chonticha wat

It is no real secret that high inflation continues to plague our economy despite efforts by the Federal Reserve to reduce or eliminate it. This has caused some investors to consider traditional ways of protecting wealth in such an environment such as gold, silver, and other natural resources. One easy way to accomplish that is to invest in a closed-end fund that specializes in such assets like the GAMCO Global Gold, Natural Resources & Income Trust (NYSE:GGN). This fund has the advantages of providing both exposure to companies active in the precious metals space and providing investors with a very attractive 10.65% distribution yield. The distribution yield is certain to appeal to many investors as the rising price of pretty much everything today has more and more people seeking additional sources of income with which to pay their expenses. In the past, this fund has unfortunately suffered from steadily declining assets under management, which I pointed out in my last article on the fund. However, a lot has changed in the past year since I discussed this fund, including inflation becoming much worse. Thus, it may be advisable to revisit this fund to see if it now may be worth considering as a way to hedge your portfolio against inflation. As usual, this article will focus specifically on the things that have changed over the past year, including reanalyzing the fund’s finances to see if the fund now makes sense as an investment.

About The Fund

According to the fund’s webpage, the GAMCO Global Gold, Natural Resources & Income Trust has the stated objective of providing a high level of current income. This is somewhat surprising for an equity fund as common equities are a total return instrument. After all, investors seek to generate returns both in the form of stock appreciation and dividend payments. However, this fund specifically states that it only seeks to achieve its objective by investing in equity securities so presumably this could also include preferred equities. Preferred equities are very rarely utilized by companies in the gold and natural resources industries though, so we can assume that the fund will be investing primarily in common equities. It is also worth noting that the fund may be investing in companies outside of gold miners as it specifically states that any company in the “gold or natural resources industries” is a potential candidate for investment. This could be an advantage given that gold has been a surprisingly weak performer despite the inflation currently devastating the economy.

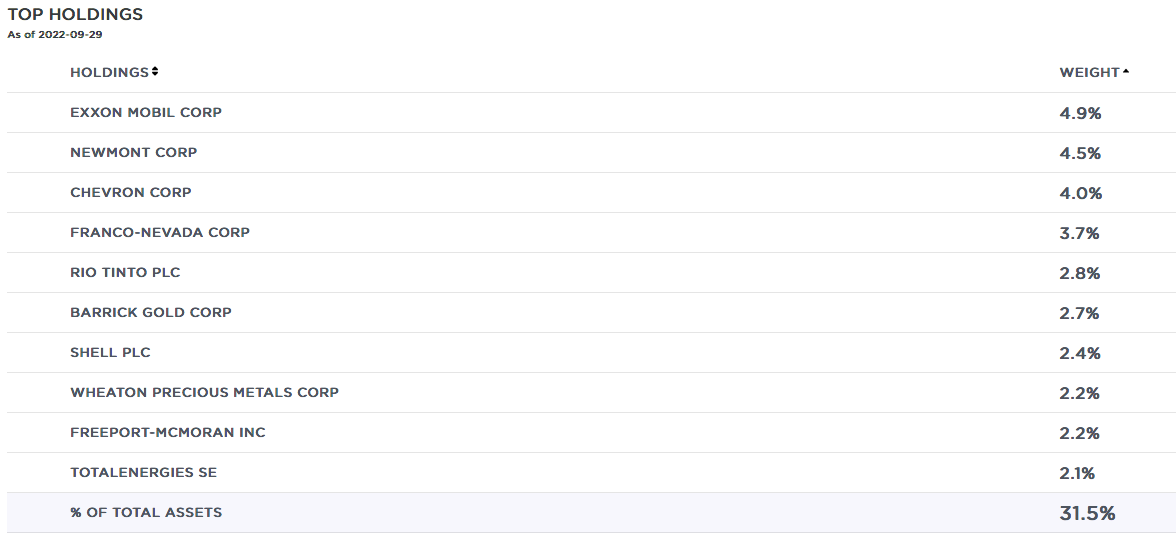

A look at the fund’s largest positions reveals some rather surprising holdings. Here they are:

Gabelli Funds

We see surprisingly few gold miners here. The only companies that are generally considered gold miners are Newmont Corporation (NEM) and Barrick Gold (GOLD). We see a number of energy companies here such as Exxon Mobil (XOM), Chevron (CVX), Shell (SHEL), and TotalEnergies (TTE) along with a few streaming companies and some diversified resource providers. However, many of the companies that are held by the fund are similar to what it had the last time that we looked at it, although the weightings significantly changed. Notably, however, Agnico Eagle Mines (AEM) has been removed from the top ten positions list in favor of TotalEnergies and Northern Star Resources (OTCPK:NESRF) has been replaced with Wheaton Precious Metals (WPM). These changes may not be a bad thing, however, as gold has surprisingly not been performing particularly well over the past two years:

Goldprice.org

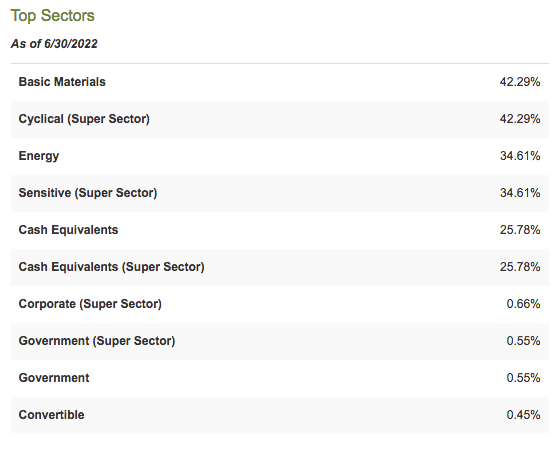

This is in stark contrast to the steep increases that we have seen in crude oil and other commodities over the same period. As such, it should be somewhat comforting to see that the fund is focusing on the commodities that are performing best and are actually driving some of the inflation (such as oil prices) that is plaguing the market. In fact, right now fully 34.61% of the fund is invested in energy, despite ostensibly being a gold fund:

CEF Connect

Despite the fund having substantial assets in things other than gold miners, the fund tends to almost perfectly track gold prices with time:

Fidelity Investments

This is likely why the fund’s performance is actually slightly up over the same period, despite the share price and the price of gold remaining almost perfectly flat over the two-year period:

Gabelli Funds

The big concern though has always been that the fund has been paying out too much money in the form of distributions to its investors. This generally continues to be the case, as we will see later in this article. Despite this though, there are certainly some things in the portfolio that we can appreciate.

One thing that we can see by looking at the largest positions in the fund is that, although the weightings have changed considerably over the past year, the companies represented in these positions have not changed much. This could be a sign that the fund is not doing very much trading since weighting changes can easily be explained in many cases by one stock outperforming another in the market. This is however not the case as the fund has a 96.00% turnover rate. The reason why a high turnover can be a problem is that trading stocks or other assets costs money, which creates a drag on returns. This is one reason for the popularity of index funds as their passive style and minimal trading activity make them remarkably cheap for investors. This does not mean that a fund with a high turnover rate will underperform an actively managed fund but the trading costs do create a hurdle for management to overcome.

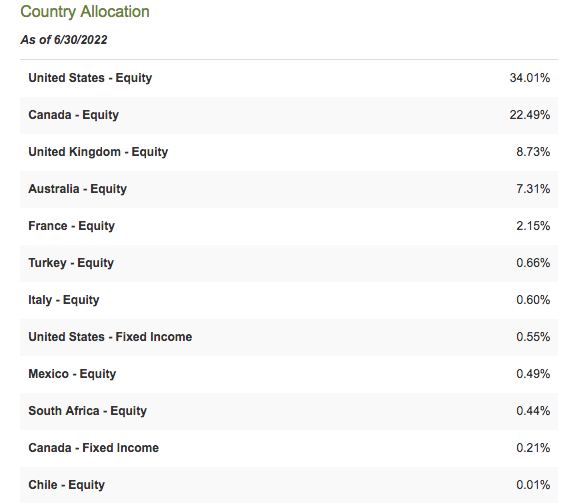

The GAMCO Global Gold, Natural Resources & Income Fund also boasts significant international diversification. We can clearly this here:

CEF Connect

In fact, calling this “significant” international diversification may be something of an understatement. The overwhelming majority of global funds have an exposure to the United States of about 60%, which greatly exceeds the nation’s actual representation in the global economy. The United States only accounts for just under 25% of the total global domestic product. This fund has one of the lowest weightings to that country that I have ever seen in a global fund, however. This international diversification is nice because of the protection that it provides us against regime risk. Regime risk is the risk that a government or other authority will take some action that has a negative effect on a company that we are invested in. We saw a great example of this back in January 2021 when the incoming Biden Administration unilaterally canceled the permits for the Keystone XL pipeline and caused all the money that TC Energy had already invested into the project to be wasted. The only realistic way to protect ourselves against this risk is to ensure that only a limited proportion of our assets is exposed to the government of any given country. As we can clearly see, this fund is doing that quite well, which is important in this industry as numerous resource-rich countries have a history of doing things like nationalizing mineral assets of private companies. This diversification should overall help reduce the risk that investors face.

Gold And Natural Resources As Protection Against Inflation

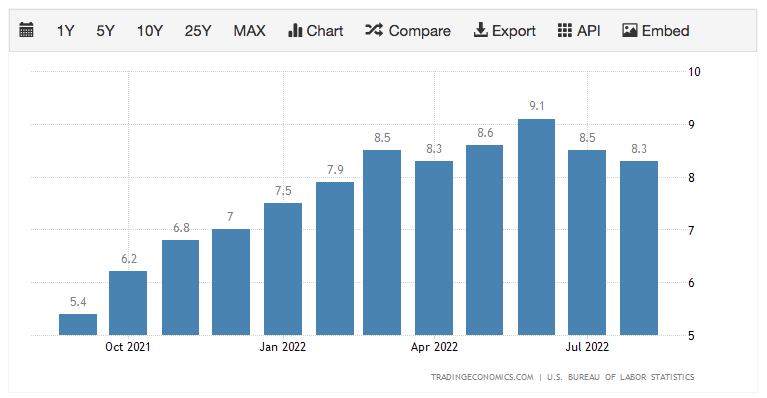

It is undoubtedly no real news to anyone reading this that inflation has been running at incredibly high levels over the past year or so. Although the inflation rate for September 2022 has not yet been announced, the rate was 8.3% in August and has been over 7.0% every month this year:

Trading Economics

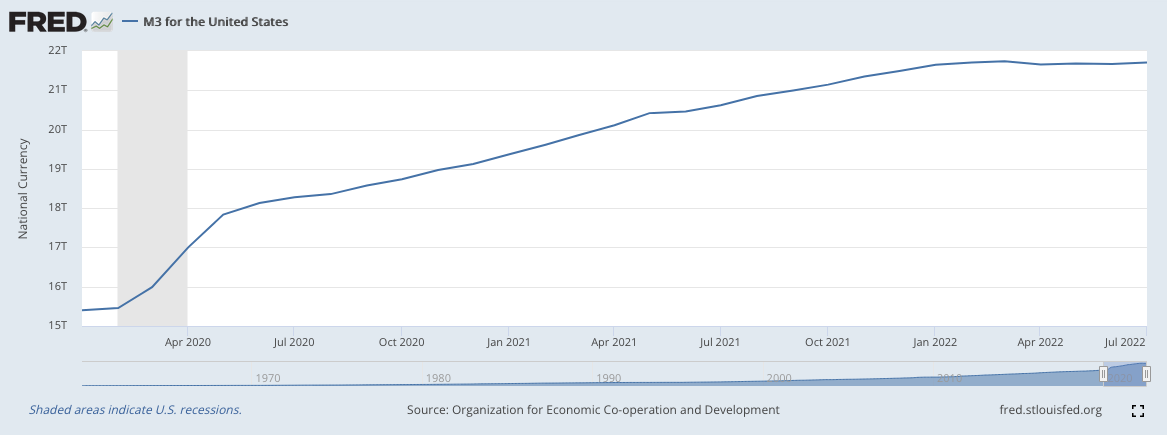

This compares to the 4.10% rate that prevailed in the country in 2021. One of the major reasons for this is the government’s response to the COVID-19 pandemic. As I pointed out in a previous article, the Federal government passed some of the largest spending bills in its history in response to the pandemic, which was essentially funded by the Federal Reserve printing money. We can clearly see this by looking at M3, which is the most comprehensive measure of the money supply in a given economy. As we can see here, the M3 money supply went from $15.4018 trillion on January 1, 2020, to $21.7092 trillion today:

Federal Reserve Bank of St. Louis

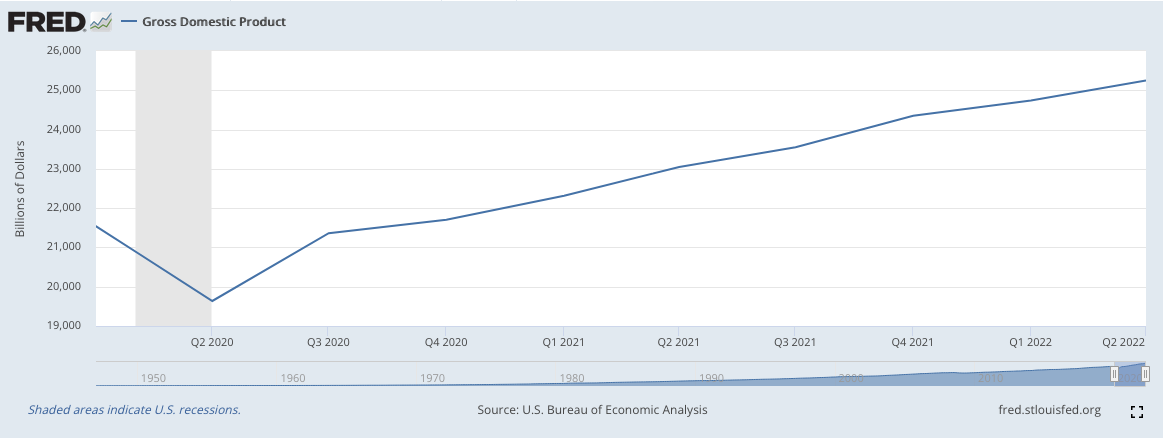

This represents an increase of $6.3074 trillion (40.95%) in only two years. This is substantially higher than the increase in America’s production of goods and services:

Federal Reserve Bank of St. Louis

The gross domestic product of the United States went from $21.538032 trillion at the start of 2020 to $25.248476 trillion today, which is only an increase of 17.23%. The root cause of inflation is when the money supply grows faster than the gross domestic product, which is exactly the situation that we are seeing today.

Historically, investors have relied on gold and other precious metals to protect themselves and the purchasing power of their wealth against the ravages of inflation. However, as we saw above, that has not proven to be the case over the past few years though as the rising dollar spurned on by the recent Federal Reserve interest rate policies has driven down gold prices. It may only be a matter of time before this is no longer the case and gold begins to rebound though. Peter Schiff recently pointed out that the overwhelming majority of government borrowing is through short-term instruments that need to be rolled over every year or two. As a result, the Federal government itself cannot afford significant increases in interest rates and it certainly cannot afford the rates that would be needed to bring inflation down to the Federal Reserve’s 2% target. Thus, there is a very high possibility that investors will be seeking other options to protect their wealth once they realize that the central bank cannot stop the current inflationary problem. Historically, that something has been gold and it seems likely that this could once again become the investment vehicle of choice. This could position the GAMCO Global Gold, Natural Resources & Income Fund to perform quite well over the long term.

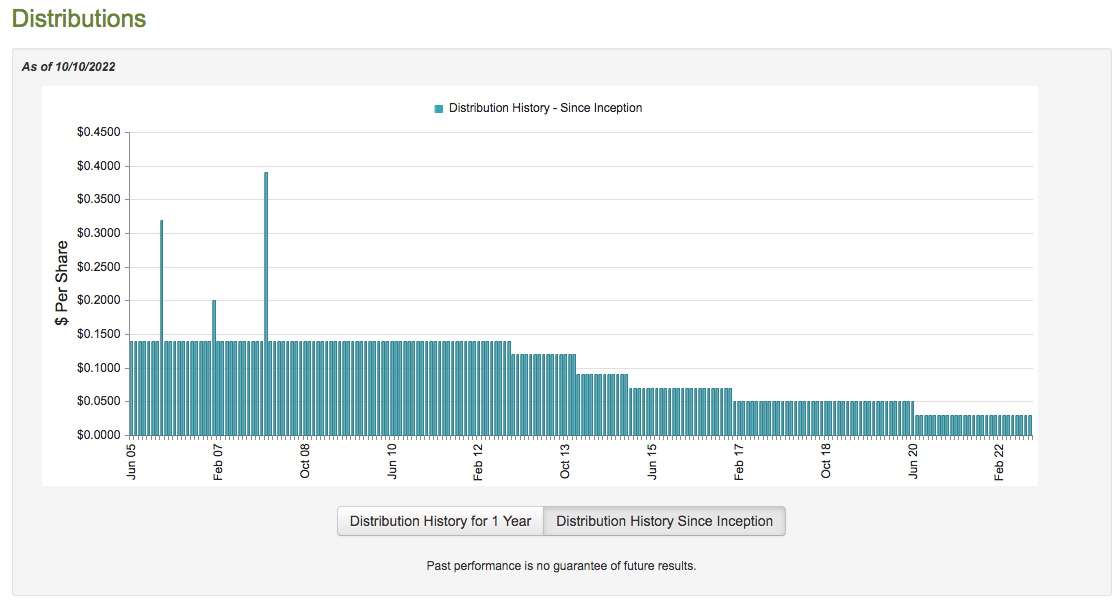

Distribution Analysis

As stated earlier, one of the goals of the GAMCO Global Gold, Natural Resources & Income Fund is to provide its investors with a high level of current income. It primarily does this through the distribution that it pays out. The fund currently pays out a monthly distribution of $0.03 per share monthly ($0.36 per share annually), which gives it a 10.65% yield at the current price. Unfortunately, the fund’s long-term track record of maintaining this distribution leaves something to be desired:

CEF Connect

We can clearly see that the fund has seen its distribution decline over the years, which is not admittedly uncommon for many closed-end funds. This still may be discouraging for those investors that are seeking a secure and consistent source of income with which to pay their bills. It has been remarkably consistent since the start of 2020 though, which is a feat that many natural resource companies cannot match. However, it is important to note that anyone purchasing the fund today will receive the current distribution and so does not have to worry too much about the fund’s past. The important thing for these people is whether or not the fund can actually maintain the distribution at the current level. Let us investigate to figure out that question.

Fortunately, we have a very recent report to consult for this purpose. The fund’s most recent financial report corresponds to the six-month period ended June 30, 2022. This is quite nice as it should give us an idea of how well the fund performed during the high inflation environment that we saw during the first half of this year. During the six-month period, the GAMCO Global Gold, Natural Resources & Income Fund brought in a total of $7,348,733 in dividends net of withholding taxes and $448,087 in interest from the assets in its portfolio. When combined with approximately $1,945,886 in non-cash dividends, the fund had a total of $9,742,706 with which to pay its bills. It paid all its expenses out of this amount, leaving it with $5,590,443 available to distribute to the investors. This was obviously not nearly enough to cover the $27,748,497 that it actually did distribute during the period, though.

Fortunately, the fund does have other ways with which it can obtain the money that it needs to pay for the distribution. The most important of these are capital gains. It, sadly, did not do particularly well at this over the period. During the six-month period, the fund had realized losses of $36,838,428 which was only partially offset by $10,286,889 of unrealized capital gains. Overall, the fund’s assets declined by $50,872,030 during the first six months of the year. This continues the fund’s track record of net asset declines that I complained about in my past articles about it. This continues to be my biggest concern with this fund as it does not appear that the distribution is sustainable despite the cuts that the company has made over the years.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the GAMCO Global Gold, Natural Resources & Income Fund, the usual way to value it is by looking at the fund’s net asset value. A fund’s net asset value is the current market value of the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can obtain them at a price that is less than the fund’s net asset value. This is because such a scenario implies that we are acquiring the fund’s assets for less than they are actually worth. This is fortunately the case right now. As of October 10, 2022 (the most recent date for which data is available as of the time of writing), the GAMCO Global Gold, Natural Resources & Income Fund has a net asset value of $3.45 per share but only trades for $3.35 per share. This gives the fund a 3.00% discount on the net asset value. This is a bit better than the 2.37% discount that the fund has traded at on average over the past month so the price appears to be reasonable. I will admit though that the fund’s long track record of asset declines gives me pause even if the price is attractive.

Conclusion

In conclusion, the GAMCO Global Gold, Natural Resources & Income Fund certainly sounds like a great idea in concept. After all, gold and natural resources both typically do well during inflationary times, even if gold has not performed particularly well so far this year. The fund also boasts a surprisingly diverse portfolio that includes far more than just gold. However, it continues to pay out more than it can actually afford, making the 10.65% yield appear rather challenged.

Be the first to comment