HomePixel/iStock via Getty Images

Gildan Activewear (NYSE:GIL) is a company we covered in detail in a previous article, so we are not going to spend time here describing the company. This article will mostly be an update based on the most recent results and a detailed valuation. As we’ll see, the economic environment has gotten more complicated for the company, but it has proven resilient, and its shares remain extremely undervalued.

In the third quarter Gildan generated sales growth of 6% year on year. It also delivered another quarter of operating margin at the top end of their target range, and grew adjusted earnings per share by 5%. While these growth rates may seem low, the results are actually pretty solid considering the environment under which the company is currently operating. The global economy is weakening significantly and many of the inputs Gildan uses have gone up considerably in price. The fact that the company is proving able to maintain stable operating margins is therefore quite remarkable and underscores its excellent cost management.

We believe Gildan might even benefit from the current macroeconomic environment if it is able to make some attractive acquisitions. It certainly has the balance sheet to either expand organically in a more aggressive way, or to so some strategic M&A. In any case, the balance sheet gives the company a lot of optionality, including a continuation of share repurchases if the valuation remains at bargain levels.

Q3 2022 Results

Sales for the quarter totaled $850 million, with Activewear sales up 13% while hosiery and underwear sales were down 26%. Total Activewear sales were $742 million in the quarter compared to $656 million last year.

GAAP and adjusted diluted EPS for the quarter was $0.84. In the third quarter of 2021 the company reported GAAP diluted EPS of $0.95 and adjusted EPS of $0.80. The company therefore delivered a 5% y/y increase in EPS on an adjusted basis.

Financials

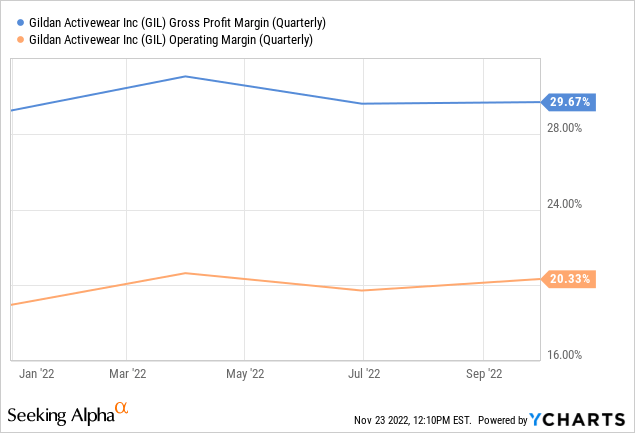

In the third quarter operating margin levels of 20.5% on a GAAP basis, and 20% on an adjusted basis, came in at the high end of their target range. As can be seen in the graph below, gross profit margins and operating margins have been relatively stable all year.

Growth

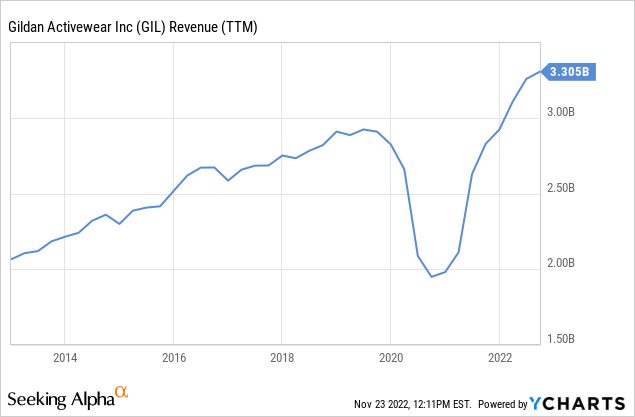

Gildan was one of the companies that was severely affected by the Covid crisis, seeing its revenue plunge. It then went on to recover relatively quickly, and is now posting record revenue numbers again. As can be seen below, it is back on its growth trend.

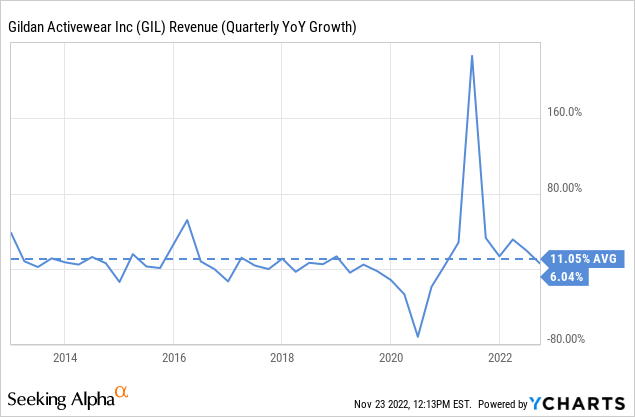

At roughly 6% growth in the third quarter was below average for the company, but this is understandable given the economic environment, and the fact that it is coming out of a period of recovery where its growth rates were extremely high.

Balance Sheet

Gildan’s balance sheet is in great shape, giving the company a lot of optionality, and the ability to weather difficult economic conditions. The company finished the quarter with a net debt position of $944 million and maintained its leverage ratio at 1.2x debt to EBITDA.

Valuation

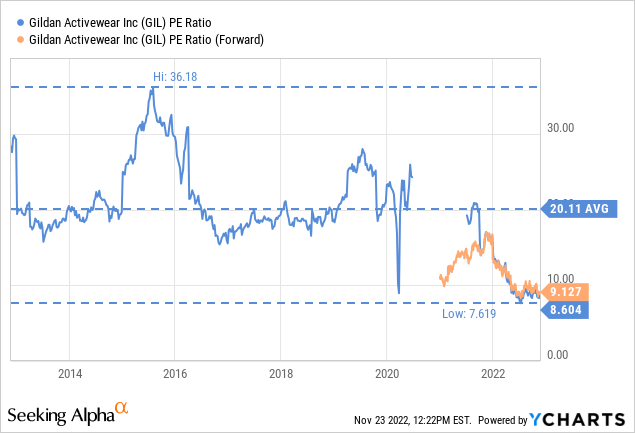

Despite Gildan’s full recovery from the Covid crisis, and that it is proving resilient to the current economic environment, the valuation remains extremely low. The price/earnings ratio is approximately 9x, which is less than half the company’s ten-year average.

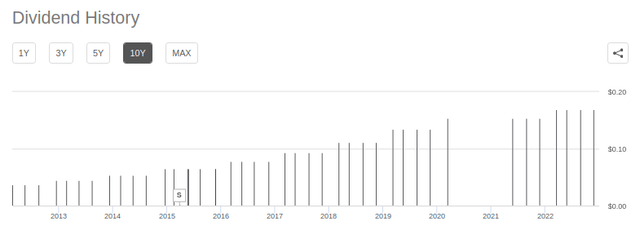

Gildan pays a dividend, but it has a low payout ratio, the dividend yield is therefore relatively low at ~2.3%. Still, the company has a good dividend growth track record, with the exception of the worst part of the Covid crisis, where the company had to temporarily suspend dividend payments.

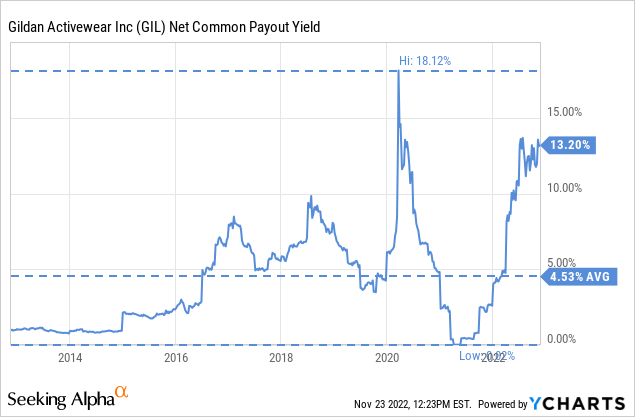

In addition to the dividend, the company returns capital to shareholder’s through share buybacks. The combination of cash dividends and buybacks is quite attractive as can be seen by the elevated net common payout yield.

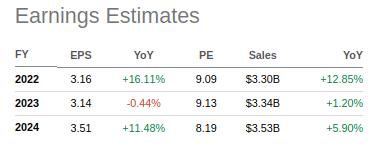

Analysts estimate that earnings per share will grow to ~$3.51 by 2024, which places the FY24 forward p/e at an extremely attractive level of close to 8x.

Seeking Alpha

To estimate a fair value for the shares we sometimes like to discount future earnings. For Gildan we took analyst estimates for the next three years, assumed a 5% EPS growth rate for the rest, and then applied a terminal growth rate of 2%. Discounting everything using a 10% discount rate, we get an estimated net present value for the shares of $45.97. This is more than 50% higher than where shares are currently trading.

| EPS | Discounted @ 10% | |

| FY 22E | 3.16 | 2.87 |

| FY 23E | 3.14 | 2.60 |

| FY 24E | 3.51 | 2.64 |

| FY 25E | 3.69 | 2.52 |

| FY 26E | 3.87 | 2.40 |

| FY 27E | 4.06 | 2.29 |

| FY 28E | 4.27 | 2.19 |

| FY 29E | 4.48 | 2.09 |

| FY 30E | 4.70 | 1.99 |

| FY 31E | 4.94 | 1.90 |

| FY 32 E | 5.19 | 1.82 |

| Terminal Value @ 2% terminal growth | 64.82 | 20.65 |

| NPV | $45.97 |

Risks

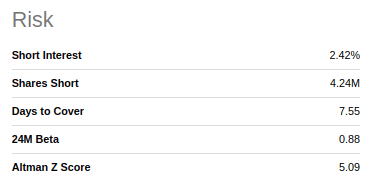

Gildan operates in an extremely competitive industry, which means at some point one or more competitors could try to launch a price war to take away business from the company. So far Gildan has been able to maintain strong profit margins despite the competitive pressures. It also faces significant commodity prices exposure which can affect margins too. These risks are mitigated by Gildan’s highly efficient operations, and strong balance sheet. Gildan has an Altman Z-score of more than 5x, which is significantly above the critical 3.0 threshold.

Seeking Alpha

Conclusion

We decided to revisit Gildan to see how it is doing in this period of high inflation and a weakening economy. The most recent quarterly results for the company are encouraging, with Gildan still posting sales and earnings growth, even if the growth rates are relatively low. Importantly, the company has been able to manage costs efficiently and has been able to maintain operating margins close to its 20% target. Overall we continue to be optimistic about Gildan, and we estimate that shares are trading with a very significant valuation margin of safety.

Be the first to comment