent protection on newer HIV regimens and Gilead’s continued dominance in the hepatitis C market will be enough to ensure strong returns for the next couple of decades.”

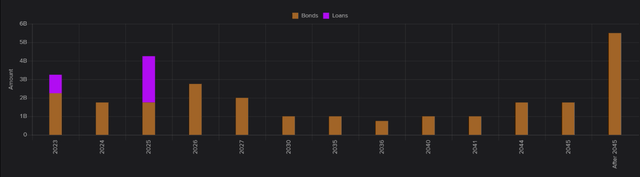

Regarding the adequate balance sheet and financial profile, Gilead does carry substantial debt, but it is well within our comfort zone considering the level and reliability of free cash flow (‘FCF’). The debt is also largely fixed rate and spread over many years going far out into the future. We can also be optimistic that the debt will be reduced over time. Much of the debt is due to recent large acquisitions such as the Immunomedics transaction, and the company is in the gradual process of paying it down. In any case, the Net Debt / EBITDA or Net Debt / FCF ratios are not at a stretched level for the cash flow profile of Gilead. For example, net debt is currently $18.7 billion while FCF in 2021 was well over $10 billion according to Refinitiv. The debt profile of the company certainly offers little concern considering the fixed rate nature of most of the debt combined with the maturation profile seen below. Perhaps inflation will even make it easier for Gilead to pay its debt down over time.

Gilead’s debt maturity profile. (Refinitiv)

Source: Refinitiv

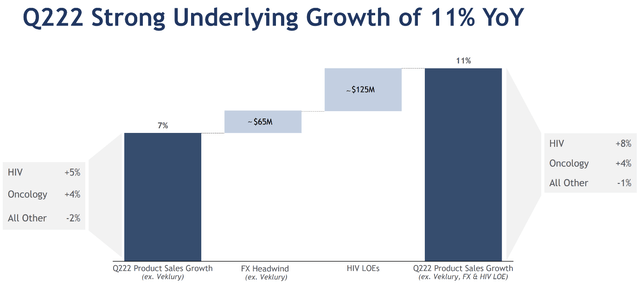

Speaking to growth potential, this is an area where we think the market in general is not giving the company much credit. Gilead’s growth profile has been impacted for several years by unusual circumstances. The first is the Hepatitis C business which has been in decline as the company managed to offer a cure for the disease. The decline in that business is essentially over, or at least on a much smaller base. The second and ongoing unusual circumstance is the company’s Covid therapy Veklury (Remdesivir). The market has seemingly given the company zero credit for growing revenues as Veklury brought in billions of sales but is now also disinterested in the company as those sales drop from the elevated pandemic levels, creating confusion about the underlying growth potential of Gilead’s base business without the Veklury product. Our thesis is that the market will soon see how fast the underlying business is growing as noise from Veklury sales fades away after the next 3-4 quarters. The HIV business continues to grow while areas such as Cell Therapy and Trodelvy demonstrate attractive growth on an ever-larger base. The recent reporting shown below demonstrates what is possible in terms of growth once the Veklury aberrations are stripped away, with underlying growth coming in at 7% or more for the Q2 of 2022.

Gilead Q222 Financial Results Presentation (Gilead Q222 Financial Results Presentation)

Source: Gilead Q222 Financial Results Presentation

Gilead’s current valuation is attractive, partially due to the market misunderstanding the growth potential of the company, recent noise from acquisitions and the resilience of its HIV business – and additionally, the current value of the company is essentially covered by just the reliable HIV business

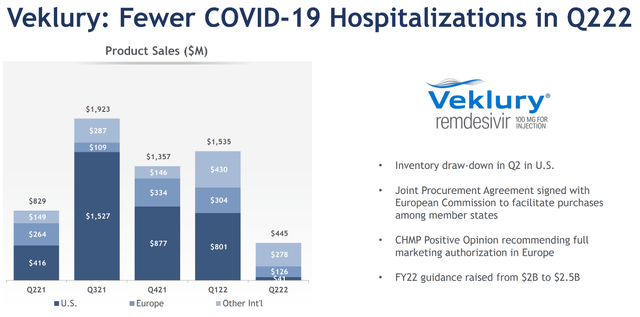

Just above, we mentioned multiple reasons why the market is misunderstanding the growth potential of the company. The noise created by the Hepatitis C business decline and now the Veklury volatility mask the underlying progress in areas such as Cell Therapy and Trodelvy. We can see that the Veklury affect will likely take a couple more quarters to clear as the Q3 of 2021 through the Q1 of 2022 still included relatively high levels of contribution for the product which are unlikely to continue in whole going forward.

Gilead’s Veklury sales. (Gilead Q222 Financial Results Presentation)

Source: Gilead Q222 Financial Results Presentation

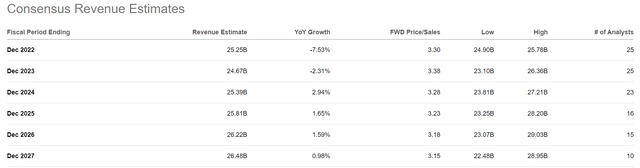

It’s also important to remember that Gilead has no real material patent expiries for many years that could potentially dent growth. The recent lapping of the Truvada and Atripla expiries have also served to dampen recent growth and perhaps hide the potential growth rate for the coming years. There are some other issues such as a strong US dollar depressing sales growth, but the key message is that the company will likely be growing sales in the mid-single digits for some time, if not faster, once the Veklury noise is lapped. The current valuation seemingly does not reflect such a growth rate. If we look at the consensus revenue estimates shown on Seeking Alpha, we see that minimal growth is expected in the coming years, which flies in the face of the recently reported 7% growth in Gilead’s underlying business.

Gilead’s consensus revenue estimates. (Seeking Alpha)

Source: Seeking Alpha

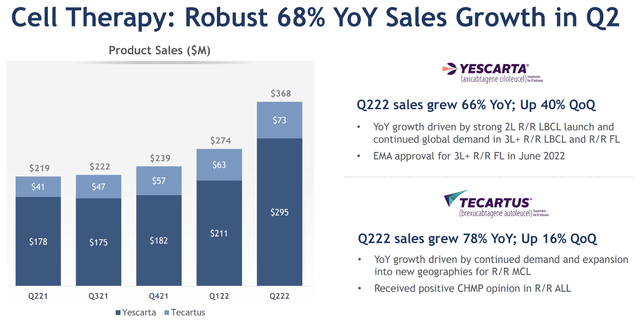

It’s also important to note that the market has possibly been confused by the recent large acquisitions and their effect on financial results with certain one-off charges and write-offs pushing reported figures down. We can’t say this is a good thing, as it certainly creates doubts around recent capital allocation, but it very well might be clouding the picture of what is a solid underlying business. We also think that the market is judging recent transactions with a rather short-term lens. We feel the transactions look more understandable using a long-term view. There was much skepticism regarding the purchase of Kite in the Cell Therapy area back in 2017, but now the company is ramping sales rapidly as therapies gain additional approvals and move up the treatment line.

Gilead’s Cell Therapy Business Revenue (Gilead Q222 Financial Results Presentation)

Source: Gilead Q222 Financial Results Presentation

One can almost hear analysts begin to applaud the company’s foresight regarding the deal. The purchase of Immunomedics with Trodelvy is more recent, but a similar pattern seems to be emerging. Many condemned the deal, and perhaps rightfully so with its huge price tag and minimal revenues at the time, but Trodelvy is slowly working itself through the clinic and ramping sales as well. More time is needed to judge the deal properly, but the sales contribution is stacking up now.

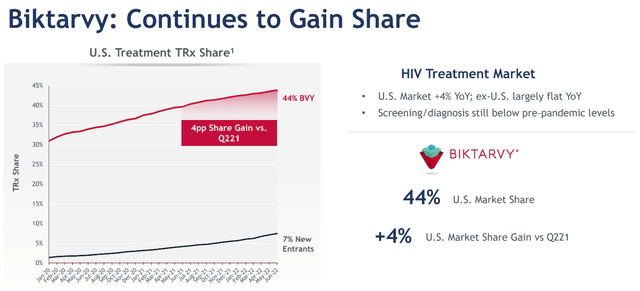

Valuation overall looks attractive to us. Gilead is a pharma company with a deep moat and cash flows that are reliable and largely detached from the business cycle, something we look for given challenging market conditions. Overall valuation using a discounted cash flow model is quite compelling. With an average annual growth rate as low as 2.2% over the coming decade, a WACC of 8% and margins in-line with historic averages, we get a fair value close to $110 per share, which provides over 60% upside with the share trading near $66. One key pillar to our investment case is an HIV business that remains robust and that alone supports much of the current market capitalization of the company. If that pillar holds strong, then we view the company as having limited downside risk while essentially providing a free call option on the rest of the business. As areas such as Cell Therapy and Trodelvy begin to bear fruit, that offer looks all the more attractive, especially as Biktarvy and Lenacapavir (Sunlenca) promise continued strength in HIV for many years to come.

Biktarvy continues to gain market share. (Gilead Q222 Financial Results Presentation)

Source: Gilead Q222 Financial Results Presentation

HIV revenues were approximately $16.3 billion in 2021 and grew at a mid-single digit rate in the first half of 2022. With the company’s 10-year average sales multiple above 4x (according to Refinitiv), HIV revenues alone could support the entire market capitalization of the company with minimal growth in the coming years. J.P Morgan analysts echo this idea, recently writing,

“At current levels, we see GILD’s HIV business alone supporting the stock’s entire market cap.”

We also take comfort in current valuation multiples, especially as they are based on potentially conservative estimates for growth in the coming years.

Gilead valuation multiples. (Refinitiv Datastream & I/B/E/S Mean valuations)

Source: Refinitiv Datastream & I/B/E/S Mean valuations

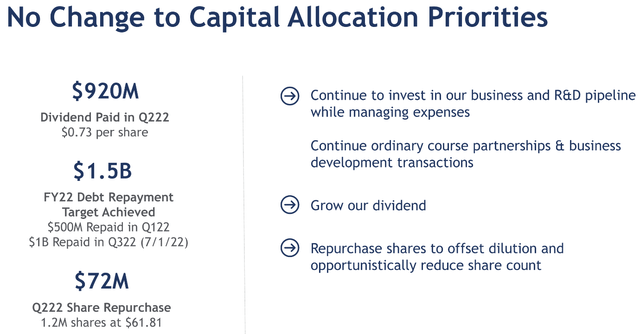

Investors receive a solid dividend while waiting for the market to get clarity regarding the growth potential of the company

It’s nice to collect 4-5% in dividends while waiting for an investment case to play out, especially when downside risk is viewed as limited. Gilead has been an excellent bond in a way, especially when looking at the performance of most bond funds in 2022. With steady cash flows and well less than half of free cash flow used to pay the dividend, we are quite comfortable in the assumption that the dividend will continue to be paid at its current level or better. The $10 billion in free cash flow in 2021 easily covered the $3.6 billion paid out in dividends recently as a reference.

Gilead Capital Allocation (Gilead Q222 Financial Results Presentation)

Source: Gilead Q222 Financial Results Presentation

Risks and yellow flags should not be ignored

Gilead’s investment case does not come without risk. As with most pharma companies, products need to continue moving through the clinic and avoid issues and litigation. There is certainly regulatory or government risk regarding pricing and distribution. Gilead also has the majority of its business in the HIV space, which brings concentration risk even if critical products appear protected for the next decade. We also struggle with executive compensation as CEO Daniel O’Day took home a total compensation of over $19 million in 2021 (according to Refinitiv) despite unproven capital allocation decisions. Elevated executive compensation is an issue across much of the US corporate world, so it’s hard to escape and not specific to Gilead, but it still makes us cringe. There is, of course, no certainty that the mid-single digit growth rates we expect will actually materialize, especially if trials for key products such as Trodelvy achieve less than desirable results. And despite the company’s debt profile looking reasonable, leverage always carries risk. Ultimately, we view risks as manageable and control them partially through prudent position sizing.

Conclusion – Gilead offers a great deal on a good company with risk skewed well to the upside

It’s not a terrible time to own solid pharma companies with their reliable free cash flows and somewhat defensive business models. Gilead’s profile with a distinct lack of near-term patent cliffs and materializing growth potential makes for an interesting option in the space. It is certainly possible that volatility in Veklury revenues and multiple recent acquisitions have clouded Gilead’s underlying growth trajectory, resulting in a valuation that appears rather tantalizing to optimists. Collecting the dividend while the company returns to its long-term return on invested capital profile makes for an interesting investment case approximating a well-yielding bond, but with substantial upside potential. Imagine Gilead can grow its business at a mid-single digit rate with its historic margin profile – certainly a 12x earnings multiple would be appropriate versus the current 9-10x multiple. Ultimately, upside is likely to come from higher-than-expected growth combined with a re-rating in multiples. We view the opportunity as attractive considering the current share price is largely supported by an HIV business that is protected for much of the next decade, if not longer – not bad considering the 10%+ free cash flow yield on offer. The market doesn’t seem to give Gilead much credit, and that’s a good thing for opportunistic active managers like us.

Be the first to comment