creisinger

July 26th proved to be an interesting and generally positive day for investors in industrial conglomerate General Electric (NYSE:GE). Before the market opened, the management team at the firm announced financial results covering the second quarter of the company’s 2022 fiscal year. Although the data could largely be described as mixed, with some positive and some negative aspects, the market perceived the news in a favorable light. In particular, the market put a significant amount of weight on the company’s performance when it came to its aerospace operations. As a bull of the company, I am happy with the market’s reaction and I found myself surprised at just how strong the company’s aerospace operations were. But I was not expecting such a favorable response considering how many other items came in on the other side of the equation. Long term, I fully believe that this enterprise will create significant value for its investors. But unlike the market, I view the most recent data provided as a mixed bag that tilted slightly toward the negative.

A necessary disclosure

Before I get into the meat and potatoes of the article, I should first make a necessary disclosure. And that is that, effective the second quarter, the company had rebranded its operating segments. For instance, what was traditionally known as its Aviation segment has now been referred to as GE Aerospace. The Healthcare segment has been rebranded as GE HealthCare. And the Power and Renewable Energy segments have been added together and branded as GE Vernova. For the purpose of comparability for my earnings preview article, I will still refer to the individual parts of the company as the segments they were once known as. But in future articles, I will rely on the new grouping and rebranding as appropriate.

General Electric’s key segments had mixed results in Q2

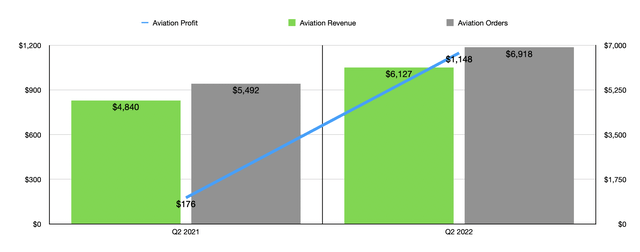

To begin with, we should touch on the highlight of the company’s earnings release. And that would be its Aviation segment. In a prior article that I wrote about the company where I highlighted what investors should keep an eye out for, I singled this unit out as one that could perform exceptionally well. Truth be told, the segment fared better than even I anticipated though. Revenue for the quarter came in at $6.13 billion. That’s 26.6% higher than the $4.84 billion reported the same quarter one year earlier. Profits did even better, skyrocketing from $176 million last year to $1.15 billion this year.

The rise in revenue can be attributed to robust demand for the company’s products and services. And the rise in profitability is largely as a result of management’s ability to push costs off onto customers and because of some of the company’s prior cost-cutting initiatives. Remember that, at the end of last year, the company said that it would achieve around $4 billion in annualized cost savings of its $6 billion target by the end of this year. This is now being reflected in the performance of its key assets like Aviation. Equally exciting was the fact that the company reported strong orders in this segment, with that number coming in at $6.92 billion. That’s 26% higher than the $5.49 billion reported for the second quarter of the company’s 2021 fiscal year. This is a leading indicator of future demand for the company’s services and reflects the increased traveling we have seen as the global pandemic winds down. In truth, it is a sign of even stronger revenue and stronger profitability in the years to come.

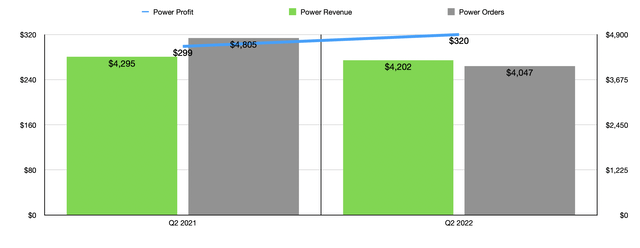

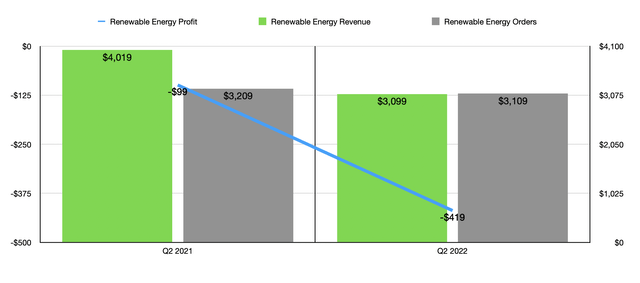

While the Aviation segment had a fantastic quarter, other segments were not quite as lucky. Consider the company’s Power segment. Revenue for the quarter came in at $4.20 billion. That was actually lower than the roughly $4.30 billion generated the same time one year earlier. To make matters worse, orders tanked year over year, dropping by 15.8% from $4.81 billion to $4.05 billion. Perhaps the only positive when it came to this particular segment was profitability. Despite revenue falling, the company saw profits for the quarter come in at $320 million. That represents an increase of 7% over the $299 million generated just one year earlier. Even worse than this, in some respects, was the Renewable Energy segment. Revenue of $3.10 billion translated to a year-over-year decrease of 22.9% compared to the $4.02 billion generated just one year earlier. Profitability also worsened, with the company’s loss soaring from $99 million in the second quarter of 2021 to $419 million the same time this year. If there was any positive when it came to this particular segment, it’s that orders fell only 3.1% year over year, dropping from $3.21 billion to $3.11 billion.

GE’s cash flow and debt

In my prior article on the company, I also said that investors should be paying attention to a couple of other factors. One of these was cash flow. And sure enough, this was one positive area for the company. According to management, operating cash flow in the latest quarter was $508 million. That compared favorably to the negative $351 million reported one year earlier. As a result of this improvement, total operating cash flow for the first half of the year came in at negative $27 million. That compares to the negative $2.99 billion the company reported for the same time of its 2021 fiscal year. Despite this improvement in cash flow, the company did see its overall leverage worsen during the quarter. Net debt ended at $12.58 billion. That compares to the $10 billion the company had in net debt as of the end of its prior quarter.

Backlog and other musings

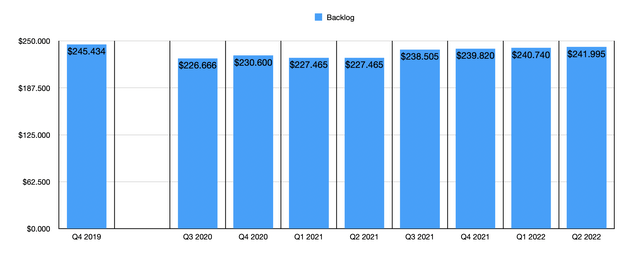

The last item that I told investors to keep a close eye on was backlog. At the end of the day, backlog is an incredibly important indicator of the company’s future potential. After all, it is representative of how much revenue the business should generate from contracts in the months and years to come. For a few quarters now, the company had been seeing this number increase. And it is vital that this trend continue if the firm is to be healthy. However, I was concerned when I saw the order data related to the Power and Renewable Energy segments, since orders are a component in determining what backlog ultimately is. Fortunately, the strong showing for Aviation helped to rectify this, pushing backlog in the latest quarter up to $242 billion. That compares to the $240.74 billion reported just one year earlier. The company is still below its 2019 levels, but the trend is clear.

Outside of the scope of my article, there were some other interesting developments that warrant attention. For instance, management said that during the quarter they repurchased 4.6 million shares of stock on the market for roughly $300 million. Although it’s possible the firm may have been better off putting this toward further debt reduction or operational improvements, buying back stock is not necessarily a bad idea when shares are as cheap as they are. The company also announced that it incurred roughly $200 million in separation costs during the quarter as it continues to cut ongoing operational expenses. Though painful, this is an investment in the future health of the business. But what didn’t help was that with the recognition of new accounting standards that are due to be implemented next year will impact the company’s equity by the tune of between $7 billion and $8 billion on a pre-tax basis, with the after-tax impact being between $4 billion and $5 billion. This largely relates to long-duration insurance contracts and first principles models connected with FASB standards. And finally, the company said that current guidance for the 2022 fiscal year still holds, but that the company is now looking to come in at the low end of that scale on all fronts, with the exception of free cash flow. Due to changes in working capital caused by supply chain issues and management’s efforts to protect its customers from inflationary pressures, it is pushing out $1 billion of free cash flow into next year that it otherwise would have recognized this year.

Takeaway

All things considered right now, I am happy that the market pushed shares of General Electric up in response to second quarter results. Truly, some aspects of the business were excellent. The Aviation segment performed exceptionally well and continues to prove that it has a bright future ahead for it. Operating cash flow showed nice improvements year over year, while the Power segment’s increased profits in an environment where revenue fell was a net positive. On the other hand, I also acknowledge that the market can be particularly fickle about this firm since it still sees it as a turnaround and since management has lost some credibility with some investors. And because of that sensitivity, I was expecting shares of the business to face more resistance when it came to some of the negative attributes of the earnings release. Having said that, I am still personally very bullish on the firm, and I believe that as time goes on, this bullishness will come to be shared by many who are currently bearish on the business.

Be the first to comment