MicroStockHub

This article is part of a series that provides an ongoing analysis of the changes made to Gardner Russo & Quinn’s 13F stock portfolio on a quarterly basis. It is based on Russo’s regulatory 13F Form filed on 8/4/2022. Please visit our Tracking Gardner Russo & Quinn Portfolio series to get an idea of their investment philosophy and our last update for their moves during Q1 2022.

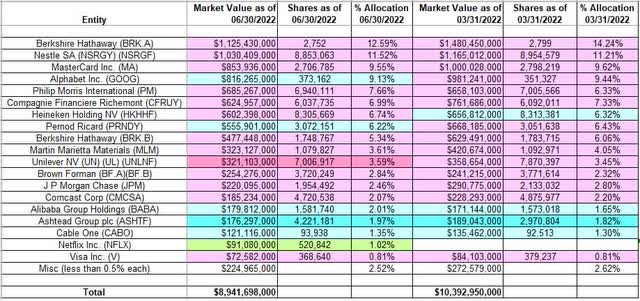

This quarter, Gardner Russo & Quinn’s 13F stock portfolio value decreased ~14% from $10.39B to $8.94B. The top three holdings are at ~39% of the portfolio while the top five are at ~56% of the assets: Berkshire Hathaway, Nestle, Mastercard, Alphabet, and Philip Morris International. Recent 13F reports have shown around 100 positions, with around 20 stakes that are significantly large. The focus of this article is on the larger positions.

Note: Russo’s portfolio on its own should not be viewed as an overall asset allocation plan, as his clients look at his firm to allocate a portion of their assets to his focus area (global equities with consumer orientation).

New Stakes:

Netflix, Inc. (NFLX): NFLX is a ~1% of the portfolio stake established this quarter at prices between ~$166 and ~$392 and the stock currently trades at ~$230.

Stake Increases:

Alphabet Inc. (GOOG): GOOG is now a 9.13% of the portfolio position. It was built from Q4 2018 when the small position saw a ~60% stake increase at prices between ~$49 and ~$60. Q2 2019 saw a stake doubling at prices between ~$52 and ~$64 and that was followed with a ~30% stake increase next quarter at prices between ~$55 and $63. The four quarters through Q3 2020 had seen another ~70% stake increase at prices between ~$53 and ~$86. The stock is now at ~$119. The last six quarters had seen minor trimming, while this quarter there was a ~6% stake increase.

Note: the prices quoted above are adjusted for the 20-for-1 stock split last month.

Pernod Ricard (OTCPK:PDRDF) (OTCPK:PRNDY): PDRDF is a large 6.22% of the 13F portfolio position. The stake was established in Q1 2011 in the low-90s price range. The two years through Q1 2017 saw a ~17% combined increase at prices between $101 and $126. The interim period had also seen purchases almost every quarter. There was a ~60% overall reduction since Q1 2017 at prices between ~$120 and ~$242. The stock is now at ~$201. This quarter saw a marginal increase.

Alibaba Group Holding (BABA): BABA is a ~2% of the portfolio position purchased in Q1 2021 at prices between ~$225 and ~$271. Next quarter saw a ~31% stake increase at prices between ~$206 and ~$244. Q3 2021 also saw a ~9% stake increase at prices between ~$144 and ~$229. The stock currently trades well below the low end of those ranges at $97.43. The last three quarters have seen only minor adjustments.

Ashtead Group plc (OTCPK:ASHTF): The ~2% ASHTF position was established in Q1 2021 at prices between ~$47 and ~$61. Last quarter saw a ~20% stake increase at prices between ~$60 and ~$82. That was followed with a ~40% increase this quarter at prices between ~$40 and ~$63. The stock currently trades at $54.18.

Cable One (CABO): CABO is a 1.35% of the portfolio stake purchased in Q1 2021 at prices between ~$1746 and ~$2104. There was a ~16% stake increase next quarter at prices between ~$1697 and ~$1913. That was followed with minor increases in the last three quarters. The stock is now at ~$1442.

Stake Decreases:

Berkshire Hathaway (BRK.A) (BRK.B): BRK.B had been consistently maintained as a top position in the portfolio since their first 13F filing in Q1 1999. At the time, the sizing was at ~6% compared to the current allocation of ~18%. The last major activity was in 2012 when around 400K shares were acquired in the low-$80s price range. The following year also saw an increase at higher prices. The stock is now at ~$293. The last several years have seen minor selling.

Nestle SA (OTCPK:NSRGY) (OTCPK:NSRGF): NSRGY is the second-largest 13F stake at ~12% of the portfolio. It was a ~3% portfolio stake (~460K shares) in Q1 1999. The position size increased to ~4M shares by 2007, but was sold out the following year. The majority of the current 8.85M shares stake was purchased in 2011 in the mid-50s price-range. The following two years also saw a combined ~45% increase at higher prices. The stake has seen minor selling most quarters since Q3 2017: ~45% overall reduction at prices between ~$75 and ~$140. The stock is currently at ~$122.

Mastercard Inc. (MA): MA is currently the third-largest 13F stake at 9.55% of the portfolio. It was established in 2008 with the bulk of the current stake purchased in 2010 in the low-20s price-range. 2011 to 2013 also saw significant buying at higher prices. There was a ~30% selling in the 2018-19 timeframe at prices between $155 and $300. Last ten quarters have seen another ~60% selling at prices between ~$211 and ~$396. The stock is now at ~$356. They are harvesting gains.

Philip Morris International (PM): PM is a large (top five) 7.66% of the 13F portfolio position. It was acquired as a result of the spinoff of Philip Morris International from Philip Morris (now Altria) in 2008. Last major activity was in 2013 when close to 2M shares were acquired in the high-80s price range. The nine quarters through Q3 2020 had seen a ~20% selling. Last several quarters have also seen minor trimming. The stock currently trades at ~$98.

Compagnie Financière Richemont (OTCPK:CFRHF) (OTCPK:CFRUY): A large ~6.5M share stake was established in 2011 in the low-50s price range and was increased to 10.32M shares through incremental purchases in the following years. Q4 2015 saw a ~17% increase at prices between $71 and $87. That was followed with a similar increase next quarter at prices between $62 and $72. There was a ~11% trimming over the five quarters through Q4 2019 and that was followed with a ~20% selling next quarter at prices between $49 and $85. Last two years have also seen minor trimming. The stock is now at ~$121 and the stake is at ~7% of the 13F portfolio.

Heineken Holding NV (OTCQX:HKHHF): HKHHF was a fairly large ~6% portfolio stake (~2.5M shares) in their first 13F filing in Q1 1999. That original position was sold out in 2008. It was built back up to a 10.2M share stake in the 2011-2013 timeframe at prices between $37 and $66. The three years through Q3 2021 had seen a one-third selling, while the next two quarters saw a ~13% stake increase. The current position is at 8.31M shares, and it is a fairly large stake at 6.74% of the portfolio. The stock is now at $75.26. There was marginal trimming this quarter.

Martin Marietta Materials (MLM): MLM is a 3.61% of the 13F portfolio stake. It had stayed steady at ~2M shares since 2004, but Q4 2016 saw a significant change: ~12% selling at prices between $169 and $234. The stock price increased around five-times over that twelve-year period. It currently trades at ~$360. There was a ~15% stake increase in Q3 2017 at prices between $196 and $228. Since then, most quarters have seen minor selling.

Unilever (UL): UL is a 3.59% of the portfolio stake first purchased in 2000. The bulk of the current ~7M shares stake was acquired during the 5-year period from 2010 to 2014 at prices in the high-20s to the low-40s. There was a ~55% selling since Q1 2018 at prices between ~$44 and ~$64. This quarter also saw a ~11% trimming. The stock is now at $48.42.

Brown-Forman (BF.A) (BF.B): BF.B is a 2.84% of the 13F portfolio position that has been in the portfolio since their first 13F filing in Q1 1999. In 2012, around 1M shares were added in the $26 to $35 price-range. There was another significant increase in Q1 2018 at prices between $50.50 and $56.50. The period since has seen a ~50% selling at prices between ~$45 and ~$81. The stock is now at $76.10.

Note: The stock prices and the share counts quoted above are adjusted for the 2-for-1 stock split in August 2016.

JPMorgan Chase (JPM): JPM is a 2.46% of the portfolio position. The stake was built in Q1 2020 at prices between $79 and $141. Next quarter saw a ~6% trimming, while in Q3 2020 there was a similar increase. The last seven quarters have seen a ~50% selling at prices between ~$98 and ~$172. The stock currently trades at ~$112.

Comcast Corp. (CMCSA): CMCSA is another very long-term position that has been in the 13F portfolio since their first filing in Q1 1999. The 2008-2011 time period saw the original position reduced by half (from ~20M shares to ~10M shares) at ~$10. The current position is at ~4.72M shares (2.07% of the portfolio) and the stock is at $38.93. There was a ~31% selling over the nine quarters through Q3 2020. Next quarter saw a ~15% stake increase at prices between $41.40 and $52.35 while in the last six quarters there was a ~18% trimming.

Note: The prices & share counts quoted above are adjusted for the 2-for-1 stock-split in February 2018.

Visa Inc. (V): The very small 0.81% Visa stake saw a ~10% increase in Q2 2018 at prices between $118 and $136 and the stock is currently at ~$214. 2019 saw a ~15% trimming at prices between ~$132 and ~$190. The last ten quarters have seen another ~25% reduction at prices between ~$147 and ~$251.

Note: Some of the securities in this report are OTC stocks with very low liquidity in the US markets. As such, it is best to use limit orders and/or use orders in their native markets.

The spreadsheet below highlights changes to Gardner Russo & Quinn’s 13F stock holdings in Q2 2022:

Tom Russo – Gardner Russo and Quinn’s Q2 2022 13F Report Q/Q Comparison (John Vincent (author))

Be the first to comment