Justin Sullivan/Getty Images News

General Mills (NYSE:GIS) manufactures and markets branded consumer foods worldwide. It offers a wide variety of products ranging from ready-to-eat goods through dessert and baking mixes to frozen and shelf-stable vegetables.

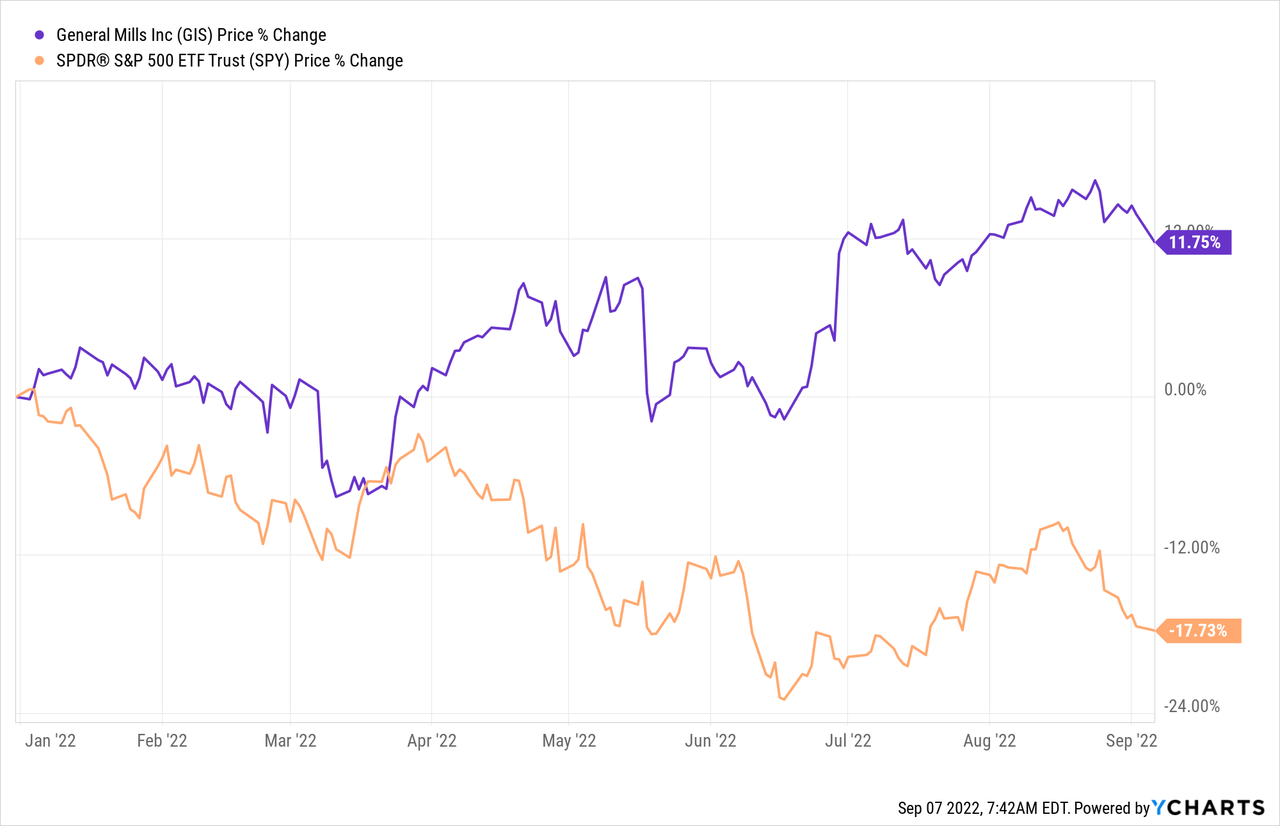

General Mills stock price has performed relatively well year to date, despite the high volatility of the overall market. The stock has been outperforming the broader market by about 30% in this time frame.

In our article, we will discuss what the two main reasons are, in our opinion, that would justify adding General Mill to your portfolio.

1) Historically outperformed the broader market during times of low consumer confidence

Consumer confidence is often treated as a forward looking economic indicator. It can be used to try to gauge the changes in the consumer spending behaviour in the near future. A low or declining consumer sentiment can be a signal of the consumer becoming more reluctant to spend larger sums of money on durable, discretionary, non-essential goods and services.

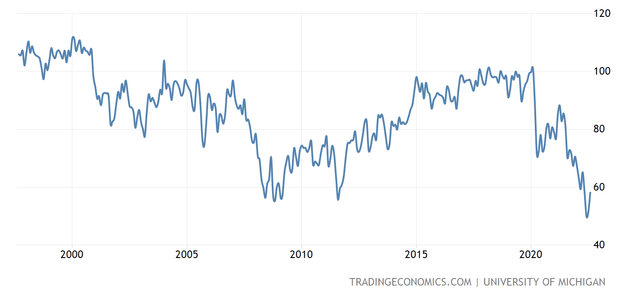

The U.S. consumer confidence in the first half of 2022 has seen a rapid decline, falling below levels seen during the 2008-2009 financial crisis.

U.S. Consumer confidence (Tradingeconomics.com)

In our opinion, the low consumer confidence does not have a significant direct impact on GIS’s financial performance. The products that General Mills manufactures and markets can be categorised as consumer staples and are, in general, essential goods.

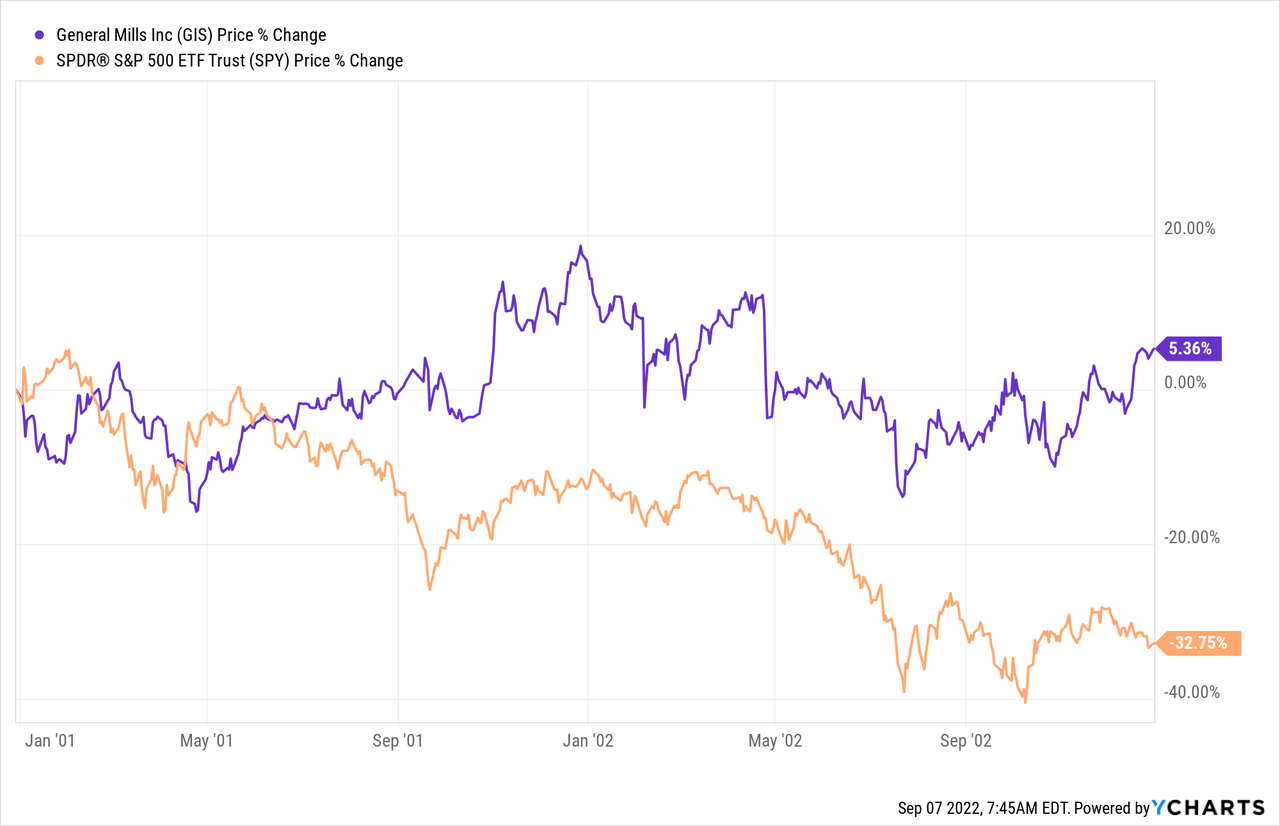

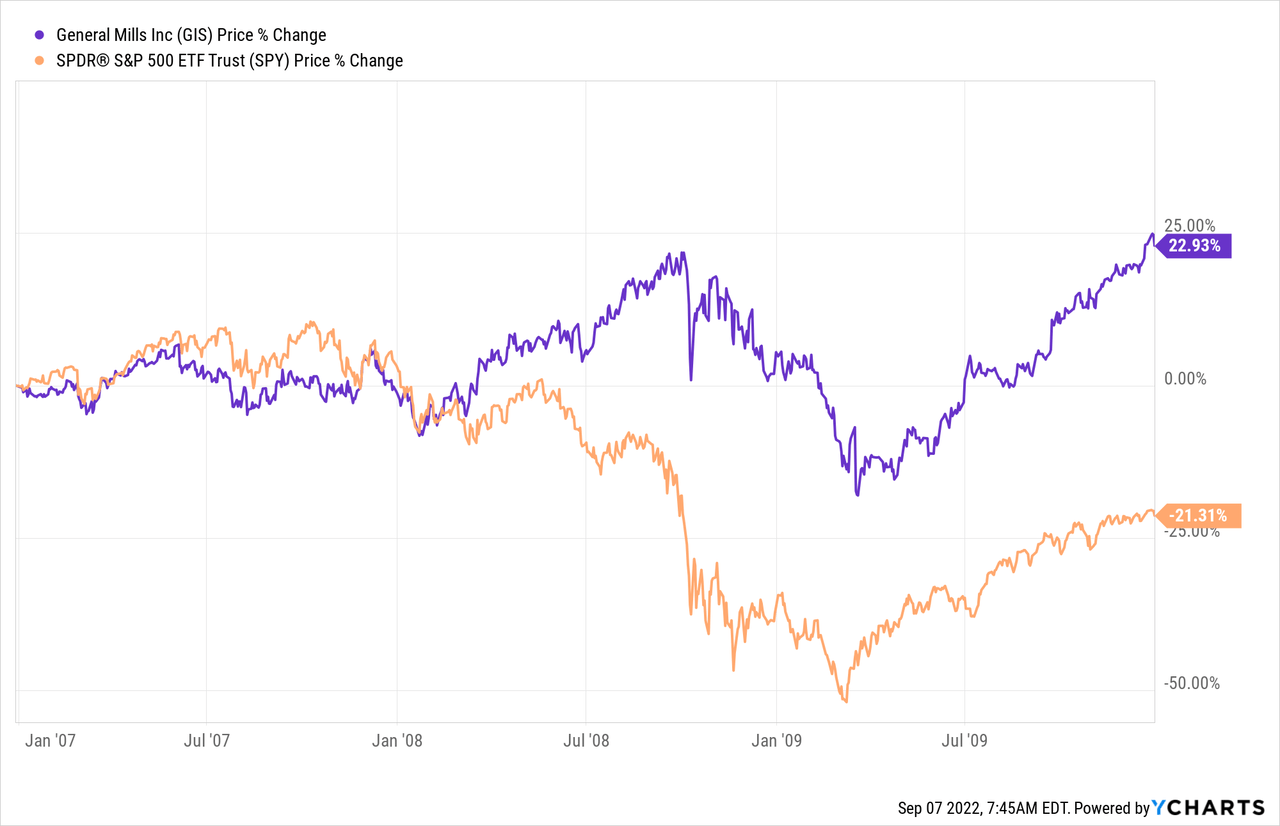

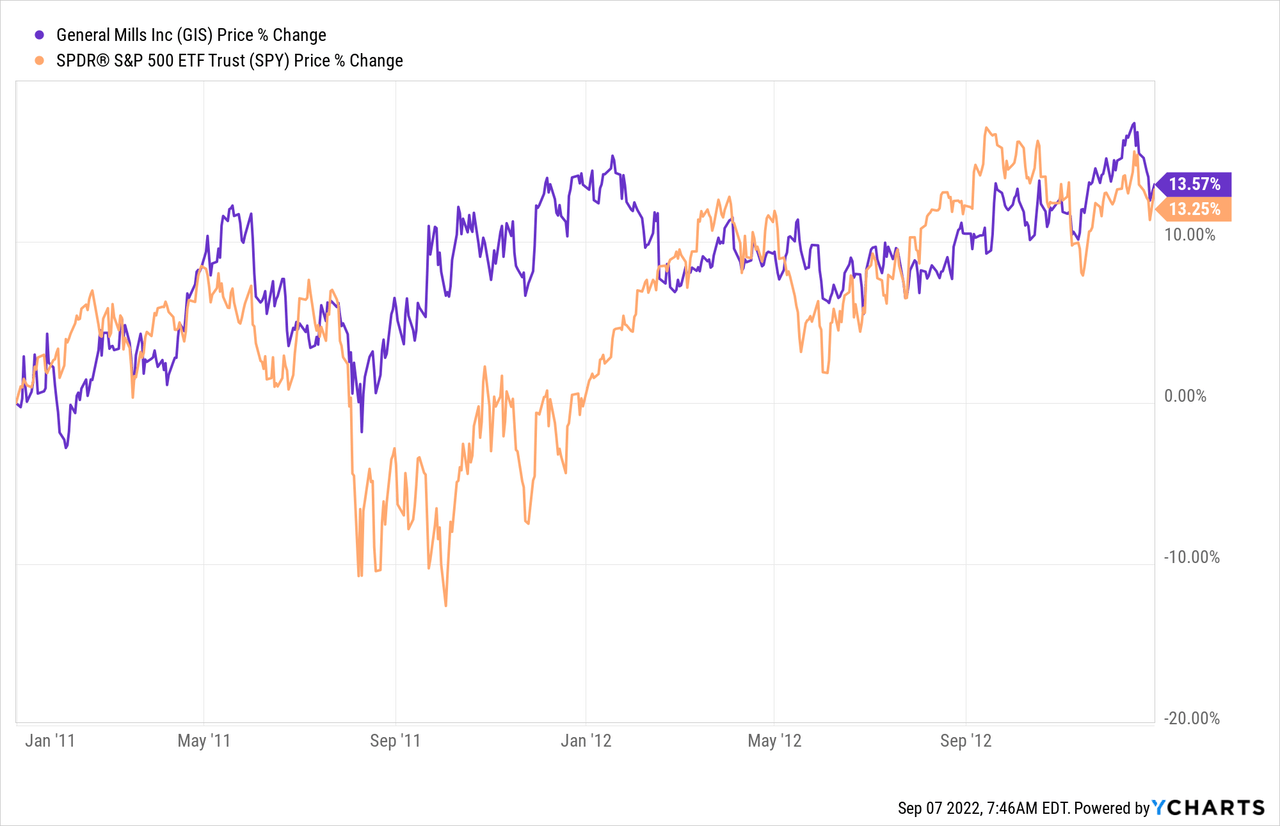

If we look at the performance of the stock in the past 20 years during times of low consumer confidence, we can see that GIS, in fact, has outperformed the broader market in all three periods and its stock price has been less volatile.

2001-2003

2007-2010

2011-2013

In the current market environment we believe GIS is also likely to keep outperforming the broader market.

Due to the increasing inflation and the low consumer confidence, people are likely to cut back on their spendings in restaurants. Further, the demand for food delivery services may also be reduced as it is also more costly than preparing meals at home. In our view, people would likely start purchasing and consuming more ready-to-eat and raw food products to reduce their expenses. Such trends could be favourable for GIS’s business and the demand for the firm’s products may increase. We believe that in the near future this trend could be one of the key drivers of General Mills’ performance.

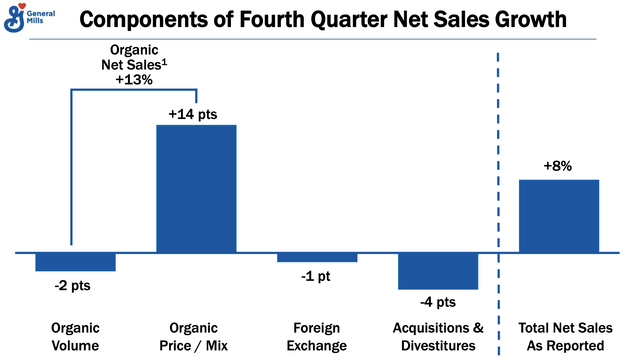

On the other hand, note that just like most other companies, General Mills is also impacted by the macroeconomic headwinds related to higher input costs, higher labour costs and potential supply chain disruptions.

In the previous quarter, however, the firm was able to partially offset these increased costs by the increase in total net sales, primarily driven by the improving price/mix.

Net sales growth (General Mills)

2) Strong track record of returning value to shareholders

GIS has been returning value to its shareholders in the past decades both through dividends and share repurchase programs.

Dividends

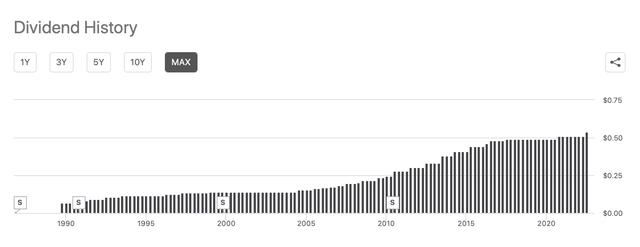

GIS has been paying dividends to its shareholders since 1989. Even during 2020, when many firms have cut their dividend payments due to the impacts of the pandemic, GIS has kept paying the quarterly dividends.

Dividend history (Seekingalpha.com)

In our opinion, a defensive firm like GIS could be an attractive addition to a dividend portfolio. During 2005 and 2015, the dividend growth has also been extraordinary, however in the last 5 to 7 years, dividend growth has substantially slowed.

The last announced dividend of GIS was a quarterly payment of $0.54 per share, which is equivalent to a yield of about 2.9% on an annual basis. We believe that this amount is safe and sustainable as the payout ratio is about 52% and neither revenue nor earnings are expected to significantly decline in the upcoming years.

Share buybacks

While dividends represent direct cash payments to the shareholders, a share buyback is when a company buys its own outstanding shares to reduce the number of shares available on the open market and thereby increase the value of the remaining shares. It can also signal confidence that the firm may feel that its shares are undervalued.

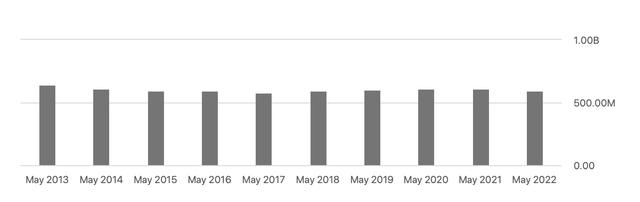

In the last decade, although there have been ups and downs in the number of shares outstanding, GIS has reduced the total number by about 7%.

Shares outstanding (Seekingalpha.com)

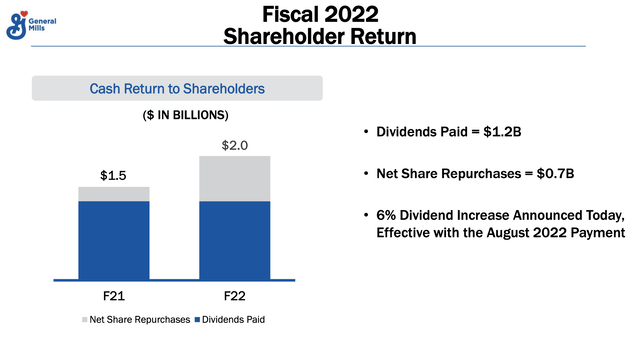

This trend is expected to continue in the near future. GIS in their latest quarterly earnings presentation showed that they are aiming to return as much as $2 billion to shareholders in cash in 2022, representing a more than 30% increase compared to the prior year.

Shareholder return (General Mills)

Key takeaways

In our opinion, in the current market environment investors can benefit from owning businesses that are less affected by the low consumer confidence and provide reliable, safe and sustainable cash returns to the shareholders. GIS checks both of these boxes. General Mills has a strong track record of outperforming the broader market during times of low confidence and has also been returning value to its shareholders during the past decades in the form of dividend payments and share buybacks.

For these reasons, we believe that GIS could be an attractive addition to a dividend portfolio.

Be the first to comment