Funtap/iStock via Getty Images

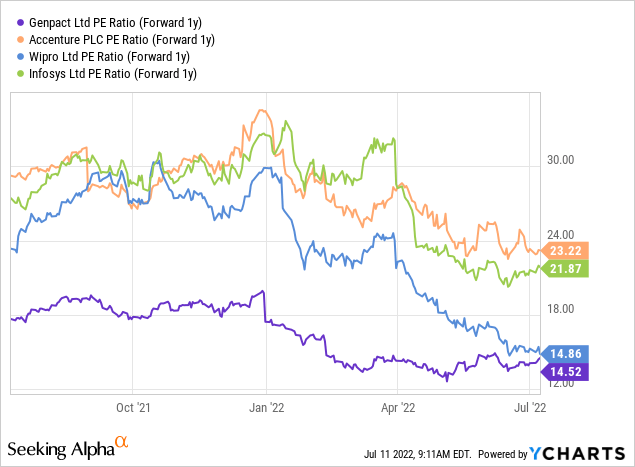

This year’s Genpact (NYSE:G) investor day event offered good insight into how management plans to unlock earnings growth over the longer-term, while also navigating through a potential economic downturn ahead. Assuming management delivers on its double-digit revenue growth target, sustains margin expansion above historical levels, and leverages its capital allocation options (share repurchases and M&A), I see a clear path to EPS outperforming through fiscal 2026. While short-term headwinds from talent attrition and wage inflation remain a concern, the company has positioned itself well to capitalize on margin-accretive growth drivers across its emerging services offerings, and therefore, I am upbeat on the margin outlook. Genpact shares trade at an EV/EBITDA multiple of c. 10x, a relative discount to business outsourcing peers like Infosys (INFY), Wipro (WIT), and Accenture (ACN).

Favorable Industry Tailwinds Support Medium-Term Outgrowth

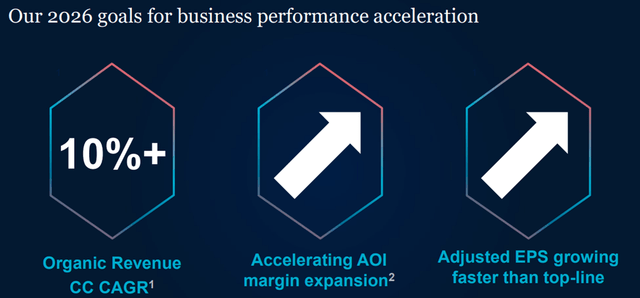

Genpact upped its TAM (“total addressable market”) estimate at its latest investor day, outlining an ambitious new $1.05 billion market size by fiscal 2026 (considerably above the previous $750 million TAM). A large portion of this growth is guided to come from the Data-Tech-AI segment, which is set to grow from 60-65% currently to 70-75% of the TAM, while Digital Ops will contribute 25-30% (vs. the prior 30-35%). As the established market leader, I see little reason Genpact cannot extend its capabilities into these new markets. The company’s strong relationships with its priority clients is a key advantage in this regard, with management now guiding to the recurring top-line contribution from these top tier clients reaching 70+% of revenues by fiscal 2026 (up from c. 55% of fiscal 2021 revenues). Looking ahead, Genpact expects organic medium-term revenue growth at 10+% CAGR, with M&A contributing an additional 1%-2% of inorganic growth per year.

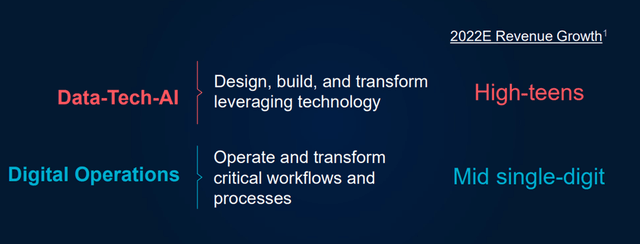

In-line with its targeted growth areas, management will be making changes to its financial disclosures. Notably, it will cease breaking out revenues from General Electric (GE) – an unsurprising development considering its pending break-up and the growing non-GE revenue base (recall Genpact was formerly the Indian captive arm within GE). Looking ahead, Genpact will report its segmental disclosures as follows – “Data-Tech-AI” (design, build, and transform using technology) and “Digital Operations” (operate and transform workflows and processes). The high-growth Data-Tech-AI segment is guided to grow in the high-teens % in fiscal 2022 and will focus on solutions driving fundamental change for its clients. The Digital Operations segment, which will see Genpact running operations on behalf of its clients, will grow at a relatively slow (but steady) mid-single digits % rate but also features a more stable margin profile. I view the updated reporting format positively, as it better reflects the underlying economics and provides investors improved visibility into the future growth path of the overall business.

Tapping into Margin Levers to Accelerate Bottom-Line Growth

Over the fiscal 2018 to 2021 period, Genpact has seen a consistent 10-20bps annual margin expansion (cumulative c. 70bps) on the back of improved pricing trends. While Genpact refrained from quantifying its medium-term margin expansion target, the company guided to an impressive acceleration in the margin expansion rate through fiscal 2026. A higher outcome-based and consumption-based pricing mix is a key margin lever, driving an incremental +500bps of operating margin relative to traditional models. Additionally, the company is increasingly leaning into employee initiatives, for instance, re-skilling programs, to reduce churn. Encouragingly, these efforts have been paying off – re-skilled employee attrition runs c. 50% below other colleagues, further boosting Genpact’s industry-leading employee stability.

A medium-term shift toward the higher-margin Data-Tech-AI business should also support incremental margin accretion – Data-Tech-AI contributed c. 42% of fiscal 2021 revenue and is set to outgrow Digital Operations, likely resulting in an overall margin uplift over the upcoming years. Other margin levers include unlocking operating efficiencies by rationalizing the real estate footprint, optimizing the operating cost base, and streamlining the portfolio. Success here, coupled with the increased scale of the overall business could drive upside surprises to the future earnings growth path.

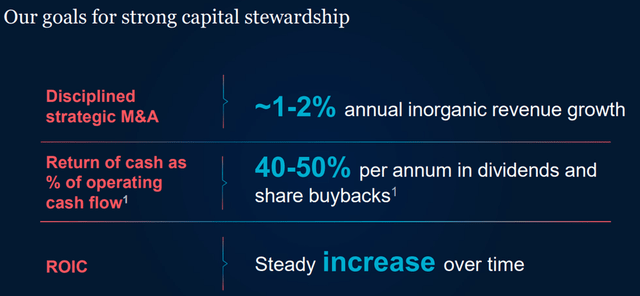

A More Shareholder-Friendly Capital Allocation Policy

Backed by its highly cash-generative business model and limited capital intensity, Genpact also unveiled a more consistent capital return policy built on strategic M&A and shareholder return. Specifically, the company plans to allocate 40-50% of its annual operating cash flow towards dividends and share repurchases (c. 30% specifically toward repurchases), with the remainder to be spent on strategic tuck-in acquisitions. While the updated repurchase size is largely in-line with prior levels, Genpact will adopt a more regular approach to repurchases, likely providing more support to the share price over the upcoming years.

Interestingly, M&A is guided to add 1%-2% to the top-line each year – a notable increase from prior years. Rather than buying incremental revenue or income, however, management is focused on growing its delivery capabilities, while also maintaining a strong longer-term ROIC (“return on invested capital”) and shareholder returns. This tallies with the recent acquisitions of Barkawi, Hoodoo, and Something Digital, all of which have provided the company a foothold into new growth areas such as supply chain management. Notably, future M&A will also be subject to Genpact’s ability to maintain leverage levels between 1-2x, ensuring a healthy balance between executing on growth-led strategic M&A and retaining its balance sheet flexibility over the medium to longer-term.

Final Take

Overall, Genpact’s investor day provided a good outline of the longer-term trajectory in its key growth segments and potential margin drivers. Considering the low penetration levels across its emerging growth services markets and the fact that Genpact is already gaining traction with its new and existing clients, I am optimistic about the longer-term growth prospects. In addition to the high single digits to low double digits top-line growth target, the conservative annual margin expansion outlook (accounting for short-term wage-related cost pressure) also looks very achievable. And with Genpact shares trading at a discounted EV/EBITDA multiple relative to its BPO peers, I see plenty of room for upside ahead.

Be the first to comment