George Frey

Thesis

Generac Holdings Inc.’s (NYSE:GNRC) FQ3 earnings release had already been anticipated in its prelim release, as we highlighted in our previous article.

However, its FY22 guidance and FY23 framework have not lifted buyers’ sentiments, despite the capitulation move from its August highs. We parse that the market has likely reflected the worst of its execution through H1’23, with concomitant slashed analysts’ estimates.

Despite the revised forward estimates, we assess that GNRC’s valuation remains close to its 10Y lows. Therefore, the potential for a re-rating remains possible if the market regains confidence over its execution.

Notwithstanding, the current property market downturn has not proffered investors sufficient confidence about the company’s execution of its FY23 framework. Therefore, investors who choose to add at the current levels need high conviction over its secular growth story of long-term megatrends supporting its two critical segments (residential, commercial & industrial).

While we continue to view Generac’s valuation and long-term growth story as constructive, we need to see buyers return with conviction to help GNRC recover its long-term bullish bias.

We parse that GNRC’s long-term uptrend bias has weakened considerably, as our anticipation of a mean-reversion rally didn’t pan out. Therefore, we encourage investors to layer in over time, as potential downside volatility could still ensue as the market assesses Generac’s credibility in its execution through FY23.

Maintain Buy, with a medium-term price target of $140.

GNRC: Market Remains Unconvinced With Potential H2’23 Inflection

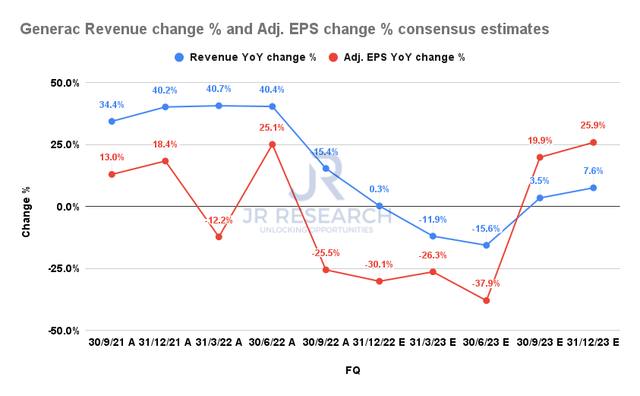

Generac Revenue change % & Adjusted EPS change % consensus estimates (S&P Cap IQ)

Management’s commentary at its FQ3 call highlighted that its inventory digestion could persist through H1’23. The company remains confident that it could return to “solid growth” in H2’23. However, the execution missteps leading to FQ3 have likely shaken investors’ confidence in management’s credibility of a sharp H2’23 inflection, as seen above.

Recent Fed minutes suggest that its staff viewed there was a 50/50 chance of a recession. However, the Fed has remained tentative over their terminal rate guidance as we head into the December FOMC meeting.

While the 30Y mortgage rates have fallen to 6.58% from their November highs of 7.08%, housing demand remains uncertain, as Freddie Mac accentuated: “This volatility is making it difficult for potential homebuyers to know when to get into the market.”

We believe the volatility could remain in the near term as the market parses the potential for a higher terminal rate than expected. Therefore, Generac needs to deal with worsening macros, and an uncertain housing market, while digesting its significant field inventories.

As such, we believe the market is assessing the risks to its FY23 framework of a significant H2’23 inflection. However, we discerned that buyers remained surprisingly different, despite the steep capitulation seen in GNRC.

Is GNRC Stock A Buy, Sell, Or Hold?

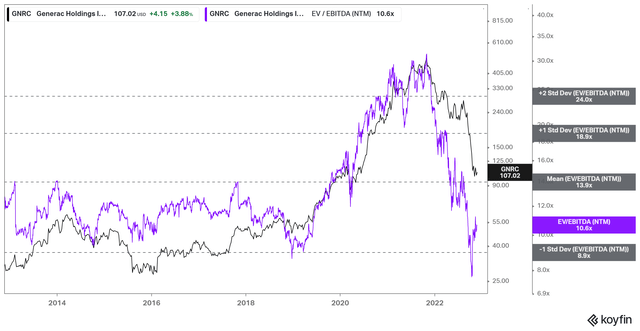

GNRC NTM EBITDA multiples valuation trend (koyfin)

GNRC last traded at an NTM EBITDA of 10.6x, well below its 10Y average of 13.9x. It’s also below its peers’ median of 17.6x (according to S&P Cap IQ data).

Hence, the de-rating by the market was brutal, sending GNRC spiraling closer to its March 2020 COVID lows. Therefore, we assess that its valuation remains attractive.

Hence, the potential for a material re-rating is possible if the market anticipates that Generac could recover its execution prowess through H2’23, in line with its FY23 framework.

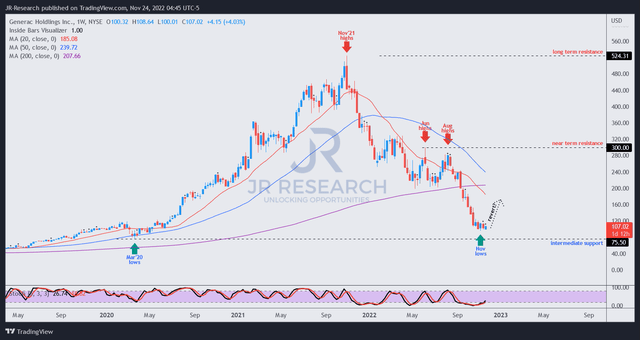

GNRC price chart (weekly) (TradingView)

GNRC has fallen way below its critical 200-week moving average (purple line). We had anticipated a sharp mean reversion rally from its recent lows, but that had yet to pan out.

Hence, it seems that GNRC buyers remain tentative over a material re-rating in the near term and could be assessing the company’s execution and the macroeconomic environment heading into FY23.

Therefore, we deduce that GNRC’s long-term bullish bias has weakened considerably, behooving investors to apply extra caution when adding positions (i.e., add over time).

Maintain Buy with a PT of $140.

Be the first to comment