Chip Somodevilla/Getty Images News

On Wednesday, the SEC disapproved the Grayscale Bitcoin Trust’s (OTC: GBTC) proposed conversion to a spot Bitcoin (BTC-USD) ETF. Restating a prior argument, the Commission said Grayscale and NYSE Arca had not adequately shown the fund is designed to prevent fraudulent and manipulative acts. Specifically, the SEC again focused on the failure to meet technical aspects of a general rule that an exchange traded product has “a comprehensive surveillance-sharing agreement with a regulated market of significant size related to the underlying or reference bitcoin assets.”

The Grayscale disapproval will have a substantial, though hard to quantify, negative effect on crypto adoption over time because of the type of access a U.S. spot Bitcoin ETF would have provided investors. Among traditional exchange traded products, a spot-based fund like Grayscale’s has the preferable structure from a harder asset and crypto tenant perspective. The investment’s value is on-chain. This is key because the primary utility of the Bitcoin blockchain is its decentralized ledger of value operating in a trustless and permissionless environment.

In place of a spot-based product, the SEC has left investors with off-chain, meaningfully less transparent participation through the CME derivatives market. Further, this Bitcoin futures market is distinctly permissioned and trust requiring. Note that Bitcoin futures trades are never on-chain, even at settlement, because they are only cash settled with no physical delivery.

Ironically and despite the coming disapproval of spot-based ETFs, earlier in June the ProShares Short Bitcoin Strategy ETF (BITI) began trading and offers futures-based short exposure to retail investors without the rigor of having a margin, futures or options account. Relatedly, this article considers the main point of contention concerning the surveillance-sharing agreement and what has become known as the “arbitrary and capricious” argument. Understanding and weighing this argument is necessary for those now considering hodling their positions in the Grayscale Bitcoin Trust longer-term. Also considered are how the disapproval affected the timeline for possible spot-based ETFs and takeaways for how to now look at the Trust.

Litigation of “a regulated market of significant size related to the underlying”

Grayscale immediately filed for review of the disapproval decision with the United States Court of Appeals for the D.C. Circuit. The review was submitted of behalf of Grayscale by former U.S. Solicitor General, Donald Verrilli. Interestingly, Verrilli has argued dozens of cases before the Supreme Court including the Affordable Care Act and is recognized for effectively making technical legal arguments.

Grayscale Tweet GBTC Litigation (Twitter)

In a letter to investors, Grayscale summed up the main thrust of their argument against the SEC decision.

The SEC is failing to apply consistent treatment to Bitcoin investment vehicles as evidenced by its denial of GBTC’s application for conversion to a spot ETF, but approval of several Bitcoin futures ETFs. If regulators are comfortable with ETFs that hold derivatives of a given asset, they should logically be comfortable with ETFs that hold that same asset.

It is the SEC’s arbitrary and capricious actions and discriminatory treatment of issuers that necessitates elevating this matter to the courts in the best interest of GBTC and our investors.

In April, the SEC approved the listing of a futures-based ETF called the Teucrium Bitcoin Futures Fund (BCFU). In the approval, the SEC accepted Arca’s surveillance-sharing agreement with the CME as a reliable, standards meeting means for detecting and deterring manipulation. And the SEC said in the approval that the Teucrium futures product is adequately protected by the surveillance-sharing agreement from manipulation attempts made “indirectly by trading outside of the CME bitcoin futures market”, such as in the underlying spot markets.

However, in the most recent order concerning Grayscale, the SEC again argues the following.

…as the Commission also states in those Orders, this reasoning does not extend to spot bitcoin ETPs. Spot bitcoin markets are not currently “regulated.” If an exchange seeking to list a spot bitcoin ETP relies on the CME as the regulated market with which it has a comprehensive surveillance-sharing agreement, the assets held by the spot bitcoin ETP would not be traded on the CME. Because of this significant difference, with respect to a spot bitcoin ETP, there would be reason to question whether a surveillance-sharing agreement with the CME would, in fact, assist in detecting and deterring fraudulent and manipulative misconduct affecting the price of the spot bitcoin held by that ETP.

Source: Order Disapproving – List and Trade Shares of Grayscale Bitcoin Trust, sec.gov p. 67 (link above)

Note the crypto industry had expected clarification, rather than restatement of this somewhat perplexing logic in the Teucrium order. The SEC did discuss numerous related issues at length. But there is still no full explanation on one key point of investor protection. Why and how does a surveillance-sharing agreement that sufficiently protects a futures-based product by detecting the effects of manipulation carried out in the spot markets, not also protect a spot-based product?

Further, in the application Arca had argued “the CME futures market represents a large, surveilled and regulated market”. Also presented was data that the CME constitutes a market of significant size related to spot Bitcoin, not just Bitcoin futures. From November 1, 2019, to August 31, 2021, the CME futures market trading volume “was approximately 50% of the trading volume of certain U.S. dollar-denominated spot bitcoin platforms, including Binance, Coinbase Pro, Bitfinex, Kraken, Bitstamp, BitFlyer, Poloniex, Bittrex, and itBit.” This may be the idea Grayscale has in mind when they write to investors, “we are confident in our legal team, as well as our compelling, common-sense legal arguments.”

For completeness, the SEC responded to this line simply by questioning the connection between the futures market, which trades derivatives based on the spot market, and the actual spot market:

Recitations of data reflecting the size of the CME bitcoin futures market and the size of the spot bitcoin market are not sufficient to establish an interrelationship between the CME bitcoin futures market and the proposed ETP.

Source: Order Disapproving – List and Trade Shares of Grayscale Bitcoin Trust, sec.gov p. 50 (link above)

And notably, the SEC does explain how the surveillance-sharing agreement with the CME could be relied upon by a spot-based ETP.

If, however, an exchange proposing to list and trade a spot bitcoin ETP identifies the CME as the regulated market with which it has a comprehensive surveillance-sharing agreement, the exchange could overcome the Commission’s concern by demonstrating that there is a reasonable likelihood that a person attempting to manipulate the spot bitcoin ETP would have to trade on the CME in order to manipulate the ETP…

Source: Order Disapproving – List and Trade Shares of Grayscale Bitcoin Trust, sec.gov p. 67-68 (link above)

So here lies the “arbitrary and capricious” point. The SEC is setting a higher bar in asking spot-based ETPs be able to show a potential manipulator is likely to trade on the CME. And importantly, the SEC is specifically not requiring this of the futures-backed products.

Accordingly, the Commission explains in the Teucrium Order and the Valkyrie XBTO Order that it is unnecessary for a listing exchange to establish a reasonable likelihood that a would-be manipulator would have to trade on the CME itself to manipulate a proposed ETP whose only non-cash holdings would be CME bitcoin futures contracts.

Source: Order Disapproving – List and Trade Shares of Grayscale Bitcoin Trust, sec.gov p. 67 (link above)

I believe that approval of futures-backed products such as Teucrium’s, while disapproving those backed by bitcoins like the Grayscale Bitcoin Trust, likely creates an unfairness between issuers not permitted by the Exchange Act. Grayscale will contest this apparent disparity though the recently filed lawsuit.

Lengthy, hard battle ahead

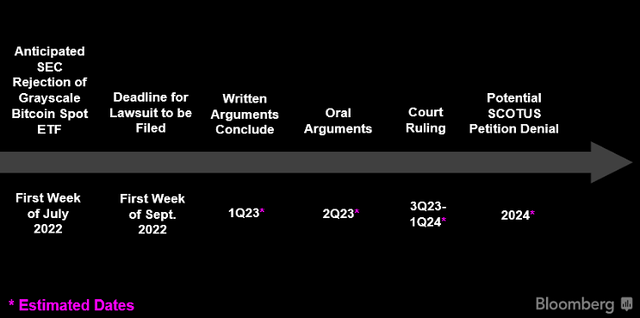

James Seyffart of Bloomberg Intelligence tweeted an estimated timeline for the resolution of the Grayscale lawsuit and proposed a court ruling would not come until the end of 2023 or the beginning of 2024. Let’s set aside the possibility of an earlier settlement or that the case will move quickly. Both the reset in timeline and the SEC’s unchanged position change the present value and expected value thinking concerning the Trust.

GBTC Litigation Timeline (@JSeyff on Twitter)

Note on June 28 the Trust was trading at a 29% discount to its NAV. Since a conversion to ETF would remove the discount, in the months prior to the disapproval there was meaningful incentive to hold GBTC because of its relatively higher expected value. This position was especially true as Grayscale’s lawyers and the general public had submitted substantial arguments to the SEC in support of the ETF listing, including highlighting the “arbitrary and capricious” point.

But because of the substantial pushout of the resolution timeline and the rejection by the SEC of the disparity of treatment argument, the Grayscale Bitcoin Trust is no longer a preferred method of gaining exposure to Bitcoin. This is despite the advantage it still holds regarding the simplicity and strength its custody arrangements provide investors. Over the past year and a half, it seems the SEC has evolved an increasingly active and antagonistic position toward the crypto space. And there is a political reality that SEC leadership, and leadership’s position on crypto sector securities falling under their jurisdiction, will not change for many years.

And it is not just the uncompromising position in the recent Grayscale decision. As another example, the SEC has also gone to some length to maintain a hardline position in their lawsuit against Ripple (XRP-USD). Though obviously from a biased perspective, there is a fact-filled and interesting read in Fortune last month by Ripple’s general counsel where he argues, “we need to finally clean up this regulatory sludge”.

In another similar move, last December, SEC Chair Gensler hired critic Corey Frayer to advise on policymaking and interagency work on oversight of crypto assets. In the years prior to moving to the SEC, Frayer served Senator Sherrod Brown and Representative Maxine Waters as a senior professional staffer in the areas of banking and financial services. This is noteworthy as Sherrod Brown and Maxine Waters have been outspoken against crypto assets in their roles as chairs of the two most influential committees for money and banking in the U.S. Congress.

Summary

The SEC has rejected the Grayscale Bitcoin Trust’s application to convert to a physically-backed Bitcoin ETF. From looking at the SEC’s prior actions, a quick or easy resolution of the recently filed lawsuit seems remote. At the end of last year, the Trust was a preferable means to gain exposure to Bitcoin as it directly invests on-chain, provides quality asset custody, and traded at a large discount to the value of its held assets. Because this discount would immediately dissipate upon conversion to an ETF, the Trust’s near-term expected value was higher than similar products in the months leading up to the SEC decision. But the SEC’s decision that maintained its prior interpretation of what constitutes a “regulated market of significant size related to the underlying”, dramatically changes this value calculation. While highly constructive on Bitcoin in the 20,000 USD range, I am changing my rating on the Trust from buy to hold.

Be the first to comment