Michael M. Santiago

The meme stonk craze found its genesis with beleaguered video game retailer GameStop (NYSE:GME) about a year and a half ago, and it has been a battleground ever since. The stock makes enormous moves in both directions, which makes it great from a trading perspective. However, with Q2 results out last night, I’m not seeing a lot of reason to want to own this one longer-term.

I’ll be clear and state right up front that the short squeeze happened in early-2021 and is not going to reoccur. GME had short interest levels exceeding 100% of the float then and shorts were scorched in spectacular fashion. Today’s short interest is around 20%, which is nowhere near high enough for the kind of move we saw earlier. Given that, anyone looking for “MOASS” round two are going to be perpetually disappointed.

What we have with GME is a retailer that, to my eye, is struggling to generate cash flow because at the end of the day, its business is still a relic of the past. The Q2 earnings report hasn’t changed that view, and indeed, I think it highlights some of the key challenges the company is facing.

GME is due for an oversold bounce, but that’s probably it

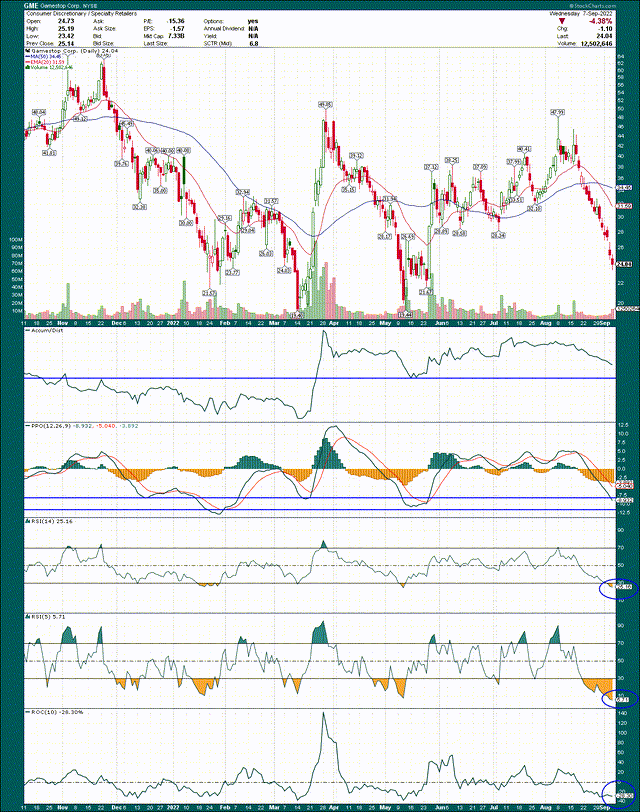

Let’s begin with the chart to get a lay of the land from a technical perspective. We can see the stock was cut in half from the peak in early-August into the earnings report, a spectacular decline in the space of four weeks or so. You’d expect it to be oversold following such a move, and it is.

The PPO is down to -9, with the histogram still accelerating to the downside. The good news is that is the level where the stock has bounced in the past. We see the same sort of behavior with the RSIs, with the 14-day at -25, and the 5-day at -5. Those are very oversold readings for all three of the momentum indicators, showing that on all three timeframes (short, intermediate, and longer), the stock is oversold. Even the 10-day rate of change is at -28%, again, around where it has bounced in the past. These readings collectively greatly increase the chances of a bounce here.

What it also means is that the odds of a sustainable rally are quite low. Stocks in bullish patterns do not become this oversold. That’s just a fact and while oversold stocks tend to see bounces, I don’t see any reason we should be expecting GME to rally meaningfully from here. The stock is up nicely in the pre-market, but keep in mind where it’s come from in the past four weeks. Odds were quite good of a bounce, but in my view, I do not think this will be anything more than a bounce. There’s been way too much damage to this stock, indicating the bears are firmly in control.

GameStop’s fundamentals are murky at best

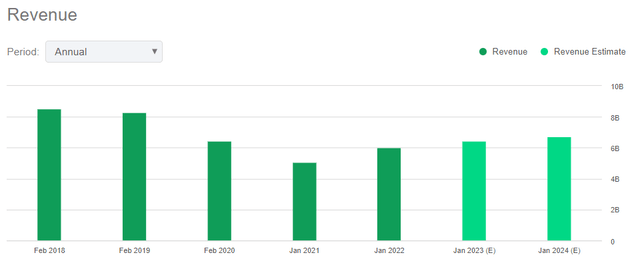

The Q2 report showed year-over-year revenue contraction of 4%, to $1.14 billion. That’s obviously not the direction investors should want revenue to be moving, and it’s a departure from the past couple of years’ results. GME has done a huge amount of work in the past two or three years to try and diversify away from selling physical games, which was its bread and butter for many years. To be clear, it has no choice but to do this, and it’s trying to boost Collectibles revenue, for instance, to help it diversify. That segment’s share of revenue was almost 20% in Q2, up from 15% a year ago. That’s fine, but the fact that Collectibles is taking a larger share of a shrinking pie isn’t giving me the warm-and-fuzzies. In other words, that segment is still way too small to stem the tide of declines elsewhere, so the total continues to fall. At some point Collectibles may be large enough to impact the total, but the question for investors is how small will revenue be if/when that happens?

The outlook for revenue is okay, with mid-single digit growth projected, but Q2 results, in my view, don’t support this level of bullishness. The second quarter isn’t nearly as critical to results as Q3 and Q4, so we’ll have to wait and see how those play out due to the company’s significant seasonality. But for now, I’m not impressed.

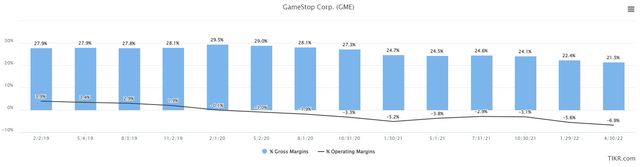

The second thing I’m concerned about, and even more so than sales, is that the company cannot get its act together from a margin perspective. Here’s some historical data that shows gross margins and operating margins as a percentage of revenue, on a trailing-twelve-months basis.

This is ugly as we continue to see quarter after quarter of lower margins. Operating margins haven’t been positive on a TTM basis since 2019. Part of this is that gross margins have tanked and are showing no signs of slowing that descent. Part of it is that SG&A costs aren’t falling at the same rate, so we’re seeing a squeeze on both ends; lower profitability on sales and higher relative costs. Meme stonk or not, GME has to show investors it can operate sustainably, and the cold hard fact is that it hasn’t done that.

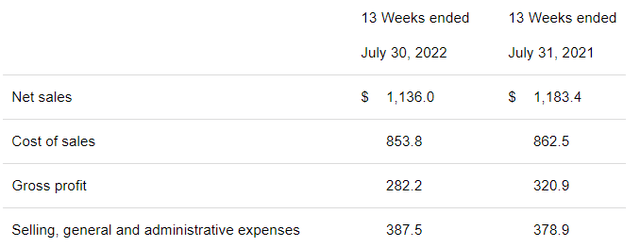

So did we see some progress on this front in Q2? Uh, no, definitely not.

Gross profit fell ~12% while SG&A costs rose about 2%. That’s a massive deleveraging of SG&A costs and it is exactly the opposite of what GME needs to be showing investors. I’m really concerned about the margin situation, and it has other implications too, such as on the balance sheet.

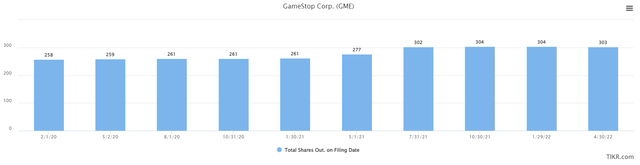

GME has issued a bunch of shares since the short squeeze occurred, and honestly, I’m not sure why it didn’t issue more. The stock was insanely overvalued for months last year, which is exactly when you’d want to issue shares.

The share count rose by about 40 million in total, which means that if GME can ever achieve profitability again, it will be that much more difficult to move the needle on a per-share basis. However, according to what I’m seeing, that may never be an issue. In other words, I’m not seeing a lot of reasons to think this company will ever be profitable again.

The good news is the big increase in shares has cleaned up GME’s balance sheet, and it ended Q2 with $909 million in cash, and almost no long-term debt. That’s fantastic, and it means the company should be able to operate for a long time, even if it’s unprofitable (which it is).

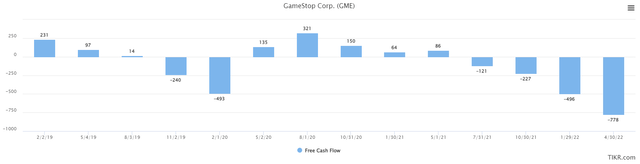

Here’s the problem; perpetually weak results are spilling over into cash flow, and that’s what is giving me pause on GME’s ability to try and turn things around. It has bought itself some time (literally) with it share issuances, but it’s also burning through that cash at an alarming rate.

Below is TTM free cash flow in millions, and it’s also not pretty.

TTM FCF has been declining for several quarters, and Q2 came to -$123.9 million (-$103.4 million in operating cash flow, and $20.5 million in capex). It’s been rough out there for GME, and in case the perma-bulls write this off as unimportant given we still have Q3 and Q4 to go, I’ll note that last year’s Q2 FCF was a loss of $25 million. That’s a deterioration of about $100 million year-over-year for a directly comparable period. There’s no way to sugarcoat this.

Let’s value this thing

Valuing GME wasn’t a concern for many months of 2021, given the stock was trading more on technicals and headlines. However, those days are gone and as I said, GME has to start delivering actual results at some point. Given that, it is my opinion we can value it based upon more traditional methods at this point. Let’s start with price-to-sales, given we cannot use any sort of earnings metrics as there are no earnings.

GME traded at an extremely small fraction of sales prior to the squeeze in early-2021, so I’ve chosen to plot just the post-squeeze valuations, which still covers about a year and a half. The average valuation has been ~2X forward sales, and we finished yesterday at 1.1X. That’s about the low we’ve seen two other times, so just like the technical indicators on the price chart, this would seem to imply we’re due a bounce in the share price. To be clear, I don’t think we’re going to see 3X forward sales again, and I’d honestly be surprised if we see 2X sales again. The factors that drove those valuations have come and gone, so those waiting for a bounce to prior highs on the P/S ratio will likely be disappointed.

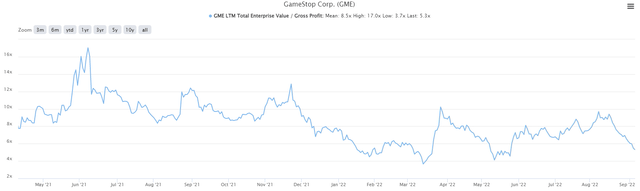

We can also value GME on its enterprise value to gross profit, and this one shows investors seem to be willing to take less valuation risk on the stock as well.

The average is over 8X gross profit since early-2021, but most of 2022 has been about half that value. On this measure, I see GME as more overvalued (or less attractive) than on P/S. That makes sense given the share price hasn’t made new lows but gross profit continues to tumble. There will be a reckoning on this, I believe, and it won’t be with gross profit rising to meet the share price.

Final thoughts

The factors that drove GME’s incomprehensible rise last year, which minted a bunch of millionaires in the process, are dead and gone. Some people continue to cling to the idea that GME is going to squeeze again, but there’s simply no basis in reality for that line of thinking. This company is struggling in a variety of critical operating metrics, and I don’t see a path forward. In addition, short interest is nowhere near high enough to generate another massive squeeze.

The valuation is okay, and the chart suggests we’ll get an oversold bounce. But if we do, I’d see that as an opportunity to sell. Shorting GME is a dangerous game, obviously, and isn’t for the risk-averse. However, long-term, this company is burning through way too much cash and at some point, it will need to raise capital again. It has essentially no long-term debt, so that’s one option, but given its ever-declining profitability, I’m not sure who would lend to GME. That means more dilution is the likely path forward, which just compounds the problems for the stock and its valuation.

The bottom line here is that any bounce we get off this earnings report is a chance to get out, and if we get to the declining 20-day exponential moving average, which is currently about $31, I’ll look to potentially take a short position at that time.

Be the first to comment