Justin Sullivan

Thesis and Background

Readers following our writings know that we like healthcare stocks. And in particular, we like to use healthcare stocks on the income-generation end of our barbell strategy because of their generous and reliable dividends.

Under this context, both Johnson & Johnson (NYSE:JNJ) and Gilead Sciences (NASDAQ:GILD) have attracted our attention (again). We have been following both regularly in the past. And both are undergoing some major changes, which motivated this article to examine their dividends closely. And the conclusion and also the answer to the question in the title, unfortunately, is that neither is an attractive dividend stock at this moment for us.

JNJ investors face a major change as the company has announced a plan to spin off the consumer health segment. The spinoff is scheduled to complete by end of 2023. The Consumer Health segment is faced with a considerable amount (estimates vary but are all in the multi-billion-dollar range) of litigation claims. The spinoff will help to shield JNJ’s core pharmaceutical segment from litigation (a strategy that corporations routinely deploy when faced with large litigations). And after the spinoff, JNJ is expected to be able to better focus on its pharmaceutical business. However, a move of this magnitude certainly entails some risks and investors should anticipate some surprises as the execution proceeds.

The spinoff could potentially change JNJ’s dividend payouts, and it is the focus of this article to examine such potential.

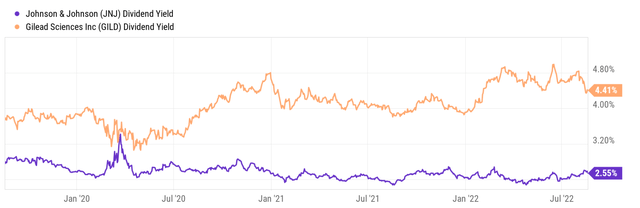

And for investors who are looking for alternative dividend ideas in the pharmaceutical space, GILD might appear as an attractive candidate. It is providing a higher yield than JNJ, both historically (as you can see from the chart below) and also currently (4.4% vs 2.55%). GILD is priced at a large valuation discount from JNJ (its FW PE is about 9.84x, compared to JNJ’s 16.80x). Later, you will also see that GILD provides a thicker dividend cushion ratio than JNJ and also solid total return potential.

However, investors need to be aware of GILD’s own uncertainties too, especially its ongoing trouble with the Immunomedics synergy and the continued declines in its HIV franchise. And we will examine the implications of these uncertainties to its dividends immediately below.

Profitability and anticipated headwinds

As aforementioned, both JNJ and GILD currently offer an attractive dividend yield of about 2.55% and 4.4%, respectively. Dividends from both companies are supported by superior and consistent profitability in the past. JNJ is a dividend king with 59 years of consecutive dividend increases behind. And GILD, though only started paying dividends in 2015, has been consistently raising its dividend since then. It has also been increasing its dividend at a fast pace (7.8% CAGR in the past 5 years compared to JNJ’s 5.8%).

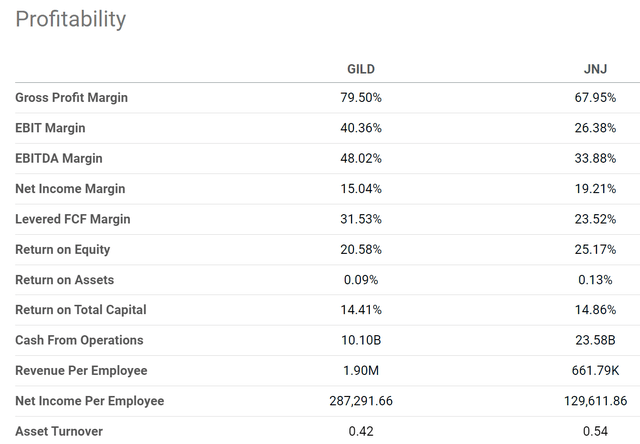

Currently, both still feature superb profitability, and I don’t see any trouble supporting a healthy dividend in the near term. Let’s start with the gross margin, GILD boasts a remarkable gross margin of 79.5% and JNJ 67.95%. In terms of net margin, GILD features a net margin of around 15% and JNJ about 19%. To put things under perspective, the average profit margin for the overall economy fluctuates around 8% and rarely goes above 10%. Of course, this is an average across all business sectors. Nonetheless, as a rule of thumb, 10% is a very healthy profit margin already. And GILD’s margin is about 50% above this level and JNJ is almost 2x of it.

However, looking ahead, there are headwinds for both of them.

For JNJ, besides the spinoff and litigation risks, there are a few other uncertainties. The business is facing pressure on the margin due to higher costs, and management is also dealing with higher R&D costs. I anticipate these headwinds, plus some additional ones, in the months ahead too. I suspect that Consumer Health and MedTech sales will remain softened given the persisting high inflation. Moreover, the pharmaceutical segment might be negatively impacted as the distribution of COVID-19 vaccines becomes muted too.

For GILD, it acquired Immunomedics (“IMMU”) back in 2020 with high hopes for its Trodelvy (at a high price tag of $21B). Unfortunately, Trodelvy did not seem to pan out. The latest results showed no improvement in patient survival than a placebo. As a result, the company is still largely relying on its HIV and HCV franchises for income generation. And as we all know, both the domestic and global demand for both has been chronically declining. These drugs are so effective that they cured a large portion of the existing patients already and are effectively running out of patients to cure. Bad for their profits, but a huge contribution to global healthcare.

Next, we will see the impacts of these headwinds on their dividends.

Dividend safety

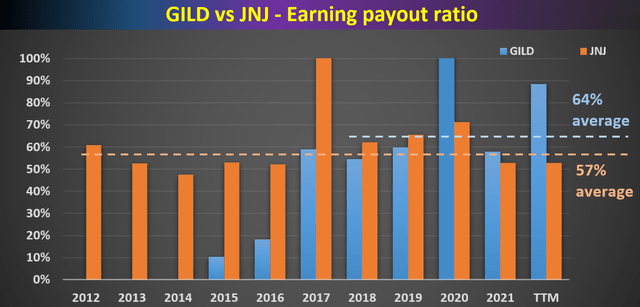

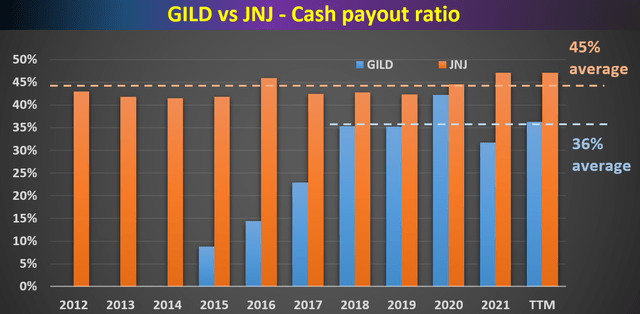

For dividend investors, I am sure all of us know all the typical metrics to gauge dividend safety such as payout ratio in terms of earnings, payout ratio in terms of cash flow, et al. The following chart shows JNJ and GILD’s payout ratio in terms of earnings and also cash flow. As seen, both JNJ and GILD have been doing a consistent job of managing their dividend payout in the past. The payout ratios have been essentially the same for both of them in terms of earnings. Again, GILD did not start paying dividends till 2015. But once its dividends stabilized around 2017, its earnings payout ratio has been on average 64%, essentially on par with JNJ’s 57% long-term average.

In terms of cash payout ratios, the picture is quite similar. GILD cash payout ratio has been on average 36% after its dividend stabilized in 2017. And currently, it is a bit lower than JNJ’s 45% long-term average.

Author based on Seeking Alpha data Author based on Seeking Alpha data

Dividend cushion ratios

As detailed in my earlier article here, there are major limitations of the above simple payout ratios. And we find the dividend cushion ratio an effective tool to overcome these limitations. A detailed description can be found in our earlier articles or Brian M Nelson’s book entitled Value Trap. And a summary is quoted below:

The Dividend Cushion measure is a ratio that sums the existing net cash (total cash less total long-term debt) a company has on hand (on its balance sheet) plus its expected future free cash flows (cash from operations less all capital expenditures) over the next five years and divides that sum by future expected cash dividends (including expected growth in them, where applicable) over the same time period. If the ratio is significantly above 1, the company generally has sufficient financial capacity to pay out its expected future dividends, by our estimates. The higher the ratio, the better, all else equal.

We made one revision to the above method here. Instead of subtracting the total long-term debt, we subtracted the total interest expenses over a past five-year period. This revision is to adjust for the status of businesses like JNJ and GILD. Such mature businesses probably will never have the need to repay all the debt at once. But it does need to service its debt.

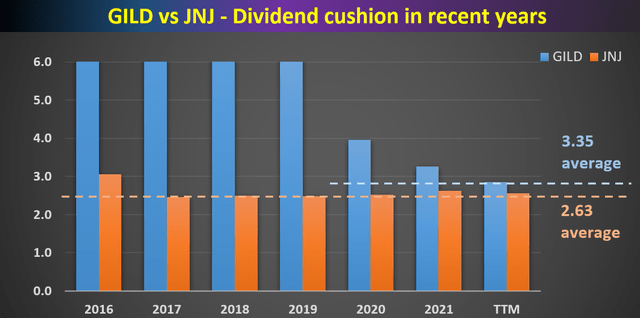

With this background, the dividend cushion ratios for GILD and JNJ are calculated and shown below. As can be seen, GILD has been maintaining an overly conservative dividend cushion ratio of more than 6x till 2020. The reason was the large cash position on its balance sheet (more than $20B). And the dividend cushion ratio declined to about 4x in 2020 due to the IMMU acquisition aforementioned. This example also serves as a good illustration of the potency of the cushion. If you just look at the payout ratios, you won’t see the impact of the acquisition on dividend safety. But intuition tells you it should have an impact. After all, the company’s cash position was reduced by $21B. And the cushion ratio reveals such impact clearly.

All told, GILD’s cushion ratio has gradually declined to the current level of 3.35x, still a very safe level. It is not substantially above the threshold of 1x, but also higher than JNJ’s 2.63x. Also, note the remarkable consistency of JNJ’s cushion ratio over the years. It only fluctuated in such a narrow range around the mean of 2.63x.

In summary, both stocks are maintaining a safe cushion ratios, which are significantly above 1x. Although I will closely monitor the impact of the ongoing headwinds as mentioned above.

Author based on Seeking Alpha data

Valuation and Projected Returns

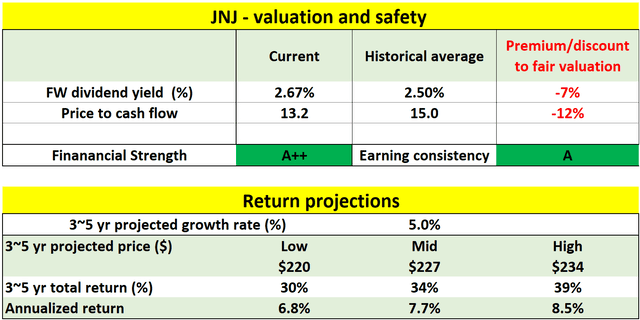

As can be seen from the table below, at its current price level, JNJ is discounted both in terms of dividend yield and also cash flow multiples. It is about 12% undervalued based on its historical price to cash flow multiples, and about 7% discounted based on its historical dividend yield. Thanks to its diversified revenue streams and profitability stability, it also boasts an A++ financial safety and A earning consistency.

For the next 3~5 years, a mid-single-digit annual growth rate is expected (near 5%) given its strong ROCE (return on capital employed), robust pipeline, and healthy reinvestment rates. JNJ’s average ROCE has been about 50% in the past. As a result, a modest 10% investment rate would be able to sustain a 5% organic growth rate alone (50% ROCE * 10% reinvestment rate = 5% organic growth rate). And the total return in the next 3~5 years is projected to be in a range of 30% (the low-end projection) to about 39% (the high-end projection), translating into a very attractive annual total return up to the upper single-digit.

Author based on Seeking Alpha data

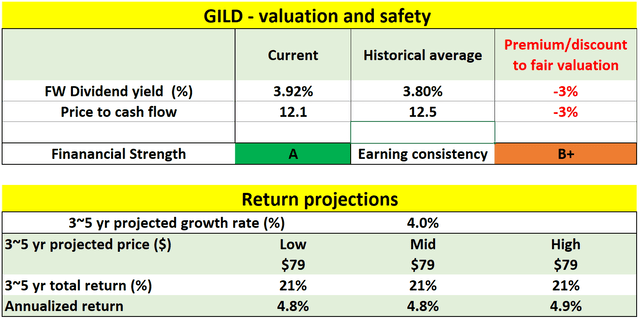

GILD’s case is a bit less rosy due to the issues discussed above. At its current price level, it is also slightly discounted, by about 3% based on its historical price to cash flow multiples and also dividend yields.

For the next 3~5 years, a lower annual growth rate is expected (near 4%). GILD’s average ROCE is about 52% in the past few years, even a bit higher than JNJ. And a 10% reinvestment rate can support a 5.2% organic growth rate. However, due to the uncertainties with its IMMU synergies and its HIV sales declines, I am projecting a 4% growth rate to be conservative. And the total return in the next 3~5 years is projected to be in a range of about 20%, translating into a mid-single-digit annual return.

Author based on Seeking Alpha data

Conclusion and final thoughts

Both JNJ and GILD attracted our attention recently, unfortunately, for the wrong kind of reasons. JNJ, a quintessential dividend growth stock, faces some major uncertainties both in the near term (cost control and inflation) and also mid-term (the spinoff plan and the litigation). GILD, a viable contender to be a dividend champion, is also facing uncertainties with its IMMU acquisition and also HIV sales declines.

As such, we ourselves will stay on the sidelines for both stocks. And investors attracted to GILD’s much higher dividend yields should be aware of its issues. Furthermore, our view is that its current valuation discount does not adequately compensate for the risks created by these issues.

Be the first to comment